PM Images

The Core Business

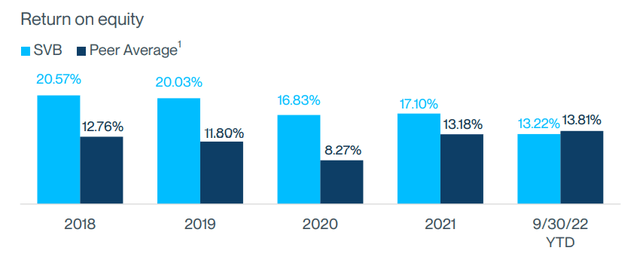

SVB Financial Group (NASDAQ:SIVB) is the holding company for Silicon Valley Bank. The company has carved out a niche for itself as a leading commercial bank servicing technology and life science, many of which are early stage. The company benefitted mightily from the tech/biotech golden age of 2012-2021, with large deposit and loan growth in commercial banking, growth in its investment banking services, and gains in its equity and warrant investment portfolio. The company rode these gains to sector beating ROE’s.

SVB ROE’s by Year vs Comps (Q3 SVB Presentation)

Unfortunately, the flipside of the tech bubble is fairly ugly for the company with added pressure coming from higher operating costs, higher costs of deposits, and unrealized losses in its htm (hold to maturity) fixed income portfolio. Both these htm losses and potential losses from the loan portfolio could wipe out book equity value.

Growth Turning to Slowdown

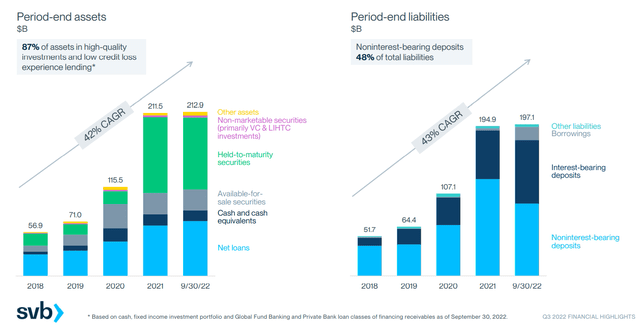

The growth in deposits and loans was steady (~10-20%) for years after the GFC. Around 2018, the growth rates of both accelerated dramatically to north of 40% CAGR’s.

SVB Deposit and Loan Portfolios (SVB Q3 Presentation)

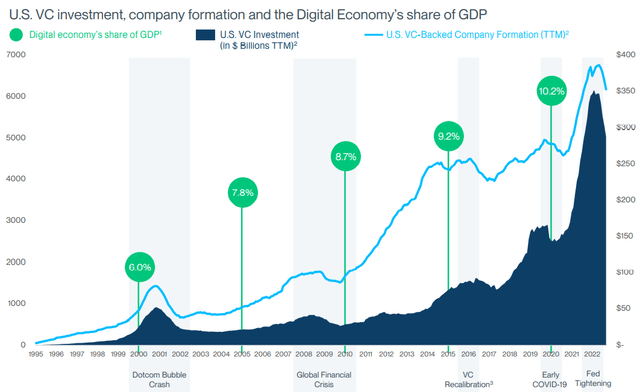

This spike in assets and liabilities mirrors the dramatic ramp up in VC investments that occurred during that time and appeared to apex in 2021.

TTM VC Investment (SVB Q3 Presentation)

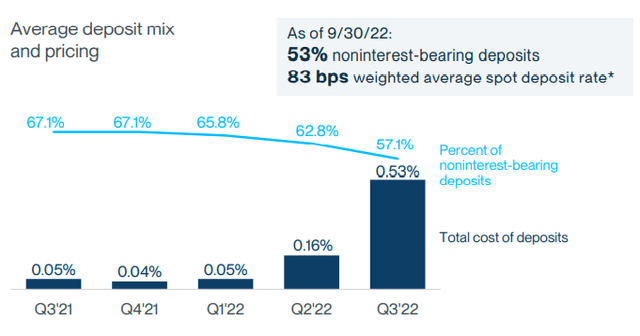

The changing funding landscape creates several challenges for SIVB. The most immediate is the reduction in non-interest-bearing deposits as a percentage of total deposits. The higher the interest-bearing percentage, the higher the cost of deposits and the lower the NIM (net interest margin). In early December, the company reduced its guidance for Q4 NIM expectations from 1.95-2.05% to 1.92-1.97%.

SVB Cost of Deposits (SVB Q3 Presentation)

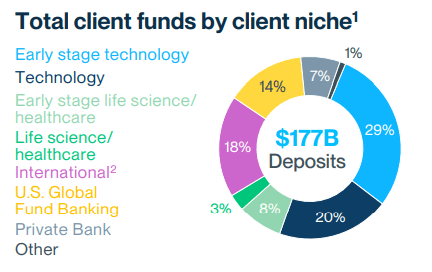

Cost of deposits will impact profitability this quarter and the immediate future. Much bigger challenges can come from potential declines in deposits and potential losses in the loan and investment portfolios. On the deposit front, a lower VC investment environment could lead to lower deposits as money-losing early-stage companies burn cash and can’t replenish it with new capital raises. 29% of SIVB’s deposits are with Early stage technology co’s and another 8% are designated from Early stage life science. I’m assuming this combined 37% of deposits are with companies that burn cash.

SVB Deposit Base by Customer Type (SVB Q3 Presentation)

The company says that these depositors have “off balance sheet” assets meaning cash that are in money-market accounts that could replenish deposit cash as it is drawn. That’s a potential liquidity release valve but I don’t think it completely offsets a bad VC investment environment that very clearly could have a long way to fall and could take a long time to recover.

If deposits bleed, the company could be forced to reduce its investment portfolio to fund those outflows. As of the end of Q3, the company had $27 billion of AFS (available for sale) securities and $65 billion of HTM (hold to maturity) securities. These securities are primarily (close to 80%) agency RMBS and CMBS mortgages. Given the bulk of this portfolio was acquired in a lower interest rate environment, there are unrealized losses, $17 billion in the HTM portfolio alone. While these losses are run through earnings, they are not run through regulatory capital unless they are realized. Fully recognizing this loss would essential wipe out the company’s tier 1 capital and force a capital raise.

The company should be able to sell its AFS with minimal losses and about $2-3 billion of the portfolio pays down every quarter. The company also has some borrowing capacity. So, right now it looks unlikely the losses on the HTM portfolio will get triggered, it is a risk.

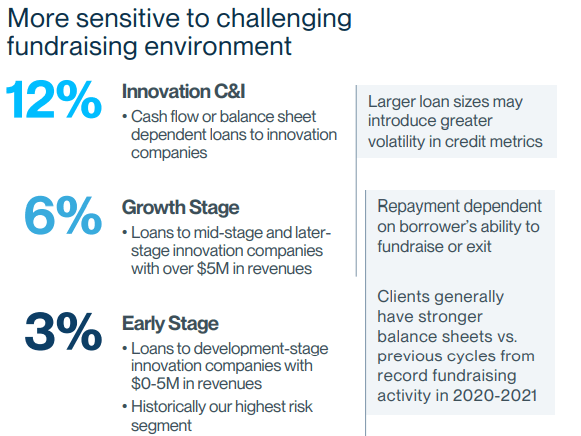

A much bigger risk in my mind is the loan portfolio, 21% of which is to early stage/”innovation” companies.

SVB Loans to Early Stage Companies (SVB Q3 Presentation)

21% of a loan portfolio that the company expects to be $72-74 billion at the end of the year is north of $15 billion, once again about equal to equity book value. Should these loans suffer material impairments they would cause major damage to the balance sheet and tier 1 capital. Moreover, this assumes that there are no other issues from the rest of the company’s loan portfolio. Heading into a recession, I’m not so sure that’s a given.

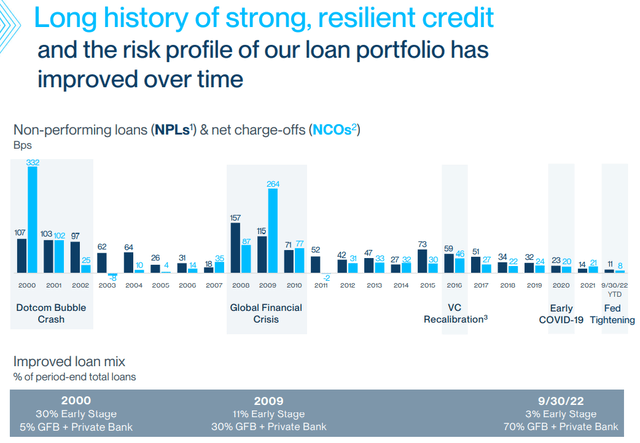

The company counters that it has derisked its business over time. That might be but I think it remains to be seen what results from the excesses of the VC investment spike that peaked in 2021.

SVB NPL’s and NCO’s (SVB Q3 presenation)

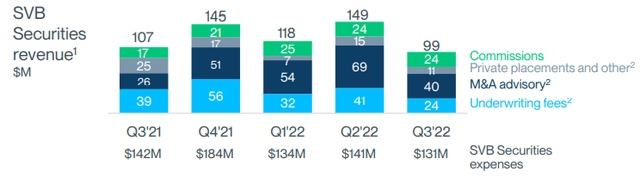

Other issues potentially impacting the company are declining investment banking revenues and declining values of its equity and warrant investment portfolios. Underwriting and M&A fees are already under pressure and might be relatively non-existent in Q4.

SVB Investment Banking Revenue (SVB Q3 Presentation)

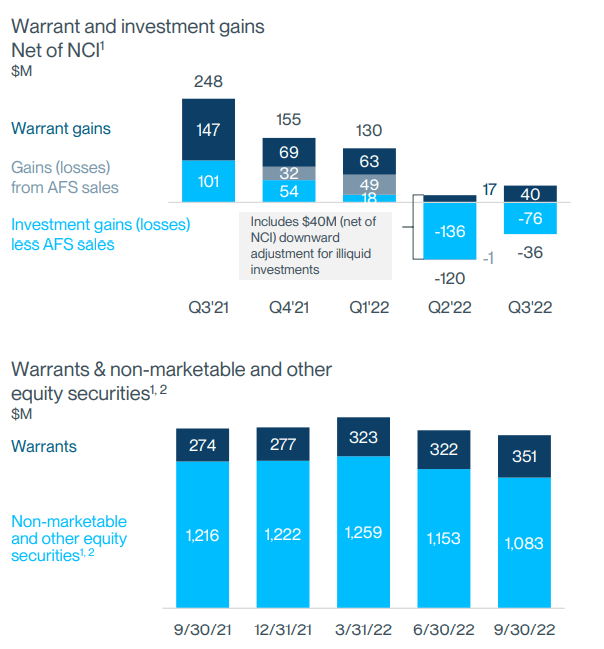

Meanwhile the warrants and other equity gains had been sources of income and are turning into losses with potential for over $1 billion more.

SVB Warrant and Other Equity Gains (SVB Q3 Presentation)

Risks

This stock was a tech bubble darling. It rose to close to $800/share in late 2021 versus the $210 it sits at right now. The biggest risk is a resumption of the tech bubble and a similar spike to much higher prices. The other issue is that the company currently sits at just a small premium to book value and less than 8x projected consensus earnings of ~$26.50. Unless the potential losses I discussed materialize, there will be some investors who regard book value as a low on the stock. The company might regard the current price as attractive and start buying it back as well.

Conclusion

While many of these tech bubble stocks have sold off quite a bit from their highs, many of them have serious threats to their underlying businesses whose inherent weaknesses are being exposed as the tides rolls out and funding dries up. SIVB was one of if not the most aggressive banker to many start-up companies. That worked brilliantly in the VC funding boom but could cut the other way as the industry retrenches. I think playing this company from the short side (via puts or shorting the stock) makes a lot of sense particularly versus other banks that do not have the same tech exposure.

Be the first to comment