DNY59/E+ via Getty Images

This article provides an update to my most recent Omeros (NASDAQ:OMER) article, “Omeros: On Death’s Door” (“Death’s Door”). Management has recently issued a comprehensive report during its annual shareholders meeting on 06/17/2022 (“Annual Meeting”) providing important new insights on Omeros’ value to shareholders.

Omeros’ shares have been cursed and blessed with extreme volatility in a down market.

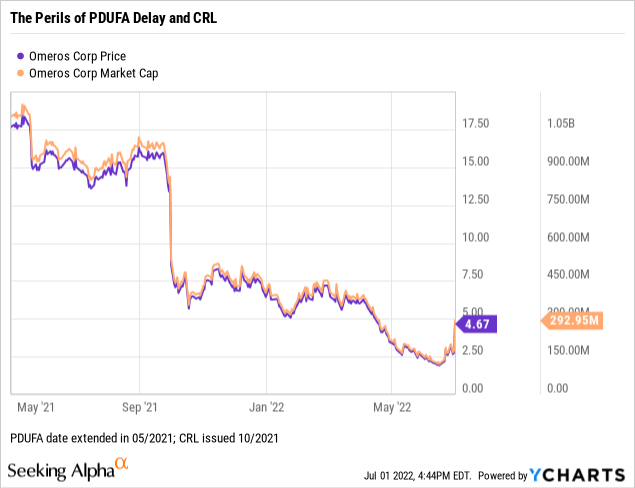

The last year and a half have been profoundly eventful for Omeros. The FDA accepted its narsoplimab BLA in treatment of HSCT-TMA for filing in 01/2021. Its PDUFA date was set for 10/2021. Everything seemed all set up. Then the FDA delayed the PDUFA; then to investors’ and management’s horror and surprise, it ultimately issued a CRL.

The PDUFA delay and the subsequent CRL poleaxed Omeros’ share price. Shares dropped from the high teens in 05/2021 down to $13-$16 range on the PDUFA delay; later following the CRL, they dropped to single digits.

As the situation has played out, Omeros shares are continuing to drop. They traded ~$7 for several months; then they dropped to successively lower levels. They hit something of a bottom in mid 06/2022, trading below $2.00 on light volume during several sessions.

At these lows it was trading at a market cap of <$150 million right around the sum of its cash on hand. The market finally seemed to wake to its foolishness. Shares quickly recovered, rising to close at $4.64 as I write on 07/01/2022. Tomfoolery, from its low of $1.86 Omeros’ bump to $4.64 reflects an increase of 164%, in a period of two weeks!

Omeros’ tremulous trading over the last year+ is shown by the price and market cap chart below:

I have searched for an explanation. The one that comes most readily to mind is that the lows reflect the FDA news exacerbated by general market doldrums. These doldrums have been particularly pronounced for small loss-generating biotechs like Omeros. The recent updrafts reflect short covering as Omeros’ towering short interest of >20% gets riled by the prospects of a colossal squeeze.

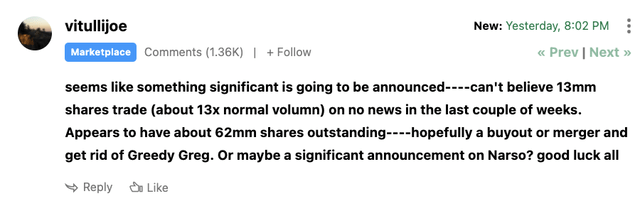

On the other hand, there may be big news afoot as suggested by the following 07/01/2022 comment to Death’s Door:

As an Omeros bull and as shareholder, I am hopeful that a deal is in the works. During the Annual Meeting CEO Demopulos assured shareholders that Omeros was open to deal making as exemplified by the Rayner deal.

The Annual Meeting provided extra data points for evaluating Omeros’ future prospects.

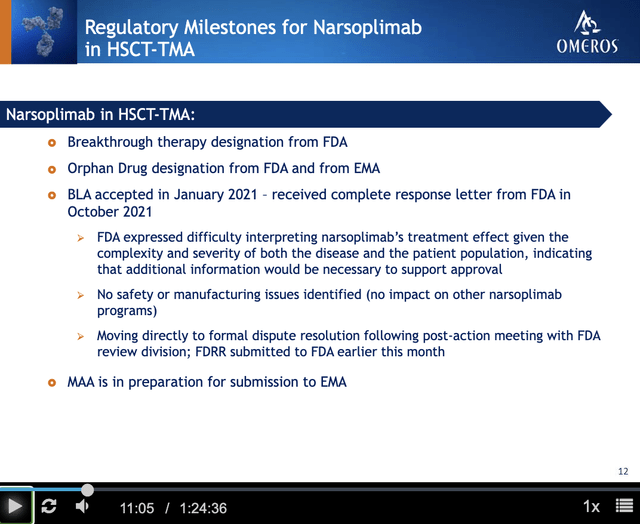

It was a sad day in Omeros-land when the FDA issued its CRL; instead of celebrating a big win, shareholders were relegated to trying to read the tea leaves on Omeros’ Type A meeting with the FDA. Ultimately the situation deteriorated to the point that Omeros threw up its hands. It decided that its only viable path forward was to resort to the FDA’s dispute resolution process.

During the Annual Meeting, Omeros issued the following presentation slide advising on the status of the regulatory process and its path forward:

Omeros Annual Shareholders’ Meeting (central.virtualshareholdermeeting.com)

CEO Demopulos provided further color on the status. He confirmed that Omeros was currently appealing the FDA’s decision to the FDA’s Office of New Drugs [OND]. It submitted its briefing package requesting formal resolution earlier in June.

Omeros expects a meeting with OND in early July. FDA rules would then dictate a decision in early August. He characterized Omeros and its advisors as convinced that their position was “very strong” and that approval of narsoplimab was warranted.

He did not speculate as to what the actual FDA response to the dispute resolution was likely to be. As discussed in Death’s Door, he had previously indicated that actual reversals were not the norm; rather a more likely outcome would be for the parties to work out a middle ground. Luckily for antsy shareholders, the resolution should take form without delay, in early August.

Omeros presents an attractive, albeit highly speculative, value proposition.

Omeros shares are searching for a price point. The only thing which seems assured is that buying interest perks up when the shares drop below $2.00, or below a market cap of ~$150 million.

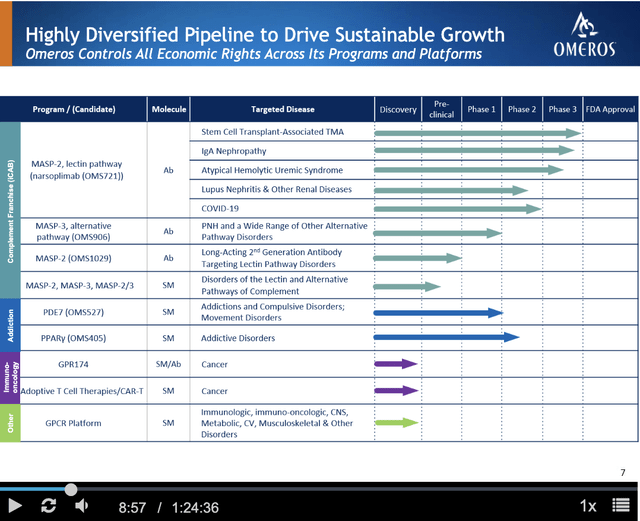

As matters now (07/02/2022) stand Omeros has significant assets consistent with a market cap many multiples higher than its current ~$0.166 billion. If approved, narsoplimab in treatment of HSCT alone presents blockbuster potential.

As such it could support a market cap of several billions of dollars. Discount this as you might for the uncertainty of its approval. Speculative investors can evaluate the situation as suits their risk appetite. Additional assets which require consideration include the balance of its rich pipeline shown on the graphic below:

Omeros Annual Shareholders’ Meeting (central.virtualshareholdermeeting.com)

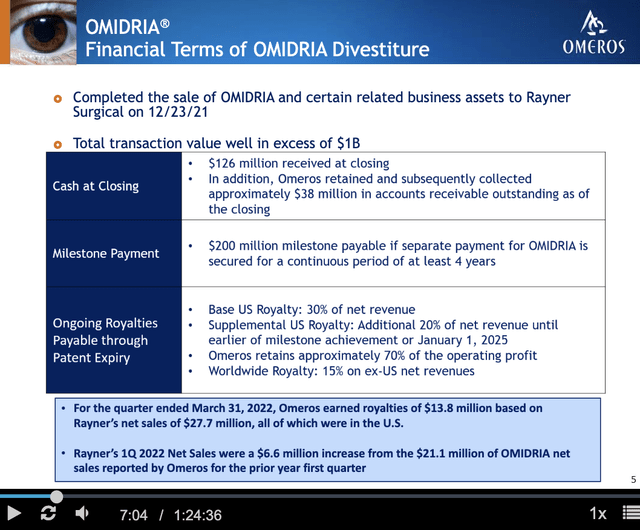

Additionally, Omeros’ asset column notably includes residuals from its OMIDRIA sale to Rayner Surgical including its milestone and royalties. The following graphic provides a generous tally of its components:

Omeros Annual Shareholders’ Meeting (central.virtualshareholdermeeting.com)

At this point, a conservative value of Omeros’ remaining value from this deal would focus on future royalties which I peg at ~$55 million per year.

Against these assets Omeros has $95 million in note payments due in 2023 and $225 million due in 2026 (10-Q, p. 17).

Conclusion

Omeros is a high-risk opportunity. As an existing shareholder, I am trading around a core position. At this point, with so many uncertainties, it is more of a trade than an investment. I am optimistic that uncertainties will resolve over time in favor of Omeros.

I note that Seeking Alpha’s Quant Rating for Omeros is a discouraging “Strong Sell”. Wall St. Analysts’ Ratings are a mixed bag with price targets ranging from a low of $4.00 to a high of $20.00.

This range of price targets likely reflects Omeros’ actual performance over the next year.

Be the first to comment