hxyume/E+ via Getty Images

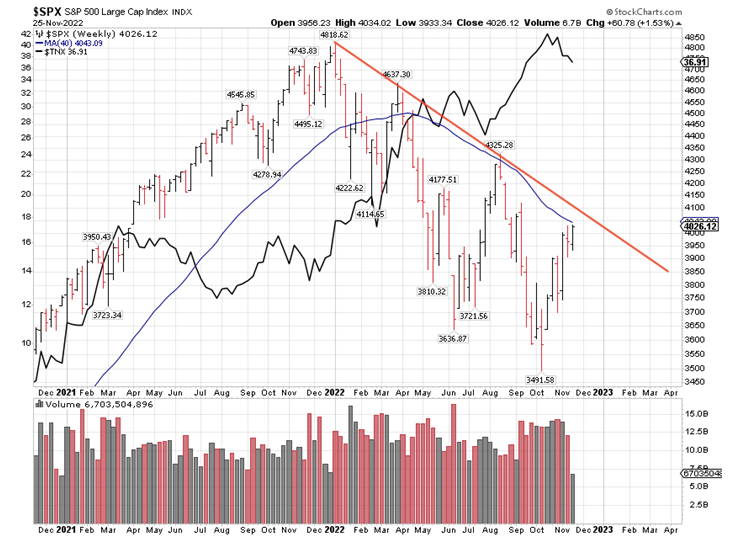

The stock market is near where it was last February, so again we are wondering if we have already seen the lows for this bear market. For mid-October to be the lows, we need: 1) the Fed to stop their rate hikes before it breaks the economy, as the recent 75-basis point hikes have not shown up in economic numbers yet; if they do this, we should see a “soft landing”; and 2) the Ukraine war to be over without escalation.

This was precisely the same setup in August, when we tagged the proverbial 200-day moving average. Since then, neither of these two conditions has been resolved, and the S&P 500 made lower lows.

S&P 500 Large Cap Index (StockCharts.com)

Graphs are for illustrative and discussion purposes only. Please read important disclosures at the end of this commentary.

These two conditions are not resolved yet, but the market is betting on a Fed rate hike slowdown and a top in Treasury yields. Still, if the Fed funds rate is going to 5%, as Fed funds futures seem to indicate, then another spike in Treasury yields is not out of the question. You will know that the Fed funds rate hikes are working when the stock market stops responding to lower Treasury yields and credit spreads begin to expand, neither of which has happened yet.

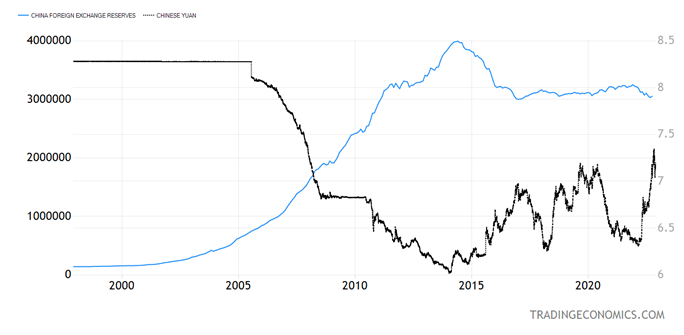

China Foreign Exchange Reserves; Chinese Yuan (Trading Economics)

Graphs are for illustrative and discussion purposes only. Please read important disclosures at the end of this commentary.

We must also face the great unknown of China’s future. They have resumed COVID lockdowns, but one wonders if it is even possible to contain the virus that way, given a dense population of 1.4 billion people in a nation the size of the continental U.S., without strong immunity or higher vaccination rates.

China also has a credit bubble that is bigger than any in history, but it is impossible to predict when it will “pop,” as China’s economy is managed very differently than any developed economy. The government controls the banking system and injects lending quotas, in effect reinflating the credit bubble, every time the economy weakens. The trouble now is if the COVID outbreak is bad and the lockdowns are severe, any new bank quotas won’t work well, so the credit bubble may finally pop.

There were massive anti-COVID lockdown protests in China over the weekend, some at least as big as the 1989 protests that resulted in tanks rolling in Tiananmen Square.

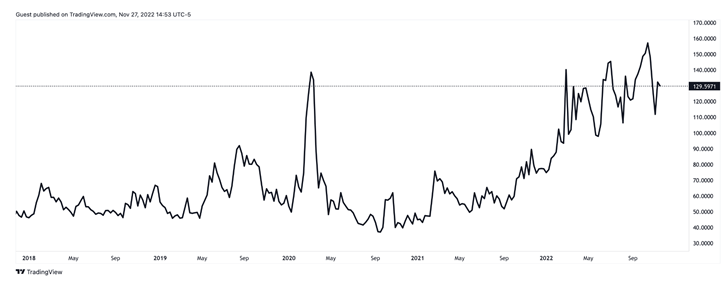

VIX is Down a Lot More than the MOVE Index

The MOVE Index (pictured below) measures bond market volatility. It is down somewhat, but not nearly as much as it was down in August, when the 10-year rate went to 2.55%. On the other hand, the VIX (stock volatility index) is barely hanging on to 20, just a tad higher than where it was in August, when we saw seven trading days where the VIX closed on either side of 20 before beginning to rise again.

MOVE Index (Trading View)

Graphs are for illustrative and discussion purposes only. Please read important disclosures at the end of this commentary.

It looks like we are close to some kind of a top in the stock market, but I am not sure if we are near a top in bond yields yet. Fed Chair Jerome Powell speaks this week, and he has been known to reinvigorate both stock market volatility (VIX) and bond market volatility (MOVE) with his speeches.

We’ll find out soon enough if he can rattle these markets again.

All content above represents the opinion of Ivan Martchev of Navellier & Associates, Inc.

Disclosure: *Navellier may hold securities in one or more investment strategies offered to its clients.

Disclaimer: Please click here for important disclosures located in the “About” section of the Navellier & Associates profile that accompany this article.

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Be the first to comment