400tmax/iStock Unreleased via Getty Images

Introduction

Alphabet (NASDAQ:GOOG) (NASDAQ:GOOGL) is mostly known for their Google search engine, but profits from advertising have allowed the company to enter alternate fields over the years. The ability to balance free-to-use software with profitable revenue is an important feature of all technology companies and has led to the rise of the SaaS model as the best (or most common at least). One interesting area of growth is in the provision of drug discovery software with the aid of algorithms, big data, and artificial intelligence as a way to reduce discovery time, decrease operational costs, and save lives.

While Alphabet is now a major provider of software, I am unsure about how the company will drive financial growth with the segment. At the same time, their ability to pour millions or billions of dollars per year into their free platform may lead to competition of proprietary software platforms, such as Schrodinger (SDGR). Therefore, this article will discuss whether investors can even gain benefit in the far more expedited drug discovery process as a result.

Big Tech Has Grown Off Open Source Software

Open Source Software (OSS) is an intrinsic part of all of our modern applications, but also inherently are net-loss, intellectual property vehicles. While most OSS started out as academic or governmental research projects – and led to the foundation of all tech giants we see today – the financial implications are not well understood. As an example, Google’s trillion-dollar business was built upon partially open-source Java (ORCL), along with fully open-source Python and C++, but monetized to the fullest due to the work of Brin and Page. See other important examples in the research paper quote below. Altogether, there certainly is plenty of financial opportunities based around OSS even when direct software sales or licensing does not result in revenues. However, I will note the key differences that arise in regard to the drug discovery industry compared to applications software.

OSS has penetrated markets in areas including operating systems, servers, and specialized languages. The most widely used operating system on the internet globally is the Linux-based Android operating system (GlobalStats statcounter 2018). As of July 2018, Apache is the most frequently used HTTP server on the internet (W3Techs 2018). Based on the cost of the nearest available substitute, Greenstein and Nagle (2013) estimated the value of capital stock of Apache software in use in 2013 at between $2 and $12 billion.

While OSS projects can compete directly with proprietary software, as in the Apache example, OSS projects are increasingly used in combination with proprietary code, either as extensions of a proprietary base, or with proprietary software extending the open source base. These cases highlight the potential for complementarity between open source and proprietary software. Top institutional contributors to the code repository GitHub in 2017 are Microsoft and Google.

Big Tech’s Foray into Drug Discovery

As the difficulty to find new disease therapies increases with time, it was only natural that the computational industry would link to the health sciences. While databases and analytics already rely heavily on technical devices and softwares, the direct process of finding new drugs has typically been a human endeavor. However, over the past 20 years, an increasing number of firms are introducing ways to use algorithms or machine learning to expedite the tedious process. Imagine the benefits!

The typical therapy takes at least 10 years to go from discovery to approval, and there is less than a 10% chance of success. This is also extremely expensive as you need to pay multiple researchers a yearly salary along with other operational costs. Then, only a few drugs can be tested at a single time, leading to a longer discovery process. Software can fix all these issues, and this will have an exponential effect on reducing costs and increasing accuracy. Use is also not limited to discovery, and can in fact be used across the entire healthcare industry as is seen with most innovative healthcare industry participants. Software, especially cloud applications, is slowly permeating into every area of the market.

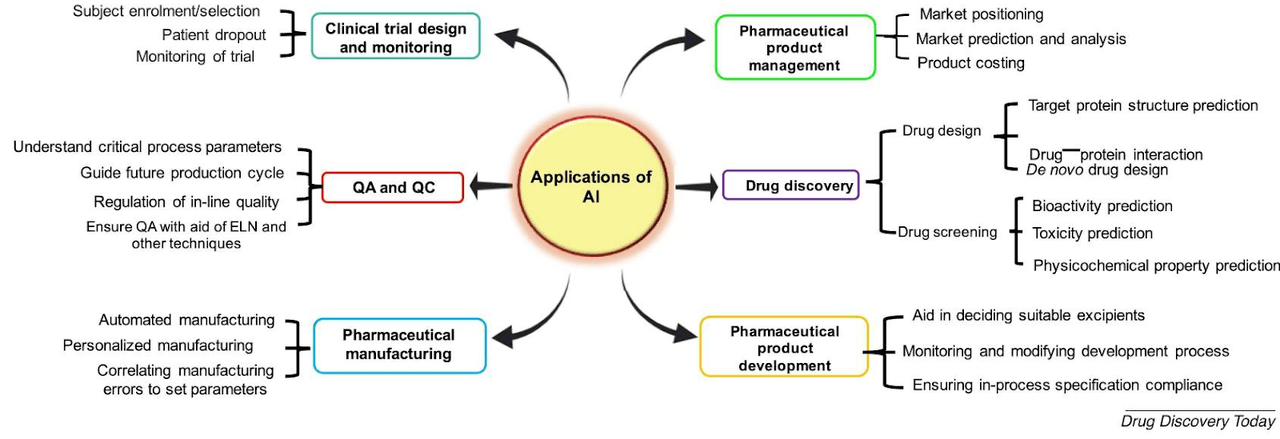

Applications of artificial intelligence (AI) in different subfields of the pharmaceutical industry, from drug discovery to pharmaceutical product management. (Paul, et al. 2021.)

At the moment, Alphabet is focusing on discovery in multiple ways. Most famously, AlphaFold is an open-source protein visualization tool that allows researchers to predict, discover, and assess protein-based treatments and diseases. The scale is incredible, and some even claim AlphaFold to be a revolutionary “Gift to Humanity“. Similar to the power of a programming language such as Python or C, AlphaFold is now leading to a growing number of published research, and will soon play a part in drugs on the market. I will also discuss two for-profit operating segments later in the article.

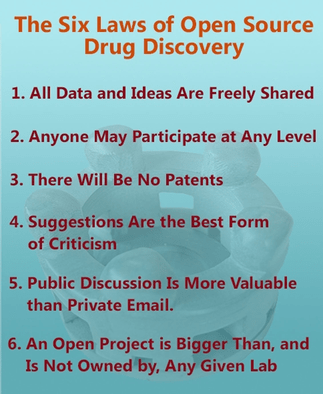

At the same time, competition is rife, especially as other tech giants enter the fray. In particular, Amazon has a highly rated database compiler, Amazon Neptune, that helps researchers disseminate data across the entire ecosystem (i.e., helping to find already published data). Also, Microsoft (MSFT) has a diverse range of software tools for the healthcare industry, including a small machine-learning discovery segment (big tech focuses more on visualization, databases, and analytics). There are certainly many niches to fill, and we remain in the early innings. However, what financial risks will arise from a competitive OSS landscape? As drug discovery specialist Mat Todd puts it:

Over the last 15 years, I have worked with large numbers of people who are interested in open source in drug discovery because the approach promises to be able to solve problems in exactly the way that the pharma industry, if acting alone, cannot. If one values competition, as I suspect all scientists do, then a competition of approaches must be seen as healthy. If open source can compete with proprietary methods in a commercial space as valuable as telecommunications (i.e., the projects leading to Android vs. iOS) can the same competition of ideas benefit another commercially-important area: drug discovery?

I strongly suspect it can. The answer depends on the disease. But I am running this experiment with others because the answer is not yet clear.

Mat Todd

Financial Impact

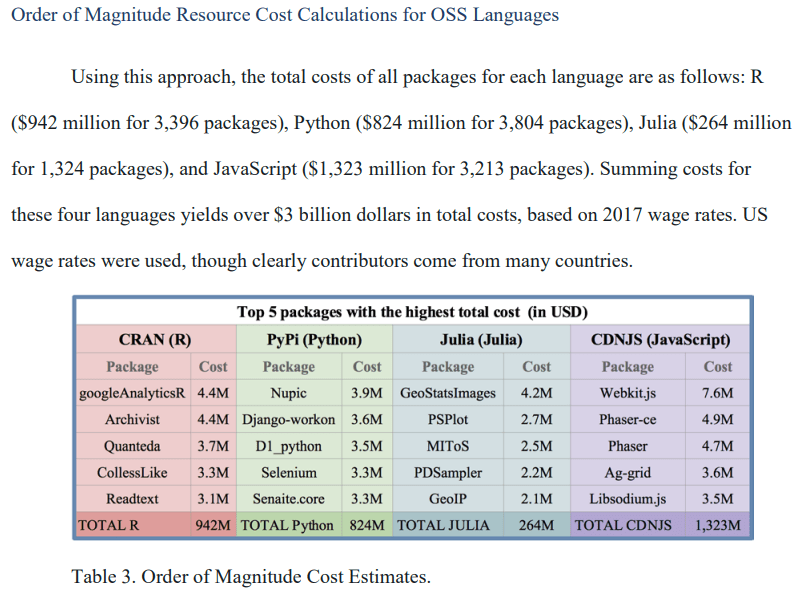

When reading the quote and “Six Laws” above, one may wonder what is in it for Alphabet? There are multiple ways to look at it. First, we know that AlphaFold, and other platforms will be a net loss system on their own as it costs a lot to run these platforms. Recent data suggest that common OSS languages cost over $3 billion per year, and this will not be directly returned to the development firm as revenues. However, these investments are returned more than 10-fold in terms of output, and gains can be earned in other ways.

Robbins, et al.

It is estimated that companies located in the EU invested around €1 billion in Open Source Software in 2018, which brought about a positive impact on the European economy of between €65 and €95 billion. Many NGI-supported projects are open source by design.

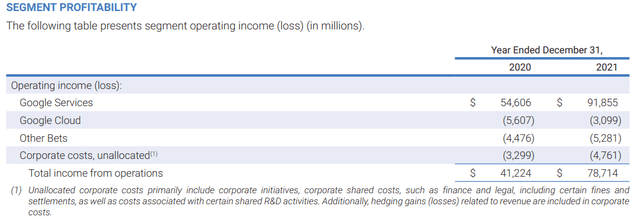

In this lane, we can see with Google that both the Google Cloud services and other bets segments are losing money, when compared to the profitable ad services segment. Will the bet on OSS be a long-term beneficial practice? I believe so, especially when Alphabet has $100 billion in operating income to throw at software and infrastructure development across the board. Let us look at what Alphabet is doing so far.

Alphabet’s Current Bets on Drug Discovery

Alphabet has two major endeavors beyond AlphaFold. The first is healthcare segment Verily, which has a diverse range of capabilities across the entire industry. In terms of software-based discovery and analytics, Verily has three advanced techniques:

-

Immune Profiler, a way to analyze the human genome to uncover and identify potential genetic therapies.

-

Virtual Stainer, a way to improve traditional biopsies through computational optimization (similar to software in smartphone cameras, but on the microscale). Used by Allergan (ABBV) for liver biopsies.

-

Lastly, Terra, a collaboration between MIT, Harvard, Microsoft, and Verily that provides cloud-based data management services. Allows for both private analysis and collaboration in order to visualize and interpret data with endless processing power.

Generally, Verily is focused on analytics in healthcare, especially in regard to primary care. However, the three software platforms above do allow for the company to obtain collaboration revenues from partners, and if not, drive traffic to the Verily platform. Then, revenues can be derived from their main services, similar to how ads work on other Google services (i.e., Gmail use leads to Google Cloud use). Driving users toward a Google Cloud subscription may be the most profitable way to go about this growing sector.

The second major subsidiary with ties to drug discovery is Calico Labs. The segment is an early-stage biotech-like company with collaborations with AbbVie for three Phase I cancer trials. However, the core focus of calico is on aging and age-related diseases. The platform leverages computation biology to discover potential therapies faster, reduce overhead, and derive high-efficacy therapies. While at an early stage, it will be interesting to see what Alphabet does with this company as therapies enter late stage trials. Will they sell the assets or continue down the path of discovery? It is unknown so far.

Competition Abounds

As I discussed, the main beneficiaries of drug discovery applications will be patients and drug discoverers. As such, we can already see a wide range of partnerships within the industry that may be competition to Alphabet’s platform. Public companies Schrodinger, Simulations Plus (SLP), and BenevolentAI (AMS:BAI) all are already earning millions per year in recurring revenues from software sales. Also, some pharma examples include Roche (OTCQX:RHHBY) (OTCQX:RHHBF) and Bristol-Myers Squibb (BMY) partnering with private company Owkin, Pfizer (PFE) and Novartis (NVS) using IBM’s Watson Health (IBM), and Bayer (OTCPK:BAYZF)/Sanofi (SNY) with Exscientia (EXAI). Also, even Merck (MRK) has their own OSS software platform. As you can see, not all competitors may be swept under the rug, and will be lasting members of the Drug Discovery Software industry.

As such, I believe Alphabet will remain focused on databasing, visualization, and cloud analysis, with Google Cloud integration being on the forefront of investment. This will always be the advantage that Alphabet has over smaller competitors. Examples of this can be seen with the Schrodinger partnership that allows for cloud-based computation power, a boon for research firms with lower computational power.

This expanded partnership will provide Schrödinger with hundreds of millions of graphics processing unit (GPU) hours, effectively tripling Schrödinger’s previous throughput, and pushing the capacity to the equivalent of the world’s most powerful supercomputers. Schrödinger aims to further accelerate drug discovery and materials design through the application of its large-scale physics-based and machine learning methods.

Conclusion

While Verily and Calico will be the main drivers of drug discovery for Alphabet, I believe there will be significant benefits from Google Cloud collaborations. At the moment, there is not enough data to suggest the impact of drug discovery on Alphabet’s current financials, but in time, it may begin to have noticeable impacts. Just as Google, Microsoft, and Amazon compete in the cloud already, look for the same battle to be taking place in regard to computational drug discovery capabilities down the road. All three remain solid investments, especially for those willing to wait years for the full drug discovery potential to play out (no drug discovery software-derived therapy has yet reached the market).

Thanks for reading.

Be the first to comment