William_Potter

It was January 24, 1848, when James Wilson Marshall discovered a lode of gold while working on the construction of a new sawmill. From that moment on, thousands of miners scoured every corner of California, giving rise to a frenzied hunt for gold. Contrary to popular belief, in the end it was not the many gold prospectors who got rich but those few who sold the tools to prospect for it, such as shovels and picks.

As old as this story is, more than 150 years, I think it is a perfect analogy to describe my investment thesis. The interest of many is directed toward 21st century gold, thus Taiwan Semiconductor Manufacturing Company Limited’s (NYSE:TSM) (“TSMC”) chips, but I think it is more reasonable to focus on who enables the chips to be built, namely ASML Holding N.V. (NASDAQ:ASML). In this article I will explain this concept in detail by clarifying the reasons behind my bullish thesis on ASML and bearish thesis on TSMC.

The importance of semiconductors in the world

Before making a comparison between ASML and TSMC, I think it is worth pointing out the main aspects of the market in which they operate.

Semiconductors make up a market that was worth $600 billion in 2021 and will most likely be worth at least a trillion dollars by the end of the decade. Their importance is crucial, since they are present in any electronic device, from the smartphone you are reading this article from, to the washing machine where you wash your clothes. Without them, it would be virtually impossible to be able to sustain the same lifestyle, but there is more. Today’s society is increasingly geared toward technological solutions involving new electronic equipment; therefore, the more time passes, the more dependent we are on semiconductors.

The current dependence that all countries in the world have on semiconductors is something extremely dangerous in my opinion, because history has taught us that when everyone is dependent on something, new conflicts are likely to be created. Oil several times has been the cause of wars because of its crucial importance in today’s industrialized economy, and gas is no different. In any case, we do not need a war to realize how dependent we already are on semiconductors; in fact, the pandemic was enough to put us on alert. Continuous lockdowns completely disrupted the semiconductor supply chain, a problem we are still paying for today. At the height of the pandemic, it had become complex to even buy a car and receive it before a year had passed.

Finally, there is one more aspect of semiconductors that should be emphasized, probably the most important of all: semiconductors are also the main component for building weapons and defense mechanisms. This means that the nations that have access to the best semiconductors are the most militarily advanced ones. So, this market, of course, is increasingly the object of interest by governments around the world. To be technologically backward would imply an inability to defend against military attack.

TSMC vs. ASML

TSMC and ASML are two pivotal companies in the semiconductor market, and in this section we will see what their greatest strengths and risks are. Once I have analyzed the companies individually, I will make a comparison that will support my investment thesis.

TSMC: everybody wants its chips

At the beginning of the article, I compared TSMC’s chips to gold, but this comparison probably does not do justice since they are worth much more than gold. The competitive advantage this company has gained over the past decade is something impressive, and its numbers almost signal a monopoly position.

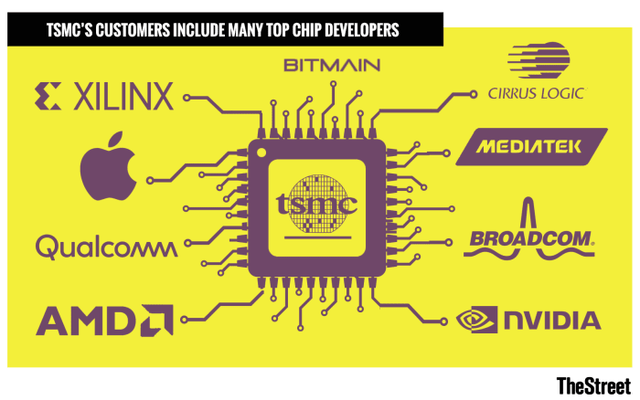

The Street

- 90% of the world’s super advanced computer chips are manufactured by TSMC. Major customers include Apple (AAPL), Qualcomm (QCOM), and Nvidia (NVDA).

- TSMC has a 53.40% share of the global pure-play foundry market.

Moreover, its main competitors, Intel (INTC) and Samsung (OTCPK:SSNLF), do not come close to TSMC’s current dominance. Intel is investing heavily in new plants in both the United States and Europe, but it is still lagging far behind in 5nm chip production. Suffice it to say that TSMC will deliver 3nm chips in 2023 and is already well-positioned on manufacturing 2nm ones. Samsung has a 16.50% share in the global foundry market and is slightly ahead in the production of 3nm chips; however, it still remains one step behind TSMC, as the latter has a better customer base. Even if Samsung produces 3nm chips a few months in advance, it does not have the same demand as TSMC. As we have seen before, Apple is a major customer, and there are not that many companies that need such powerful chips.

But why does TSMC have a better customer base? The answer lies in the different business model compared to Intel and Samsung. TSMC operates as a contract manufacturer that produces chips designed by other companies, while Samsung and Intel are IDMs, so they are involved in both chip design and manufacturing. So, for a potential customer, it appears both cheaper and more efficient to design their own chips and outsource production to TSMC. This is exactly the process adopted by “fabless” companies such as Nvidia and Advanced Micro Devices (AMD).

In addition, there is also reason to include the aspect related to possible conflicts of interest in the cases of Samsung and Intel. Assuming Intel was in the current position of TSMC, it is unlikely that it would produce AMD-designed chips, since this would favor the sale of AMD processors. The same is true for Samsung with its competitors. For TSMC, being engaged only in manufacturing, this problem does not exist since it does not compete against companies that design chips.

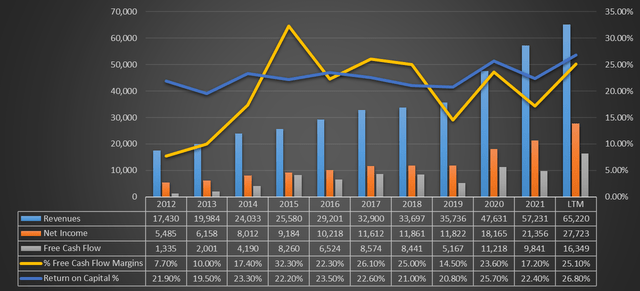

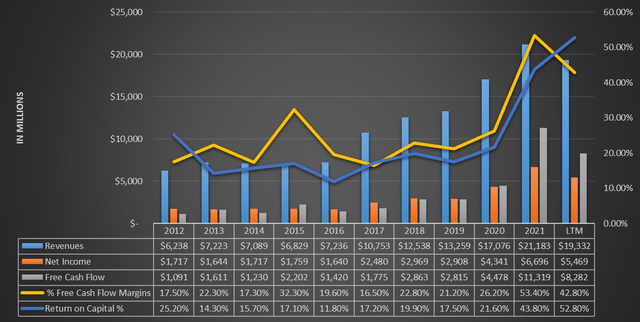

TIKR Terminal

Contextualizing what has been said in economic/financial data, TSMC is basically a money machine. Revenues and profits growing almost every year, return on capital firmly above 20%, and a high free cash flow margin considering the industry in which it operates. Objectively, TSMC is currently one of the best companies in the world in terms of competitive advantage and profitability.

The advantage Taiwan Semiconductor has gained over its competitors is so great that it would not take just years to close it. In Intel’s case probably not even a decade. In addition, it is to be ruled out that new competitors could take over in these years since it operates in an industry in which large sums of capital are needed to start a business. A company starting from scratch and wanting to compare itself with TSMC would face an almost insurmountable barrier to entry. TSMC’s competitive advantage is likely to endure; in fact, analysts predict that revenues can continue to grow rapidly driven by increasing demand for the most sophisticated chips.

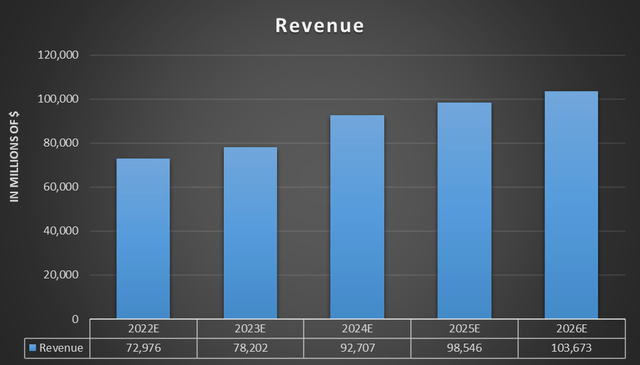

TIKR Terminal

According to TIKR Terminal analysts, TSMC could cross the $100 billion revenue threshold in 2026, almost double the amount produced in the full year 2021. In light of these considerations, one might think that TSMC is the perfect company, but that is not quite the case. Unlike most companies, its main weakness is not economic, but geopolitical. In fact, the next section will deal with this.

Taiwan Semiconductor: The geopolitical risk

As explained earlier, the semiconductor market is increasingly becoming a political issue, which is why the world’s major countries are doing everything they can to grab the best chips. Since TSMC is the company on which almost the entire world depends for the production of the most advanced chips, it is obvious that it has attracted the interest of the major economic powers, namely China and the United States.

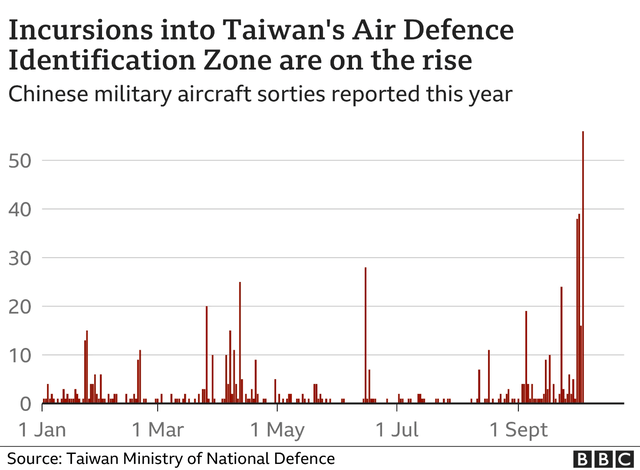

The problem is that TSMC is a Taiwanese company, and China has made it very clear several times that it does not accept Taiwan’s independence. On the other hand, the United States obviously does not want China to have control over TSMC, as it would have too great an advantage in the semiconductor market. President Biden has already stated that the U.S. will defend Taiwan militarily in the event of an attack, but Xi Jinping has also declared in turn that he will take all necessary measures to reunify Taiwan. Meanwhile, Chinese incursions are becoming more and more frequent.

BBC, Taiwan Ministry of National Defence

Currently, TSMC is in the eye of the storm, and I personally cannot see how this situation can be resolved. My hope is that it won’t come to a military conflict, but I have my doubts about that, since neither China nor the United States is stepping back. Having dominance over the best semiconductors is too important because it would mean being the first power in the world. But in all this, how is TSMC doing?

Taiwan’s largest company is trying to diversify its business away from its headquarters so as to untie itself from Beijing’s grip. In Arizona, TSMC is giving birth to its most technologically advanced factory, while other investments are being made in Japan. This diversification process, however, is by no means easy, as there are three problems:

- The first is that excessive investment abroad, and especially “in enemy territory” could trigger an attack from China. Certainly, the investments in Arizona did not please Xi Jinping.

- The second is that the production capacity of factories in Taiwan is huge, and years of overseas investment will not be enough to diversify the business. For example, the factory in Arizona, as technologically advanced as it is, will be nowhere near comparable in terms of production capacity to those in Taiwan. Certainly, a $12 billion investment is not enough to diversify the business of a company as large as TSMC. Huge amounts of capital will be needed to invest, but without upsetting China too much.

- The third problem is that maintaining plants abroad tends to be more expensive, which would reduce profit margins. Paying labor costs in the United States is not the same as paying them in Taiwan, as well as many other expenses.

Overall, the situation is too complex from a geopolitical point of view, and no one now can know precisely what this will lead to. As much as I appreciate TSMC’s numbers, I am compelled not to invest in it because I believe that the risks related to an investment may outweigh the benefits. Everyone wants its chips, but the problem is that an attack on Taiwan is becoming more of a reality than a black swan. From the words of Defense Minister Chiu Kuo, Taiwan is already preparing:

We are building up our arsenal and preparing for war according to our own plan. We want to ensure we have a certain period of stockpiles in Taiwan, including food, including critical supplies, minerals, chemicals and energy of course.

Finally, if you are wondering what would happen to TSMC in the event of a military attack, here is the answer from its president Mark Liu:

Nobody can control TSMC by force. If you take a military force or invasion, you will render TSMC factory not operable. Because this is such a sophisticated manufacturing facility, it depends on real-time connection with the outside world, with Europe, with Japan, with U.S., from materials to chemicals to spare parts to engineering software and diagnosis.

ASML: Little-known but extremely important

Previously we have seen how TSMC, Intel, and Samsung are fighting for an ever-larger share in the semiconductor market. Everyone wants to produce the best chips and everyone wants to buy the best chips. But have you ever wondered how TSMC, Samsung and Intel produce such cutting-edge chips? How do they have such powerful machines to generate 3nm chips? The answer is that all the major semiconductor companies are dependent on machinery from the same supplier, ASML.

The entire semiconductor supply chain relies on ASML, because its EUV lithography machines are currently the only ones in the world that enable the creation of the most advanced chips. If for TSMC there is Samsung that comes close to its technology, for ASML there is no competitor that can hold a candle to it, since no one has been able to develop such advanced technology. Moreover, what makes the gap with competitors grow even wider is that ASML continues to innovate. By next year, the first High-NA EUV lithography machine could be delivered, and early hypotheses are already being made about the Hyper-NA EUV. For ASML, competition exists only in the sale of DUV lithography machines, which are those designed to create lower-performance chips. However, the technological development of today’s society requires increasingly high-performance chips, so the growth of ASML seems almost inevitable.

TIKR Terminal

As can be seen from this graph, ASML experienced some difficulties growing before 2017, but from that year on, growth has not stopped as EUV lithography began to be widely used. What’s more, the demand for advanced chips is favoring the sale of EUV machines, and the results achieved in the past three years are proof of that. According to TIKR Terminal analysts, this company could nearly double its revenues by 2026.

TIKR Terminal

Ascertaining how important and solid ASML is, I would like to elaborate further regarding its competitive advantage as I think it is interesting. As you may have guessed, ASML is the most important technology company in the world because it manufactures the best lithography machines, which are critical in the initial stage of manufacturing the best chips around. Without ASML, TSMC would not be able to manufacture Apple’s designated chips, and the same goes for Samsung and Intel. So, it is clear that if ASML were to stop selling its machines, the whole world could not continue to develop technologically. But how is it possible that one company has so much power? How is it possible that no one else could create an EUV lithography machine? More importantly, could not the machines already sold by ASML be “copied” through a process of reverse engineering? An entire article would probably not be enough to answer these legitimate questions, but I will try to be as clear and concise as possible.

ASML

First of all, the EUV machines sold by ASML are difficult to reproduce because of an economic issue. They are currently sold for $200 million each, while the new High-NA EUV ones will be sold for at least $300 million each. This aspect already puts off potential competitors who do not present enough funds to reproduce them.

Those who do have the money, however, will have considerable difficulty sourcing major and minor components as well as assembling them. An EUV system weighs nearly 200 tons and consists of 100,000 parts, 3,000 cables, 40,000 bolts and 2 kilometers of hoses. All purchased from 5,000 different suppliers.

Even assuming that a hypothetical company managed to have everything on hand, it still would not be able to properly assemble the 100,000 parts. Reproducing the mechanism of an EUV system is something extremely complex even when in possession of all the necessary components and thousands of engineers on hand. To give you an idea, the company stated that an EUV system controls light beams so precisely that it is equivalent to shining a flashlight from earth and hitting a 50-cent coin placed on the moon. Finally, as if that were not enough, it takes 40 cargo containers, spread over 20 trucks and 3 cargo planes, to deliver an EUV system.

China has been trying for years to reproduce what is currently the most powerful machine in the world, but it is still too far from finding a solution. What’s more, the Dutch government, under pressure from the United States, has banned the export of the latest EUV systems to China. The aim is obviously to leave China as far behind as possible from a technological point of view. Currently, ASML can continue to sell only the less sophisticated systems such as DUV to China. This last aspect will be discussed in more detail in the next section on ASML’s risks

ASML: U.S. pressure and technical limitations

ASML is the only company in the world capable of creating EUV lithography machines, so it goes without saying that there is a geopolitical component to analyze here as well. As anticipated earlier, the United States pressed the Dutch government to prohibit ASML from exporting EUV lithography machines to China. This choice, although reasonable from a certain point of view, hurts its profitability since it cannot expand its business in China. Moreover, it must be said that before the blockade China had already purchased some EUV lithography machines; therefore, this decision does not benefit ASML in any way. In the future, it cannot be ruled out that DUV lithography machines will also be subjected to the same treatment, and this would make the situation even worse. Should this second ban become a reality, a reduction in revenues of about 10% is expected. Beyond this possible immediate loss, I believe the long-term economic damage is greater, since China is likely to be the largest semiconductor market in the world.

The second risk is purely technical in nature. How long can ASML innovate? Current lithographic technology borders on perfection, and it will be difficult to improve on the new high-NA EUV machines. Beyond the physical limitations that prevent chips from being miniaturized beyond a certain level, there is also an economic aspect to consider. ASML CTO Van den Brink does not currently believe that hyper-NA EUV is feasible, and high-NA EUV may be the last NA.

We’re researching it, but that doesn’t mean it will make it into production. For years, I’ve been suspecting that high-NA will be the last NA, and this belief hasn’t changed. Theoretically, it can be done. Technologically, it can be done. But how much room is left in the market for even larger lenses? Could we even sell those systems? I was paranoid about high-NA and I’m even more paranoid about hyper-NA. If the cost of hyper-NA grows as fast as we’ve seen with high-NA, it will pretty much be economically unfeasible. Although, in itself, that’s also a technological issue. And that’s what we’re looking into.

Final Thoughts

Before I summarize my reasons why I believe ASML is a better investment overall, I would like to say my two cents about an event involving TSMC recently that might be discussed in the comments.

In recent weeks, I have noticed that there has been a lot of positivity about TSMC after it was discovered that Warren Buffett invested $4.1 billion in it. Certainly this is a positive signal, but I do not think it can be decisive in an investment thesis. Since the day this news came out, I have seen a lot of analysis based on bullish theses, as if “the Warren Buffett effect” has completely erased geopolitical risk. In my opinion, having critical and personal thinking is the basis of any successful investment, because copying the operations made by someone else (even if it is the best investor in history) is not necessarily a good strategy. Berkshire Hathaway’s (BRK.B) reasons for investing in TSMC may be different from those of the average investor, who perhaps expects a profit as early as the next few months.

In addition, one must also consider that for Berkshire to invest $4.1 billion in a company represents only 1.40% of the total portfolio. There are many aspects to consider in order not to copy an investor managing hundreds of billions of dollars, and if you are interested you can find more information in this article. To invest in TSMC, it is not enough to know that Warren Buffett did it, but we need to understand whether this company fits our field of knowledge and whether, through our own quantitative valuation, it is undervalued.

That said, the conclusion of the article reflects my personal comparison of ASML and TSMC.

ASML and TSMC from a quantitative point of view present an uncommon strength, moreover they are perfectly placed within a market that is destined to grow in the long run. If we looked only at the numbers, these companies are extremely interesting, However, this is not enough, as we must also consider the context in which they operate. The latter aspect, in fact, is what leads me to doubt investing in Taiwan Semiconductor in the long term.

China will not stop pressing TSMC, the United States will not back down, and Taiwan is already prepared to defend itself against an attack. No one can know exactly what this geopolitical tension will evolve into, but certainly the premises are not rosy. Based on my degree of risk aversion, with regret, I prefer to avoid investing in Taiwan Semiconductor since I already know that I would not experience well any price fluctuations due to the upcoming news between China and Taiwan. I wanted to point out that it is a regret for me, since the company is undoubtedly a money machine. If it were not for this aspect, I would invest in it at an appropriate price.

The whole world depends mainly on TSMC, Samsung and Intel in chip manufacturing, and these companies are warring with each other to produce the best chips. However, although geographically different from each other, they have one thing in common: they all depend on ASML’s EUV lithography machines. It is true that ASML also has a geopolitical risk, but it is limited to the inability to sell its EUV/DUV machines in China; the rest of the world in fact can buy them. Personally, I even consider it more reasonable to invest in Intel rather than TSMC. In addition to not having geopolitical risk, recent investments in high-NA EUV could thin the gap with both TSMC and Samsung. I recently wrote an article about this.

To conclude, linking back to the initial thesis, whether it is Taiwan Semiconductor, Samsung, or Intel that dominates the semiconductor market in the future matters little to ASML, since they will all have to buy its machines anyway. No one can know who will be the winner and who will be the loser in the race to produce the most advanced chips, but we do know that whoever produces the machines to build them will benefit from the competition. As in the mid-nineteenth-century gold rush, the best strategy may turn out to be not to seek what everyone wants, but to sell the means to seek what everyone wants.

Be the first to comment