filadendron/E+ via Getty Images

Background/History

NexPoint Diversified Real Estate Trust’s (NYSE:NXDT) journey to today began in 2006 when it was listed as NexPoint Holdings (NHF) – a closed end fund holding a range of investments including real estate, CLOs, distressed debt, and equities. NHF began investing larger amounts of capital into private real estate and in 2015 spun out NexPoint Residential (NXRT) which owns multifamily properties. NHF began trading at a substantial discount to the stated Net Asset Value starting in early 2020. Subsequently, management determined that a move to a REIT structure would allow the company to trade closer to fair value – this transition was recently approved by the SEC this summer. NXDT plans to report their first quarter as a REIT covering the third quarter of 2022 in November.

Experience With Real Estate

NexPoint as a company is James Dondero’s second major foray in the investment space after Highland Capital. Highland was a sizable leveraged loan and CLO manager over the past 30 years but ran into issues from the Great Financial Crisis.

Dondero has increasingly focused on real estate over time, beginning with the spinoff of NexPoint Residential Trust and other subsequent investment vehicles. Currently, NexPoint manages $14 billion in real estate assets across public and private vehicles.

NXDT Current Portfolio

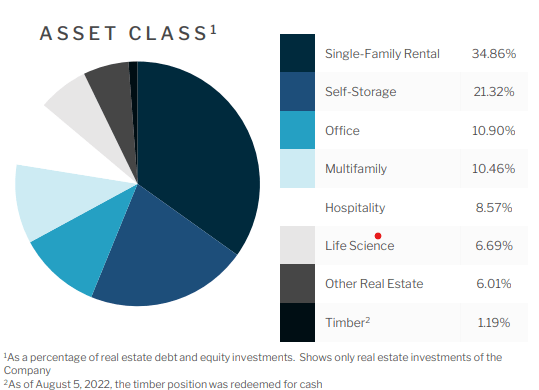

As stated in the company name – NexPoint Diversified Trust, the company has real estate holdings across RE verticals (office, single family rentals, and self-storage), geographies (across the US), and capital structure (debt and equity).

Company Presentation

The company’s single family rental assets are on both the debt (through NexPoint Real Estate Finance) and equity side (through VineBrook and NexPoint Homes). Self-storage is largely equity through NexPoint Storage Partners and SAFStor. The office exposure is through an equity investment in Cityplace – a 42-story office tower just outside downtown Dallas. NexPoint purchased the asset in 2018 with a plan to improve the asset through needed improvements with a plan to subsequently move rents higher. Neiman Marcus recently announced a new lease at Cityplace and Intercontinental plans a hotel opening early 2024.

Capital Structure

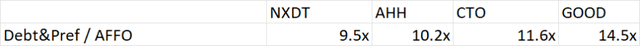

Looking at NXDT vs. other diversified REITs suggests they are somewhat underlevered vs. others in the space.

The provides more financial flexibility going forward to take on new assets or buy back shares to achieve comparable leverage.

Additionally, NXDT has been distributing only 15% of net investment income vs. a 79% distribution rate for its peers. I would expect them to increase their dividend moving forward.

Earnings

As the company has morphed from a closed end fund to a REIT, its portfolio has changed as well. As a closed end fund they were required to file twice/year reports and I believe the most recent two (second half of 2021 and first half of 2022) are fairly indicative of the economics they will report going forward. The key figure I look at in these reports is “Net Investment Income.” This figure shows the operating cash flow coming from the properties – I view it similarly to Funds From Operations. While they have also generated realized and unrealized gains, both of these are sort of unstable and one-time in nature.

Net Investment Income available to common stock (which is Net Investment Income less the dividend they owe to preferred equity holders) has averaged in the range of $70mm for each of the last two half-year reporting periods. If we project that going forward (which I think is quite conservative), then FFO will approximate $140mm/year ($3.77/share).

Over the next several years, I believe FFO will grow above $5/share due to growth in profitability at Cityplace, ongoing rental increases in their single family and self-storage portfolios, and contribution from the use of excess cash flow.

Valuation

In their presentation to investors back in August, the company named GOOD, AHH, and CTO as comparables. Recently those were trading around a 9.2x FFO multiple. On that basis, NXDT is worth $34.70/share ($3.77/share in FFO x 9.2 multiple).

Catalysts/Other Consideration

As a closed end fund, NXDT suffered from lack of inclusion in most equity indices as well as a lack of equity analyst coverage. By the company’s estimates, they will be eligible for certain REIT indices over the next few months and broad market indices over the next year. These will eventually comprise ~10-15% of outstanding shares. Said another way, there will be forced buyers of NXDT shares over the next year – regardless of price.

I would expect NXDT to receive sell-side analyst coverage over the next year or so. This raises the profile of the company with institutional investors allowing for greater visibility in the marketplace and increased investor interest.

Company insiders own approximately 15% of outstanding shares (~$75mm) – this is a huge holding by insiders and both show their commitment to the company and highly align their interests with those of external equity investors.

One last catalyst would be if the company buys back shares itself. I think this is the best use of capital given the very low valuation of the company currently. Looking at other publicly traded vehicles managed by NexPoint suggests that management is willing to opportunistically buy back shares when the price makes sense.

Be the first to comment