jgroup/iStock via Getty Images

TTEC’s complementary solutions and services businesses feed off each other. Furthermore, the company’s focus on automation and relationship with its customers across the private and public sectors make it a differentiated asset that is relatively under-priced with a potential to deliver strong returns.

Business

TTEC Holdings, Inc. (NASDAQ:TTEC) is in the customer service business. The company operates through two divisions: Digital and Engage.

Digital: This division delivers digital transformation solutions for customer experience through orchestration of customer data, analytics, technology and automation solutions.

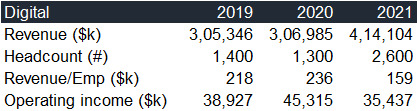

Company filings, Author’s analysis

Engage: The managed services division of the company supports omnichannel customer interaction, back office, content moderation and fraud management services.

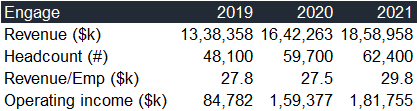

Company filings, Author’s analysis

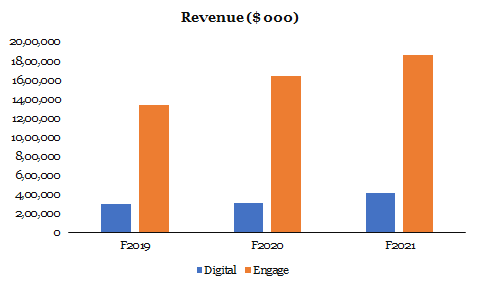

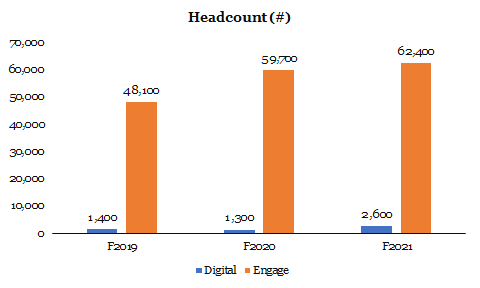

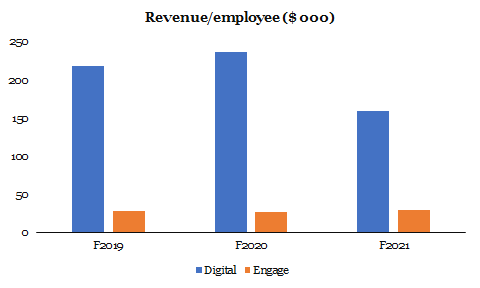

While the two divisions complement each other, their metrics are quite contrasting:

Company filings, Author’s analysis

Although Digital revenues are just one-fifth of Engage, Digital has only 3-4% of the workforce that Engage employs

Company filings, Author’s analysis

We highlight this difference to emphasize the technology-led characteristics of the Digital business as opposed to the services first business model of Engage.

Company filings, Author’s analysis

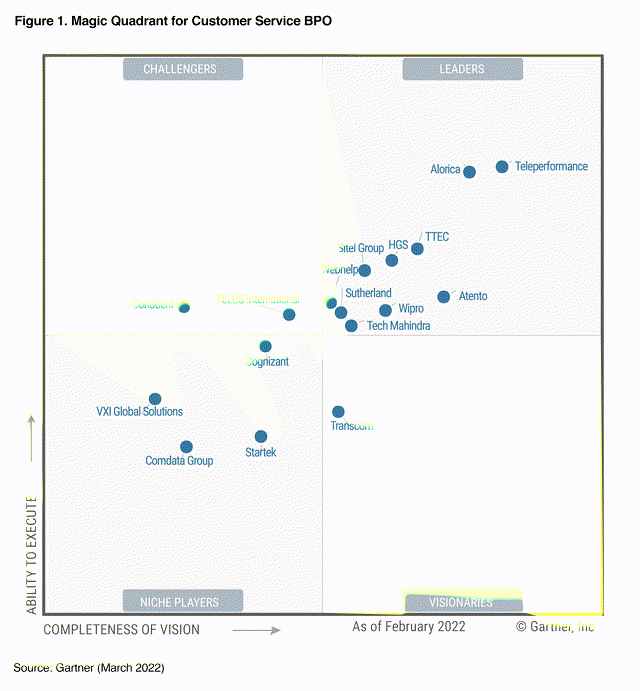

The solution and services model has allowed TTEC to be recognized as a leader in the Gartner Magic Quadrant for Customer Service BPO.

Gartner notes:

Leaders demonstrate market-defining vision and the ability to execute that vision through CS BPO services and a cross-section of vertical industries. Leaders have strong investments in digital service offerings, work-from-anywhere solutions and CX innovation. They have a superior understanding of client needs and current market conditions, and they are actively building competencies in the CS BPO market across multiple regions. The CS BPO service providers in this quadrant generally also have strong global and regional service delivery operations and deep technology to leverage.

Source: TTEC Press Release

The company also has significant IP for a services player – it held nearly 100 patents and over ten pending patents. From a delivery perspective, almost 90% of the company’s workforce is spread across Asia-Pacific and North America.

TTEC competes with the likes of EPAM, Endava, Globant, GlobalLogic, Accenture, Cognizant, Infosys, Genpact, and other IT-enabled services providers.

Investment thesis

Ability to pass through costs to customers: The double whammy of demand softness and inflation is likely to hurt the margins of most service providers. TTEC management’s guidance and commentary provide comfort that the company is expected to fare much better than many other service providers.

we’ve never been in a situation in our entire history of being in business where clients are more understandable about wage increases

they’re working with us when we see the need to adjust wages up and obviously pass that on. And so, we feel really good about this. I mean, at the end of the day, the services that we provide are mission-critical.

Source: 1Q22 Earnings Call

We think the full-year 2022 revenue guidance growth of 14% (midpoint) and non-GAAP EBITDA margin of nearly 15% corroborates the stickiness of TTEC’s customer base.

Furthermore, we think the strength in pricing will also augur well for the company’s order book and help cash flows.

Growth in digital: The momentum in the Digital business is telling.

First quarter bookings increased 15% to $195 million over the prior year period, resulting in $776 million of bookings over the last 12 months. In our Digital segment, bookings increased 137% in the first quarter, over the prior period, and 97% over the last 12 months versus the prior period. Strong demand continues for our Genesys, Amazon Connect, and Microsoft CX Solutions, including larger CX technology transformational engagements like the public sector client example Ken shared earlier.

Source: 1Q22 Earnings Call

Lastly, the appointment of Shelly Swanback (over 30 years of experience in digital transformation and consulting, ex-Accenture) as the CEO of TTEC Digital also adds a lot of firepower to growing the Digital business.

Strength in the TTEC’s government business: The management has vehemently stated that it sees a lot of potential in the government business:

So, as all of you know, we’ve had a couple of administrations that have decided to put out trillions of dollars, something that none of us have ever experienced in our lifetime, those trillions of dollars, the majority of which flows down to state and public sector. And so, we’re a big believer in following the money, and that’s really all we’re doing. And so, consequently, what the pandemic did is, it made it brutally honest to each and every one of these states that they’re not equipped to provide virtual capabilities, and that when there’s a pandemic and you can’t get your driver’s license renewed, you can’t pay a ticket, you can’t pay your franchise tax or, or get a building permit, et cetera. And so, our focus is going to be in the area of helping these governments provide e-government services so that we have the ability to assist them in having a more digital interface to the public.

Source: 1Q22 Earnings Call

The presidential action to fast-track citizens’ experience puts TTEC in a delightful spot, given the credentials that the company has established working with governmental agencies. In addition, TTEC’s affiliations are likely to serve as a differentiating moat versus the competition, which is likely to face stringent evaluations to get in the government business.

TTEC’s strength in the public sector has been further bolstered by its acquisition of Faneuil. Given the demand and resources in the public sector, we think TTEC is likely to be a key beneficiary of the modernization narrative.

Overall, we see Digital becoming the tip of the spear with Engage as providing a tail. The complementary dynamics of the company’s two business units suggest that TTEC could be best valued as a sum of the parts business.

Financials

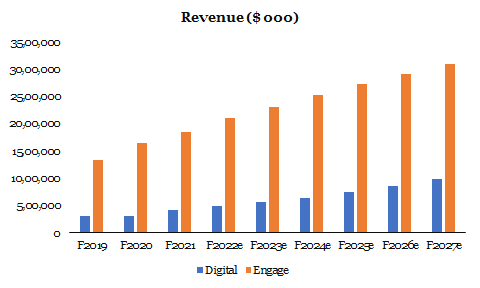

Taking a cue from the momentum in the digital and government businesses, we project the following revenues for the two divisions.

Company filings, Author’s analysis

We expect Digital revenue to grow at a CAGR of 15.1% between 2022-27 to reach $983 million in 2027 from $487 million in 2022. Along expected lines, Engage’s revenue growth is assumed to be slower at a CAGR of 8% to reach $3.1 billion in 2027 from $2.1 billion in 2022. We note that the 8% growth in a service-oriented business may look high but is a consequence of the stickiness in TTEC’s customer base.

Company filings, Author’s analysis

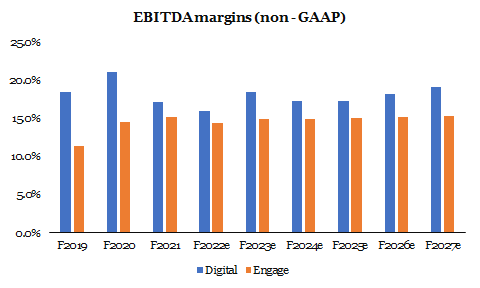

On the margin front, we expect Digital margins to expand by 300 bps to over 19% by 2027 from the 16% levels in 2022. The pricing strength is also likely to benefit the tail, with Engage’s margins expanding by 40 bps. Notably, commodity service margins are likely to see a contraction. However, Engage operates as a complementary offering to Digital, which could help in the margin expansion.

Company filings, Author’s analysis

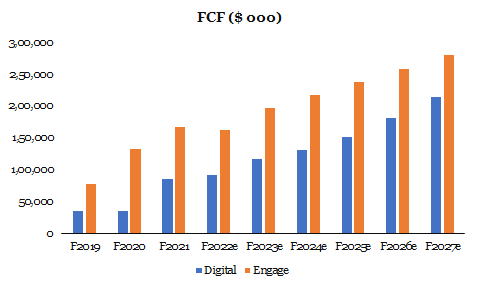

On the FCF front, we think Digital’s growth could be much faster than Engage’s due to the more significant deferred revenue component in technology businesses versus in service-only companies. As a result, we think Digital could generate $213 million in FCF by 2027 versus $280 million for Engage.

Valuation

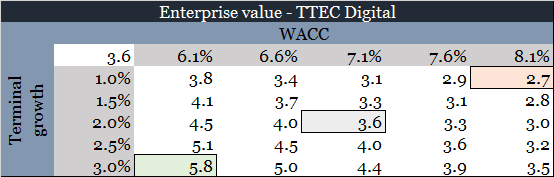

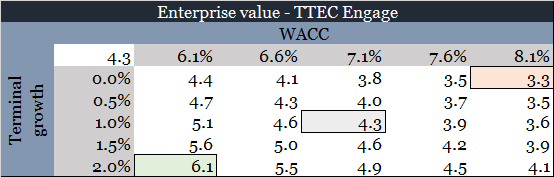

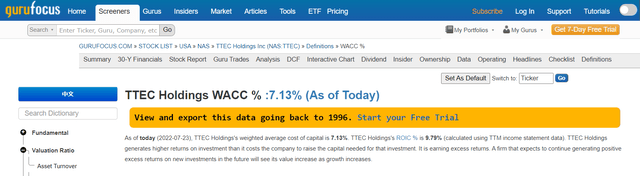

We use a DCF to do the sum of parts valuation for TTEC’s business divisions. To arrive at the WACC, we use 7.1% from Gurufocus.

The terminal growth rates for the Digital and Engage businesses are likely to be significantly different due to the business model considerations. Accordingly, we ascribe a 2% rate to Digital and 1% to Engage.

Company filings, Author’s analysis

To account for the possible vagaries of the demand environment and execution risk, we illustrate our enterprise value estimates across a range of WACCs and terminal growth rates.

Company filings, Author’s analysis

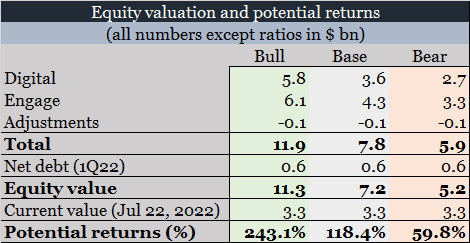

We consider three scenarios – Bull, Base and Bear.

Company filings, Author’s analysis

Our estimates suggest a potential upside of 60-240%.

Risks to our thesis

Execution: The key to our thesis is TTEC’s ability to continue growing its digital business, which also lifts the Engage unit. Any negative variances in Digital are likely to have a cascading effect on the overall financials. We, however, remain optimistic given the growing demand in the government sector.

Macroeconomic, attrition, inflation and currency-related: These are larger risks to which no company can be immune. However, we derive a lot of comfort in the management’s ability to pass rising costs to customers.

Conclusion

TTEC is one of the better-known names in the customer service industry. The company’s patent portfolio, government contracts, and focus on growing Digital business make it a unique asset. We think betting on the execution; the stock can potentially deliver multi-bagger returns.

Be the first to comment