Win McNamee

How we got here

2022 has been the golden age for merger arb with many wide deal spreads, but the widest of them all is Twitter (NYSE:TWTR). In April, Elon Musk signed a definitive agreement to buy Twitter. At the time, he said that,

Free speech is the bedrock of a functioning democracy, and Twitter is the digital town square where matters vital to the future of humanity are debated. I also want to make Twitter better than ever by enhancing the product with new features, making the algorithms open source to increase trust, defeating the spam bots, and authenticating all humans. Twitter has tremendous potential – I look forward to working with the company and the community of users to unlock it.

In his own words, he bought Twitter in part to defeat bots and authenticate humans; demonstrably, this was a problem that he knew existed and that he planned to fix. The next month, Musk suffered from buyer’s remorse. In his own words, it was due to his concerns over Putin’s aggression in Ukraine and the threat of World War III. He also grew increasingly agitated over Tesla’s (TSLA) poor stock performance, which would increase the cost of Twitter in terms of the number of Tesla shares he’d have to sell.

Musk’s problem was that neither his real macro concerns nor his specific problems with Tesla-driven wealth destruction were outs under the merger agreement. They were problems, but they were his problems. They were excellent examples of things he should have thought of ahead of time. They could have potentially allowed him to pay something in the $30s per share instead of the contractual price in the $50s. So Musk was forced to turn to one thinly-veiled pretext after another to see if anything could stick. It didn’t.

The buyer is erratic and conducted much of his disclosure via crazy tweets. We have been active shareholders, including writing an open letter to Twitter’s board immediately following Musk’s first of several purported deal terminations, encouraging the board to fight for the original deal. Fight they did. Meanwhile, Musk’s constant stream of tweets badly damaged his legal case.

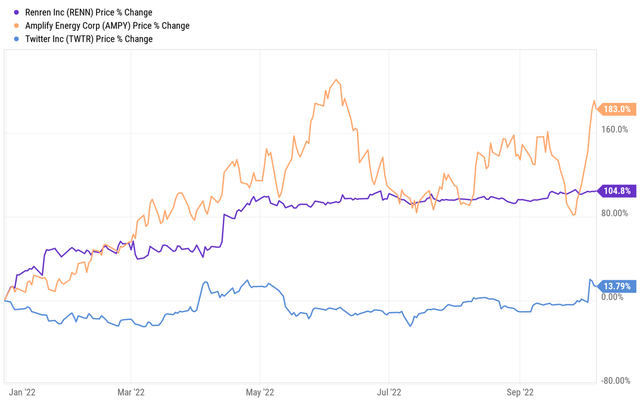

My confidence is in the iron-clad Twitter definitive merger agreement, in Wachtell Lipton’s ability to uphold it, in Chancellor McCormick’s ability to judge, and in the Delaware court and rule of law generally. That’s why TWTR is one of my three biggest positions and best ideas for 2022 along with Renren (RENN) and Amplify (AMPY).

YCharts

The deal has a number of conditions including HSR approval as well as sign offs from the UK CMA, NSI, and Twitter shareholders. Each of those have been secured. Then in early October, Musk made a conditional offer to close the deal this month on the original $54.20 per share terms. Twitter responded,

The intention of the Company is to close the transaction at $54.20 per share.

The prospects for a price cut appear to have substantially diminished. Following his most recent change of heart, he’s been sounding more positive about Twitter on Twitter and said to the FT that,

I’m not doing Twitter for the money. It’s not like I’m trying to buy some yacht and I can’t afford it. I don’t own any boats. But I think it’s important that people have a maximally trusted and inclusive means of exchanging ideas and that it should be as trusted and transparent as possible.

As of this writing, there remains a $5.00 net spread between the market price and the original deal price.

What Could Go Wrong

The reasonably likely downside is for Musk’s erratic behavior to date to continue unabated throughout the course of this month. He can change his mind yet again. He can nuke his financing (indirectly through his irreparable damage to Twitter or directly through additional contact with the banks asking them again to slow or stop the debt financing process). He can fail to line up equity financing. He can refuse to sign or have signed the solvency agreement. He can attempt to pay the oft quoted but rarely understood $1 billion parent termination fee.

What Could Go Wrong with What Could Go Wrong

The Honorable Chancellor Kathaleen St. J. McCormick (DE C of C)

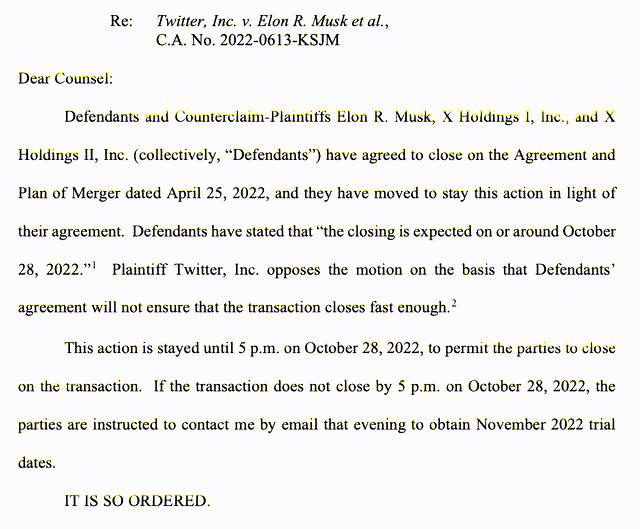

No matter how much chaos Elon Musk creates in October and whether or not he’s able to spread it to Morgan Stanley (MS) and others contractually committed to financing this deal, the chaos will abruptly end at 5 PM Oct. 28, 2022. The brief and pointed stay is worth reading for its substance and tone:

DE Court of Chancery

Just to lay out the possibilities: She could be joking. She could be lying. But she sure sounds as if she means it. If the deal isn’t closed by then, my strongest possible sense is that Chancellor McCormick will in fact schedule a trial in November 2022 and that Elon Musk won’t like it. This was a matter between Musk and Twitter. Now it’s a matter between Mr. Musk and Chancellor McCormick. While I doubt she was joking or lying, it’s entirely possible, even in character, for Musk to have been joking or lying when he told her that he expects to close the deal. He might expect to find a new way to renege on his commitments. She will take it badly.

If he was not telling the truth in his closing expectation, then the $54.20 per share that he owes Twitter shareholders will become the least of his problems. He still will need to be deposed, which he already seems exceedingly enthusiastic to avoid. He could risk legal jeopardy far beyond the deal if he lied already or if he doubles down on the lies and then gets caught.

Even if Musk doesn’t direct Morgan Stanley and others to renege on their debt commitments, his hands are already dirty. His almost daily violations of his efforts duties under the merger agreement will raise Chancellor McCormick’s skepticism that he was directly or indirectly responsible for any failure to get financing. Thus he would be unable to trigger the parent termination fee. In the end, the only just legal outcome available is specific performance requiring Musk to close the deal. This could even incur prejudgment interest starting on or about Sept. 15 that could add as much as another few dollars to the final price.

Hedge

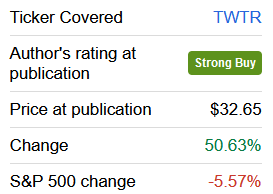

Since Elon Musk’s Twitter Options And Yours was posted, TWTR has returned over 50% in a down market.

SA

So you might want to lock in some of those gains. In terms of hedges, Tesla (TSLA) is a major source of funds for the equity commitment. A TSLA short serves as a worthy hedge. Another hedge worth considering is shorting out social media exposure by shorting Digital World (DWAC).

Be the first to comment