mizoula/iStock Editorial via Getty Images

TV Asahi Holdings (OTCPK:THDDY) is a Japanese broadcasting company with some of the major TV channels for news and entertainment in Japan. Japanese TV viewing habits have a different tenor from the rest of the world due to demographic effects where older people compose the majority of the population and life expectancies are very long. Where in the West TV viewing is on a pretty clear terminal downtrend, Japan has a more stable secular picture where this middle-aged and older cohort compose the majority of the viewer base and will live for decades to come.

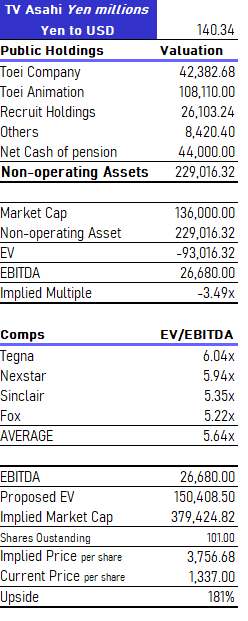

Besides a more limited secular decline of TV viewing to streaming erosion in Japan being a good reason for a potential premium, the lower risk fundamentals together with the valuation make TV Asahi a no-brainer buy. TV Asahi’s operating asset values exceed its market capitalisation. It has about 33% of the market cap covered by net cash over the only real liability of defined pension, and then it has more than 100% of its market cap covered principally by Toei Company and Toei Animation (OTC:TOEAF) stock, not even including shares in Recruit Holdings (OTCPK:RCRRF) which readers may know as the owner of Glassdoor and Indeed.com. This kind of massive cover of market caps with non-operating assets is surprisingly common in Japan as we explain later.

Toei Animation, the distributor of which is Toei Company which trades separately, is a superb company, exposing Asahi to the reopening of theaters and releases of movies from massive franchises like One Piece and Dragon Ball, as well as licensing revenues from related branded merchandise, the rights of which are owned by Toei. Ultimately, TV Asahi trades deeply in negative EV territory covered by a profitable, IP rich non-operating asset with reopening tailwinds, massive internet properties like Glassdoor.com and lots of cash with no debt. With companies like Toppan (OTCPK:TOPPY) selling half of their own shares in Recruit Holdings, and coming close to realising large non-operating assets for markets, there is definitely scope for companies like TV Asahi to do the same for investors. Upside could be almost 3x – a clear buy.

The Japanese Stock Market Structure

We’ve been covering Japan for a while, and some of our most successful ideas lately have been Japanese. There are a couple of general reasons why the Japanese market offers downside protection that has no comparison in other markets. Firstly, unlike the US, Japan doesn’t depend on private investing for pensions which means not a lot of money goes into stocks relative to the massively overinvested Japanese bond market. This structurally means things are cheaper in the Japanese stock markets and risk appetite lower. The second reason is that Japanese companies have these strange, incestuous ownership relationships with each other. A Japanese company will own lots of its stakeholders’ stocks, up and down stream. Every Japanese car company owns boat-loads of Toyota (TM) shares, and in general these share ownerships tend to cover 10% of the market cap at the very minimum. It can quite often go above 30%. This creates a lot of non-operating asset cover, and critically renders stock screeners, especially when screening on EV, completely useless as screeners don’t take into account these non-cash operating assets when calculating EV. It is important to mention that Japanese companies have started selling these large non-operating asset bases to return capital to shareholders. Toppan has done it, which is also a substantial owner of Recruit Holdings like TV Asahi, selling more than 66% of their $3.4 billion ownership from November 2020. This is essential because it disputes that these assets will remain perennially unpaid to shareholders.

Finally, Japanese companies buy their own shares and hold them as treasury shares, not nixing them. This means typically the shares outstanding are much higher than what they should be, overstating market capitalisation. Because all these companies are so overcapitalised as well, and have no debt, they will never have to issue those shares again – never ever! They can really just be eliminated from share outstanding counts and therefore downstate valuations below what screeners could pick up.

For these reasons, Japanese markets can contain extremely undervalued, no-brainer stocks, despite being one of the most developed markets in the world.

Japan’s TV Landscape

We believe the TV Asahi opportunity is a believable one, and not a too-good-to-be-true story or a value trap. We think the rest of the conviction in TV Asahi comes from details about the TV landscape in Japan and why it’s not likely to be a source of further value destruction given the multiple. Indeed, the TV landscape is pretty solid in Japan relative to the rest of the world.

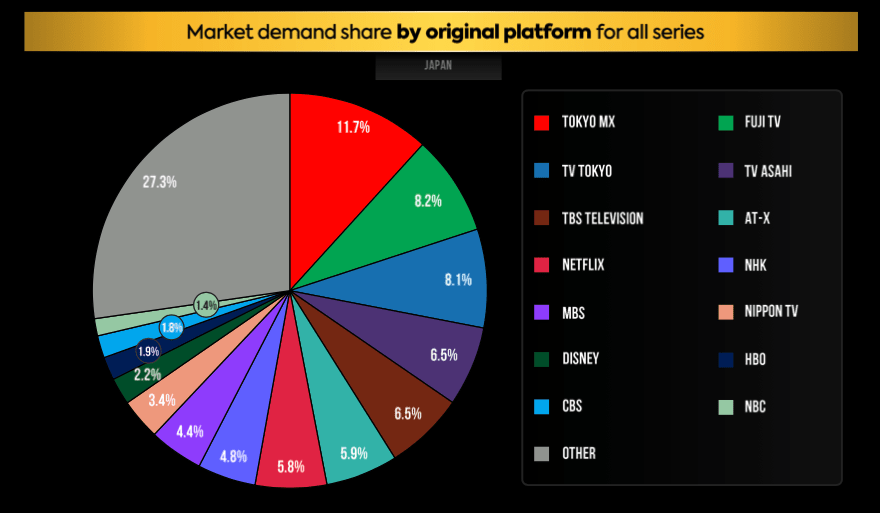

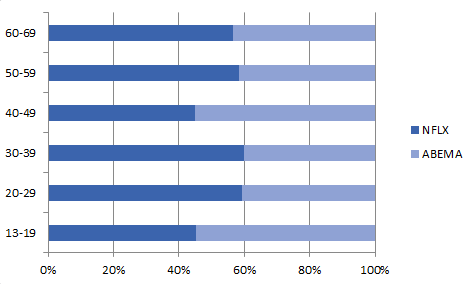

While Netflix (NFLX) has a presence, thanks in part to its anime originals, the overall Netflix presence is pretty low in Japan relative to the average share it has in other markets. Same goes for other global streaming players. This is partly due to the fact that there are native streaming services like ABEMA (owned in an unconsolidated J.V by TV Asahi at around 36%, CyberAgent (OTCPK:CYAGF) owns the controlling 55% share) present only in the Japanese market that has similar penetration and competitive presence as Netflix. However, the main reason is demographics.

Market Shares (Parrotanalytics.com)

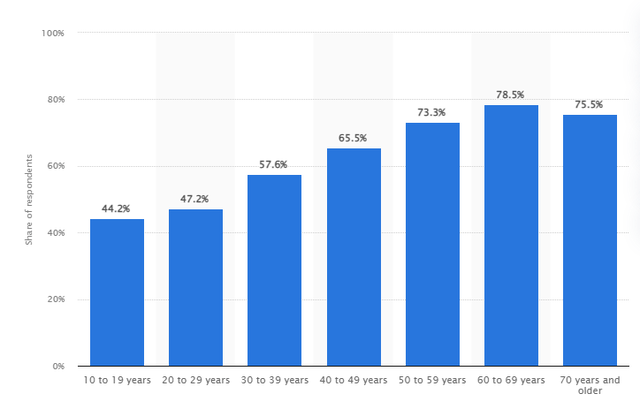

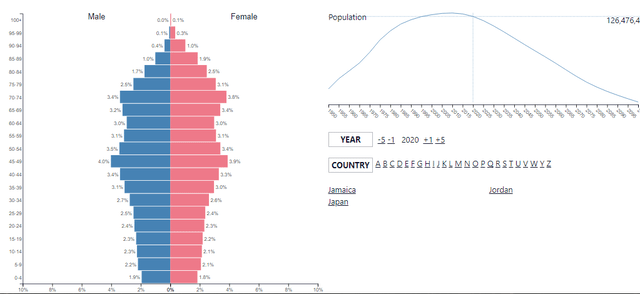

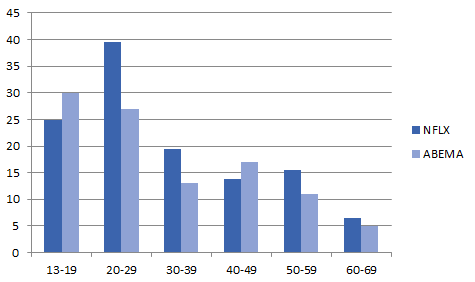

Focusing on males, the distribution of TV watching is unsurprisingly concentrated among older people, and this chunk dominates the Japanese population pyramid and will do so for decades to come. The TV and cable viewing rates among younger people are also substantially higher, by as much as 10% higher among younger groups in Japan compared to younger groups in the US.

TV Watchers Japan (Statista.com)

Population Pyramid (populationpyramid.net)

Older groups still dominate the Japanese audience, but this works out well for broadcasters. Japan has a life expectancy almost 10 years longer than in the US, and the biggest population cohort is between middle-aged and the very elderly. This is a relatively durable group in Japan thanks to longer life expectancy with the bulk of the audience for TV having a long ways to go before death; at least 10 years before mortality starts to erode the base. Indeed, historical revenue growth across the major broadcasters has been flat to slightly positive, with EBITDA growth more clearly positive, since 2018 with a gulley during the initial wave of COVID-19. This is not a declining category like in other Western countries, where cord-cutting has been a phenomenon for a decade already.

There are several major TV broadcasting companies in Japan:

- Nippon TV Holdings

- Tokyo TV

- Asahi TV Holdings

- TBS Holdings

- Fuji TV

Then there are some regional players that focus on providing terrestrial broadcasting for certain regions like the Kansai regions, covered by another Asahi-named player, although unaffiliated to Asahi TV, called Asahi Broadcasting Group. These are marginal players, about a 10th of the market cap of these larger fish. Most of the content coming out of studios goes to the five players mentioned above, and Asahi TV is the fourth largest in market share.

Performance of the TV groups has been boosted under the pandemic for obvious reasons, and in general sales grew incrementally into 2021. 2022 is seeing flat development because of economic uncertainty. In Japan, uncertainty is primarily revolving around the depreciating Yen and pressure on households that buy imported products. Downward revisions to forecasts in revenues have been to the tune of 2-3% and 10% in operating income. Operating incomes have already declined YoY due to rising production costs among other types of inflation, while revenues for ad time in particular, less so for spot sales, decline.

TV Asahi’s Businesses

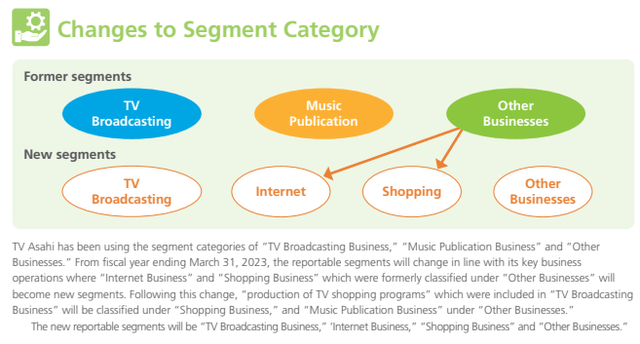

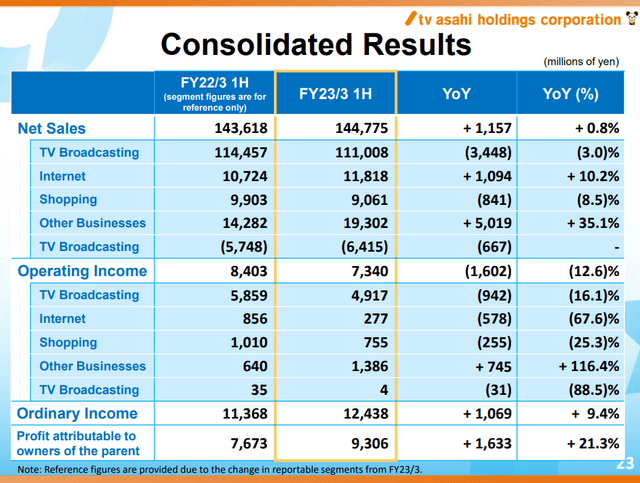

TV Asahi is on a go-forward basis going to change its segment reporting and therefore the categories for business guidance in their annual investor’s guide.

Segment Reporting (2022 Investor Guide)

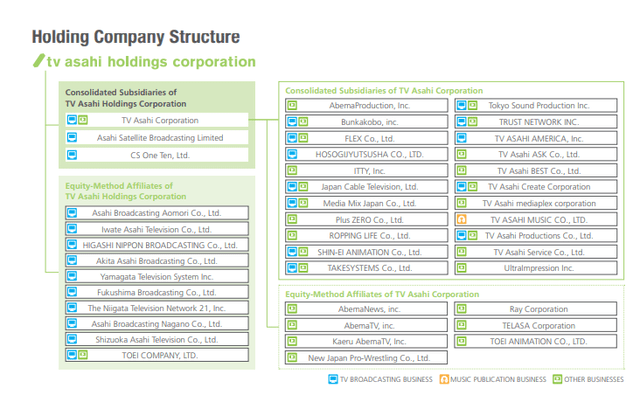

Before there was the TV broadcasting service which includes terrestrial and satellite broadcasting, a very marginal music publication business, and then ‘other businesses’ which are becoming increasingly dominated by ‘internet’ businesses. In the investor’s guide posted last year, they provided the topline metrics and commentary on the ‘other businesses’ which includes their independent efforts but also equity-accounted investments in streaming platforms or delayed viewing platforms online leveraging VOD content, like TELASA and ABEMA.

Shopping was part of the old segment of ‘other businesses’ and is a relevant category related to the provision of shopping channels on TV which is going to be matched by more ecommerce efforts to attract younger generations.

The new segment reporting breaks out the other businesses into internet and shopping, and folds the miscellaneous businesses, including an increasingly irrelevant music business into a new other businesses category.

Segments (H1 2023 Supplements)

The performance to follow their broadcasting business is that of operating income, which doesn’t include dividends coming in from equity affiliates like Toei Animation and ABEMA + some other streaming J.Vs.

While TV isn’t a secular loser in Japan like in the West, this year it is in general decline thanks to economic pressures on corporate budgets thanks to a weaker Yen, moderate-to-high rates of inflation and therefore a poorer Japan. Ad budgets are shrinking the world over, affecting even companies like Alphabet (GOOG).

TV Asahi’s businesses were growing steeply YoY as of the last FY 2022 thanks to the pandemic and general goods boom. Current declines in income a half-year later are primarily being driven by increases in production cost for content but also general inflation. The shopping business is being affected by logistics and falling revenues and scale as pandemic impulses recede, and internet businesses dominated by streaming are seeing eroding profitability on the scale-ups and marketing.

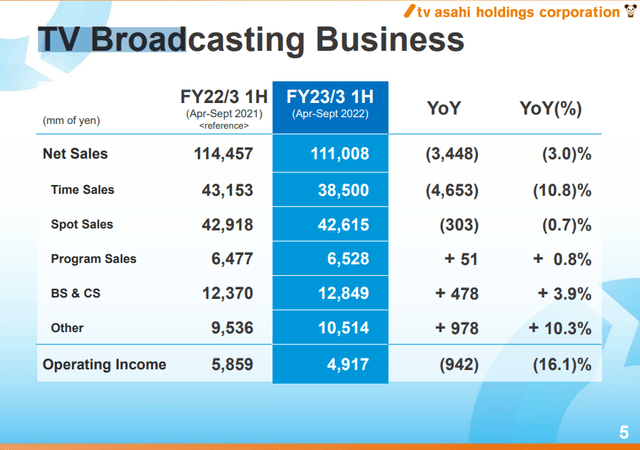

The TV broadcasting business is where most of the declines are coming from, which saw a 16% decline in operating income. This was driven entirely by falling scale in revenues with declines of 3% driven by declines in time sales for ads, where Japanese businesses typically have higher operating leverage due to it being difficult to do layoffs. The flip side is that wages never rise in Japan, leading to no real inflation in SGA YoY as of the H1 2022, with SGA growth having happened over the last fiscal year period prior to the goods bust as a consequence of growing scale of new initiatives including the very recent launch of several streaming services towards the beginning of the year.

There are clear declines in the face of economic pressure, but since pre-pandemic levels, the net growth has still been positive in EBIT at over 10%. Moreover, the reopening of China, which has an idiosyncratically heavy effect on Japanese prosperity, could revitalise these figures as of the reopening-related announcements last week.

Broadcasting Business (H1 2023 Supplements)

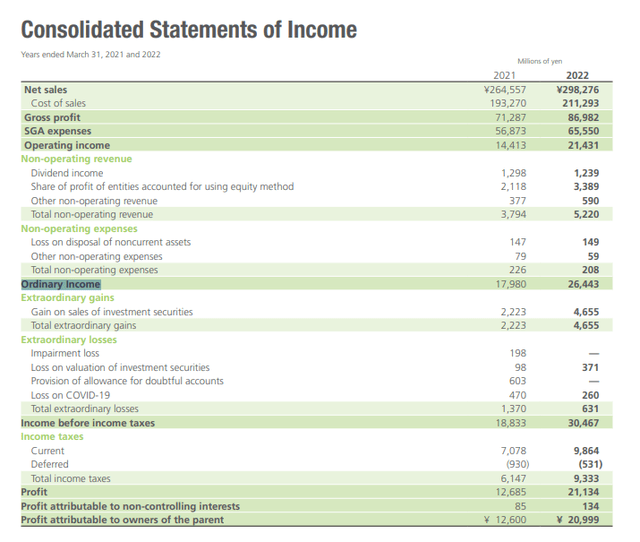

The other important metric is ordinary income, which is the figure that includes equity-accounted holdings and dividends from associated businesses like J.Vs in addition to the consolidated operating income we discussed above. Since TV Asahi has so many non-operating assets, this figure is critical. In H1 2023 it is higher YoY as Toei Company, Toei Animation and other holdings have continued strong momentum providing either their apportioned income growth as per the equity accounting method, or a growing dividend in the case of Recruit. We discuss Toei in detail later.

IS Showing Treatment of Ordinary Income (Investor’s Guide 2022)

Corporate Structure (Investor Guide 2022)

What is important to note is that quite a few of the streaming initiatives are conducted through either J.Vs or some other divvying up of joint projects with more tech oriented companies. Therefore, a lot of the streaming opportunity is being captured by the ordinary income growth.

These streaming services seem to be either growing profits or reducing losses. The contribution from growth in Toei Company and Toei Animation income, and the growth in dividends from Recruit and other initiatives, don’t fully account for the offset of declines from the consolidated businesses. The rest of the ordinary income increase, probably around 800 million Yen, is likely coming from profit growth from streaming services like ABEMA and TELASA. ABEMA boasts over 10 million monthly active users, and has penetration rates in line with Netflix. Among the youngest cohort of 13-19 years of age, ABEMA actually has a 30% penetration to Netflix’s 25%. Netflix wins out in young adults, but then loses again in the middle-aged groups where ABEMA does really well thanks to AbemaNews. In other words, Netflix may be the top streaming service in Japan, but ABEMA is a very close second – so by far the largest native streaming service. The next service is Disney+ with less than half of Netflix’s penetration.

NFLX vs ABEMA (by cohort) (Statista)

NFLX and ABEMA Penetration (%) (Statista)

While we don’t make a point of it in our thesis since we don’t have exact figures, consider that Netflix has about 5% of its revenues coming from Japan. If you were to value ABEMA in that proportion to Netflix’s EV, since they have businesses that are about the same size in Japan, you’d get around a $7.5 billion dollar valuation on ABEMA of which TV Asahi owns about 36%, which would value TV Asahi’s shares at 2.5x the market cap of TV Asahi today.

Toei

Now that we’ve discussed the core businesses seeing that there’s nothing so bad about them to justify a negative EV, and commented on the significance of ABEMA, the last contributors to the TV Asahi economic picture are Toei Animation and Toei Company.

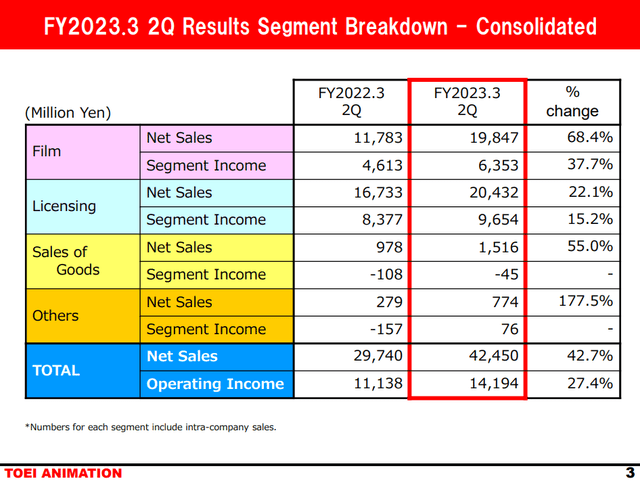

In our bullet points at the beginning of the article, we said that TV Asahi effectively owns about 25% of Toei Animation. In reality, they own around 20% of Toei Animation, and then 17% of Toei company, which in turn owns 40% of Toei animation. Toei Company isn’t a terribly exciting business, it is just the distributor of the movies made by Toei Animation, which houses all the merchandising rights related to their movies, as well as are the beneficiaries of the success of the movies at the box office. Toei Company, quite like TV Asahi, trades at almost 0x EV/EBITDA, covered substantially by cash and the value of Toei Animation stock it owns – so it’s another frightfully undervalued stock. Toei Animation is valued as one would expect of a company with Dragon Ball and One Piece Merchandising rights, as well as recent successes with One Piece and Dragon Ball movies at the Japanese box office. It has a 20x EV/EBITDA, and has doubled its EBITDA since 2018 thanks to durable merchandising rights, growing audiences and very deep moats. Toei Company has likewise been growing, riding on Toei Animation’s coattails.

Toei Animation’s business is booming as COVID-19 restrictions totally ease and the release of movies from massive, blockbuster properties like the One Piece Film Red Movie. They also earn licensing revenues from sales of Dragon Ball and One Piece merchandise related to the theatrical releases of related movies. Income from Toei is up 27%, which together with the 5% growth in the Recruit Holdings dividend and income growth from other equity holdings like ABEMA, the declines in TV broadcasting for Asahi are completely offset to reach the 9.4% ordinary income growth mark.

Toei Segment Results (Q2 2023 Toei Results)

SoTP Breakdown

For the SoTP breakdown we backtrack from ordinary income and use operating income to build the EBITDA figures. This is because we intend to use Toei Company and Toei Animation’s market value in the SoTP to provide a more objective measure of the value of non-operating assets and for easier parsing. This would also give us space to add ABEMA’s valuation, but we don’t do that at this stage as we want to be conservative. We sum the value of the holdings, and the net cash value of pension liabilities, which is the only liability to speak of in the balance sheet that could be akin to debt, in order to get the net value of non-operating assets.

SoTP Valuation (VTS)

The forecast performances short term are pretty similar between the various US networks and those of Japan, although the Japanese secular picture is more robust. Perhaps Japan is under slightly more immediate pressure due to the difficulties in the Japanese economy due to the depreciating Yen as compared to the more solid US economy thanks to the dollar strength. But better demographic dynamics and viewing habits play more in favour for Japanese companies than US companies. Overall, we use US networks as EV/EBITDA comps to build the upside. With non-operating assets almost wholly covering market cap, it’s no surprise that with about almost any multiple, lots of upside can be justified.

Toei and Recruit drive the value of non-operating assets. While tech multiples have been under more pressure and this has affected Recruit Holdings, which owns Glassdoor and Indeed.com job-search and referral websites (Recruit is down 40% YTD and below pre-pandemic levels), Toei Animation has tripled since just before the pandemic and is up 26% YTD thanks to growth in Otaku culture, its bottom line and growth brand equity in its merchandising rights. We think that as of now, valuations are durable for both businesses as Toei’s value becomes more ensconced as well as benefits from reopening tailwinds, and as the likelihood of incremental tech declines become more limited.

Bottom Line

The TV broadcasting business which drives consolidated results is seeing pressure from the topline related to a general decline in ad spending. This is normal in a world under recessionary pressure. Excitement over ads has generally declined, but TV ads’ secular picture isn’t bad, especially in Japan, and has stayed very stable over the last five years. Nonetheless, its core broadcasting business is given a negative value after accounting for TV Asahi’s non-operating assets, which include very well known and powerful properties like Glassdoor and Indeed.com from Recruit and the merchandising rights to blockbuster anime properties under Toei. Not only do these non-operating assets command large and sustainable values, but they offer meaningful income on a deconsolidated basis to TV Asahi that has driven growth in ordinary income which ends up supporting a quite strong 3.3% dividend yield. Payout ratios are below 30%, and net income has risen in the high 20%s thanks mostly to Toei’s growth increment. More growth could come from burgeoning streaming platforms both consolidated and owned through J.Vs, especially ABEMA, which is head-to-head with Netflix for Japan’s streaming crown. When valuing the TV Asahi businesses with conservative, low multiples in line with similar slow-moving broadcasting peers in the US, the upside is almost 3x. Peak CPI figures help ease pressure on the Yen too as the phase looks to change in the rate cycle, and with TV Asahi earning almost completely in Yen, peak rates in the US could mean a resurgence of the Yen, and provide an extra zest of return to US investors through the FX avenue. This risk could also be hedged if investors are just looking for the downside protection in the valuation.

There is very limited downside, thanks also to a better structural picture compared to other developed markets for TV in Japan, but mainly due to an undeniable valuation. As for the upside, a nice dividend pays you to wait for markets to either recognise the value in this stock, as Japanese companies are beginning to turn to balance sheet and capitalisation questions to unlock low-hanging fruits of value, or a recovery in economic sentiment supports ad-exposed businesses generally and create return. Nonetheless, you can be very confident in the margin of safety in both income and valuation that TV Asahi offers.

Editor’s Note: This article was submitted as part of Seeking Alpha’s Top 2023 Pick competition, which runs through December 25. This competition is open to all users and contributors; click here to find out more and submit your article today!

Be the first to comment