jaanalisette/iStock Editorial via Getty Images

Investment Thesis

Twilio (NYSE:TWLO) is a leading communication platform. Twilio is well set up to disrupt the ways that companies rely on legacy technologies to communicate with their own customers. Disrupt. That’s the keyword. And that’s also why the stock has fully blown up.

Investors latched on too tightly to the idea of a ”disruptor” on the way up and now investors want nothing to do with yet another disruptive platform on the way down.

And there are obvious reasons to avoid an investment in Twilio. More specifically, the business appears incapable of turning a clean profit any time soon.

That being said, I now question whether insight may have already been factored in many times over already?

Hence, in this new context, I upgrade Twilio to neutral from sell.

A Very Fast Moving Market

Two months ago, I issued Twilio with a sell rating:

Author’s coverage

Since then, the stock has sold off substantially in a short period of time, and it’s down 30% in two months. And despite being directionally correct, I’m now updating my stance to a neutral stance. Here’s why.

Investing is not a science. It’s more of art combined with mathematical odds. There are times when the odds are slightly more aligned in one direction than the other.

But as a long-only investor, I’m much more interested in finding stocks that could work out positively than couldn’t.

What’s more, I acknowledge that the game is not about timing the bottom on the stock. It’s about buying low and selling high. That’s it.

But at the same time, even without being able to buy at the bottom, there are times when an investment looks more favorable and when it looks less favorable.

Case in point: Back in May, when I issued my sell rating, I noted that Twilio was priced at 6x forward sales. And then I went on to say,

I’m inclined to believe that this stock is now fairly valued.

That being said, keep in mind, that the main blemish here is that Twilio simply can’t stop stemming losses.

When I made those statements, Twilio was priced at $122 per share. Today Twilio is priced at $85. And always keep in mind the context, that from its highs Twilio is down circa 80%.

Hence, I believe that there becomes a point when investors can only meet a stock with despondency where there was once passion.

With all this in mind, I’m now upgrading my rating to a neutral rating. There are still the same issues that there were in May.

But investing is about context. And the context is that countless small and midcap players in tech are now down more than 75%. These are viable businesses, but the significant passion for these businesses has now washed out.

TWLO Stock Valuation – Looks Very Reasonable

There are two negative considerations at play and one positive consideration. The positive is that we are now over halfway through 2022 and we can start to price 2023.

Looking out to 2023 Twilio is priced at 3x forward sales. Is that a fair multiple for a SaaS business? I don’t know.

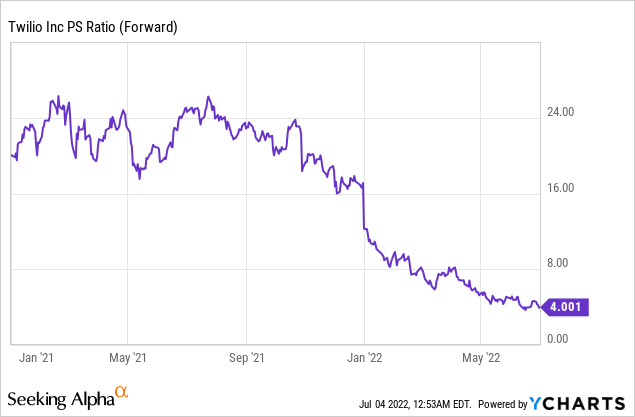

Let’s think this through. What we see above is that Twilio is now priced at 4x this year’s sales, fiscal 2022. While I don’t know if this indeed is the fair multiple for a SaaS business, I have to keep in mind that this is a dramatic compression in its multiple from this time a year ago, when Twilio was being priced at 24x forward sales.

Could Twilio’s multiple compress even further? It could. But is it likely to substantially compress further? I’m not entirely convinced.

Why could Twilio’s multiple compress further? This is what we discuss in the next section.

Two Investment Risks Facing Twilio

There are two risks facing Twilio. The first is its lack of profitability and the second is the potential impact of a recession on Twilio’s business model.

As you know, for fiscal Q2 2022, Twilio’s non-GAAP operating margins were 1%. Meanwhile, Twilio has often cited that it will look to exit 2022 with non-GAAP operating margins at a breakeven level.

This includes stock-based compensation being added back, of course. If Twilio’s upcoming earnings show that despite a slowing business environment it is still on track to exit 2022 with non-GAAP operating margins at breakeven, that would be very much bullish for the stock.

But if the narrative were to change, and Twilio gave investors the impression that its path to breakeven is now further away, investors would not look kindly towards the stock.

Twilio is a communication platform. For companies that wish to get their message out to their own customers, to contact their customers through their own first-party data, Twilio’s platform provides this solution.

And this takes me to my second investment risk.

Given that we are now facing an imminent recession, it’s only logical to ask the following question. Will demand for Twilio’s products be materially reduced during a recession? Will its customers view Twilio’s products as a critical service?

I’m inclined to believe that Twilio’s customers would in the first instance look to cut back other operational expenses in a recession. Why?

Because if a company can’t adequately communicate with their own customers, the likelihood of making more sales gets dramatically reduced. After all, companies still need to get their message out there. Or better said, now more than ever, customers need to get their message out there.

Twilio offers its customers the tools to tailor their messages to different customer cohorts, in order to maximize engagement and drive sales.

That being said, it will be very helpful to see Twilio’s updated guidance to get a better feel for how management believes Twilio will be positioned for a recessionary environment.

The Bottom Line

As I alluded to throughout, Twilio’s stock has now thoroughly washed out. Very few investors that were holding onto Twilio when it was at +$400 are now still holding this stock.

That’s not to say that Twilio doesn’t have its detractions. It does. The main detraction continues to be its inability to make a clean GAAP profit.

But at the same time, I have no doubts that there’s a viable business under the hood, and with the business rapidly growing, it’s just a question of profitability that holds this stock back. Any insights into its profitability profile in a recessionary environment will be welcomed by investors and would see the stock re-rating higher.

Be the first to comment