Andrii Dodonov

Thesis

STORE Capital Corporation (NYSE:STOR) has been battered since its July/August 2021 highs, falling nearly 26% (as of July 22’s close). For a net-lease REIT with stable revenue and AFFO per share growth trend, some investors could have been surprised by the market reaction.

Furthermore, STOR’s YTD total return closely mirrors the SPDR S&P 500 ETF’s (SPY) YTD performance. Therefore, we believe the market has de-rated STOR relative to the worsening macro risks that is looming.

Notwithstanding, the market is a forward discounting mechanism. Hence, it’s critical for investors to ask whether they expect the inherent risks in STORE Capital’s operating model have been priced in accordingly?

Our analysis suggests that the market has likely de-rated STOR since July/August 2021 due to markedly lower growth estimates through FY24, as growth is estimated to normalize. Coupled with heightened inflation risks, a hawkish Fed, and a potential recession, the market is justifiably asking for higher dividend yields.

However, our price action analysis indicates that STOR formed a subtle bear trap in mid-June. Bear traps are used by the market to deny further selling downside decisively (by creating false breaks impression), snaring bearish/pessimistic investors into directionally-bearish bets, or selling their shares at the lows.

Therefore, we are confident that STOR has likely staged a medium-term bottom that has attracted dip buyers. Also, it coincides with the SPY’s bottom that we discussed in a recent article. Given the performance correlation between the SPY and STOR in 2022, we believe the price action is constructive.

Accordingly, we rate STOR as a Buy. Nevertheless, it appears to be technically short-term overbought as it closes in on its near-term resistance. Hence, investors can consider layering in, taking advantage of a potential retracement before adding more aggressively.

Why Did The Market De-rate STOR?

What’s not to like about STOR’s underlying operating model? Its stable revenue and AFFO per share growth trend provide tremendous visibility to investors.

The company also has rent escalators embedded in its leases to protect against inflation. Coupled with a relatively low payout ratio, it demonstrates management’s financial discipline to safeguard against unforeseen circumstances that could impact its ability to sustain its dividend.

Yet, despite its seemingly robust business model, the market still de-rated STOR markedly. Why?

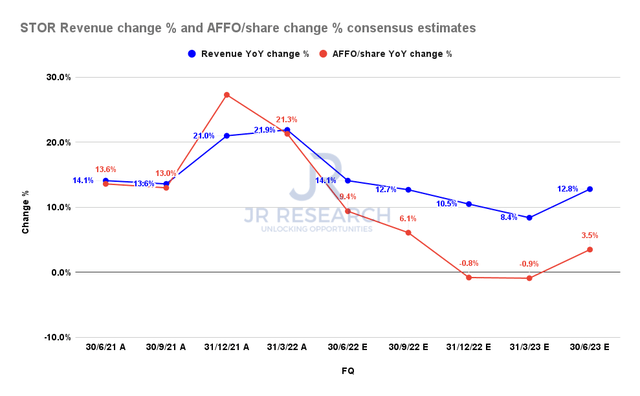

STORE Capital revenue change % and AFFO/share change % consensus estimates (S&P Cap IQ)

The consensus estimates (neutral) suggest that STORE Capital’s revenue and AFFO per share growth metrics could have peaked. Therefore, we believe the market has already de-rated STOR back in July/August 2021, as it anticipated the normalization.

STORE Capital’s slowdown is expected to persist through FY22 before reaching a nadir. Worsening macro headwinds and higher interest rates and inflation are still likely to impact STORE Capital. The company also cautioned in its filings (edited):

An increase in market interest rates may lead prospective investors to expect a higher dividend yield. Also, higher market interest rates would likely increase our borrowing costs and potentially decrease funds available for distribution. In such periods, we may be unable to obtain debt financing on favorable terms, or at all, or fully refinance maturing indebtedness with new indebtedness. When inflation is higher, contingent rent increases may not keep up with the rate of inflation due to the formula in our rent escalators. While the revenues from our leases are not directly dependent upon the value of the underlying real estate could adversely affect us in many ways, including a decline in the residual values of properties at lease expiration, possible lease abandonments by our customers, and a decline in the attractiveness of triple-net lease transactions to potential sellers. (STORE Capital 10-Q)

Given the market’s complex dynamics, we believe it’s challenging for retail investors to consider how the market is attempting to reflect such risks in their valuation model.

Therefore, we suggest investors consider leveraging price action analysis, as they are forward-looking. Consequently, it lends clarity and helps investors model the expected market dynamics moving forward.

STOR – Likely At A Medium-Term Bottom

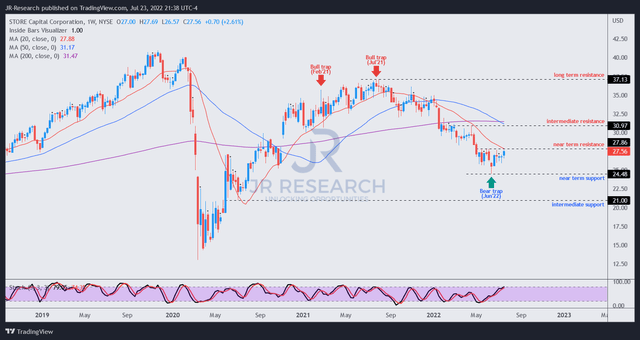

STOR price chart (weekly) (TradingView)

As seen above, the market forced STOR into two bull traps in February and July 2021. Bull traps are used to deny further buying upside decisively, luring investors/traders into thinking that the price action could continue moving higher.

Therefore, we believe the market anticipated the growth normalization ahead of time last year, as it digested the massive gains from its COVID bottom.

However, our analysis indicates that the market has likely formed a medium-term bottom in mid-June, underpinned by a validated bear trap. Therefore, we believe the recovery from its June lows is sustainable and unlikely to be a bear market rally (dead cat bounce).

Still, STOR is testing its near-term resistance, which could force a short-term retracement, given its overbought breadth and momentum. Therefore, investors can consider a retracement first before adding exposure.

Is STOR Stock A Buy, Sell, Or Hold?

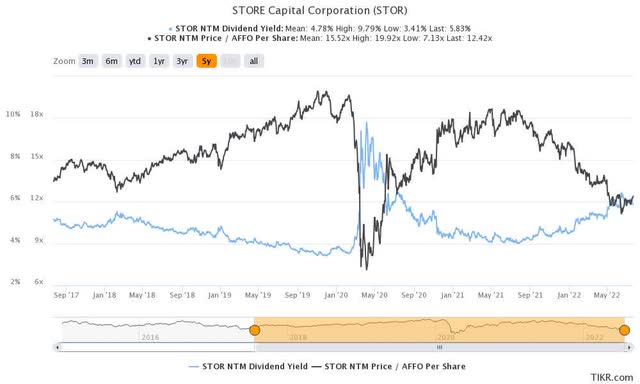

STOR NTM valuation metrics (TIKR)

STOR last traded at an NTM P/AFFO per share of 12.42x (Vs. 5Y mean of 15.52x). It also posted an NTM dividend yield of 5.83% (Vs. 5Y mean of 4.78%).

Therefore, we posit that the selldown has sent STOR into attractive valuation zones as the market adjusted to worsening macro risks.

Coupled with constructive price structures in STOR’s price action, we believe the risk/reward profile points to further medium-term upside from here (despite potential near-term volatility).

Accordingly, we rate STOR as a Buy.

Be the first to comment