EUR/USD started a recovery wave above the 1.0200 level. USD/CHF is declining and broke a key support near the 0.9750 zone.

Important Takeaways for EUR/USD and USD/CHF

· The Euro started a decent recovery wave above the 1.0150 zone against the US Dollar.

· There is a key bullish trend line forming with support near 1.0225 on the hourly chart of EUR/USD.

· USD/CHF started a fresh decline after it failed to clear the 0.9880 resistance zone.

· There is a major bearish trend line forming with resistance near 0.9720 on the hourly chart.

EUR/USD Technical Analysis

This past week, the Euro gained pace below the 1.0100 support against the US Dollar. The EUR/USD pair even spiked below the parity level and traded as low as 0.9952 on FXOpen.

Recently, there was a recovery wave above the 1.0000 and 1.0100 resistance levels. The pair climbed above the 1.0150 level and the 50 hourly simple moving average. The pair traded as high as 1.0268 and is currently showing positive signs.

There was a minor drop and a test of the 23.6% Fib retracement level of the upward move from the 1.0119 swing low to 1.0268 high.

An immediate resistance is near the 1.0255 level. The next major resistance is near the 1.0270 level. A clear move above the 1.0270 resistance zone could set the pace for a larger increase towards 1.0350. The next major resistance is near the 1.0450 zone.

On the downside, an immediate support is near the 1.0230 level. There is also a key bullish trend line forming with support near 1.0225 on the hourly chart of EUR/USD.

The next major support is near the 1.0200 level. It is near the 50% Fib retracement level of the upward move from the 1.0119 swing low to 1.0268 high. A downside break below the 1.0200 support could start another decline.

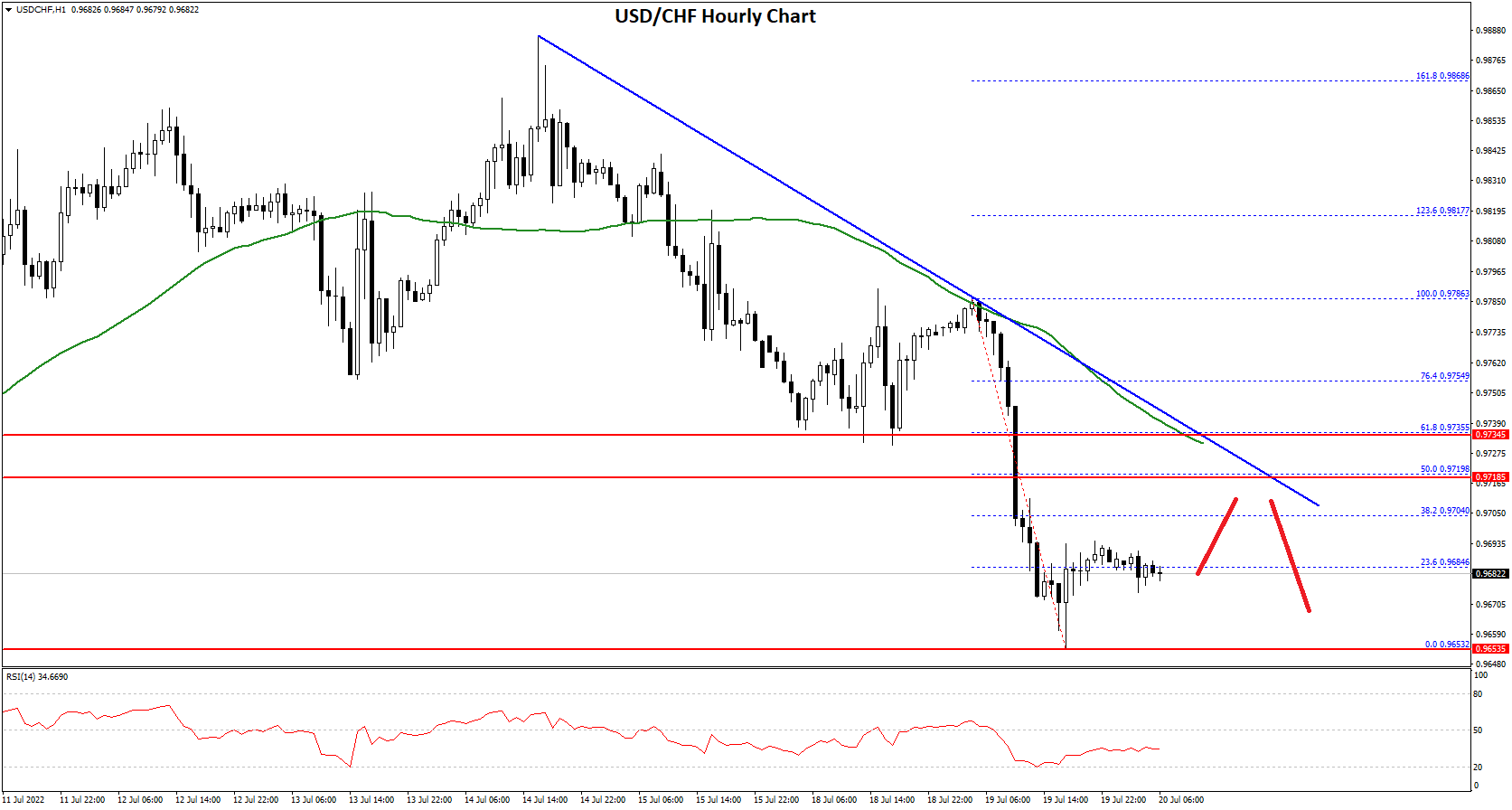

USD/CHF Technical Analysis

The US Dollar struggled to clear the 0.9880 resistance zone and started a fresh decline against the Swiss franc. The USD/CHF pair traded below the 0.9800 support zone to move into a bearish zone.

The pair even declined below the 0.9750 level and the 50 hourly simple moving average. The recent low is formed near 0.9652 and the pair is now consolidating losses. There was a minor upward move above the 23.6% Fib retracement level of the recent decline from the 0.9786 swing high to 0.9652 low.

An immediate resistance is near the 0.9700 level. The next major resistance is near the 0.9720 level. There is also a major bearish trend line forming with resistance near 0.9720 on the hourly chart. The trend line is near the 50% Fib retracement level of the recent decline from the 0.9786 swing high to 0.9652 low.

If there is a clear break above the 0.9720 resistance zone, the pair could start another increase. If not, the pair could decline towards the 0.9650 support. The main support is now forming near the 0.9620 level. Any more losses may possibly open the doors for a move towards the 0.9550 level.

This forecast represents FXOpen Markets Limited opinion only, it should not be construed as an offer, invitation or recommendation in respect to FXOpen Markets Limited products and services or as financial advice.

Be the first to comment