Drew Angerer

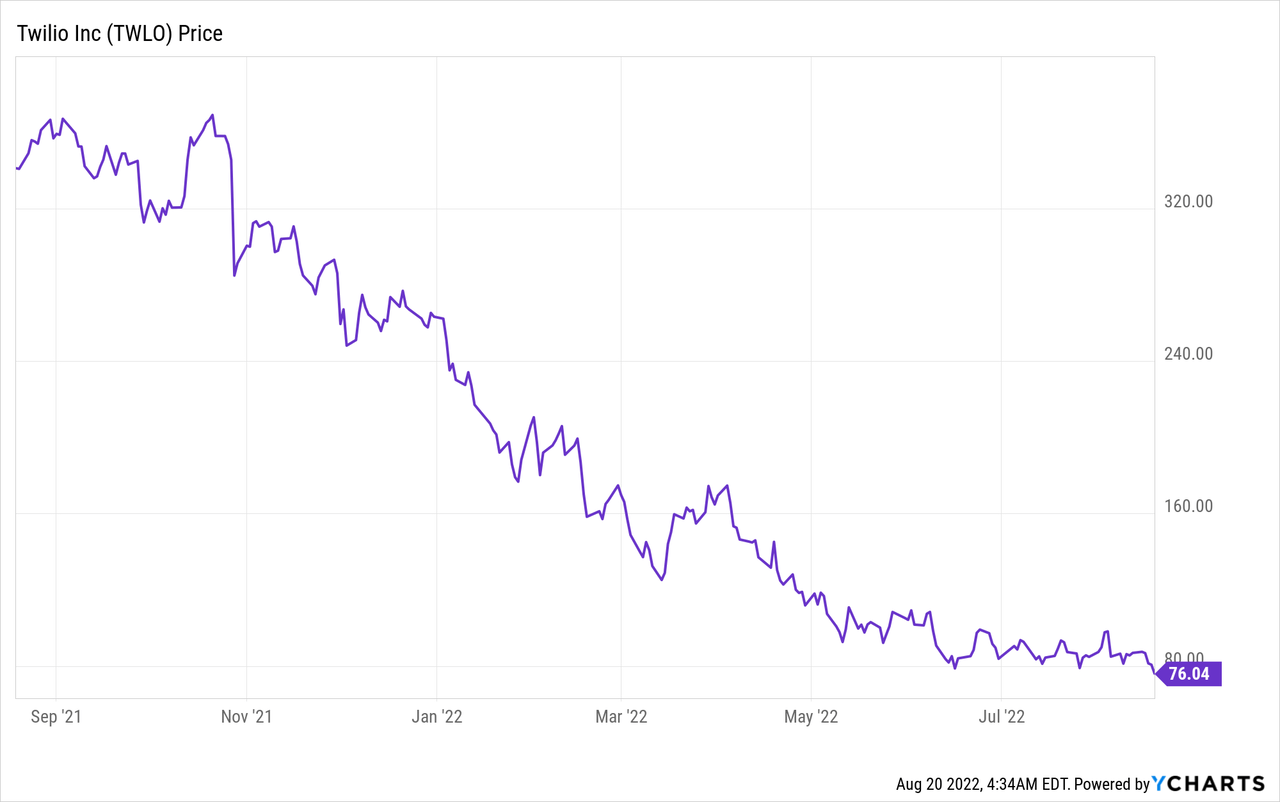

Twilio (NYSE:TWLO) is a gold standard communications as a service [CaaS] company. Its platform acts as the communications highway for 275,000 customers which include big name brands such as Airbnb (ABNB), Netflix (NFLX) and even Salesforce (CRM). According to one study, the global unified communications as a service market was worth ~$29 billion in 2021 and is forecasted to grow at a solid 13.4% compounded annual growth rate [CAGR] to reach $69.93 billion by 2028. The company recently announced strong earnings for the second quarter of 2022, which beat top and bottom line estimates. However, managements tepid guidance caused the stock to sell off even more so. Twilio’s share price has now been butchered by ~83% from its all-time highs in February 2021 and is undervalued. Let’s dive into the business model, financials, and valuation for the juicy details.

Business Model

In my last very in-depth post on Twilio, I delved deep into its business model, here is a quick review.

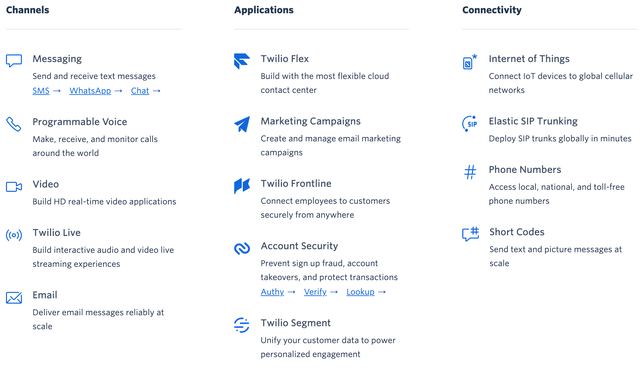

Twilio’s products can be segmented across three main areas;

- Channels

- Applications

- Connectivity.

Its “Channels” are its most well known feature and enables companies to send automated and bulk text messages, notifications, emails and even phone calls. For example, when your food delivery provider (such as Deliveroo) which is one of Twilio’s customers sends you a text message to confirm your order is enroute, that is powered by Twilio. Another example is when you receive an automated booking text from Airbnb, who is also a Twilio customer.

Twilio Products (Official Website)

Its applications segment include products such as Twilio Flex which is the company’s “Cloud Contact Center” service. Traditional physical office call centres tend to have high overheads (rent, electricity, phone bills etc) and are not easily scalable. Whereas, a “Cloud Center” allows new remote workers to be onboarded fast an easily. This agility and flexibility is especially useful given the pandemic lockdowns is prevalent in companies’ minds. In the second quarter, Twilio signed a monster deal for Twilio Flex with a large Fortune 100 retailer. The company will also leverage its customer data platform from the acquisition of Segment to help organizations bring together siloed data and get a 360′ view of the customer.

Its Connectivity segment includes the connectivity of Internet of Things (IoT) devices, phone numbers and IT connectivity services such as SIP trunking which enables VoIP (Voice over Internet) calling.

Strong Second Quarter

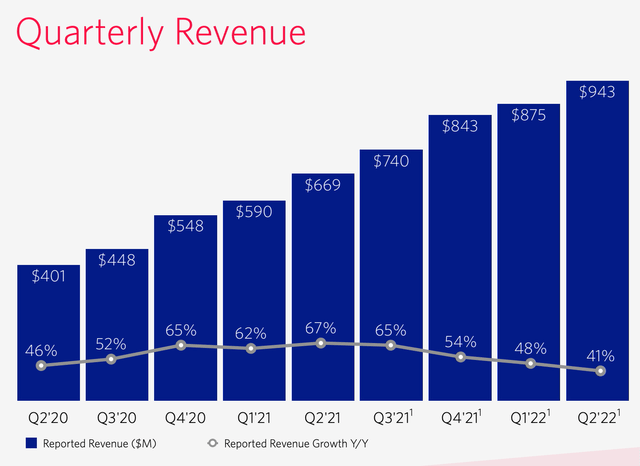

Twilio generated strong second quarter revenue of $943 million, up a blistering 41% year over year. With organic revenue of $862 million, up a rapid 33% year over year. Its growth rate has started to slow down relative to previous quarters but some of that can be attributed to lockdowns, which caused an acceleration in the digital transformation of businesses. It should also be noted that despite the lower growth rate, this still beat analyst expectations by $22.39 million.

The top line revenue growth includes $34 million from Zipwhip a toll free messaging platform the company acquired in 2021. This revenue also included $44 million from 10DLC A2P fees. Don’t let that acronym confuse you, it stands for Application-to-Person (A2P) type messaging via local 10-digit long code (10DLC) phone numbers. Basically, this is a new business text message standard which plans to reduce the number of spammers using automated text message services. T-Mobile and AT&T have introduced extra fee for unverified users and thus this could be strong tailwind behind Twilio’s compliant offering.

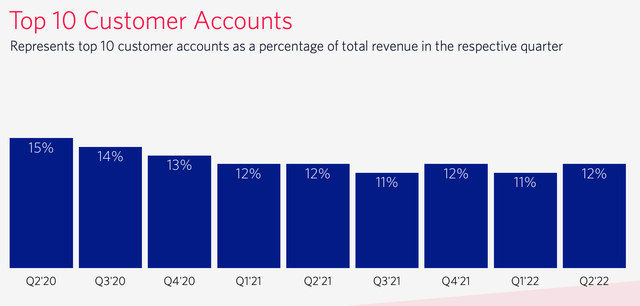

As mentioned in the intro, Twilio has a diversified customer base of over 275,000 active accounts. In many SaaS companies the top 10 customers can take up a large portion of revenue and this adds a risk to investors. However, in this case Twilio has gradually diversified its customer based from the top 10 making up 15% in 2020 to just 12% by the second quarter of 2022, which is a positive sign.

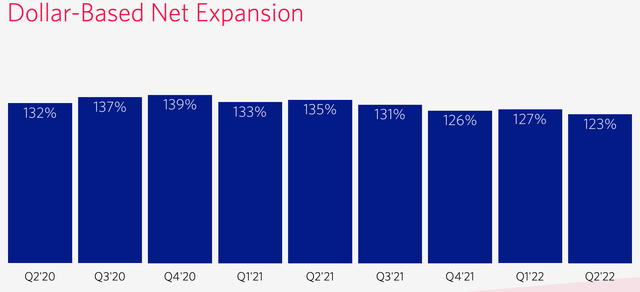

Its second quarter dollar based net expansion rate is a strong 123%. This shows customers are finding Twilio’s products “sticky” and spending more. However, it should be noted this expansion rate has declined from the astronomical ~130%+ rates generated in 2020 and 2021. Again, I believe this may be due to the increased technology adoption during the pandemic lockdown and then economic acceleration in 2021.

Dollar Based Net expansion (Q2 Earnings)

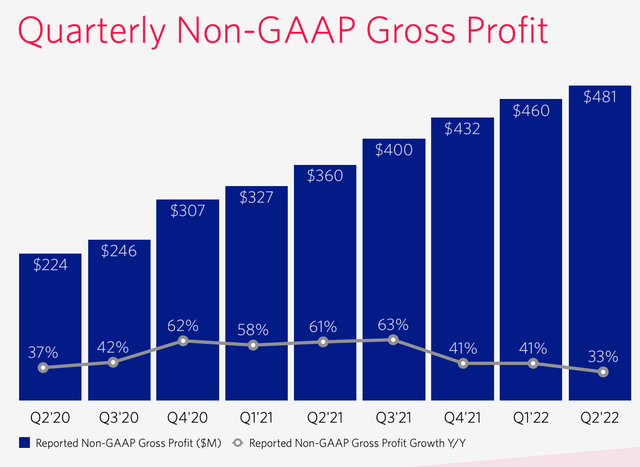

Quarterly Gross Profit on a Non-GAAP basis was $481 million in the second quarter. This represented a growth rate of 33% year over year, which was great but also slower than prior quarters, which may be due to the aforementioned reasons.

Gross Profit (Q2 Earnings report)

Twilio generated Earnings Per Share (Normalized) of -$0.11 which beat analyst estimates by $0.09.

The company has a fortress balance sheet with $4.4 billion in cash and short-term investments and $1.3 billion in total debt.

Despite Twilio’s strong quarter management issued tepid guidance of 30% to 32% revenue growth, which is slower than the 41% growth rate generated in Q2. This equates to a total revenue of between $965 million to $975 million.

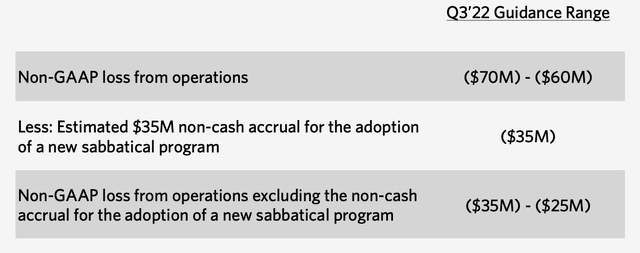

Third quarter operating loss is $60 million to $70 million, which includes a $35 million non-cash accrual for a new employee sabbatical program.

Guidance Range (Q2 earnings report)

Advanced Valuation

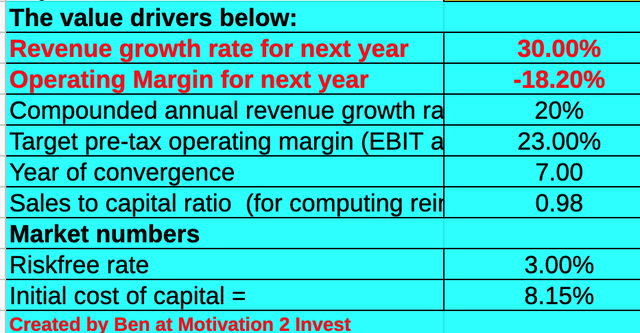

In order to value Twilio stock, I have plugged in the latest financials into my advanced valuation model, which uses the discounted cash flow (“DCF”) method of valuation. I have estimated a conservative 30% revenue growth for next year and 20% for the next 2 to 5 years.

Twilio Stock Valuation (created by author Ben at Motivation 2 invest)

In addition, I have forecasted margins to increase to 23% within the next 7 years as the company continues to scale and acquisition synergies start to become more prevalent. I have also capitalized R&D investments in order to increase the accuracy of the valuation.

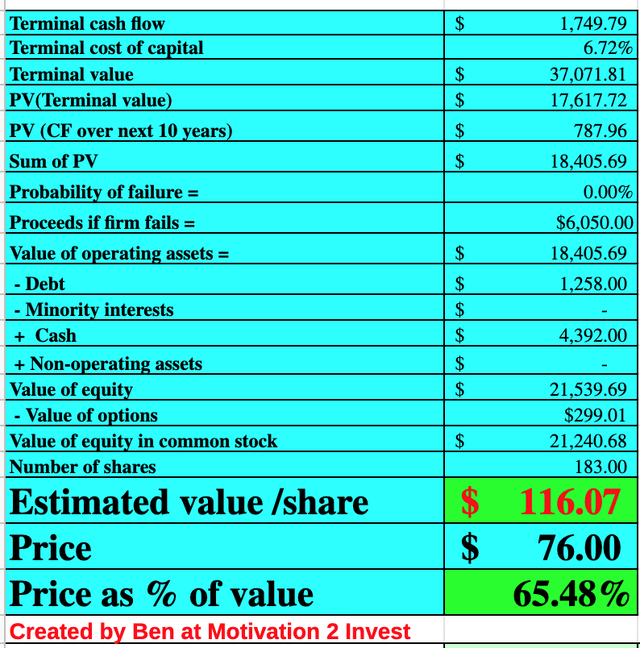

Twilio Stock Valuation 2 (created by author Ben at Motivation 2 Invest)

Given these factors, I get a fair value of $116/share. The stock is trading at ~$76 at the time of writing, and thus is ~34% undervalued, which gives a substantial margin of safety.

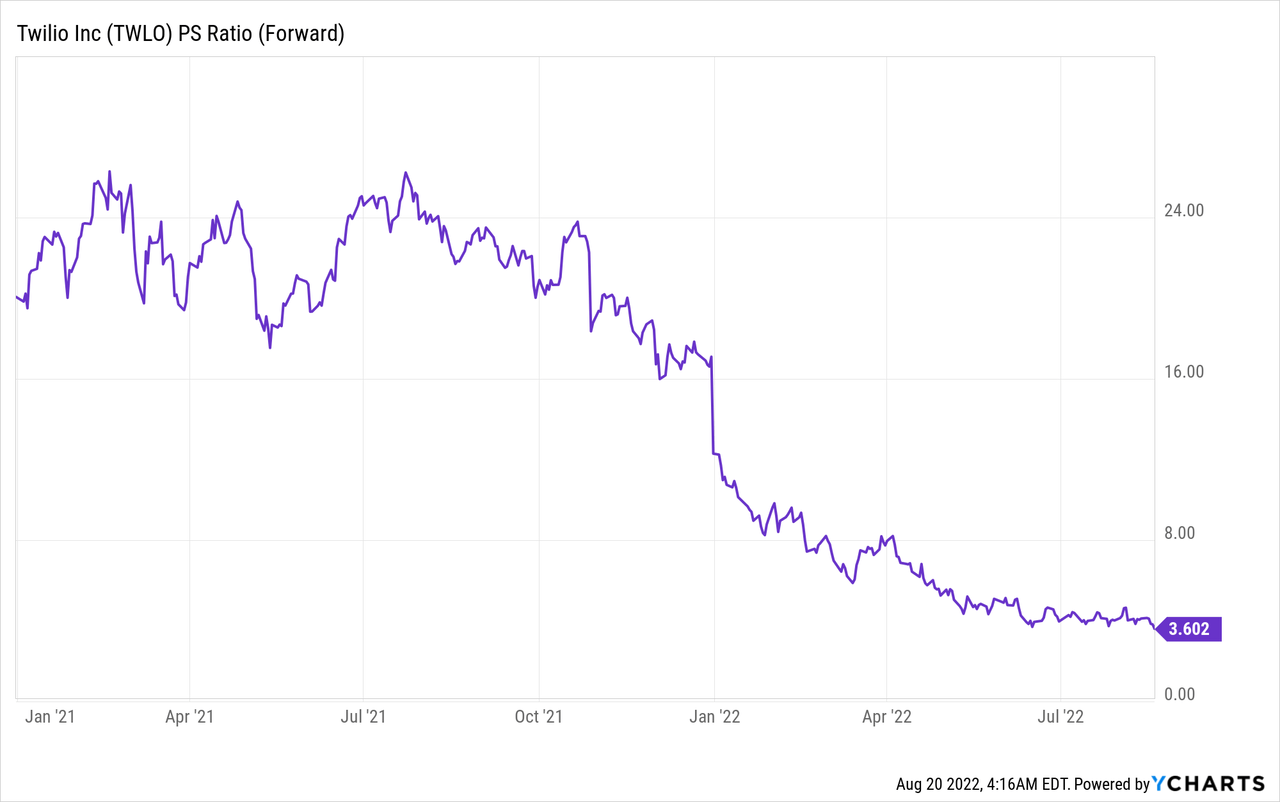

Twilio trades at a price-to-sales ratio = 3.82, which is the lowest level since 2017 and even lower than the pandemic low of P/S = 9.

Risks?

Competition

Twilio offers gold standard communication services but they are not alone in the market. Amazon Web Services [AWS] (Amazon’s Cloud division) is really a company in itself which pretty much offers every SaaS service you can imagine. As I recently became certified in AWS cloud, I discovered a Simple Notification Service (SNS) which basically does the same as the Twilio product, in offering bulk automated text messages and push notifications. But that is not all, AWS also provides a Cloud contact center service called Amazon Connect, which competes directly with Twilio Flex. Now although I believe Twilio has a strong brand in relation to its services, the fact a company like Amazon has similar services shows the company doesn’t have a strong moat.

Data Hack

In a blog post, Twilio announced an unknown entity gained “unauthorized access” to some customer accounts on August 4. This was a classic phishing or fraud-based attack which apparently fooled some employees into giving their credentials. These attackers gained access to Twilio’s internal systems and the company confirmed they were able to access certain customer data. Although, this investigation is still ongoing, it’s not great sign for the company and its enterprise clients which demand high security.

Final Thoughts

Twilio provides the communication highway for many leading companies across the global. Its team is continuously innovating and I do like the fact the company is founder led, which I didn’t discuss deeply in this post. Despite the competition, the market is huge, its retention rate is high and the stock is undervalued.

Be the first to comment