RomoloTavani

I’m sure many of you know who the so-called “Grave Dancer” is, but in case you don’t, let me give you a quick education.

Sam Zell is a billionaire – worth $5.4 billion according to Forbes – and he is ranked as the 485th largest billionaire in the world on the Forbes Billionaires list.

Much of Zell’s net worth was created in commercial real estate – specifically in portfolios that include healthcare, hospitality, energy, finance, and communications holdings.

In 2007, he sold Equity Office Properties Trust to Blackstone Inc. (BX) for $39 billion. At the time, that was the largest LBO (leverage buyout) in history. As it turned out, his timing was practically impeccable considering how most of those properties were underwater by early 2009.

Zell was once nicknamed “the grave dancer” for his strategy of profiting from distressed real estate after a bubble burst. Though, of that, he also once cautioned“:

“He who dances closest to the graves always has to be careful he doesn’t fall in.”

Those are good words to live by. And my regular readers know what I think of excess risk. Zell’s net worth is also tied to three real estate investment trusts (“REITs”):

- Equity Residential (EQR): Founder & Chairman

- Equity LifeStyle (ELS): Founder & Chairman

- Equity Commonwealth (EQC): Founder & Chairman.

Now, given that definition of “grave dancing,” I would say that Mr. Zell is an experienced real estate investor who is considered a quintessential bargain hunter.

I actually met him a few months ago at his office in Chicago, where I provided him with an autographed copy of my new book, The Intelligent REIT Investor Guide. Mr. Zell was kind enough to provide a testimonial for my book.

Zell is not the only billionaire that I’ve met (or the last). I’m in the process of lining up a few more billionaire interviews which are invaluable to me and my followers.

Sitting down to spend time with these industry titans is extraordinarily valuable as I can absorb knowledge that in turn enables me to generate content, much like this article that you’re reading. One of my frequent comments goes like this,

“The most durable education is self-education.”

Now, let me show you three REITs that are textbook examples of investing like a grave dancer…

Medical Properties Trust, Inc. (MPW)

When thinking of REITs that have been beaten down and left for dead, one of the first names that comes to mind is Medical Properties Trust. The REIT and its management team has been on thin ice with investors for some time now.

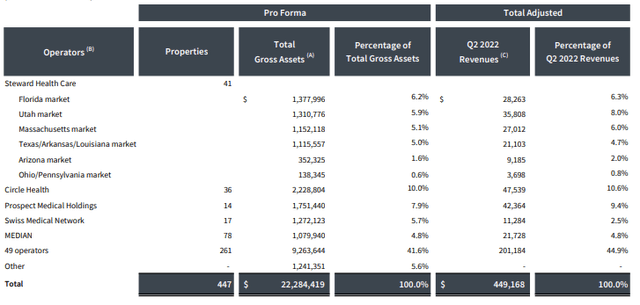

Investors are beginning to lose confidence in the MPW management over a lack of transparency, particularly related to the company’s top operator, Steward.

All this is essentially the center focus regarding a short report that is out on MPW shares from Risk Management firm Hedgeye. Hedgeye and some investors would like the financials of Steward or more metrics, given that Steward accounts for a large portion of the REIT’s total annual rent.

It is a valid concern given the exposure MPW has to Steward, but based on everything management has told us directly, combined with the data they do release, Steward still seems to be doing OK.

This leads to two real options. If you side with Hedgeye and believe Steward is going under, then MPW may not be a position for you. However, if you are value hunting, well then you have the opportunity to pick up shares of MPW at an extremely low valuation, something I will dive into a little more below.

Medical Properties Trust is a pure-play hospital REIT, and, if the past two years did not tell you the importance of hospitals, well then I do not know what else to tell you. Hospitals are essential to healthcare and are something that are always needed, across the globe.

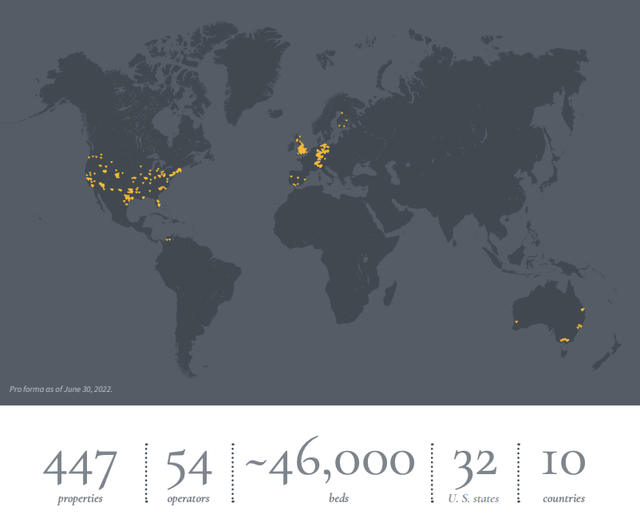

MPW is a global REIT with properties here in the U.S. and throughout 10 countries overall, including Australia, Colombia, Portugal, Italy, Spain, Switzerland, and Finland. In all, the company has 447 properties that are leased out to 54 different operators.

Q2-22 MPW Investor Presentation

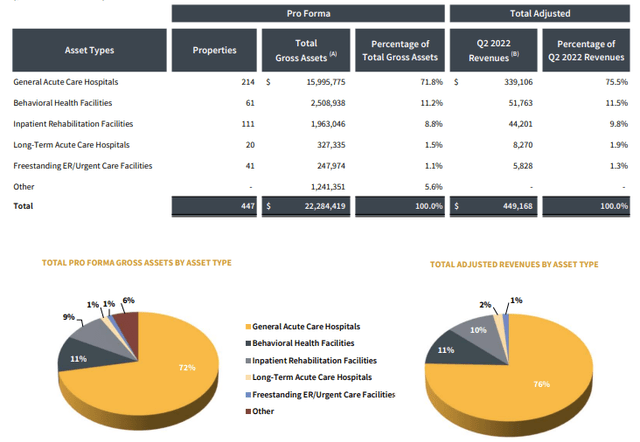

The chart below is a snapshot of the company’s different asset types, which you can see is made up of 72% general acute care hospitals followed by 11% behavioral health facilities

Q2-22 MPW Investor Presentation

Through the first half of the year, MPW has generated revenues of $810 million, which is up 8.7% from the $744.6 million they generated through the first half of 2021.

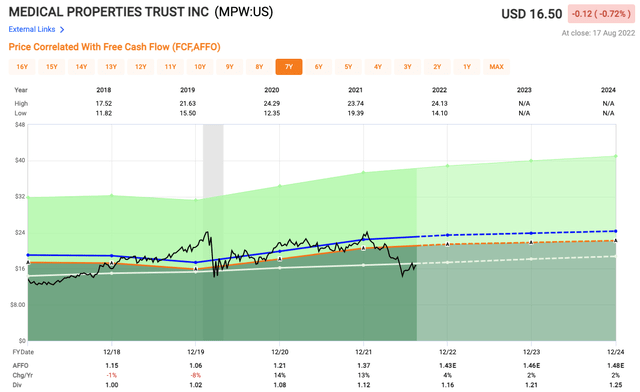

Revenue fell short of analyst expectations during the quarter while funds from operations (“FFO”) beat by $0.01. MPW reported adjusted FFO (“AFFO”) of $0.35 per share during Q2, which was $0.01 higher than prior year.

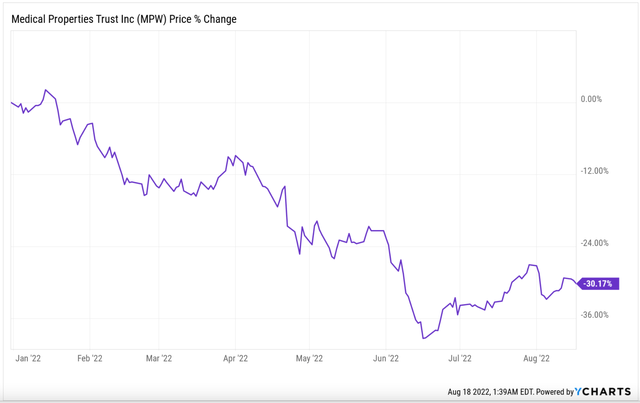

On the year, shares of MPW are down 30%, which is part of the reason we have now seen the dividend yield cross the 7% yield threshold.

MPW has been underperforming the broader market and REIT market so far in 2022 by a large margin. As I mentioned earlier, Steward is the top operator for the company and accounts for 27.8% of Q2 revenues.

Q2-22 MPW Investor Presentation

The exposure is high and investors have a right to be concerned. If the exposure was in the low single digits, we may be having a different conversation, but given that over a quarter of the company’s total revenues comes from this tenant who has shown cash flow issues in the past, investors have a right to be concerned.

As Nathan Rothschild famously said, “the time to buy is when there’s blood in the streets.” The blood is everywhere right now for MPW, but for those willing to take a little risk, shares of MPW appear to be trading at a grave valuation.

Long-term investors willing to wait it out, could be handsomely rewarded in the long-term. The risk/reward opportunity is quite compelling with the REIT trading at a P/AFFO of 11.6x and over the past five years, shares have traded closer to an AFFO multiple of 16.4x.

Simon Property Group, Inc. (SPG)

Next up is one of the most well-run REITs in all the land, and that is Simon Property Group, Inc. Simon Property has been a family business of sorts, as the current CEO is David Simon and his father and uncle are the ones who founded the company over 50 years ago.

As many of you are aware, the U.S. has now seen two consecutive quarters of negative GDP, which by definition equates to a recession. A recession can do a number of things to an economy, but the most common is the impact it has on consumer discretionary goods and services.

Simon Property Group is the highest-quality REIT in the world today, but a recession typically does not bode well for its customers. Simon Property Group has a portfolio of A-rated malls, meaning their sales per square foot is extremely high when compared to other malls.

This tells you that not only does the REIT have the highest quality properties, but it also hints at the idea of the demographic that shops at these malls. Higher-income individuals are typically the last to get impacted by a recession, so the window is typically not as long for them.

Whether that is the case remains to be seen this time around, but what we do know is the quality of the portfolio. As of Q2 2022, SPG owned or had an interest in 231 properties comprising 186 million square feet in North America, Asia and Europe.

The company also has an 80% stake in The Taubman Realty Group, which owns 24 regional, super-regional, and outlet malls in the U.S. and Asia. Additionally, the company also has a 22.4% ownership interest in Klépierre, a publicly traded, Paris-based real estate company, which owns shopping centers in 14 European countries.

Given the economic backdrop, being a mall owner has not been the greatest business around, but what we do know is the resilience the company shows after periods of slower economic growth. Long-term minded investors have a great opportunity to scoop up shares of a high-quality Blue chip REIT.

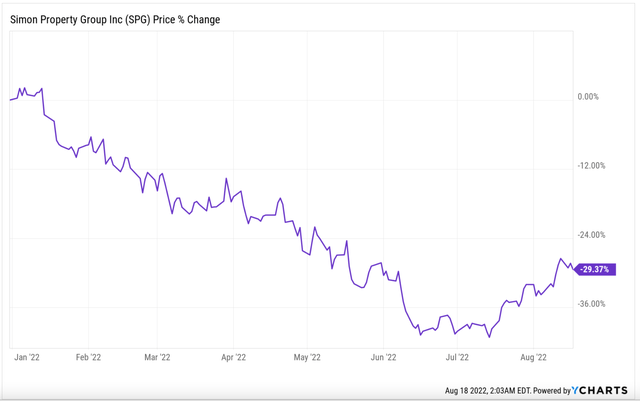

On the year, shares of SPG are down nearly 30%, in-line with where we saw MPW shares as well.

Regardless of where the greater economy is, SPG still reported a solid Q2 report. During Q2, the company reported an increase in revenue of 2.0%, operating income up 3.6%, and funds from operations up 1.2% year-over-year.

In terms of the results, SPG has not been hit all that hard yet, but that does not mean its tenants could start feeling a further pinch in the back half of the year as the federal reserve continues to hike interest rates.

In addition to decent results, management noted in the Q2 earnings call that “terminations continue to be at record lows for the year. Occupancy for the quarter was 93.9%.”

Companies continue to look for mall space, as the company’s leasing team signed nearly 1,300 leases for more than 4 million square feet during the quarter, and a strong pipeline of new leases in the works as well.

Prior to the Q2 earnings release, Simon Property’s board increased their dividend yet again by 16.7%. Here at iREIT, we often discuss the confidence it shows when a company increases its dividend, especially when facing a recession.

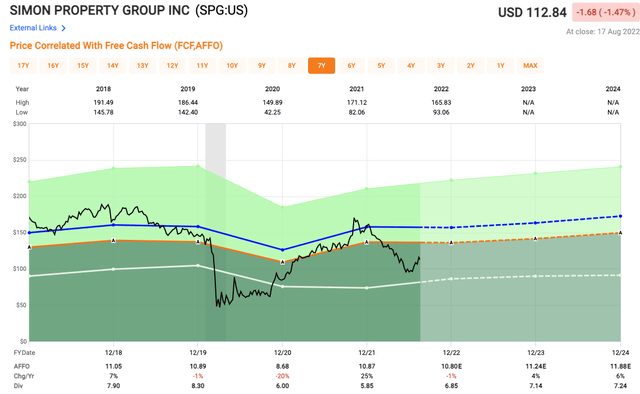

Management even raised its 2022 FFO guidance from $11.60-$11.75 to $11.70-$11.77, the second consecutive quarter it has done this.

A management team showing improving results, increasing guidance, AND a huge dividend raise isn’t one that seems too concerned about the economic downturn.

As we already noted, shares of SPG have been under pressure this year. The recent dividend increases combined with the lower share price has seen the dividend yield rise to 6.9% currently.

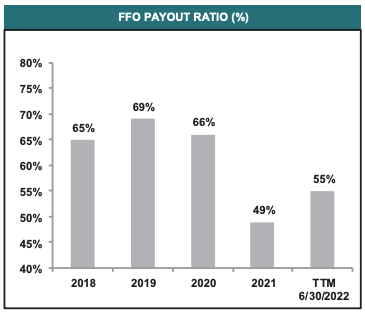

When a dividend is near 7%, an investor can’t help but think this may be a trap or a sucker’s yield. That is certainly not the case as it pertains to the SPG dividend, as it is well-covered by FFO.

As Simon currently trades, you could earn a 7% dividend yield right off the bat.

That’s not a trap, either. The current dividend is more than covered by FFO. Here is a look at how low that payout ratio is.

Q2-22 SPG Investor Presentation

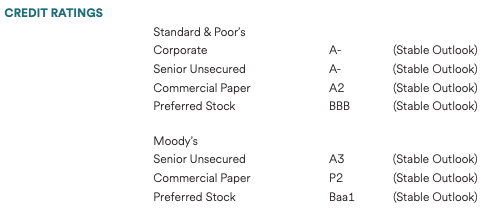

Simon Property Group also maintains a fortress balance sheet and is only one of seven U.S. REITs with two A-/A3 or greater credit ratings.

Q2-22 SPG Investor Presentation

David Simon and company have done a very fine job over the years and they continue to execute.

My thesis surrounding this company has not changed one bit. We may see some bumps in the short-term, which is natural during recessionary times, but owning a REIT like SPG is not something one would regret, especially at current levels.

Shares of SPG currently trade at a P/AFFO multiple of 9.4x and over the past five years that number has averaged 14.5x, indicating shares are very undervalued at current levels.

Boston Properties, Inc. (BXP)

The final REIT we will look at today that has also been sent to the penalty box in 2022 is Boston Properties.

We just looked at malls, and we can see a situation where those types of properties struggle in the near-term given the potential recession. Boston Properties is not a mall REIT, but instead, they are the largest publicly held developer and owner of Class A office properties in the U.S.

In the post-pandemic world, we can certainly see where office landlords have been impacted. Many companies offer more flexible work arrangements with remote working opportunities, which has put pressure on office landlords like BXP.

However, not all office properties are created equal. Take note that I said BXP is the largest owner of “Class A” office properties. These are not just any regular office building; these are some of the highest quality and technologically advanced office properties available.

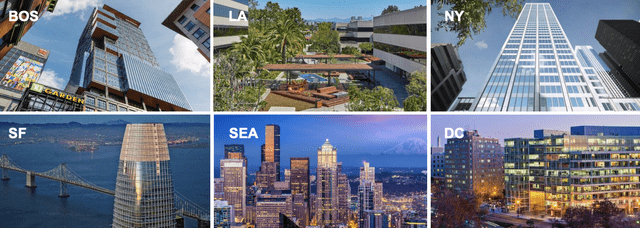

BXP owns a portfolio of 201 properties (over 53.1 million square feet) with a focus on gateway regions that have favorable supply/demand balances and rent growth, such as Boston, Los Angeles, New York, San Francisco, Seattle, and Washington DC.

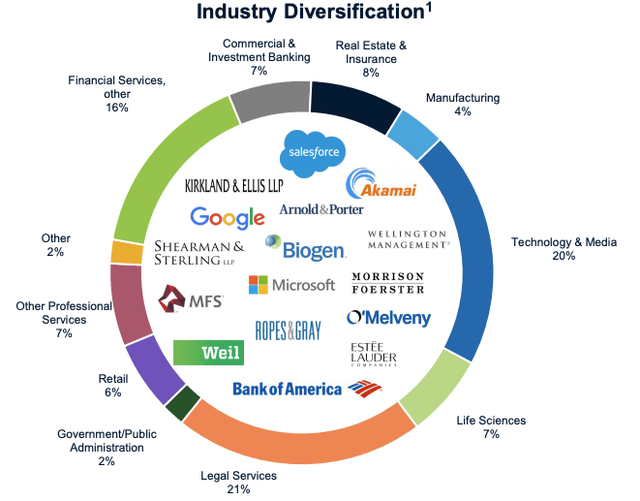

Across the 200+ property portfolio, you will find that these properties are leased out to some of the largest and well-known companies in the world. The industry diversification is fascinating as well.

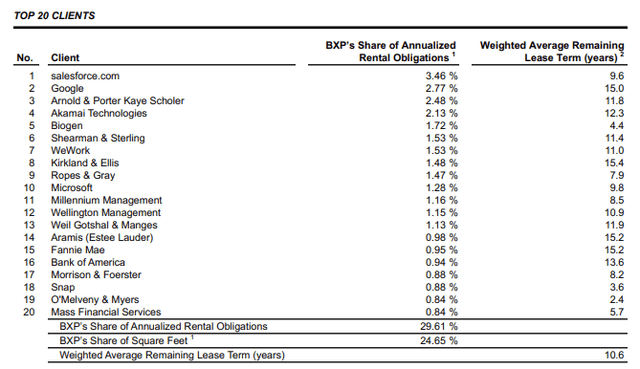

Here is a look at their top 20 tenants:

Having a diverse set of office types and tenants plays to BXP’s advantage. One of those property types that management remains very upbeat on is the Life Sciences properties. The Life Science industry continues to expand and the demand for these property types is high, just look at Alexandria Real Estate (ARE).

However, the Life Science industry is not immune to the slowdown we are seeing in the economy, and management alluded to that in their Q2 earnings call.

” …2021 was an extraordinary leasing year for life science, and the slowdown we are now seeing in the office leasing activity is also being felt in the life science market in our suburban Boston, suburban San Francisco and suburban Montgomery County portfolio.

The biotech index, IBX, is down significantly from a year ago and fewer private companies are getting funded, which translates into a drop in active requirements relative to last year. I would note that the big pharma companies continue to have an appetite for new space in our markets.

Early-stage life science tenants and their investors with an eye to slowing down their capital outflows are also pushing more of the capital spend needed to fit out space to the landlord in the form of higher TI demand.”

Let’s next take a look at the financials to see how the company performed in Q2. During the quarter, BXP saw revenues increase 8% to $773.9 million and FFO increased 13.4% to $304.6 million.

Overall, the quarter was rather solid for the company, not yet suggesting the recession is impacting tenants yet. In fact, management stated that they executed leases on 1.9 million square feet during the quarter, making it the strongest quarter since Q3 2019.

Management did warn on the call that although their leasing activity remains strong, they expect further headwinds in the back half of the year. If economic conditions worsen, they expect businesses to cut costs, which could see a tightening up of the in-person workforce.

Similar to the others we have looked at today, the risks are evident, but long-term investors could be greatly rewarded down the road.

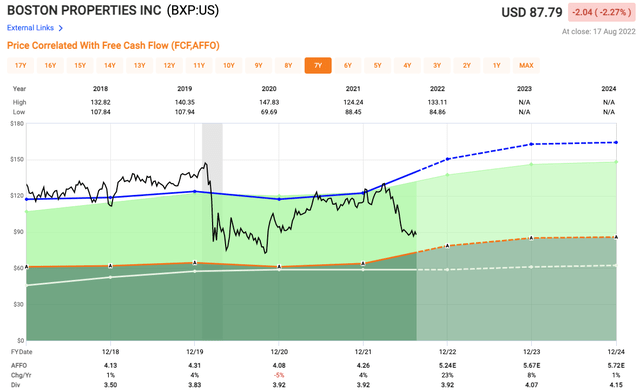

Shares of BXP current pay an annual dividend of $3.92 per share, which equates to a dividend yield of 4.4%.

BXP currently trades at a blended P/AFFO of 18x, which is well below its five-year average of 28.7x.

Given the company’s high-quality portfolio, strong leasing, and pipeline of future development, BXP may have a blurry near-term, but the long-term outlook sure looks bright.

Don’t Follow the Herd

One of the common traits of many billionaires is that they possess contrarian characteristics, such that when everyone is selling, they’re buying. These ultra-wealthy investors don’t buy popular stocks, they seek out bargains, just like the “grave dancer.”

Keep in mind, any value investor who can see beyond the downgrades and negative news can buy stocks at deeper discounts because they’re able to recognize a company’s long-term value.

In the world of investing there is a natural tendency to “follow the herd” and become fixated on the irrational exuberance of the market. When the stock market is going down, your natural tendency is to want to sell.

Conversely, when the stock market is going up every day, your natural tendency is to want to buy.

So, to follow another billionaire, Warren Buffett’s sentiment, in a bubble you probably should be a seller and in a bust you should probably be a buyer. Not following the herd means that you must have that kind of a discipline.

Of course, discipline means thinking long term.

The “herd” mentality is simply the reaction of Mr. Market and the whims of short-term trading prices that are affected by many things – most of which have nothing to do with the value of the company.

Value investors recognize that there is simply no way to accurately and consistently time short-term market movements and, by investing in companies with long-term predictability, the stocks will offer the highest potential returns.

Happy REIT Investing!

Be the first to comment