Justin Sullivan

Snap Inc. (NYSE:SNAP) again disappointed Wall Street with its Q3 earnings last week, with the company finding it challenging to monetize its growing userbase to become consistently profitable. Last June, in an exclusive article published for members of Leads From Gurus, I highlighted how Snap is finally focusing on profitability and revenue growth, which I found exciting. Q3 earnings hardly reflect Snap’s commendable efforts, which is why it’s important for investors to dig a little deeper to understand whether Snap is the victim of macroeconomic and geopolitical challenges or whether the company is still facing fundamental difficulties in monetizing its users.

Why Is Snap Not Profitable Yet?

In the long run, earnings will determine the market value of any public company. For long-term-oriented investors, this is why it’s important to invest in companies that are well-positioned to grow their earnings. For Snap, breaking through to profitability has been a tremendous challenge. Despite reporting positive net income in Q4 2021, Snap reported a loss of close to $490 million in 2021 and the company has accumulated a loss of $1.14 billion in the first three quarters of this year. Although it would be easy to dismiss these losses claiming Snap is still a young, growing company, it’s not easy to forget that Meta Platforms, Inc. (META), was a highly profitable company when it turned 10 years in 2014 (Snap has been around for a little over 10 years now).

The question is, what is keeping Snap from breaking through to profitability?

To answer this question, we need to understand how Snap makes money. The company brings in revenue from two major sources.

- Advertising income which accounts for the lion’s share of total revenue.

- Subscription revenue.

Focusing on the advertising business, Snap’s revenue in any given period depends on two key factors.

- Daily active users of the platform.

- The average revenue per user.

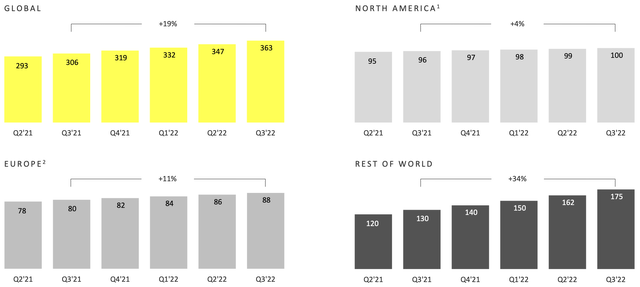

With this understanding, it’s easy to see that Snap needs to grow its daily active users and improve ARPUs to report revenue growth. Coming back to the original question of why Snap is failing to turn profits consistently, it is evident (see exhibit 1) that the company is indeed growing its user base, which leaves us to believe that Snap’s struggles stem from its inability to meaningfully improve ARPUs.

Exhibit 1: Snap DAUs are growing in all regions

In Q3, DAUs jumped 19% YoY, which I believe is a noteworthy achievement given that many social media platforms are dealing with lackluster user growth on the back of an acceleration of user growth at the height of pandemic fears. Snapchat continues to attract young users between 18-24 years, a demography Facebook has found challenging to penetrate.

So far, so good.

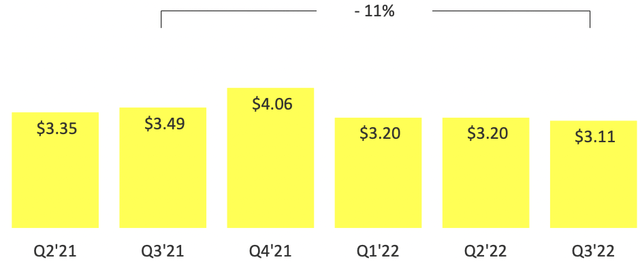

Snap’s troubles come to light when investors focus on ARPU. Now that we have established the fact that Snap needs to realize higher ARPUs to drive earnings growth, it makes sense to identify the reasons behind the disappointing ARPU growth.

Exhibit 2: Snap ARPU by quarter

The average revenue per user will be impacted by both the time users spend on the platform and the advertising budgets of marketers. The more time a user spends on Snapchat, the better it is for the company as these users are likely to engage with advertisements. If users are spending more time on Snapchat compared to other social media platforms, this will be an incentive for advertisers to prefer Snapchat over its rivals as well. Because of these reasons, it is important for Snap to invest in products to attract and retain eyeballs. The advertising budgets of marketers will also be influenced by general economic conditions. Historically, the advertising industry has performed poorly during times of economic crises but has rebounded sharply in the recovery phase as business conditions improve.

Snap’s struggles stem from its inability to win advertisers over. This, in return, is the result of two things.

- Snapchat, until recently, was primarily used to direct-message with friends and family, and therefore, plugging in advertisements seamlessly proved to be a big challenge for the company. This is a fundamental issue faced by Snap.

- Snap’s rivals such as Facebook, owned by Meta Platforms, offer advertisers advanced tools to measure the performance of their ads and target the correct audience. These advanced measurement tools enable advertisers to earn more bang for the buck.

With this understanding of where Snap is and the challenges faced by the company, the next step is to evaluate whether Snap can turn things around and be consistently profitable in the future.

Can Snap Be Profitable?

Investor focus should be on ARPU. There is nothing wrong with the trajectory of DAUs, so we will leave it out for now.

Today, Snap is trying to address both the challenges highlighted in the latter part of the previous segment. First, the company has identified the need to improve the level of engagement on Snapchat, which is why Snap is now focusing on not just DMs but also on creating a platform where creators are rewarded for attracting eyeballs. Snapchat is transforming from a direct messaging app to a mini-Facebook where the young generation is using the platform to build communities. This community-like branding will enable the company to seamlessly integrate ads into the platform. Product innovation has been key to transforming Snapchat into a true social media platform where users spend a lot of time. Both Discover and Spotlight reported YoY growth in content consumption in Q3, which is a testament to how Snapchat is growing in importance as a platform of choice for both content creators and social media users. Snap is also focused on improving the performance of its web platforms, which is a welcome sign as advertisers are likely to partner with social media platforms that are accessed not just from mobile handsets but also from laptops and computers.

Investing in developing and upgrading augmented reality tools is another step forward in improving user engagement. Offering an immersive experience to users may go a long way in helping the company build long-lasting competitive advantages as Snapchat is the only social media platform that offers an AR experience to its users today.

Second, Snap is aggressively investing money to offer a seamless, data-rich experience to advertisers who partner with the company. The company, over the last few quarters, has improved how on and off-platform click-through conversions are captured by its algorithms, enabling advertisers to get a better idea about the performance of the campaigns run on Snapchat. Also, the company has made it easier for advertisers to integrate third-party measurement tools to evaluate the performance of their Snapchat ad campaigns.

Snap is addressing both the major obstacles that have limited its growth in the past, which is the correct way forward to enjoying profits. The 8% increase in ad impression volume in Q3 is encouraging as it highlights how user growth is leading to better results from its ad business. Because CPMs declined 3% YoY, Snap’s revenue growth came in at 5.6% in Q3, which would have been better if not for the decline in CPMs. Based on how Snap is addressing the elephant in the room, there is reason to believe that the company is on the right track to turn profits consistently in the long run.

Macroeconomic Headwinds Will Get In The Way

Rising inflation, supply-chain challenges, rising interest rates, a slowdown in consumer spending, and geopolitical tensions have forced many businesses to cut down their marketing budgets. This is not good news for Snap and its closest rivals who rely on ad dollars to drive earnings growth. Mr. Market is likely to be blinded by this macroeconomic uncertainty and punish Snap for failing to show any improvements in monetization. In reality, however, Snap is strengthening its business by addressing the key weaknesses seen in the last few years, but this strength is not likely to be reflected in its financial performance until the global advertising industry recovers fully.

Takeaway

Investors need to be brave to bet on SNAP stock today. Snap seems to be well-positioned to deliver strong earnings growth in the long run but before that, things are likely to get worse as Snap’s progress will not yield any encouraging results because of macroeconomic headwinds. Snap stock is certainly not for the faint at heart as short-term pains need to be stomached but in the long run, brave, patient investors are likely to be rewarded handsomely.

Be the first to comment