oatawa/iStock via Getty Images

In response to recent developments surrounding Elon Musk and social media company Twitter (NYSE:TWTR), I am changing my recommendation from Twitter from buy to sell. Considering that a full hostile takeover of Twitter is unlikely, I believe it is best for shareholders to sell into the current strength!

Recent Events

The share price of Twitter has surged after Elon Musk first announced accumulating a 9.2% stake in the micro-blogging platform at the beginning of the month. Twitter initially responded positively, offering Elon Musk a seat on the board. However, the social media company attached a condition to Elon Musk taking up a board seat on Twitter: The billionaire Tesla (TSLA) founder would not be allowed to sit on the board while holding more than 14.9% of Twitter.

After rejecting his board seat, Elon Musk yesterday made an offer to acquire 100% of the social media company and proposed to take the company private. The offer was made for $54.20 which values Twitter at $43B. The takeover price represents a 38% premium over the closing price of Twitter’s stock on April 1, 2022 which was the day before Elon Musk’s 9.2% investment in Twitter was made public.

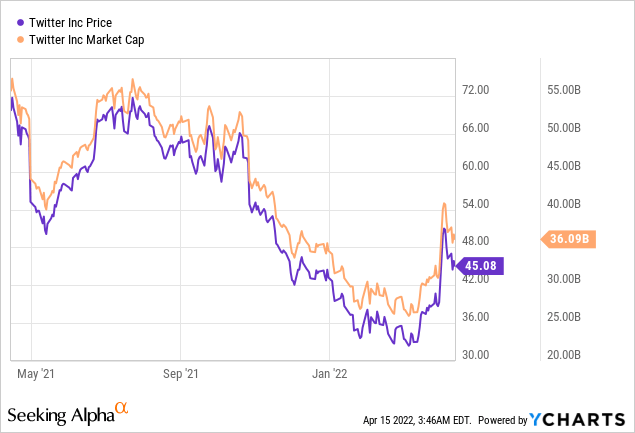

Shares of Twitter initially surged yesterday, but later skidded as the market reevaluated the odds of a hostile takeover of Twitter succeeding. Still, Elon Musk’s involvement in the social media company has resulted in a much higher valuation for the firm compared to March.

How Likely Is It That Elon Musk’s Takeover Offer Will Be Accepted?

Board members have a fiduciary duty to evaluate take-over offers and make a determination about whether or not an offer is in the best financial interests of shareholders. I don’t believe, at this point, that Twitter will accept Elon Musk’s takeover offer and the company might look for another potential acquirer. The reason why I believe that the takeover offer will not succeed is because the existing management team at Twitter and Elon Musk have different strategic visions for the micro-blogging platform and a compromise solution seems unlikely.

Changing Recommendations

In my last work on Twitter, I recommended to buy the social media company due to a strengthening ad business, strong user growth and improving free cash flow in FY 2022. I still believe these reasons are valid reasons to consider Twitter… if there wasn’t a takeover offer on the table.

The surge in Twitter’s stock price from $39, before the disclosure of Elon Musk’s 9.2% stake, to $54 this week gives investors the opportunity to capture a huge takeover premium. If the takeover bid for Twitter gets rejected by the firm’s board and Elon Musk officially abandons his hostile takeover of the company, the share price of Twitter is likely to sink back to where it was in March.

Why I Could Be Wrong About My Sell Recommendation

Text messages from Elon Musk to the board of Twitter, disclosed in a regulatory filing, show that the billionaire wants to take Twitter private. Doing this requires not only board approval but also the approval of the majority of shareholders. I see this as unlikely as Elon Musk is likely going to face considerable opposition to his plans.

But anything can happen in the stock market and Elon Musk’s bid for Twitter may succeed. In this case, Twitter’s current stock price of $45.08 is set to rise to the official takeover price of $54.20, meaning investors that sell now may potentially leave 20% of returns on the table… at a minimum.

I deliberately say “at a minimum” because there is the possibility that the hostile takeover fight over Twitter escalates and draws in other bidders. Anti-trust laws likely preclude companies like Google or Meta Platforms to jump into the takeover battle, but other companies or a consortium of private investors may decide to snatch Twitter away from Elon Musk… by offering a higher price. The likelihood of this happening may be low, but it is nonetheless a risk when selling shares now. Should competing offers for Twitter be made, the share price of the social media company may rise significantly above the current share price and above Musk’s takeover price of $54.20.

Final Thoughts

I sold Twitter yesterday but I may jump back in if Twitter’s share price drops to the low $30s again. Given the pros and cons of an investment in Twitter, given the current takeover situation at the social media company, I believe the best course of action is to sell into the current strength!

Be the first to comment