Khanchit Khirisutchalual

A Quick Take On Couchbase

Couchbase (NASDAQ:BASE) went public in July 2021, raising approximately $200 million in gross proceeds from an IPO that priced at $24.00 per share.

The firm provides database technologies that operate across all cloud environments.

While BASE is producing reasonable growth, its mounting operating losses are a drag on the stock in a growing cost of capital environment.

I’m therefore on Hold for BASE in the near term.

Couchbase Overview

Santa Clara, California-based Couchbase was founded to provide multiple database configurations into a single subscription service-based platform including public clouds, hybrid environments and distributed structures.

Management is headed by president and CEO Matthew M. Cain, who has been with the firm since April 2017 and was previously president of Worldwide Field Operations for Veritas Technologies.

The firm pursues a ‘land and expand’ sales and marketing approach among medium and large size enterprises via a direct sales force and through ecosystem partners.

Couchbase’s Market & Competition

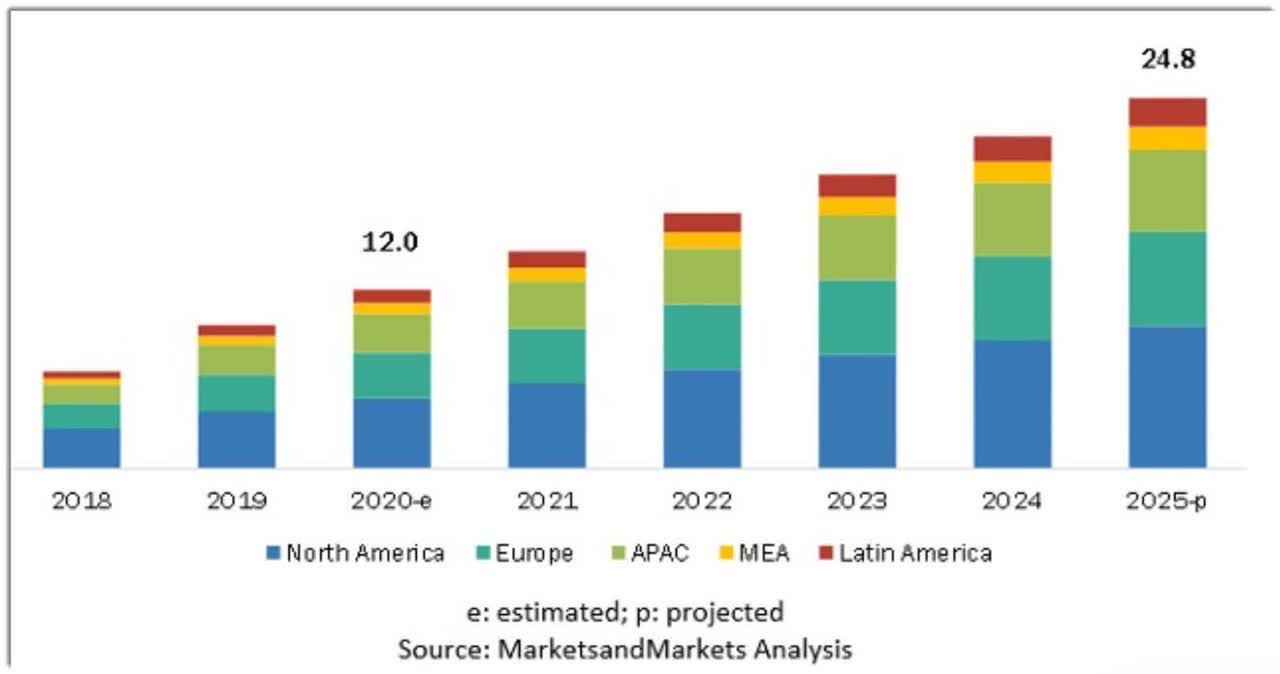

According to a 2020 market research report by MarketsandMarkets, the global cloud database and DBaaS market was an estimated $12 billion in 2020 and is forecast to reach $24.8 billion by 2025.

This represents a forecast CAGR of 15.7% from 2020 to 2025.

The main drivers for this expected growth are a rising demand for ‘self-driving’ cloud database functionalities.

Also, the consumer goods and related retail sector is expected to lead demand for DBaaS services due to the need to process a large quantity of invoices and to buttress their business continuity and competitiveness requirements.

Below is a chart showing the historical and projected industry growth:

Global Cloud Database and DBaaS Market (MarketsAndMarkets)

Major competitive or other industry participants include:

-

Oracle (ORCL)

-

IBM (IBM)

-

Microsoft (MSFT)

-

Amazon (AMZN)

-

MongoDB (MDB)

-

SAP (SAP)

-

EnterpriseDB

-

Redis Labs

-

Neo4j

-

DataStax

-

MariaDB

-

MemSQL

-

Others

Couchbase’s Recent Financial Performance

-

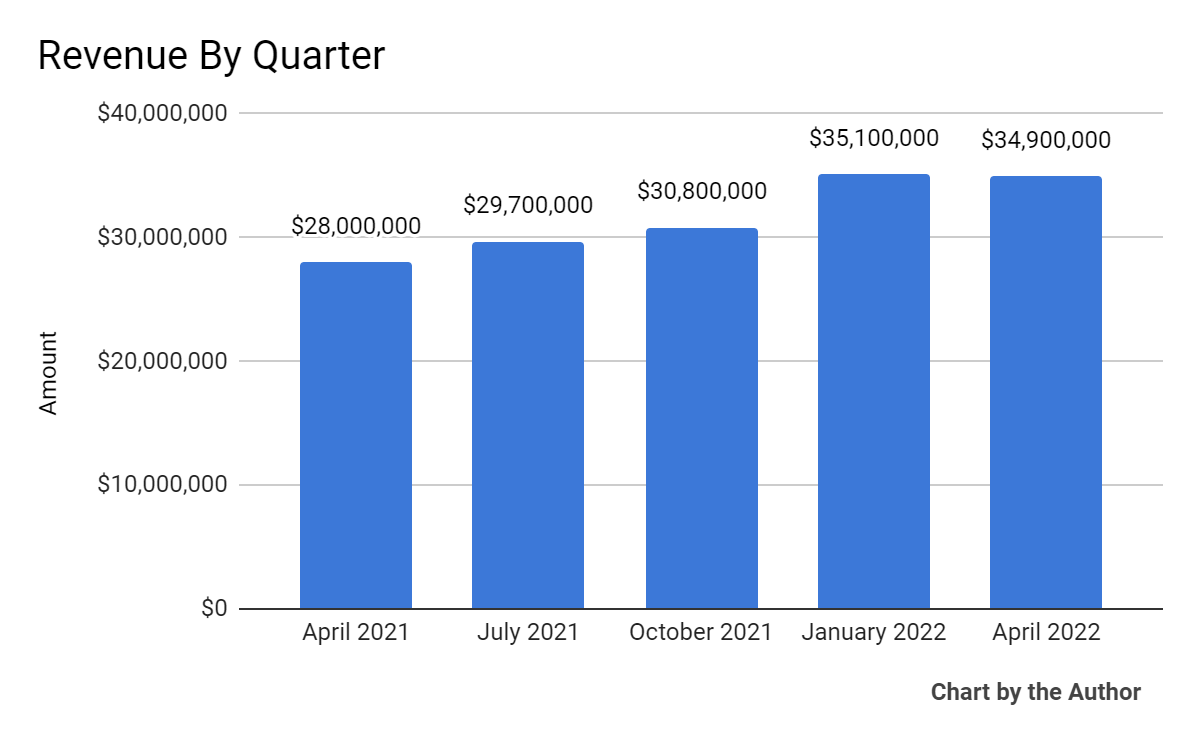

Total revenue by quarter has risen, as the chart below indicates:

5 Quarter Total Revenue (Seeking Alpha)

-

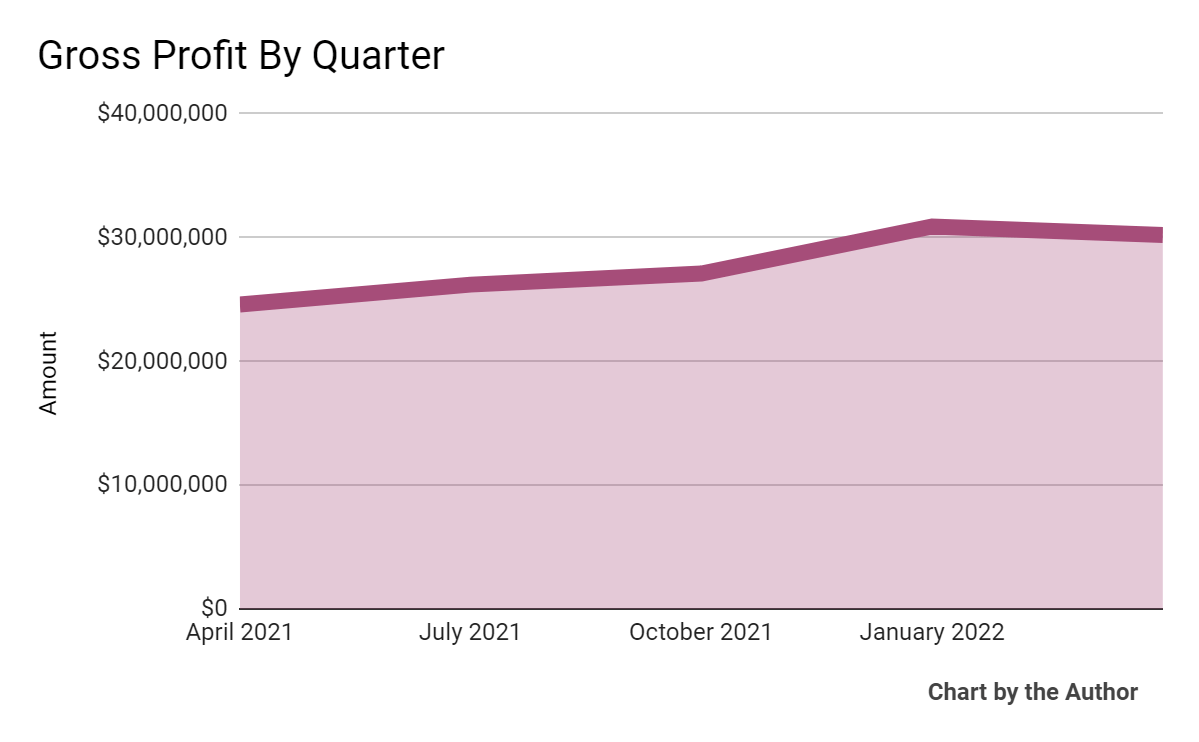

Gross profit by quarter has grown with approximately the same trajectory as that of total revenue:

5 Quarter Gross Profit (Seeking Alpha)

-

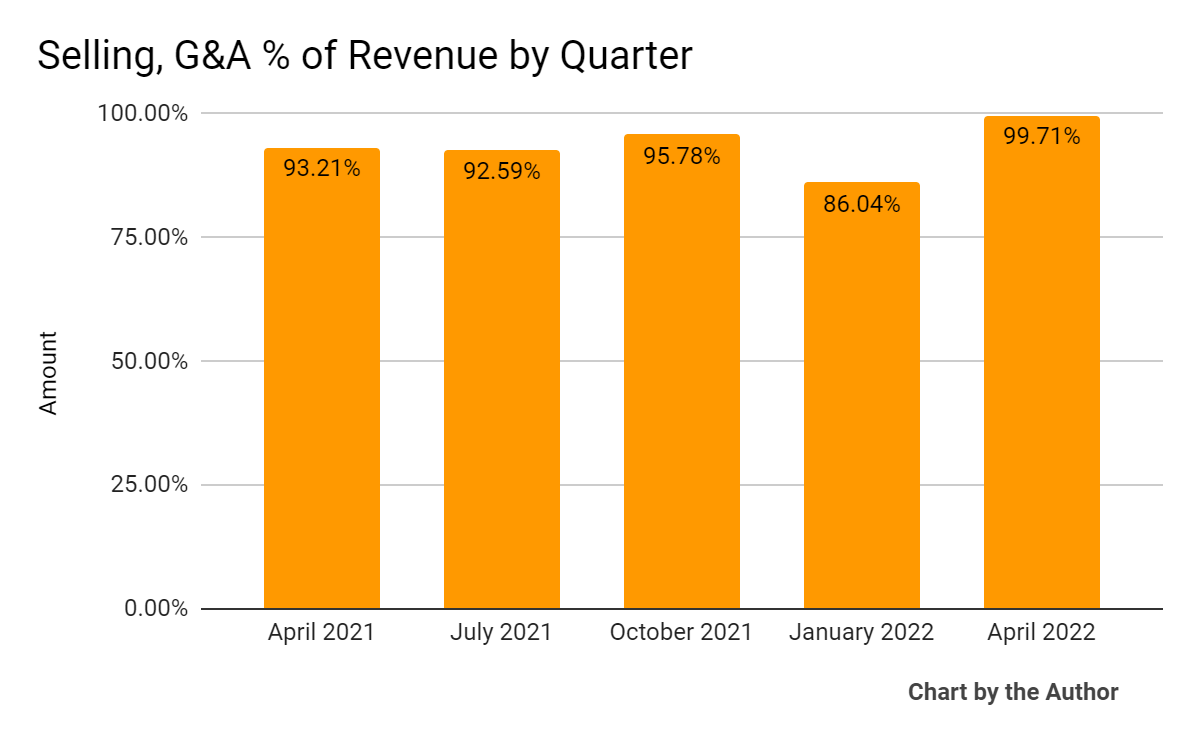

Selling, G&A expenses as a percentage of total revenue by quarter have remained relatively high in the past five quarters:

5 Quarter Selling, G&A % Of Revenue (Seeking Alpha)

-

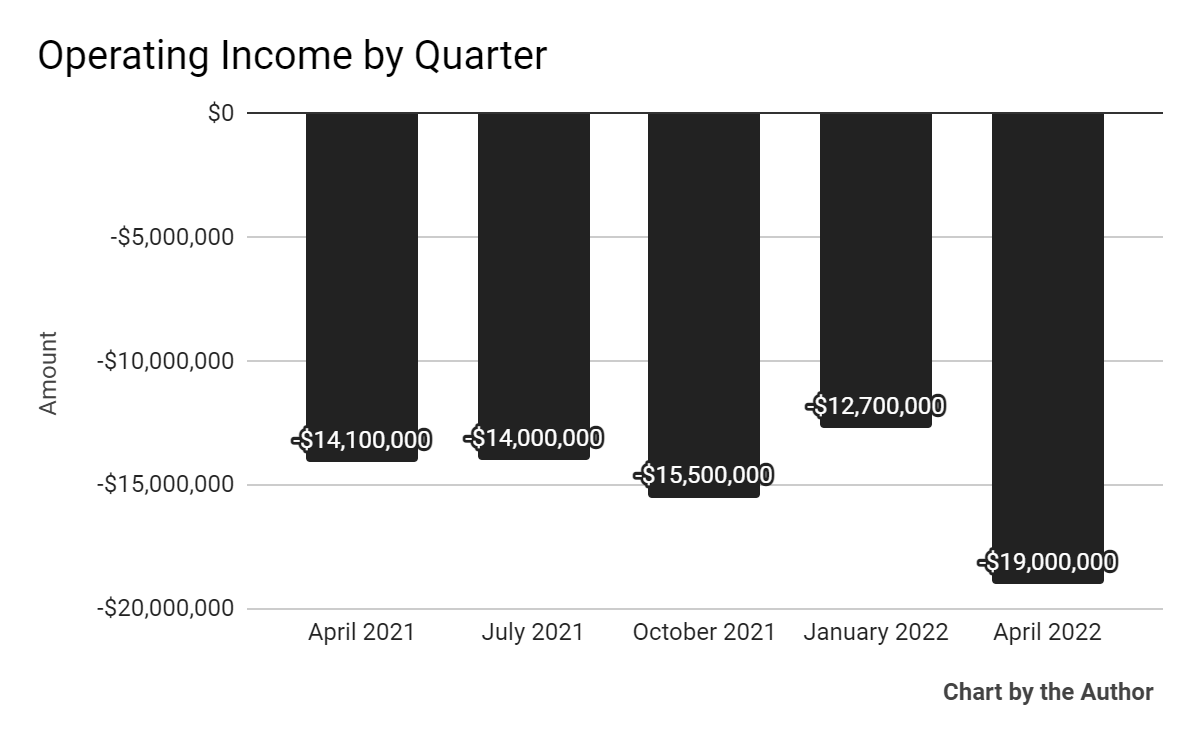

Operating losses by quarter have worsened in the most recent quarter:

5 Quarter Operating Income (Seeking Alpha)

-

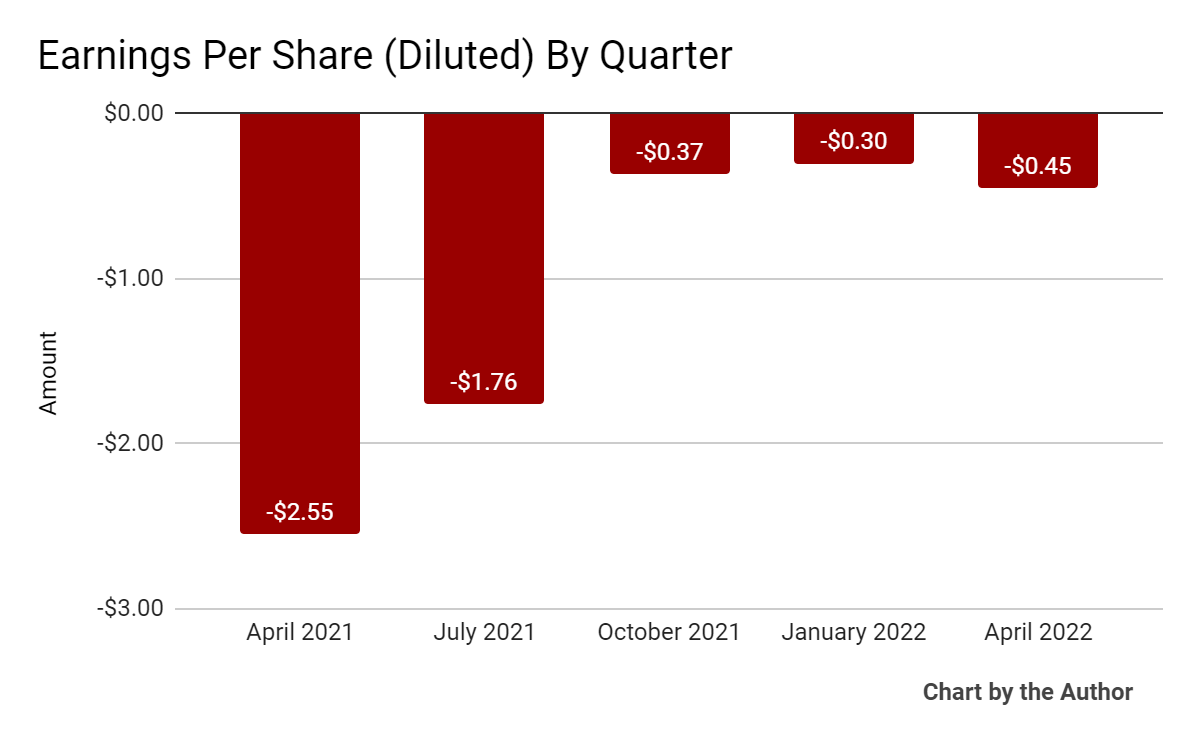

Earnings per share (Diluted) have also remained significantly negative, as shown below:

5 Quarter Earnings Per Share (Seeking Alpha)

(All data in above charts is GAAP)

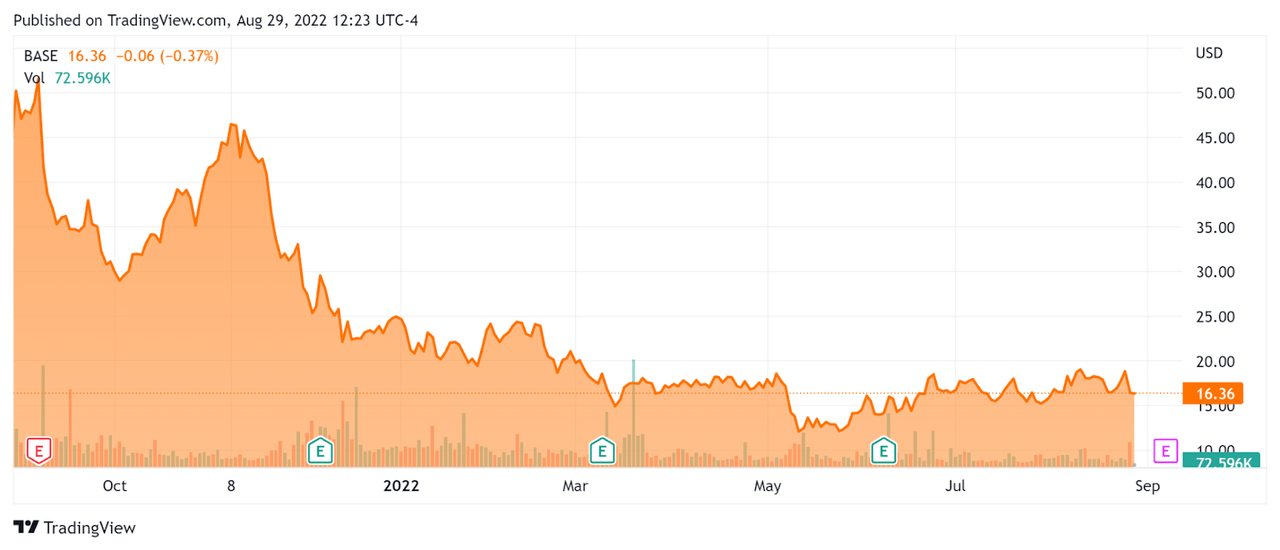

In the past 12 months, BASE’s stock price has fallen 63.5% vs. the U.S. S&P 500 index’ drop of around 10.7%, as the chart below indicates:

52 Week Stock Price (Seeking Alpha)

Valuation And Other Metrics For Couchbase

Below is a table of relevant capitalization and valuation figures for the company:

|

Measure [TTM] |

Amount |

|

Enterprise Value / Sales |

4.13 |

|

Revenue Growth Rate |

20.6% |

|

Net Income Margin |

-48.7% |

|

GAAP EBITDA % |

-46.1% |

|

Market Capitalization |

$731,530,000 |

|

Enterprise Value |

$538,790,000 |

|

Operating Cash Flow |

-$46,990,000 |

|

Earnings Per Share (Fully Diluted) |

-$2.88 |

(Source – Seeking Alpha)

As a reference, a relevant partial public comparable would be MongoDB; shown below is a comparison of their primary valuation metrics:

|

Metric |

MongoDB |

Couchbase |

Variance |

|

Enterprise Value / Sales |

24.03 |

4.13 |

-82.8% |

|

Revenue Growth Rate |

52.3% |

20.6% |

-60.7% |

|

Net Income Margin |

-32.8% |

-48.7% |

48.5% |

|

Operating Cash Flow |

$8,340,000 |

-$46,990,000 |

-663.4% |

(Source – Seeking Alpha)

A full comparison of the two companies’ performance metrics may be viewed here.

The Rule of 40 is a software industry rule of thumb that says that as long as the combined revenue growth rate and EBITDA percentage rate equal or exceed 40%, the firm is on an acceptable growth/EBITDA trajectory.

BASE’s most recent GAAP Rule of 40 calculation was negative (25.6%) as of April 30, 2022, so the firm needs significant improvement in this regard, per the table below:

|

Rule of 40 – GAAP |

Calculation |

|

Recent Rev. Growth % |

20.6% |

|

GAAP EBITDA % |

-46.1% |

|

Total |

-25.6% |

(Source – Seeking Alpha)

Commentary On Couchbase

In its last earnings call (Source – Seeking Alpha), covering FQ1 2023’s results, management highlighted continued momentum with large deals as well as demand for its emerging cloud database-as-a-service business umbrella of Capella.

Management continues to ‘invest aggressively in Capella’ due to its prospects to drive company growth as a fully integrated system. The firm doubled its Capella development headcount during the quarter.

Annual recurring revenue [ARR] rose 31% year-over-year, the fastest rate of growth since the start of the pandemic and a third straight quarter of growth.

The company is also seeing growth in new free trial accounts as it seeks to woo developers with a low barrier to try out the system.

As to its financial results, total revenue rose by 25% year-over, with subscription revenue accounting for 92% of total revenue and the company finished the quarter with 614 customers generating an average ARR of $227,000.

The company’s net dollar retention rate ‘exceed[ed] 115%, indicating excellent product/market fit and strong sales & marketing efficiency.’

However, operating loss increased to $19 million, a worsening result that is likely acting as a damper to the stock price.

Management continues to spend on headcount as it seeks to ‘capture the generational opportunity that we see ahead of us.’

For the balance sheet, the company ended the quarter with $201 million in cash, equivalents and short-term investments, while it used $9.4 million in free cash flow.

Looking ahead, for the full fiscal year 2023, management raised its annual recurring revenue expectation to around $162 million, or approximately 22% growth at the midpoint and non-GAAP operating loss of around $54.7 million at the midpoint.

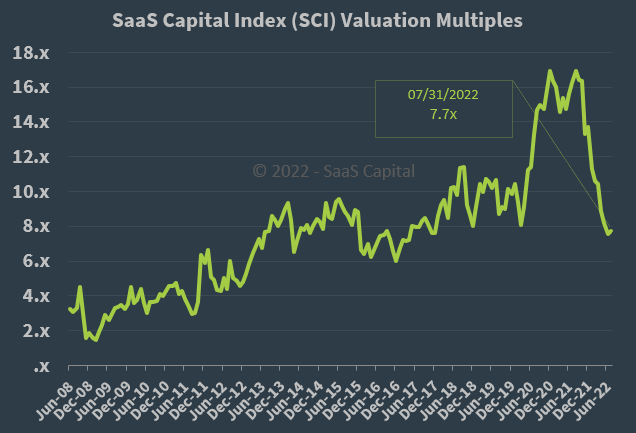

Regarding valuation, the market is valuing BASE at an EV/Sales multiple of around 4.1x.

The SaaS Capital Index of publicly held SaaS software companies showed an average forward EV/Revenue multiple of around 7.7x at July 31, 2022, as the chart shows here:

SaaS Capital Index (SaaS Capital)

So, by comparison, BASE is currently valued by the market at a significant discount to the SaaS Capital Index, at least as of July 31, 2022.

The primary risk to the company’s outlook is a potential macroeconomic slowdown or recession, which may slow sales cycles and reduce its expected revenue growth trajectory.

A potential upside catalyst to the stock could include a slowing of interest rate hikes or reduced cost of capital which may serve to increase its valuation multiple.

Couchbase management appears willing to continue spending to add headcount despite a global macroeconomic slowdown which may prove that bet too risky.

While the company is producing reasonable growth, its mounting operating losses are a drag in a growing cost of capital environment.

I’m therefore on Hold for BASE in the near term.

Be the first to comment