Paul Morigi

Taiwan Semiconductor Manufacturing (NYSE:TSM) and Intel (NASDAQ:INTC) are two notable value plays within the semiconductor industry. The former is relatively cheap and growing, with a 13.8 P/E ratio and 38% TTM revenue growth. The latter is truly dirt cheap, with a 1.2 price/book ratio, but is actively shrinking.

TSMC got some attention this month when Berkshire Hathaway (BRK.B) took a $5 billion position in it. Berkshire’s stake may or may not have been bought by Warren Buffett (some think it was Todd Combs), but it got people interested regardless: TSMC stock rallied 12% the day Berkshire’s buy was disclosed.

Intel for its part has always had its fans who buy the stock because of its optical cheapness. Few dispute that INTC is struggling, but it is so cheap that a person could conclude the bad news is priced in.

For me personally, there’s no question that TSMC is a better buy than Intel. Both of these stocks are relatively cheap by the standards of their sector, but the former retains relatively high growth, while the latter is shrinking. Furthermore, there are reasons to believe that TSMC will retain its strong business performance: it still has Apple’s (AAPL) business, whereas Intel lost Apple in the transition to Apple Silicon. Competitive dynamics suggest that Taiwan Semiconductor has a good future, the same is harder to say of Intel. For this reason, I believe that TSMC is actually cheaper than Intel relative to future earnings and is a better buy today.

Competitive Landscape

When comparing stocks like TSM and INTC, it’s crucial to look at the industry they operate in. If you were to look at these stocks purely based on multiples, you would conclude that INTC is the better value, but when you look at their competitive advantages, you see that TSM has a lot more of them and is therefore more likely to thrive in the future.

So, what are TSM’s competitive advantages?

There are many, a few mentioned by Seeking Alpha semiconductor writer Robert Castellano include:

-

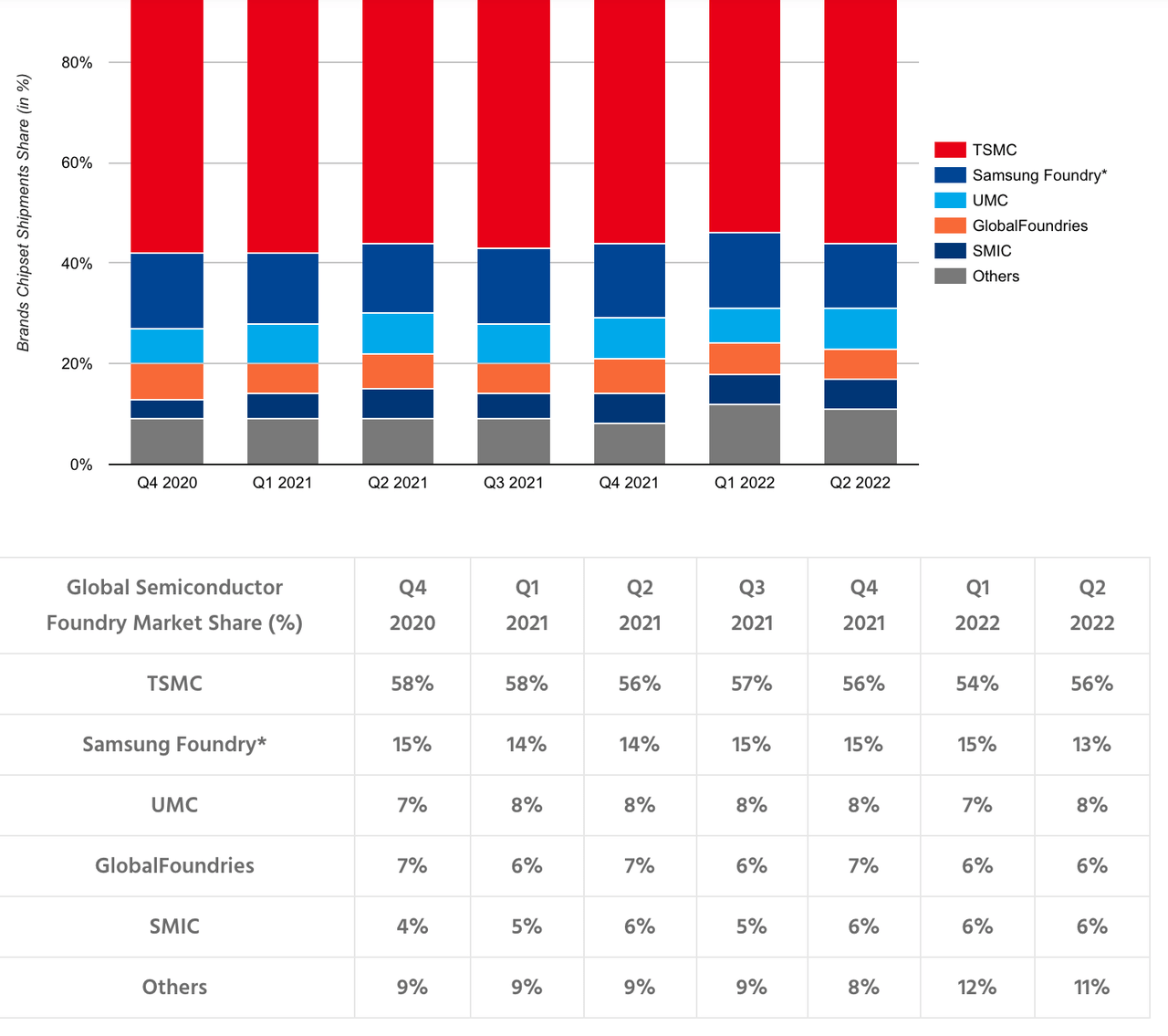

A 57% market share in semiconductor fabrication, well ahead of the second place name Samsung (OTCPK:SSNLF).

-

Higher CAPEX spending than competitors (while still maintaining higher margins).

-

A lead over Intel in feature size (TSM is already doing a 3nm process, Intel was rolling out 7nm as late as this past Summer).

So, TSMC has the current lead over its competitors in market share, and it has technical advantages suggesting that the lead can be maintained.

You might wonder why I’m comparing TSMC and Intel head-to-head like this, when Intel is best known as a chip designer that sells its own branded products. The reason is that Intel broke into the foundry business last year. Kicking off the new business unit by buying two foundries in Arizona for $20 billion, the company launched ‘Intel Foundry Services,’ its own miniature in-house TSM. As of today, the unit appears to be quite small. In a market share chart by CounterPoint research, Intel Foundry Services isn’t even big enough to get named individually in the chart, instead being bundled in with other small players in the ‘others’ category.

TSMC: large market share (CounterPoint Research)

This could change, of course. Intel Foundry Services is a new business, it could do big things. But as mentioned previously, it’s way behind TSM and Samsung in feature size, which won’t help it in courting buyers who want the latest and greatest chips. A 2017 Wired article covered the importance of fast chips in powering AI algorithms, which sort through enormous quantities of data every second. Feature size partially determines a chip’s speed, as it determines how many nodes can fit on a given amount of space. So, Intel, which plans to launch 7nm chips in 2023, is behind TSMC, which is building 3nm chips and shipping 5nm chips.

As for the bread and butter of Intel’s business (the fully assembled branded chips), it’s hard to see that recovering any time soon. For one thing, it faces competition from AMD (AMD) in the PC market, for another thing, it lost Apple’s business when that company started designing its own chips. The loss of Apple’s business is a pretty big deal. Apple used to source Intel chips for its entire Mac lineup, now all of the current models use M-series Apple chips. Apple used to be a big moneymaker for Intel. AAPL only occasionally used AMD products, mainly graphics cards, it used Intel chips for all of its core CPUs. So, Apple was a big book of business for Intel, in which it had a huge edge over AMD. Now, though, that business is gone, and Intel is competing with AMD in a market where the latter is gaining share. The competitive picture does not look bullish for Intel.

Comparative Valuation

Having looked at the competitive dynamics facing TSMC and INTC, we can now look at their valuations side by side. As you’ll see shortly, multiples make Intel look optically cheaper, but TSMC’s growth gives it much more upside in a discounted cash flow model.

First, let’s take a look at some select multiples for TSMC and Intel side by side.

|

P/E (GAAP accounting) |

15 |

9 |

|

P/E (adjusted) |

13.8 |

10.3 |

|

P/sales |

6.4 |

1.73 |

|

P/cash flow |

8.8 |

8.8 |

|

P/book |

4.85 |

1.21 |

On the surface, it looks like TSMC is more expensive than Intel. But you need to remember that these are all trailing multiples. Seeking Alpha Quant has a 12.3 forward multiple for TSMC, and a 14.3 multiple for Intel. Basically, Seeking Alpha’s Quant system is saying that, at today’s prices, TSM is cheaper relative to future earnings than Intel is.

So, Intel’s lower multiples are something of a mirage. Or rather, they will prove to have been a mirage if the downward earnings trend continues. It’s possible that Intel’s earnings will someday bottom and the company’s foundry business will make up for what was lost when Apple switched to in-house chip design. But there’s no sign of that happening now.

Furthermore, a discounted cash flow approach yields a similar result to the one yielded by Seeking Alpha’s forward P/E multiples.

Here’s how I worked that out:

If you look at TSMC’s free cash flow per share, you’ll see that it’s around $0.62 (depending on the prevailing exchange rate). One TSM ADR is worth five ordinary shares, so we have $3.1 in FCF/share for the version of TSM that most Western investors buy. According to Seeking Alpha Quant, TSM’s free cash flow per share has grown by 82% over the last 12 months. That’s significant growth, but for argument’s sake, let’s assume that it did not continue. I suspect, given TSM’s impressive competitive position, that it WILL continue growing, but we’ll be conservative here. Even if TSM’s growth slowed to 18% for five years, and then stopped growing after that, it would have a present value of $80.7. The math breaks down like this:

At 18%, $3.1 in free cash flow grows to $7.09 in five years. In the sixth year, if we assume that there is no further growth, it stays at $7.09. Divide that by the 8% discount rate, and you have a terminal value of $88.62 in year six. Discount that back to the present at 1.08 to the power of 6 (that’s 1.586), and you get $55.88 in present value of terminal value. The individual cash flows in the growth period end up being worth about $24.82, so our overall fair value estimate is $80.7.

So, I get a slight amount of upside even assuming a severe deceleration in TSM’s revenue growth. Unfortunately, you cannot get such a rosy forecast for Intel. Even if it got its free cash flow growth up to 0%, from the current negative growth rate, no fair value could be calculated, as its free cash flows are negative. In fact, FCF has been going deeper and deeper into the red over the last several quarters! If this trend continues, then Intel’s only value will be as an asset play, where the goal is to buy below book value and profit off an obvious mispricing. With a 1.21 price/book multiple, Intel is not too far from levels where that could work, but it isn’t there just yet.

The Bottom Line

The bottom line about TSMC and Intel is that one of the two is simply a better business than the other. TSMC is profitable, is growing, has positive cash flows, and has a rock-solid competitive position. Intel on the other hand has negative free cash flow and has been visibly struggling ever since it lost Apple’s business. I do not mean to suggest that INTC’s negative cash flows are a permanent condition: sometimes companies spend money short term to make more long term. But with the limited technical manufacturing capacity INTC has compared to TSMC, it’s hard to see the foundry business taking off, and it faces steep competition from AMD in the CPU business. Sure, Intel’s a little bit cheaper than TSMC going by multiples, but that’s about the only advantage it has. TSMC is the better business, and as Warren Buffett says, “better to buy a wonderful business at a fair price, than a fair business at a wonderful price.”

Be the first to comment