Serhii Ivashchuk/iStock Editorial via Getty Images

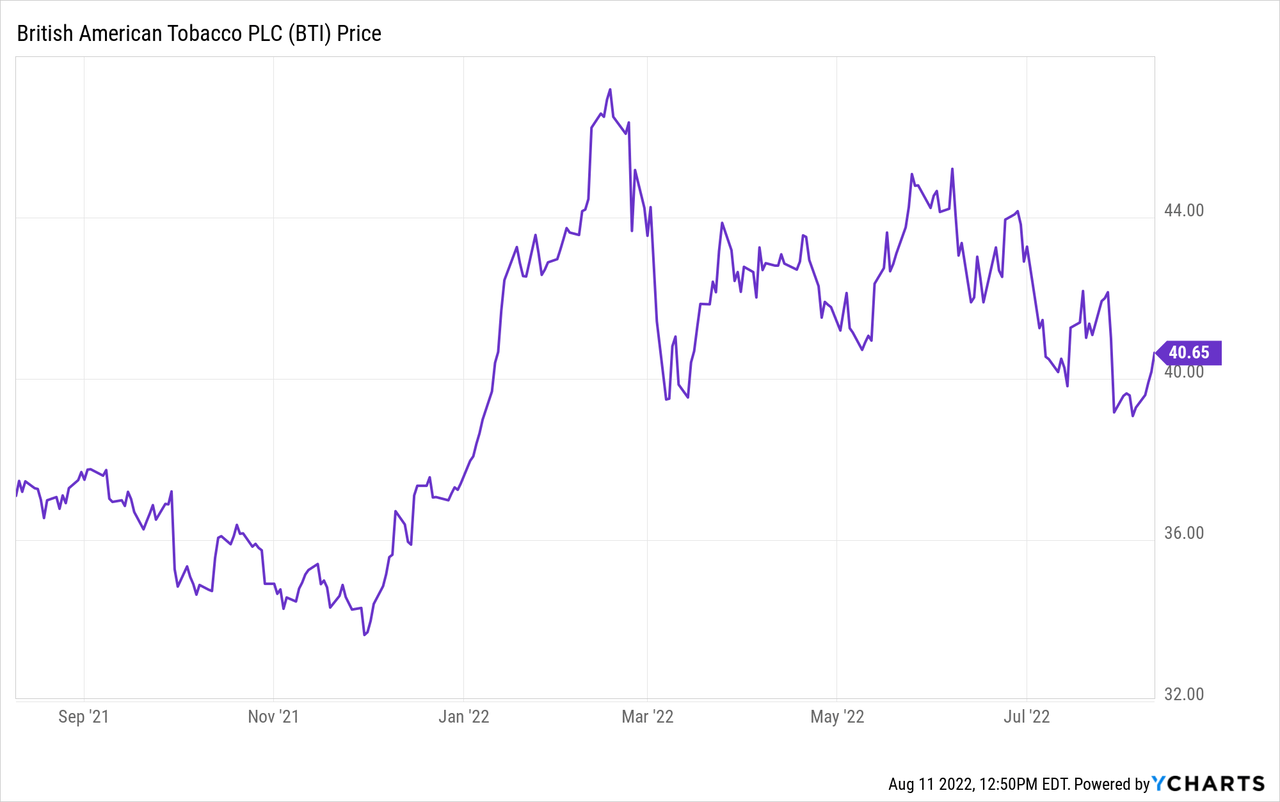

British American Tobacco (NYSE:BTI), hereafter referred to as BAT, has had a good year, characterized by a decent outperformance versus the main market, which, on the other hand, has suffered for various reasons. The stock is up more than 10% in dollar terms and more than 20% in British pound terms, and has paid a hefty dividend of about 7% over the past 12 months.

That means BAT has done an outrageous job of protecting its investors’ money from inflation, which is what you should expect from a company like this.

The results of the first half year

A few days ago, BAT published its results for H1/2022. They were negatively impacted by some one-off events, notably a £450m provision for a potential fine for an alleged sanctions violation and a £957m non-cash write-down of the value of the company’s Russian business, which is now up for sale. Adjusted for these items, results were mixed, with total revenue up mid-single digits and diluted earnings per share up about 9% year over year. New category revenue increased 45% and now represents approximately 10% of total revenue. Losses of this segment narrowed significantly in the first half to £222 million and are likely to reach profitability sooner than expected (2025).

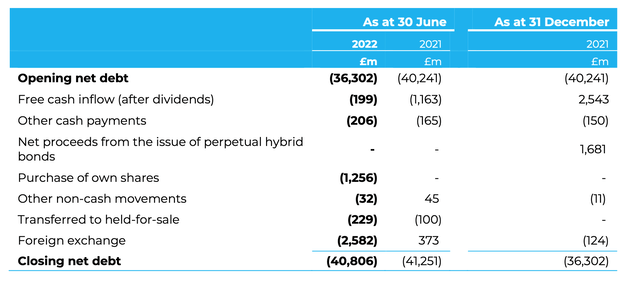

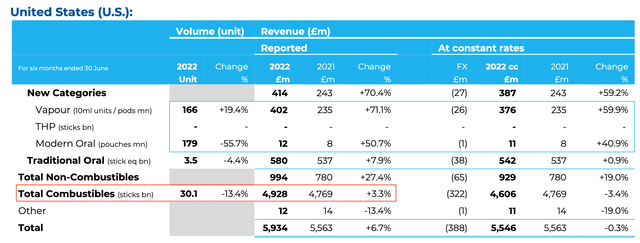

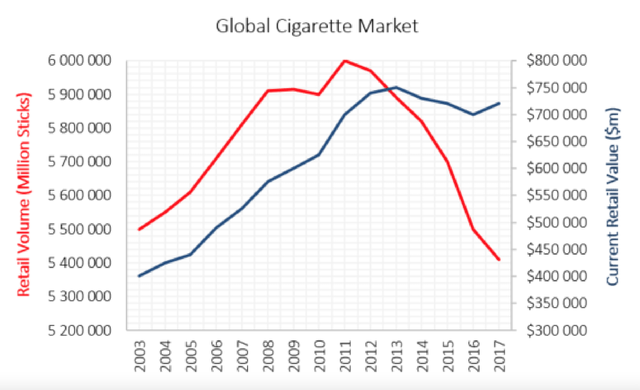

All in all, the company will gradually move away from the combustible tobacco products business in the coming years and focus on developing new product categories: this will not be an easy path, as the profitability of the new products is likely to be lower compared to the traditional tobacco business: meanwhile, the latter is also cannibalized by the new product trends. The big negative factor in the first half was a massive drop in U.S. cigarette volumes (-13.4%), which the company partly justified by reducing inventories. However, the number seems too bad not to raise concerns, and the market confirmed this by punishing BAT ‘s stock, perhaps a bit too much: -7% in the five days after the results were released. Apart from the business model, which makes sense to me as I remain convinced that the switch to NTPs will eventually be successful, and BAT manages to build a strong moat around its products, it’s more the debt load that worries me as an investor. The British tobacco giant took on a lot of debt a few years ago to acquire the entire American Reynolds in a huge $49 billion deal. In hindsight, that decision probably was not wise, as we now see U.S. volumes declining rapidly, and on the other hand, debt still piled up on BAT ‘s balance sheet, even though it is admittedly being steadily reduced. This year, with a net debt/EBITDA ratio of about 3, management felt confident enough to launch a buyback program in addition to the generous dividend that gives shareholders a yield of nearly 7%. They may be right to do so, as the average debt maturity is almost 10 years and 90% fixed, while cash flow generation is obviously very high with a forecast of £40 billion of free cash flow over the next 5 years, which incidentally is also the same level as the company’s net debt. However, we must not overlook the fact that we are currently in a highly inflationary environment and that is likely to put pressure on the company’s debt management: over the last six months, for example, net debt has increased by 12%, although it is still declining year-on-year.

A creative option

In the current situation, I do not think it should be considered heresy to consider a dividend cut. I am well aware that much of the company’s reputation rests on its status as a reliable dividend payer, and many BAT shareholders rely on that. However, it is prudent to move quickly on debt reduction now, and delay could have long-term negative consequences. For example, if inflation finally gets out of control, the cost of debt repayment will be too high for the UK company. In that case, a dividend cut would not be an option, but a necessity.

So it is better to get ahead of the times and do it now when most things are under control. I know that probably the majority of readers here would argue that BAT manages inflation very efficiently, but I think that’s not quite right. As we just saw last quarter, the company has been acting on prices to offset inflation in the U.S., but it has only managed to deliver modest annual nominal growth (see the image below).

It has not been able to keep up with the near double-digit inflation increase that has occurred over the past 12 months. The point is that BAT (and the other tobacco companies as well) is using price increases in their traditional business to counteract the steady decline in their tobacco volumes. It is not realistic to believe that they would be able to continue to raise prices to offset inflationary pressures as well and achieve real growth.

In this context, it is important to note that BAT should not suspend its buyback programs, but rather extend them. If a dividend cut (or full suspension) would lead to a significant drop in the company’s share price, a buyback would be a very efficient way to create value. A few years later, a nice dividend could then be paid again, possibly much higher than the current one.

Bottom line

British American Tobacco is probably the ideal company to own in this complicated nexus of history. Its business is resilient to major disruptions in the economy and financial markets. And yes, British American Tobacco is an inflation play, albeit to a lesser extent than many believe: plus, the stock is cheap! Still, there are some risks to consider. First and foremost is the debt load, which could threaten the company’s financial stability if interest rates rise significantly in the near future (although the long average maturity and fixed coupon that most of its bonds have, significantly mitigate this risk).

All in all, I think cutting the dividend for a few years and accelerating the debt reduction would be a good move. If the stock eventually falls, BAT could strengthen its buyback plan and reward shareholders in a more efficient way. Regardless, the stock is a hold right now and definitely a buy below $35, which is about 13% below the current price at the time of writing.

Be the first to comment