Vitalii Pasichnyk/iStock via Getty Images

Investment Thesis

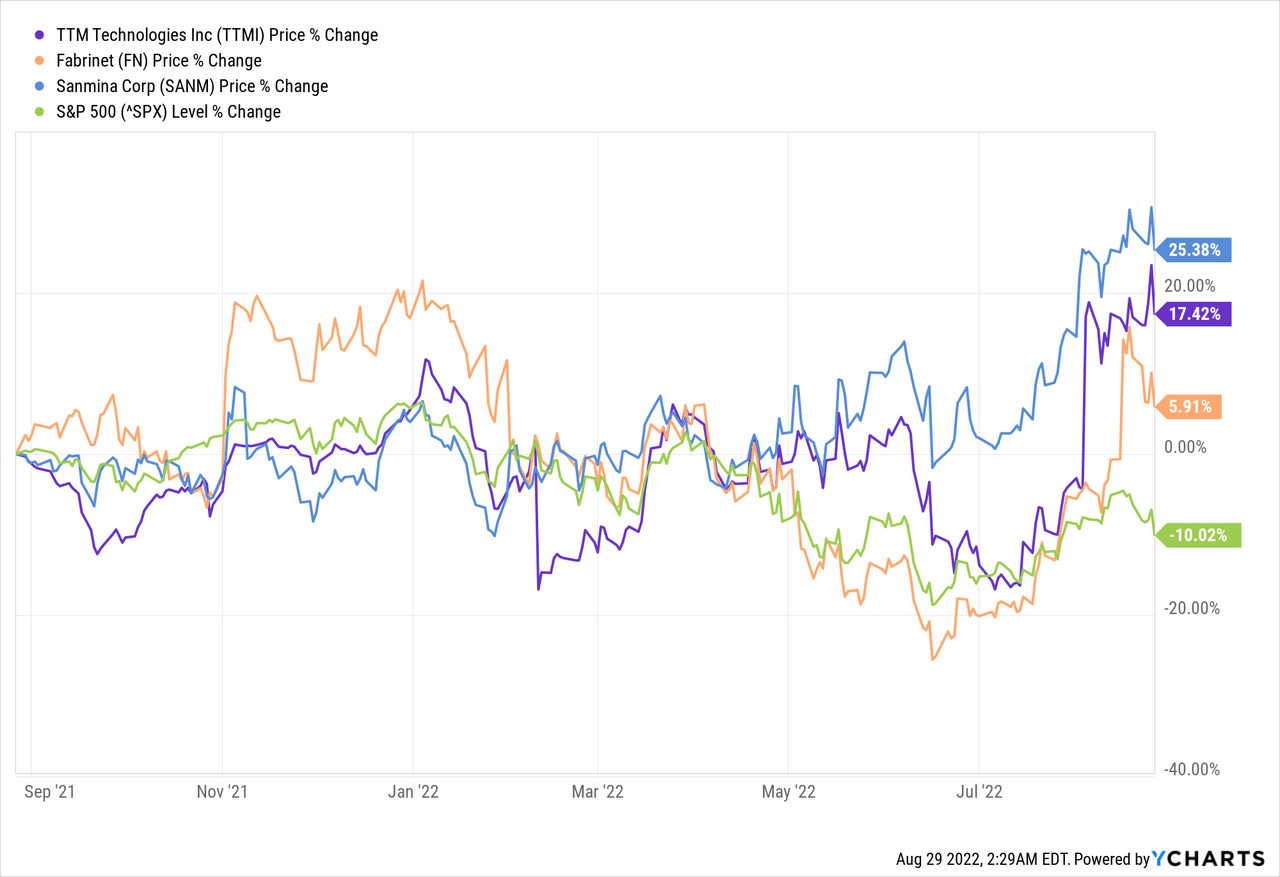

Pertinent to my current streak, writing about Fabrinet (FN) and Sanmina Corp. (SANM), another worthy stock to put on your radar is TTM Technologies, Inc. (NASDAQ:TTMI). The stock is lower capped and showed the highest post-earnings price gain than the previous 2 stocks.

Despite lagging SANM in price returns for the previous periods, the company has been leading against its competitors & the market for the last 6 months, with over a 30% gain in the last month. The significant gains are driven by strong financial performance, outperforming its guidance, and rewarding the stock’s relatively higher risk and volatility accordingly.

The company is working well to diversify and stabilize its revenue streams by engaging in multiple end markets, as is evident from its recent acquisition and new facility, both essentially directed at different end markets.

I am bullish on the stock because of its amazing financial performance and growth prospects, which will likely beat the upcoming estimates again.

The Company

Like FN and SANM, TTM Tech is a global provider of time-to-market & volume production of advanced technology products, offering end-to-end design, engineering, and manufacturing solutions to customers, including engineered systems, printed circuit boards (PCB), radio frequency (RF) components, and RF microwave/microelectronic assemblies.

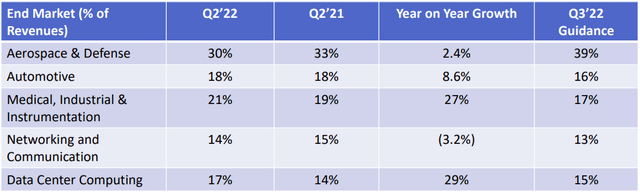

The company’s customer base includes aerospace and defense, data center computing, automotive components, medical, industrial, and instrumentation-related products, and networking/communications infrastructure products, including OEMs and electronic manufacturing services (EMS) providers.

It has about 1000 customers, but the top 10 customers accounted for about 43% of its H1 net revenue, including 30% from its top 5 customers and 10% from 1 customer. Its top 5 customers are Apple (AAPL), Cisco (CSCO), Huawei, Robert Bosch GmbH, and Tesla Motors (TSLA).

TTM Technologies Investor Presentation

Recent Acquisition For A&D Growth

The company acquired Gritel and ISC Farmingdale Corp., including Telephonics Corporation, for about $330 million in cash. Gritel has operated for almost 9 decades, globally providing highly sophisticated intelligence, surveillance, and communications solutions, deployed across a wide range of land, sea, and air applications.

The acquisition is aimed to widen TTM’s Aerospace and Defense offerings into higher-level engineered system solutions and surveillance and communications markets while strengthening its position in radar systems.

TTM expects this transaction to affect the EPS immediately in the upcoming financial reports, with over $12 million in pre-tax run-rate cost synergies to be realized by 2024.

Strong Revenue And Profitability Growth

TTM Technologies Investor Presentation

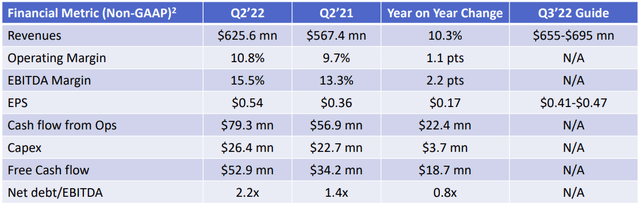

TTMI’s recent price surge resulted from its over-the-top earnings report, as it continued its 3-year streak of beating market revenue and EPS estimates. The company has also successfully translated its revenue growth into higher profits and cash flows.

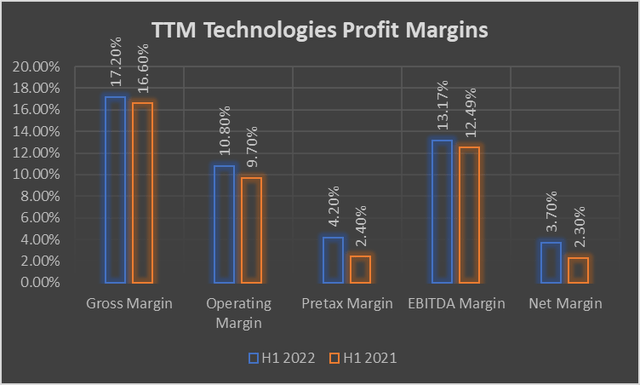

For the first half of 2022, TTM Technologies has reported a YoY topline growth of 10.3%, followed by a gross margin of 17.2%, up 60 bps, a non-GAAP operating margin of 10.8%, up 110 bps, a pretax margin of 4.2%, up 180 bps, an Adjusted EBITDA margin of 13.17%, up 68 bps, and a net margin of 3.7%, up 140 bps YoY.

Its upcoming quarterly results are also expected to exhibit strong growth, and considering its current trajectory and outperformance, it will likely achieve the given targets.

| TTMI Expected Results | Q3 2022 Guidance | Q3 2021 Actual | Q2 2022 Actual | YoY Growth |

| Revenue | $675 | $556.8 | $625.6 | 21.2% |

| SG&A | $57.4 | $48 | $66.36 | 19.6% |

| R&D | $7.4 | $4.4 | $5.2 | 68% |

| Interest | $10.2 | $11.15 | $10.7 | (8.5%) |

| Effective Interest Rate | 15% | 7% | 15% | 800 bps |

| Non-GAAP Diluted EPS | $0.44 | $0.34 | $0.54 | 29.4% |

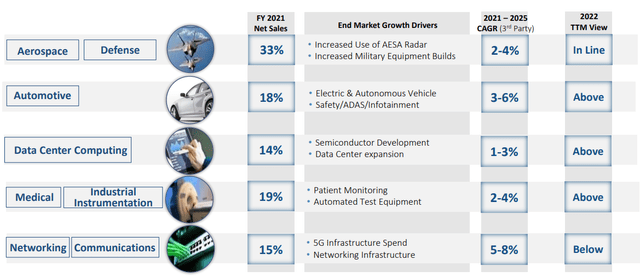

As a manufacturer of crucial modern world products, TTM has diversified end markets, with a well-balanced proportion of sales inflowing from each market. This makes the company open to leveraging opportunities from high-growth markets, such as the growing 5G infrastructure and data centers market and growing A&D budgets.

TTM Technologies Investor Presentation

The company has been moving to add stability and sustainability to its topline since its acquisition of Anaren in 2018. With the recent acquisition of Gritel, it is substantiating that drive by expanding its footprint in the A&D market while targeting the rapidly expanding 5G wireless infrastructure market. Telephonics already includes a backlog of $303 million from the A&D market, which pushed TTM’s total A&D backlog to over $1 billion.

The significant focus on the A&D market is driven by the high defense budget, which has resulted in the company recording significant bookings for the Joint Strike Fighter and other space and airborne programs.

The following statement by the company’s CEO, Tom Edman, during its Q2 earnings call envelops its plans for the future of its revenue streams:

In the future, the aerospace and defense end market will be about 40% of revenues, providing growth and stability in a potentially uncertain demand environment for commercial markets. In addition, over 50% of A&D revenues will be from engineered and integrated electronic products, with PCBs being less than 50% of the overall contribution.

Given the current market situation riddled with macroeconomic & geopolitical uncertainties, aiming for stability and sustainability by reducing the company’s cyclicity appears to be the right direction.

Apart from A&D, the company is also showing considerable progress in other end markets, especially the data center computing segment, which currently accounts for a smaller portion of its total revenues but showed the strongest YoY growth. My Fabrinet and Sanmina Corp articles are also directly relevant for TTMI’s end market assessment.

TTM’s move in this direction is bolstered by the company’s announcement of its automated PCB manufacturing facility in Malaysia to address supply chain strains, regional diversification, cost-effectiveness, and less reliance on China. This decision for the Malaysian facility is supported by the company’s 200 bps capacity utilization improvement to 86% in its Asian PCB facilities due to the increased production for commercial end markets.

The facility is expected to initiate pilot production in the second half of 2023, with volume production commencing in 2024 and a full phase 1 capacity of about $180 million in revenue by 2025. The facility is planned to support a 25% upside expansion in phase 2. The facility is set to serve customers in commercial markets, including networking & telecom, data center computing, and medical, industrial, and instrumentation.

Balance Sheet Snapshot

The company has ample liquidity to cover the current year’s CapEx spending of about $120 million with cash in hand of about $266.5 million. Its cash position remains strong despite the $300 million cash acquisition, $50 addition of PP&E and other assets, and share repurchase of $35.5 million during H1 2022.

The cash flows were enhanced by operational cash flows, which generated $115.3 million in the first half of 2022 and net addition of $74 million in long-term debt. The added debt has affected its net leverage negatively from 1.4x to 2.2x and deteriorated its debt to FCF ratio to over 78x, significantly higher than its peers.

The company repurchased 0.4 million shares of its stock for $5.2 million in the MRQ, completing the repurchase of its 7.5 million shares from common stock for $100 million under the share repurchase program authorized in February 2021.

Valuation

Given the post-recession rebound prospects of tech stocks, undervalued tech stocks need to be monitored by investors for potential winners. TTM Tech’s relatively lower market and higher leverage are reflected in its valuation metrics, with the company historically trading at a discount to its peers.

The recent price surge has made the stock trade at higher multiples than its 5-year average but still relatively cheaper than its competitors. However, even though the stock appears undervalued, it trades at higher valuation multiples than SANM, which in my opinion, is a better alternative to TTMI.

Taking the average of all relative measures in the following table, TTMI’s share price fair value churns out to be $24 relative to its 5-year average. As the market changes its perception from low-risk, low-return stocks due to a highly uncertain economy to high-risk, high-return stocks for leveraging the post-recession rebounding market, TTMI will likely catch the eye of investors and continue its outperformance along with its financial performance.

Conclusion

TTM Technologies produces integral products for a plethora of end markets with varying degrees of growth prospects. Its focus on stabilizing its revenues through topline diversification by focusing on multiple markets is a great strategy to generate long-term shareholder value.

Its upcoming financial results are again likely to be beaten through meticulous financial and operational performance, with the market responding positively to it, especially considering the accretive expected results from Telephonics.

The company’s share price may be fairly valued or undervalued depending on investors’ point of view, but it certainly doesn’t appear overvalued. With the market readying itself for post-recession price gains, TTMI offers risk-tolerant investors an amazing opportunity to generate substantial price returns.

Be the first to comment