Drew Angerer

Thesis

Twilio Inc.’s (NYSE:TWLO) Q2 earnings release corroborated our concerns illustrated in our previous article that its growth has continued to slow markedly. Furthermore, the macro headwinds impacting its customers also seemed to have affected its usage-based business model, which could see further headwinds on its small and medium-sized businesses (SMBs) customers.

Notwithstanding these headwinds, the company remains committed to meeting its non-GAAP operating profitability by 2023. Also, management highlighted that it has yet to see a broad-based slowdown across various verticals, even though there was some “softness” in crypto, consumer on-demand, and social media. Hence, the company does not expect structural weaknesses to persist in its growth trajectory as it deals with the impending economic downturn.

We have been observing TWLO’s price action for a while. We note that its valuations have been sufficiently de-risked to reflect its unprofitability and near-term uncertainties. Coupled with the likely medium-term bottoming process of speculative stocks, we are confident that the reward-to-risk profile seems attractive for TWLO moving forward, as it has a line of sight over its profitability profile.

Accordingly, we revise our rating on TWLO from Hold to Speculative Buy, with a medium-term price target (PT) of $100 (an implied upside of 31.6%).

Q3’s Guidance Spooked The Market, But Look Ahead

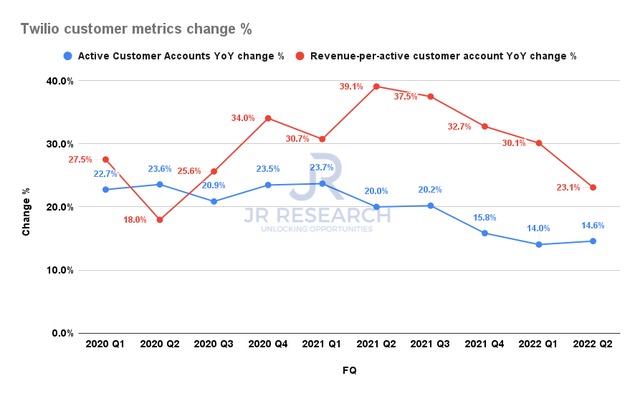

Twilio customer statistics % (Company filings)

Management highlighted that it did not see a material de-rating in its overall business in Q2 as the company outperformed the consensus estimates. However, as seen above, the trends in its critical underlying metrics have also demonstrated a marked slowdown since Q2’21.

Its active customer accounts reached more than 275K in Q2’22. However, its growth has also been slowing markedly from 2021, reaching 14.6%. Notwithstanding, it’s possible that its normalization could be reaching a nadir over the next few quarters as Twilio laps less challenging comps. Given Twilio’s scale with SMBs in general, we urge investors to pay attention to whether it could further impact Twilio’s accounts growth.

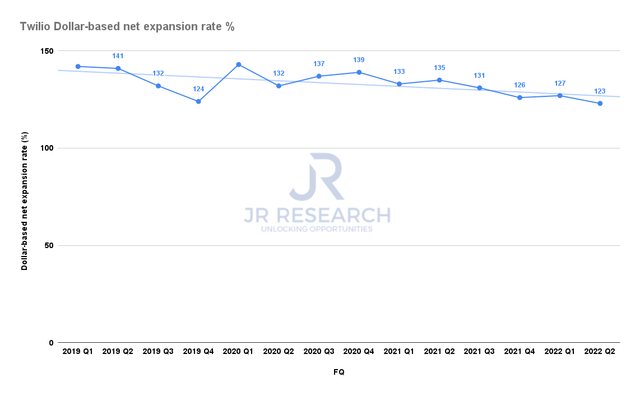

Twilio dollar-based net expansion rate % (Company filings)

Furthermore, the company’s dollar-based net expansion rate (DBNER) has been trending down, suggesting that its customers’ recurring spending has been weakening. The company posted a DBNER of just 123% in Q2, down from Q1’s 127%. Argus also highlighted its concerns in a recent commentary, as it articulated:

The company’s forward growth is likely to continue to move lower. The dollar-based net expansion rate of 123% for 2Q22 moderated from 135% a year earlier, as revenue growth among existing customers shows signs of slowing. – Seeking Alpha

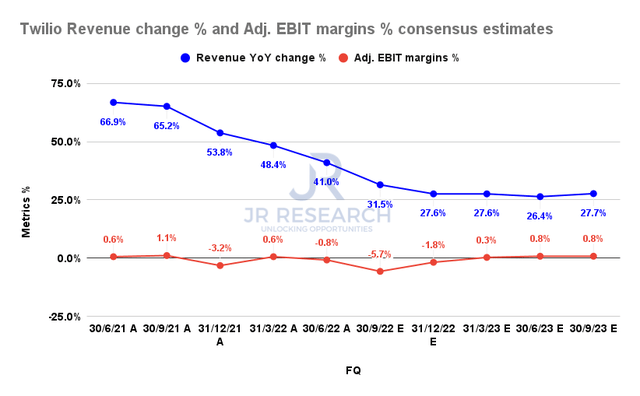

Twilio revenue change % and adjusted EBIT margins % consensus estimates (S&P Cap IQ)

Furthermore, the company’s tepid Q3 guidance was well below the consensus estimates (bullish). Therefore, we believe it spooked the market as it suggests that the company’s growth profile and profitability guidance could be at risk.

However, the consensus estimates suggest that the company’s growth normalization could reach a bottom in Q3 or Q4 before stabilizing. Hence, we postulate that the battering seen in TWLO has justifiably accounted for such moderation in its growth parameters, given the current economic headwinds.

Accordingly, we are confident that the market would likely re-rate TWLO subsequently, as speculative stocks have also likely bottomed out in June/July.

Is TWLO Stock A Buy, Sell, Or Hold?

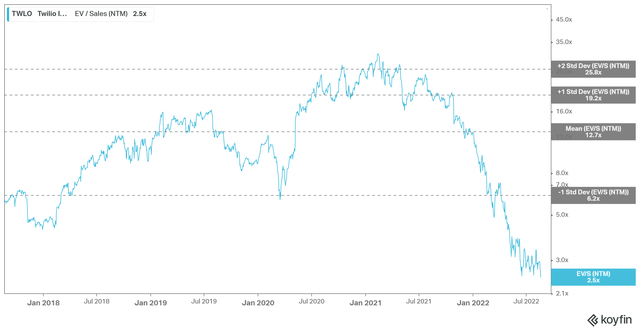

TWLO EV/NTM revenue trend (koyfin)

TWLO last traded at an NTM revenue multiple of 2.48x, which is well below its mean and 1 standard deviation band, as seen above. Therefore, it’s arguable that the market has reflected its unprofitability and growth normalization from its pandemic-driven tailwinds.

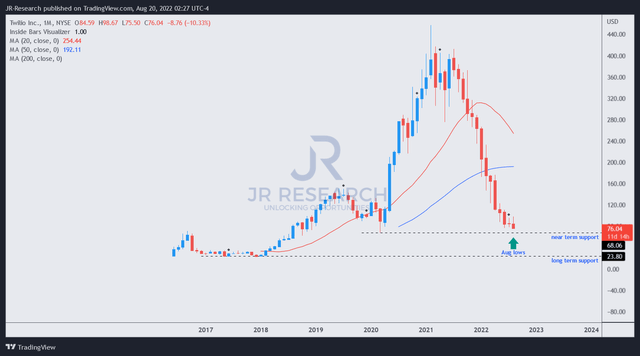

TWLO price chart (monthly) (TradingView)

Notwithstanding, TWLO’s price action in August breached its June lows. However, a glance over its long-term chart suggests that the long-term bottoming process remains intact, despite the recent downside volatility.

Therefore, we postulate that the recent weakness represents a “clear the deck” move to shake out weak hands before the market re-rates TWLO higher subsequently.

We are confident that TWLO’s reward-to-risk profile points to further upside from here, with limited downside risks.

As such, we revise our rating on TWLO from Hold to Speculative Buy, with a medium-term PT of $100.

Be the first to comment