Eric Francis/Getty Images News

Charlie Munger’s Alibaba Group (NYSE:BABA) investment was the talk of the town last week. In its Q1 13F, the Daily Journal Corp (DJCO) revealed that it had sold 50% of its stake in the Chinese tech company, after several quarters of averaging down. It wasn’t immediately clear whether Munger himself made the decision to sell the shares, as he had stepped down just days before the end of the quarter. Tu To was elected to serve as the company’s CFO on March 22. She signed all of the company’s SEC filings from the 22nd onward.

There are many reasons why Munger (or somebody else) might have chosen to sell Alibaba. Not all of them necessarily reflect lower conviction in the stock. It’s possible that DJCO converted some of its NYSE shares to Hong Kong shares, or sold to cover a margin loan. Munger hasn’t spoken on the matter publicly yet, nor have any other DJCO officers, so we don’t know.

Charlie Munger is thought to have influenced many investors who bought BABA stock in 2021. He began buying the stock around $226, averaging down after that. Many other investors made similar moves. It was shortly after Munger’s first 13F featuring Alibaba that internet communities focused on BABA really started to take off. Some were founded just days after the release.

Naturally, Munger’s apparent sale made a big splash. BABA has always been at least partially a Munger clone trade, and it appears that Munger’s conviction in the stock has diminished. Shortly after the 13F was released, investors took to Twitter offering opinions and running polls asking others about what had happened.

We may never know. But it doesn’t matter, because BABA ceased being a Munger clone trade long before the 13F came out. When Munger stepped down as Chairman of the Daily Journal, it created ambiguity as to the actual level of influence he will exercise over the firm’s portfolio going forward. The DJCO portfolio is no longer a Munger portfolio–or at least, not 100% a Munger portfolio. For this reason, investors will need a better thesis than “clone Munger because he is good.” In this article, I will attempt to advance such a thesis, based on valuation, competitive position and China’s economic growth. First, though, let’s examine why it will not be possible to clone “Munger’s” BABA trades in future quarters.

Why Munger Can’t be Cloned Anymore

There are two reasons why it is impossible to clone Munger’s future BABA trades:

-

Munger is no longer Chairman of the Daily Journal.

-

Some of DJCO’s potential trades are impossible to confirm.

The first of these is easy enough to explain. When Munger was Chairman of the Daily Journal, he managed the investment portfolio. Now that he is no longer Chairman, he simply has the duties of a director. Munger could still volunteer to manage the portfolio, but the ultimate decisions would fall on Steven Myhill-Jones, the new CEO, or Tu To, the new CFO. The SEC filings announcing these new hires didn’t say who’d manage the portfolio.

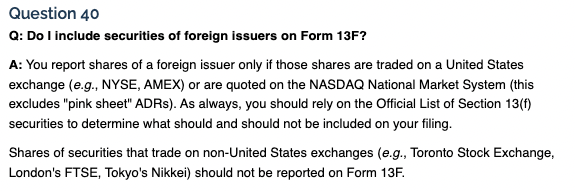

The second reason why Munger can’t be cloned now is because some of his potential trades wouldn’t have to be disclosed. Munger is well known for not telling investors more than he has to. If he simply converted some of his NYSE ADRs to Hong Kong shares, as some think he did, then he is no longer under the obligation to report all of his holdings. As the SEC website states, you don’t have to disclose foreign listed shares in a 13F, even if your position is massive.

Securities and Exchange Commission

What all this means is that cloning Munger’s BABA trades won’t be possible going forward. For those whose BABA position was little more than a Munger copycat, that has got to sting. Fortunately, the fundamentals-based thesis on the stock is not that difficult to comprehend, and can be explained in terms of four basic principles. In the next section I will explain that case in detail.

The Bullish Thesis on BABA

A strong bullish thesis on BABA can be built on four pillars:

-

China’s economy.

-

BABA’s competitive position.

-

Financial health.

-

Valuation.

I’ll look at each of these factors one by one, starting with China’s economy

China’s Economy

Despite the negative headlines you’re seeing these days, China’s economy is very strong. Its GDP growth was 8.1% in 2021. GDP has grown at 7.4% CAGR over 10 years. In 2020, when many countries entered recessions, China’s growth merely decelerated to 2.2%. With all of this growth, you might think that China is pumping itself full of debt. But think again! At 66.8, China’s government debt as a percentage of GDP is lower than that of the U.S., Canada, and the Eurozone. You may have heard stories about China’s “debt problem,” and claims of a 250% debt to GDP ratio. The figure is correct but it includes all debt, government and private. China’s government debt–the kind used to pay for fiscal stimulus–is low as a percentage of GDP. So China is growing very quickly and is fiscally sound enough to stimulate its economy should stimulation become necessary.

BABA’s Competitive Position

As we’ve seen, China has a high growth economy–the kind of economy that a company wants to operate in. That’s a great start but we still need to know about BABA’s competitive position.

As an eCommerce company, BABA has few rivals of similar scale. JD.com (JD) technically does more revenue than BABA does, but it has much smaller margins. It could beat Alibaba on scale but probably not on profitability. JD holds and sells inventory. It’s hard to beat a “platform” company like BABA when you have inventory costs. It eats into margins.

Pinduoduo (PDD) has been cited as a potential competitor to BABA but there’s just not much evidence of PDD moving beyond agricultural goods. Its group buying model has proven popular in China, but until it moves into other verticals, it’s not competing with huge chunks of Alibaba’s business.

Tencent (OTCPK:TCEHY) competes with BABA in one limited way: it has a payment app. The Chinese government forced BABA and Tencent to accept each other’s payment apps last year. So the competition between these two companies for share of payments has indeed increased.

BABA’s Financials

Alibaba’s long-term financials are excellent. The most recent calendar year was a bit of a departure from the long term trend, but that could turn around.

According to Seeking Alpha Quant, BABA’s five year CAGR growth rates in revenue, earnings and cash flows are:

-

Revenue: 42%.

-

Net income: 11.3%.

-

Diluted EPS: 9.8%.

-

Free cash flow: 13.66%.

These are pretty solid metrics. They were all much higher prior to this year, but the 2021 Chinese tech crackdown caused last year’s numbers to suffer. BABA did take some new costs in 2021, like a $2.8 billion fine and a higher tax rate. However, the fine was non-recurring and the higher tax rate could be “outgrown” with enough quarters of strong revenue gains.

At any rate, Alibaba has more than enough financial strength to ride out a few lacklustre quarters. Its balance sheet is one of the strongest in the world, boasting eye-popping metrics like:

-

$276 billion in assets.

-

$100 billion in liabilities.

-

$176 billion in equity.

-

$45 billion in cash.

-

About $20 billion in debt (calculated from $5.09 billion in bonds $14.85 billion in long term bank loans).

-

$105 billion in current assets.

-

$64 billion in current liabilities.

-

A 0.2 debt to equity ratio.

-

A 1.64 current ratio.

So we have debt that is very low as a proportion of shareholder equity, and high liquidity. Even BABA’s cash and equivalents outstrip its long term debt! This suggests a very solid balance sheet and a second-to-none ability to ride out a crisis.

Valuation

Valuation has always been one of the pillars on which the BABA bull case has rested. BABA stock is very cheap by almost every multiple you can think of. Some of its most encouraging value metrics include:

-

Adjusted P/E: 11.

-

Price/sales: 1.96.

-

Price/book: 1.67.

-

Price/operating cash flow: 9.37.

All of these multiples are comparatively low for the tech sector. For comparison, Amazon (AMZN), the closest comparable U.S. company, has a 46 adjusted P/E ratio.

BABA’s GAAP P/E ratio (25) is a little high, but the most recent quarter included large unrealized losses on the company’s stock portfolio. Adjusted earnings and cash from operations are more closely related to the company’s operating performance, and not surprisingly, they were much higher than GAAP earnings. This isn’t just selective choice of non-GAAP measures either: operating cash flow is a GAAP metric and Alibaba reports in accordance with U.S. GAAP.

Risks and Challenges

As we’ve seen, Alibaba is cheap, profitable, and has high historical growth. Certainly this stock has many things to recommend it, even after Charlie Munger rode off into the sunset. However, there are still risks and challenges to the bullish thesis on Alibaba stock. Two of the most salient include:

-

A renewed tech crackdown by China. China’s tech crackdown was likely responsible for BABA’s 2021 stock price decline. Among other things, the crackdown resulted in a $2.8 billion fine, a tax hike, and forced payment sharing with Tencent. The fine and the tax hike were real costs that were recorded on BABA’s income statements in 2021. If the CCP resumes its crackdown it could culminate in more measures that erode shareholder value.

-

Delisting. Alibaba stock is thought by some to be at risk of being delisted from U.S. Exchanges. The SEC maintains a list of companies that need to open their books to more audit inspection. Alibaba is not on the list, but tech giants like Baidu (BIDU) are. If Alibaba is added to the list, that could cause some nervous investors to sell. The factual consequences of delisting aren’t that concerning: investors can convert to Hong Kong shares. But the threat of it may make investors worry.

These are real risks that investors will need to keep in mind. But on balance, Alibaba looks like a solid value play today. It’s still growing its revenue, its cloud business is inching toward profitability, and its valuation is cheaper than ever before. On the whole, it looks like a sweet deal – with or without Munger on board.

Be the first to comment