kokkai

Sea Limited (NYSE:SE) crashed after a disappointing earnings report. The company retracted guidance for e-commerce growth, as it finally acknowledged that the macro-environment was having a toll on its business. The company continues to see weakness in its cash cow gaming division, which may be a troubling sign in an environment where many tech companies have shifted their focus from growth to profits. Still, the stock is quite cheap here and can take off if positive sentiment returns to the name.

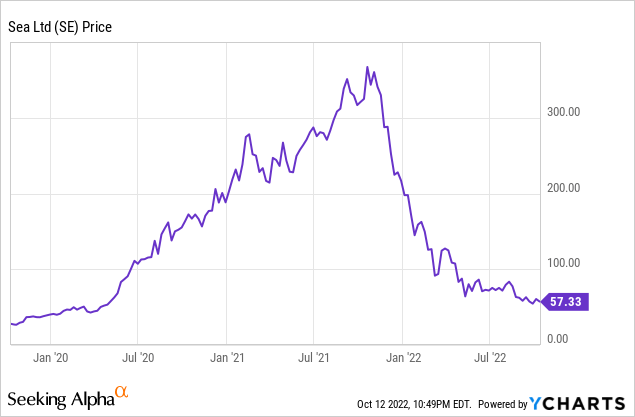

SE Stock Price

SE peaked at around $373 per share, but has since crashed over 80%.

I last covered the name in July, where I rated the stock a buy on account of the undervaluation. The stock has since dropped 25%, offering even more attractive valuations – though the risks remain ever-present.

SE Stock Key Metrics

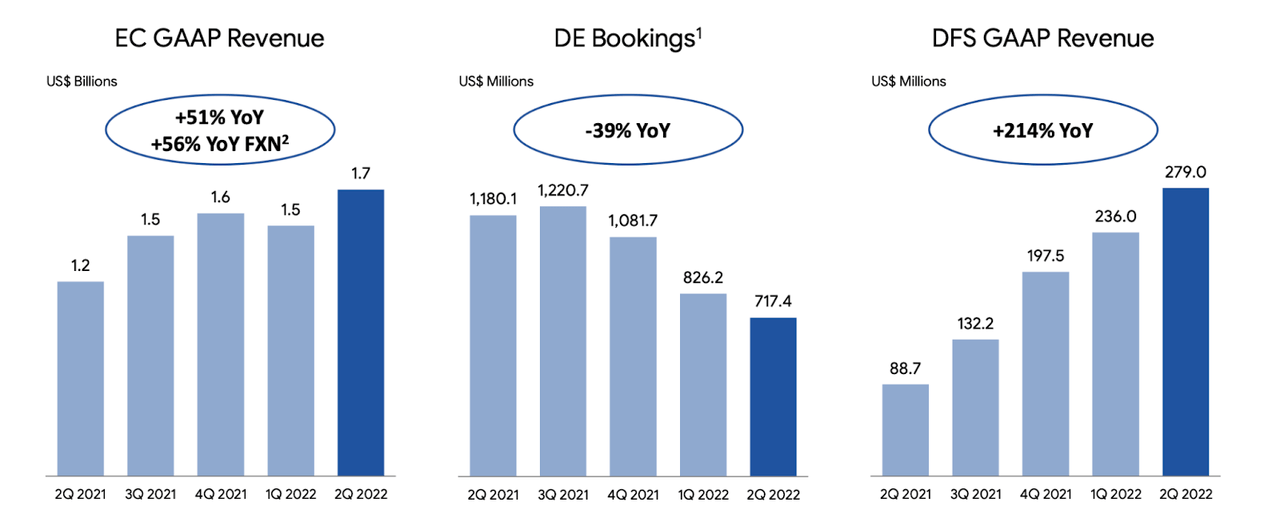

SE reported 29% overall revenue growth in the latest quarter, as strength in e-commerce and financial services offset weakness in gaming.

2022 Q2 Presentation

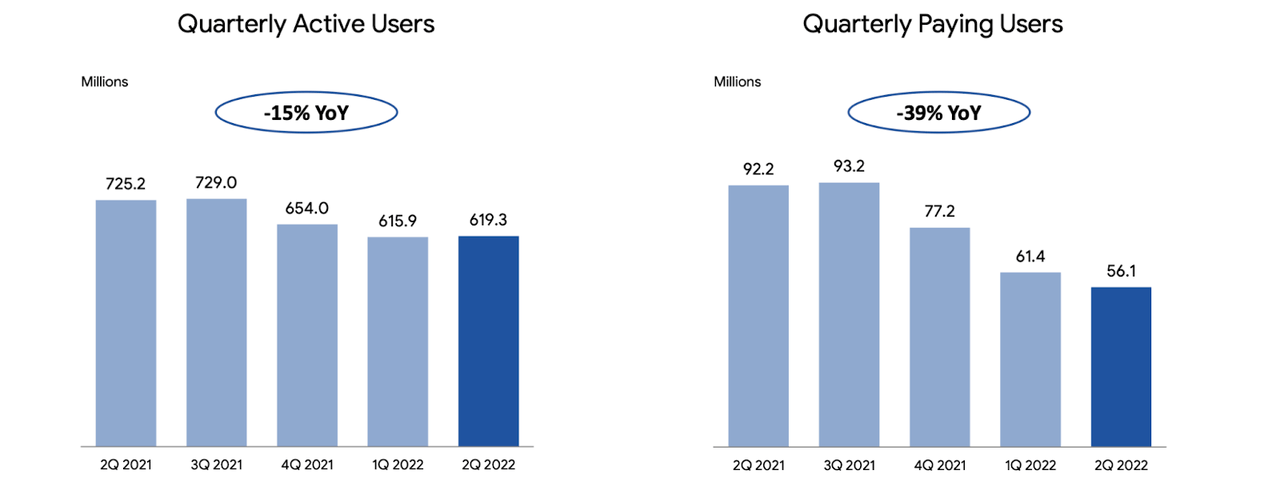

SE saw paying users in gaming decline 8.6% sequentially and 39% YOY.

2022 Q2 Presentation

That is concerning because historically, the digital entertainment unit provides the cash to fund losses from e-commerce and financial services. Due to the weakness in digital entertainment, SE has seen adjusted EBITDA swing sharply negative.

2022 Q2 Presentation

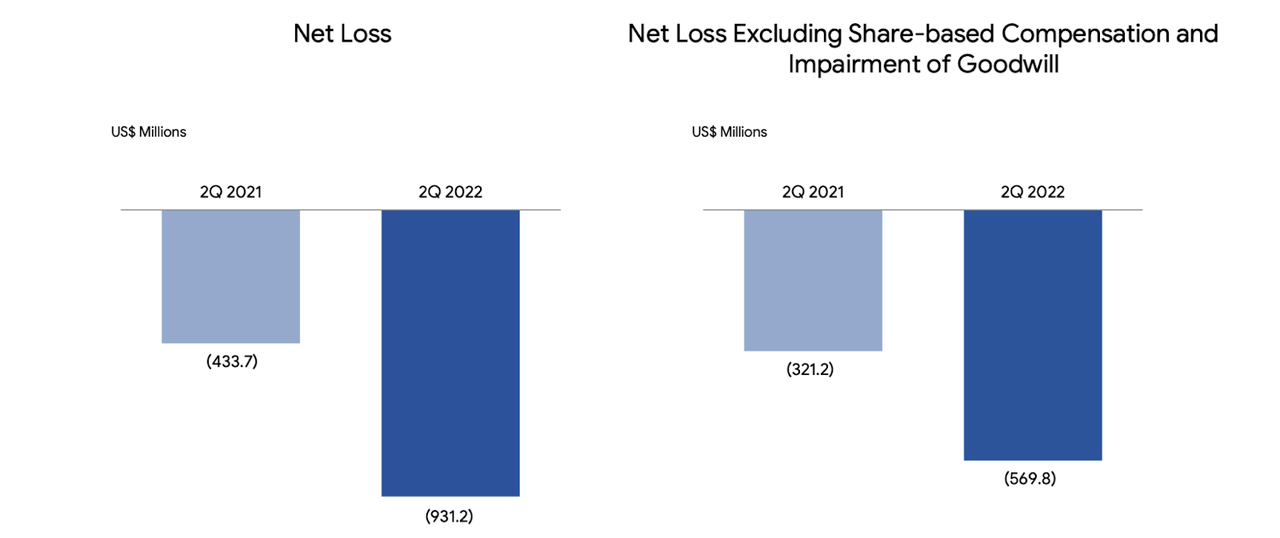

That led to the company posting a staggering $931 million net loss or $569.8 million non-GAAP net loss.

2022 Q2 Presentation

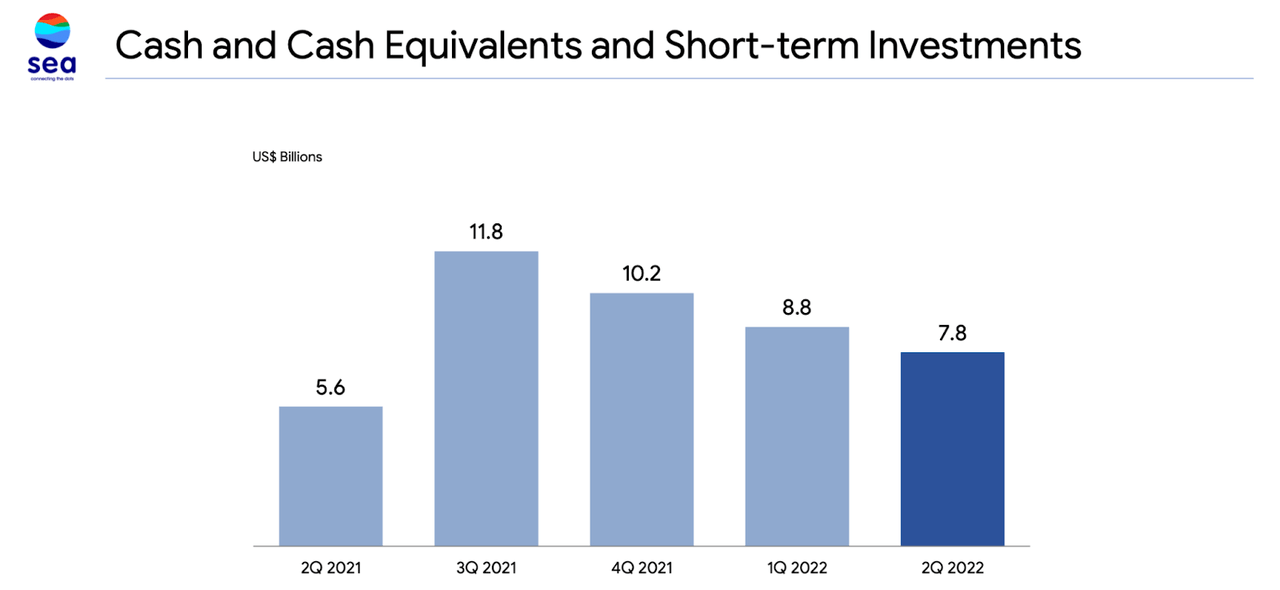

The company ended the quarter with $7.8 billion of cash, enough to fund a couple years of these losses.

2022 Q2 Presentation

These results weren’t great, but not necessarily enough to explain the huge fall after earnings. Instead, it was the guidance:

In our efforts to adapt to increasing macro uncertainties, we are proactively shifting our strategies to further focus on efficiency and optimization for the long-term strength and profitability of the e-commerce business. Given this strategic shift, we will be suspending e-commerce GAAP revenue guidance for the full year 2022. We believe such efforts will further strengthen our ability to better capture the long-term growth opportunities in our markets, which we remain highly positive about.

In the conference call, management stated that there was no change in guidance of breakeven on Asia operations after headquarter costs, though I wouldn’t be surprised if they backtracked on that guidance over the coming quarters.

Is SE Stock A Buy, Sell, or Hold?

In September, SE announced in an internal memo that it was exiting LATAM countries Mexico, Argentina, Chile, and Colombia. SE had entered Mexico, Chile, and Colombia just last year. The company then announced that the leadership team would be foregoing their salaries to help conserve cash.

While these efforts should help reduce the quarterly cash burn, they’ll likely dramatically reduce the forward growth profile. It is difficult to predict which will prove more important in determining forward valuations.

SE previously guided to $8.9 billion in e-commerce revenues. If we instead assume $7 billion in revenues, 10% long term net margins, a 1x price to earnings growth ratio (‘PEG ratio’) and 30% growth in 2023, then I value the e-commerce division at $21 billion. For the video game business, I again use $1 billion of adjusted EBITDA and a 5x multiple to arrive at a $5 billion valuation. For the digital financial services, I reduce my estimate to $1 billion in revenues. Assuming 30% long term margins, 1x PEG ratio and 40% growth in 2023, that segment might be worth $12 billion. In total, we arrive at a valuation of $37 billion, somewhat higher than the current $35 billion market cap. I note that the 1x PEG ratio may be too conservative as 1.5x to 2x may be more appropriate, but the company’s cash burn may warrant a greater risk premium.

This is precisely the moment to own a stock like SE: huge growth opportunity clouded by a murky near term outlook, with a valuation that can pay off big. But the risks are real. There is cash burn risk, though the company does have plenty of cash on its balance sheet. An underappreciated risk is that of slowing growth rates. It is possible (if not likely) that the company’s previous growth rates were being juiced by highly unprofitable growth in Latin America – which the company is now exiting. As a result, there is great uncertainty in forward growth rates, though my assumed 1x PEG ratio may provide some margin of safety. I rate SE a buy, and it is one of the tech stocks I purchased in the 2022 Tech Stock Crash List provided for subscribers of Best of Breed Growth Stocks. While the risk is elevated as ever in the current environment, a basket of deeply undervalued tech stocks might provide strong returns from here, and I have allocated my portfolio to reflect that view.

Be the first to comment