Drew Angerer

Only a few years ago, Twilio (NYSE:TWLO) was seen as a modern communications company. Now, some question whether the company is already obsolete due to a suddenly hot AI chat product. My investment thesis is a lot more constructive on Twilio with the stock cratering to $45, but the company has disappointed us in the last year.

Overrated Threat

OpenAI just released ChatGPT at the end of November and the natural language AI chatbot quickly soared to 1 million users. Users have already proclaimed the service is going to replace Google (GOOG, GOOGL) search and any host of messaging and communications platforms.

Twilio is a leader in CPaaS and CDP markets with solutions to power omni-channel engagement with customers worldwide. The company has millions of developers working with Twilio to integrate services making the replacement of their products difficult.

ChatGPT uses AI to converse with people in answering questions to the extent people think the questions are being answered by a person. The problem with the AI chatbot replacing communications service providers is that the AI service isn’t reliable to answer questions correctly.

As ZDnet highlights, ChatGPT has a high rate of providing incorrect data while providing the data in such a manner as to appear correct and accurate. The service appears good at providing information and helping create code, but this AI chatbot has limits in only providing information from training data as opposed to searching the internet for the information.

A company wants a communications service that either allows for human interaction or an intelligent system to provide accurate information for the company offering the service. A customer of Twilio wouldn’t want such an AI chatbot to provide random data to customers based on what could quickly become outdated training.

In addition, CEO Sam Altman suggested the ChatGPT service was expensive. While a few cents per chat doesn’t sound expensive, Twilio only produces a small gross profit per message. The high costs of AI chatbots might limit the ability to replace cloud communications services.

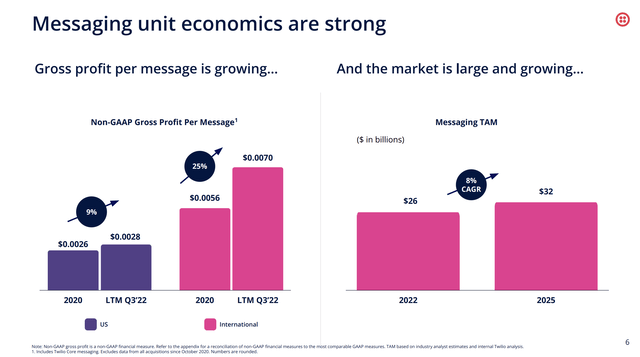

Twilio has made great strides in expanding the profitability of messages. The US gross profit is just a fraction of a penny leading to the company only generating gross margins in the mid-30% range for the communications unit.

Source: Twilio Analyst Day 2022 presentation

Since ChatGPT is a new technology chat one shouldn’t assume that Twilio doesn’t incorporate such a service into their offerings in the future. ChatGPT would have to learn customer data collected by Twilio over the years in order to be useful.

AI chatbots definitely have some future with the ChatGPT able to hold natural conversations with end users, but the service doesn’t appear built as a standalone customer service tool. The service could possibly work with a Twilio tool to provide data to customers provided by the company in a natural language conversation.

Either way, ChatGPT is nowhere close to providing a contact center solution to interact with customers in a flexible environment across multiple channels. The ChatGPT requires a user to login to their service to ask questions and converse with the AI chatbot while Twilio offers full solutions for customers already.

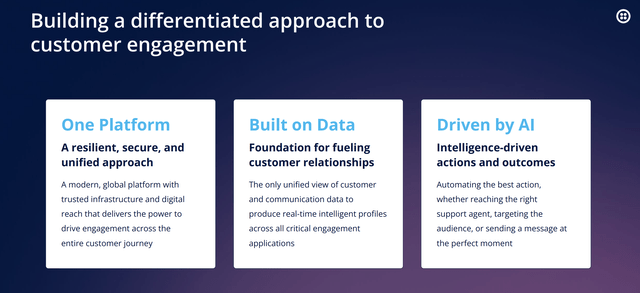

Source: Twilio Analyst Day 2022 presentation

Lack Of Profits

While Twilio not being profitable yet isn’t necessarily a problem, the company is definitely in a tough position when difficult financial conditions hit expectations. The cloud communications company is on the pace for $4 billion in annual revenue where investing for future growth still has tons of appeal, but the business model needs to start throwing off cash to cushion any blows from future business hiccups.

Twilio increased spending during covid boosts in order to participate in anticipated attractive growth opportunities that are disappearing now. The company guided to Q4’22 non-GAAP loss from operations at only $10 million at the midpoint.

Management recently instituted a 11% cost reduction impacting 816 employees out of a workforce that ballooned to 8,992 during a recent hiring spree. While the company is surprisingly close to breakeven despite cutting revenue guidance for the current quarter, Twilio is still disappointingly unprofitable with quarterly revenues at $1 billion.

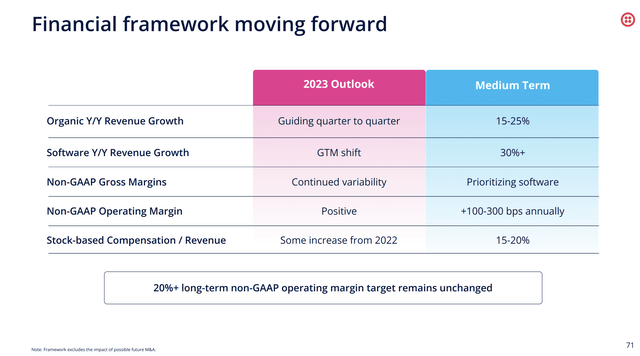

The company recently cut annual growth targets to between 15% to 25%, substantially below prior goals of 30%+ growth. A lot of analysts were already questioning the competitive impact with signs Twilio wasn’t standing out from the crowd anymore.

Source: Twilio Analyst Day 2022 presentation

Per BoA analyst Michael Funk, the cloud communications provider was facing pricing pressure due to a premium product and 52% of respondents in a survey exiting to spend less next year. Remember though, the communications and contact center applications sector had a huge pull forward during 2020 when customers needed quick solutions for interacting with customers during covid. Enterprises were quick to implement more efficient solutions to reduce the need for customer service reps either not willing to work or unable to work being stuck at home.

If the company was facing tough competition in the messaging segment, respected CEO Jeff Lawson wouldn’t have discussed a shift away from sales reps in the cloud communications product area. Over and over at the Barclays Global Tech. Conference last week, the CEO was clear the product was selling so well Twilio had incorrectly inserted sales reps into the process.

An environment where Twilio is able to produce 20% revenue growth is impressive and a sign that competition isn’t greatly impacting the business. The company was clearly too aggressive on forecasts similar to other tech sectors where covid pull forwards finally impacted previously strong growth rates.

The market cap has dipped to $8.5 billion with revenue targets still topping $4.4 billion next year. The stock is appealing on a typical forward P/S multiple below 2x, though the market wants Twilio to produce profits in this environment.

The company isn’t too far from reaching profits and the shift to focusing sales reps on software solutions should help with gross margins trending down.

Takeaway

The key investor takeaway is that Twilio is far too cheap here. The cloud communications company operates in a competitive environment, but the market has over extrapolated recent weakness as due to competition.

Investors should start looking at investing in Twilio, especially on any signs the business has stabilized and is now heading towards profitable growth in the 20% range.

Be the first to comment