Maja Hitij/Getty Images News

One of the largest and most influential social platforms in the world today is Twitter (NYSE:TWTR). For years, the company has been growing its user base, particularly abroad, and has been expanding its revenue. There is no doubt that the platform has become a lightning rod for controversy in recent years as the company’s decision to crack down on fake news and other misinformation has stirred up individuals of all walks of life and across the political spectrum. Despite this controversy, the company continues to march forward, but the most recent development for the company involving an offer by Tesla (TSLA) founder Elon Musk has reawakened interests in the company and its potential to generate attractive returns for its investors. While some investors may be keen on a potential deal here, the data suggests that a purchase is unlikely to transpire at this time. And for the bulk of investors, this likely is a positive thing in the long run, even though it would mean missing out on a short-term windfall.

A look at recent developments

In recent days, news broke that Tesla founder Elon Musk had acquired approximately 9.1% of the outstanding shares of Twitter on the open market. At current pricing of $45.08 per share, that translates to a value of about $3.30 billion. Following this acquisition, Musk submitted a proposal to acquire the rest of the business he did not own in an all-cash deal, valuing it at $54.20 per share. That would imply a premium of 54% over where shares were in January of this year and it would represent a 38% premium over where the stock closed on April 1st of 2022. As with many endeavors that involve Tesla’s controversial and mercurial founder, a great deal of drama has developed along the way. For instance, after Twitter announced plans to accept Musk onto the company’s board of directors, Musk changed direction and decided not to join. He has also made numerous statements claiming that he does not have faith in the current management team of the business and that if changes are not made, he would likely sell his shares.

If we take Musk at his word, his objective is to take the company private and subject it to a number of changes that he views would be beneficial for the enterprise. For instance, one objective that he cited was to try his best to remove bots from the platform. Bots, as well as other nuisances, are a major threat to the credibility of the platform. This is especially true when discussing the followers of politicians and other major figures on the platform. One study from 2020, for instance, came to the conclusion that 61% of former President Trump’s followers are bots, spam, propaganda, or inactive accounts.

Another objective pointed out by Musk is to promote free speech as much as possible. He wants to be cautious about permanently banning accounts and believes that timeouts can be a more effective way of addressing bad actors. He also wants to be reluctant to delete posts on the platform. While this would all promote free speech, it can also prove counterintuitive because the platform is already a hotbed of misinformation. One study, covered in 2018 by MIT, found that false stories on the platform are 70% more likely to be retweeted than true stories. In general, these false stories take six times as long to reach 1,500 people than true stories, with stories involving unbroken retweet chains that are false reaching people between 10 and 20 times faster than for true stories. By failing to address these issues and even allowing them to proliferate, the already controversial credibility of the platform will affect the business further. However, Musk maintains that his objective here is not profit. Rather, it is for the promotion of the general well-being of the world to have an open platform with open dialogue. Along this vein, he also wants to make the company’s algorithm open-source and decisions regarding moderation more transparent.

The latest salvo launched by management came recently when the company announced the approval of a shareholder rights plan. In short, the plan should last roughly one year and will prevent any shareholder from accumulating 15% or more of the company’s equity without the approval of the Board. As part of his original agreement to join the Board, Musk agreed not to increase his ownership above the 14.9% threshold mark. So this is clearly a response to that deal falling through. He also cannot partner up with any other investors to go above this limit. Should that transpire, the Board can authorize the issuance of additional shares to all parties that aren’t Musk, effectively diluting Musk or any other party that surpasses that limit.

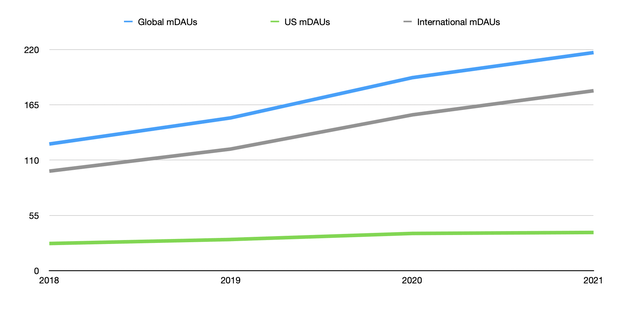

A deal is unlikely to make sense

Critics of Twitter likely have a number of reasons why the company should agree to sell out at such a hefty premium to where shares were trading previously. At first glance, the argument can be rather compelling. For starters, we need only look at the number of users (as defined by mDAU, or monetizable daily active users) on the platform. It is true that Twitter continues to expand year after year. For instance, from 2018 through 2021, the number of mDAUs on the platform expanded from 126 million to 217 million. From 2020 to 2021 alone, the year-over-year growth rate was 13%. Having said that, the company has essentially stagnated in the U.S. market. After rising from 27 million mDAUs in 2018 to 37 million in 2020, the number rose only modestly to 38 million last year. The counterargument to this, though, is that international growth is alive and well. In its international markets, mDAUs expanded from 99 million in 2018 to 179 million last year. The rise from 2020 to 2021 amounted to 15.5%.

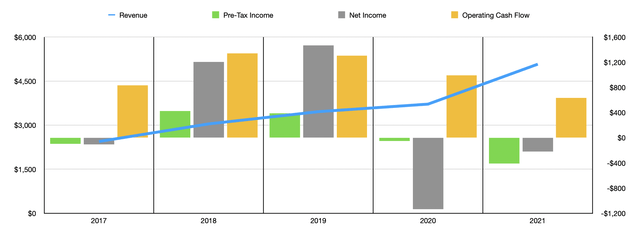

Another, more nuanced, issue relates to profitability. Net income has always been an unreliable measure for the company, with the firm generating net losses in three of the past five years, including in each of the past two years. However, the picture is more complicated than that. Significant tax payment fluctuations from year to year have impacted the company’s bottom line. But that doesn’t change the fact that from 2018 through 2021, the pretax profit of the business declined year after year, dropping from a profit of $423.5 million to a loss of $411.1 million. Operating cash flow has also been volatile. After peaking at $1.34 billion in 2018, the metric began a rapid descent, eventually bottoming out (so far) at $632.7 million last year. A similar trend can be seen when looking at EBITDA, but the 2021 result of $817.8 million was greater than the $623.6 million generated one year earlier.

Given all of these issues, investors might think that Musk is crazy for offering to buy the company at such a high price. But then again, billionaires do sometimes have a track record of turning media-oriented companies around. Amazon (AMZN) founder Jeff Bezos, for instance, acquired the Washington Post years ago and, in the span of just a few short years, turned the company into a cash cow. Having said that, to say that Twitter is beleaguered would be a mischaracterization. Despite the numbers that I already went through, there are a number of positive aspects to the company at this point in time. The easiest example to point to is revenue. From 2017 through 2021, sales at the company expanded each year, climbing from $2.44 billion to $5.08 billion. The increase from 2020 to 2021 was an astounding 36.6%. According to management, the big driver for this improvement was a 40% increase in revenue associated with its advertising activities. The company experienced a 7% increase in the number of ad engagements during this time frame and was able to charge 32% more when it came to its ad engagements. This latter improvement came in large part from lower funnel ad formats, as well as the proliferation of 15-second videos that resulted in higher advertising payouts.

Moving forward, management has high hopes for the business. In recent months, the company launched Twitter Blue, a premium subscription that is priced differently based on the region its subscriber is in. In the US market, the service costs $2.99 per month. Users get an advertising-free experience, access to top articles, and the ability to upload longer video formats. There are other benefits to the platform as well. To be fair to critics, management refuses to reveal how many people are paying for the service. But the company has said that it will not play a significant role in the company’s revenue anytime soon. Even if the subscription service fails to really take off, management still sees revenue rising in the low to mid 20% range for 2022 and for sales to climb to around $7.5 billion in 2023. They expect at least some of this to be attributable to an acceleration in the growth of mDAUs.

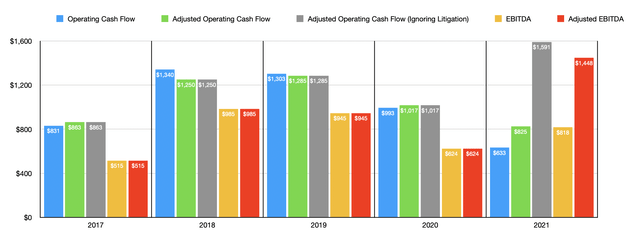

For its bottom line, the picture of the company is also complicated. I already highlighted some of the bad aspects of the firm. However, the picture changes if you make certain adjustments. In 2021, for instance, the company had a significant litigation related settlement charge that it incurred in 2021 that amounted to $765.7 million. This was in response to management painting a rosy picture of its future back in 2014 but not basing the expectations on any reliable data. Stripping this out and making other adjustments like removing changes and working capital from operating cash flow would result in cash flow for 2021 hitting an all-time high of $1.59 billion. That compares to the $1.02 billion reported one year earlier and is up from the prior high of $1.29 billion in 2019. A similar adjustment made for EBITDA would result in that metric totaling $1.45 billion for 2021. The fundamental picture of the company, after making these adjustments, does look far more appealing.

As for the pricing of the company, shares don’t look all that bad if management can continue growing the business at the rate they anticipate. Using 2021 results, the price to adjusted operating cash flow multiple of the company is 21.6. Should the company decide to sell itself out to Elon Musk at the aforementioned price of $54.20 per share, the multiple would come out to 26. Meanwhile, the adjusted EV to EBITDA multiple of the company, using 2021 results, is 22.9. This is after making adjustments for a recent debt issuance of $1 billion, the sale of MoPub for $1.05 billion, and management decision to buy back $2 billion worth of stock, amounting to roughly 37.8 million shares in all, at an effective weighted average price of $52.91 per share as part of an accelerated share buyback plan. The company also has plans to buy back up to another $2 billion worth of stock over a period of time. Clearly, management believes the stock is undervalued at current prices. Should the company achieve the kind of growth that management is anticipating, then revenue of $7.5 billion, using adjusted margins for 2021, would translate to operating cash flow for the company of about $2.35 billion for 2023. That would bring the price to adjusted operating cash flow multiple for the company down to 14.6. For a cash producing social platform with a global reach, this is not a ridiculous price to pay by any means.

Takeaway

Based on the data provided, it seems to me as though a deal between Twitter and Elon Musk is not likely at current prices. There is considerable concern as to what a change in ownership would mean for the users of the platform, plus management has recently started doing a good job of expanding the company’s top line and adjusted cash flows. Shares are not particularly cheap at this point in time, but if management can hit their targets, the business might offer some attractive upside moving forward. Of course, if Musk can succeed in getting the support of many other investors, then a deal might be able to be pushed through. But barring that, there is no way that he can force a sale of the business. And if management’s prognostications do come to fruition, it might be better for shareholders, in the long run, if such a deal does not come to pass.

Be the first to comment