Toby Jorrin/Getty Images News

The wait is over as WarnerMedia has finally been spun off from AT&T (NYSE:T) and merged with Discovery (DISCA). As a long-term bull that believed the market had misvalued T for years, it’s bittersweet as a new chapter begins. Warner Bros. Discovery (WBD) was born, and former shareholders of T have retained their legacy shares of T, while receiving shares in the new company. While I would have loved for T to become vindicated through an appreciating share price, I am confident that this deal will ultimately benefit shareholders more than keeping WarnerMedia under the legacy entity.

Sometimes new beginnings are beautiful as new stories begin to unfold. For me, the overall investment thesis hasn’t changed; if anything, this deal made it stronger. I am keeping both the legacy T shares and the newly minted WBD shares as I believe both will appreciate. I will not be cashing in either set of shares as I still view T as a strategic income play with significant upside and WBD as an underappreciated media conglomerate with tremendous upside and possible buyout possibilities. Whether you’re a previous shareholder or buying shares for the first time, I believe there are opportunities in both T and WBD.

The Aftermath For Shareholders of AT&T

Leading up to 4/11/22 has been painful, to say the least. Finally, the transaction closed to combine WarnerMedia and DISCA to form WBD. A media conglomerate has been born as this combination is a premier standalone global media and entertainment company. The quality of content lies in the eyes of the beholder, but its irrefutable is the strength of WBD’s portfolio. Every streaming service, including Netflix (NFLX), Disney+ (DIS), and Hulu, should be extremely worried. The argument could be made that the combination of HBO, HBO Max, Warner Bros. Entertainment, Discovery Channel, discovery+, CNN, CNN+, DC, Eurosport, HGTV, Food Network, Investigation Discovery, TLC, TNT, TBS, truTV, Travel Channel, MotorTrend, Animal Planet, Science Channel, New Line Cinema, Cartoon Network, Adult Swim, Turner Classic Movies, etc., would create the most complete streaming service on the market if packaged together.

AT&T

I believe the shareholders of T are the winners for once. Shareholders of T received 0.241917 shares of WBD for each share of T’s common stock they held.1.7 billion shares of WBD, representing 71% of WBD, were distributed to T shareholders. Within the details, the legacy entity of T received $40.4 billion in cash and WBD’s retention of certain debt. Shares of WBD opened around $24.89 on 4/11, while T opened at $19.03. After three days of trading, WBD closed at $26, an increase of $1.11 or 4.46%, while shares of T closed at $19.42, increasing by $0.39 or 2.05%. T’s dividend is still a monster with a forward yield of 5.72%, as it now pays $1.11 per share.

So what is the street saying in the wake of these events?

WBD

- Deutsche Bank has made WBD its top pick in Media, saying it’s one of the best-positioned companies in global streaming. Deutsche Bank has a $40 price target on WBD, implying a hefty 66% upside.

- Evercore has an outperform rating on WBD, indicating that shares are undervalued given a 14% 2023 levered free cash flow yield and a path to grow free cash flow per share at double digits beyond 2023

- Atlantic Equities also boosted WBD to Overweight with a $40 target

- Bank of America (BOA) has a buy rating with a $45 price target

T

- BOA has a buy rating on T with a $25 price target

- JPMorgan Chase (JPM) has a $22 price target on T

- Deutsche Bank has a $24 price target on T

- Citi has a $22 price target on T

- Raymond James has an outperform rating on T with a $26 price target

Ultimately the street seems to favor T’s new direction. The price targets on WBD look favorable, and legacy T also looks to have some upside potential. Over the next several weeks, we’ll see how the market reacts, but things are looking up for battered shareholders of T.

The New Income Play

Back on July 26th, 2021, I broke down what T’s future dividend would look like based on the information provided. This quote was directly from AT&T’s website:

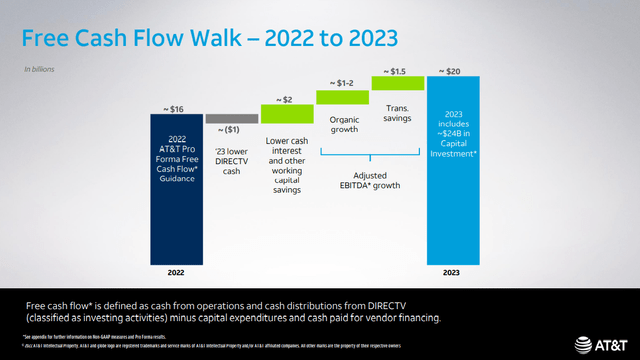

Attractive dividend – resized to account for the distribution of WarnerMedia to AT&T shareholders. After close and subject to AT&T Board approval, AT&T expects an annual dividend payout ratio of 40% to 43% on anticipated free cash flow1 of $20 billion-plus.

I had speculated that T would stay conservative and only payout 40% of its projected FCF, which allocates $8 billion toward the dividend. T had 7.2 billion shares outstanding, so the math was simple. $8 billion divided by 7.2 billion common shares is a dividend of $1.11 per share. The question was, how would WarnerMedia be valued, and how much would T’s share price drop after it was spun off?

We received our answers, and as expected, T is still a high-yielding beast. Shares of legacy T started trading around $19.03, putting its forward yield at 5.83% based on the $1.11 dividend. At $20 per share, the forward dividend yield is 5.55%, and at $22 per share, T still exceeds 5% with a 5.05% forward yield. So far, Raymond James has the highest price target on legacy T at $26 a share. If this is reached, which would be a 36.63% ($6.97) increase from where it started trading, the dividend would still have a forward yield of 4.27%.

Previously, T was a dividend aristocrat, on its way to becoming a dividend king, having increased its annual dividend 36 consecutive times. Those days are in the past, but that doesn’t mean a new dividend appreciation plan won’t be put in place. With a 40% payout ratio, T has more than enough room to provide annual dividend increases going forward. Today legacy T is still one of the highest yielding large-cap equities you can invest in. The forward yield, which exceeds 5%, should be intact for some time, and the dividend is not under any pressure due to T’s enormous FCF. Shares of T still represent an income play with the potential for future dividend increases in the future.

The Growth Opportunity

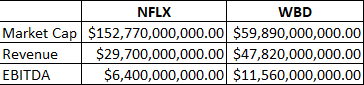

Personally, I believe WBD represents a tremendous growth opportunity. Now that WBD is trading, the analysis becomes even more clear compared to Netflix (NFLX). WBD has a market cap of $59.89 billion, while NFLX has a market cap of $152.77 billion. NFLX has a larger market cap of $92.88 billion, which is 255% larger than WBD. I believe WBD is worth $66.07 per share at the very minimum as its market cap should be equivalent to or exceed NFLX.

Please put any bias about content aside, as there will be people who feel NFLX has superior content as some readers will feel that the combined content library on the WBD side is vastly superior to NFLX. I have both NFLX and HBO Max, and I feel that if WBD was to package all of their content together, I would rather pay for that over NFLX, but that’s just a personal opinion. The numbers between the two entities are not an opinion; they are facts, and here is how these entities stack up.

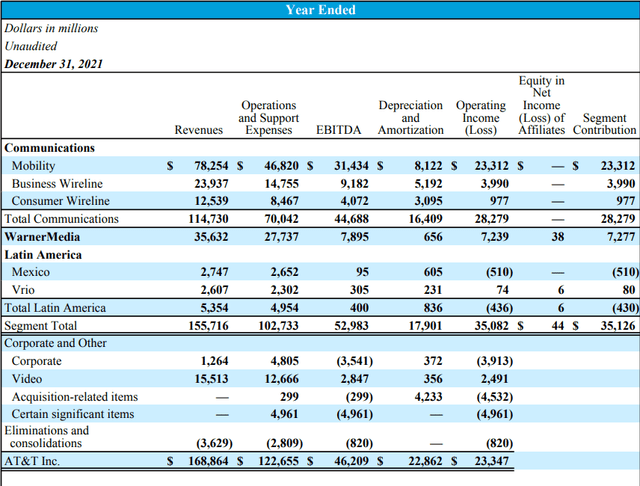

Netflix has a $152.77 billion market cap and, in 2021, generated $29.7 billion in revenue and $6.4 billion in EBITDA. DISCA pre-merger generated $12.19 billion in revenue and $3.66 billion of EBITDA in 2021. The WarnerMedia segment, when it was under T’s corporate umbrella in 2021, generated $35.63 billion in revenue and $7.9 billion of EBITDA. In 2021 the combined entity of WarnerMedia and DISCA generated $47.82 billion in revenue and $11.56 billion in EBITDA.

Steven Fiorillo

NFLX is drastically overvalued by the numbers, or WBD is drastically undervalued. NFLX reached a 52-week high of $700.99 and has taken a 51% haircut since then. Over the past month, NFLX has traded sideways, indicating that a bottom has been established. I can’t predict if NFLX has bottomed, but what is clear to me is that WBD is undervalued. I think the $40 and $45 price targets on WBD are conservative, and WBD could go north of $50 or $60. I think this was the correct course of action for T, and merging WarnerMedia with DISCA should create a growth opportunity and unlock value for shareholders.

There is also another side to the growth play, and that’s an acquisition. There are 4 main companies that could acquire WBD, and those are NFLX, Amazon (AMZN), Disney, and Apple (AAPL). I think NFLX or AAPL would be the most likely suitors, though.

NFLX has seen increased competition and, due to consolidation, has lost distribution rights to highly sought-after content. More consolidation in the space will only hurt NFLX, and acquiring WBD makes perfect sense. NFLX could create a standard plan with incremental increases for additional services or create an all-inclusive subscription plan. This would boost original content, add a massive library, and provide access to actual TV networks while generating a tremendous increase in revenue and EBITDA. This bolt-on acquisition may need to be done out of necessity.

AAPL has $63.91 billion in cash on hand and another $139 billion in cash under long-term investments. AAPL could write a check for WBD and bolster Apple TV and its Services business. This would provide significant studios for original content, deal a blow through consolidation to its streaming rivals by taking a chess piece off the board, and AAPL could sell off any pieces from WBD that they don’t want.

I think WBD has a halfway decent chance of being acquired as content is king in a digital world.

Conclusion

As one door closes, another door opens. T has been one of the market’s most hated stocks, but today is a new day. I am planning on holding both the legacy T and WBD shares. Most people invested in T as an income play, and with T’s forward yield still exceeding 5%, it’s still a sufficient income play. WBD has tremendous potential, and I see shares appreciating or a buyout occurring. I think shareholders will see a small level of share appreciation in legacy T while generating a substantial yield and could see more than 100% in capital appreciation from their shares in WBD. Only time will tell how this deal pans out, but it’s currently looking promising.

Be the first to comment