Marko Geber/DigitalVision via Getty Images

Investment Overview – Can Biogen/Eisai’s Success With Lecanemab Be Matched By Anavex’s Lead Candidate?

Anavex Life Sciences (NASDAQ:AVXL) stock has underperformed in 2022, falling in value by ~48% to trade at a value of $8.9 at the time of writing. Over a 5-year period, however, the stock price remains up by >125%, and as recently as November 2021 it was up >450% over a 48-month period, trading at a value of $23.

Anavex’ lead drug candidate is ANAVEX®2-73 and it is indicated for a wide range of Central Nervous System (“CNS”) disorders, including Parkinson’s Disease, Rett Syndrome, Fragile X Syndrome, Angelman’s, and most importantly – in terms of the valuation of the company – Alzheimer’s Disease.

Alzheimer’s Disease has defied drug developers for decades and there are still no cures or even disease modifying therapies available to patients. Biogen’s (BIIB) Aduhelm was controversially approved last June, but concerns about its efficacy and safety persisted and the drug has been effectively shelved after physicians refused to prescribe it and the Centers for Medicaid and Medicare Services (“CMS”) refused to provide reimbursement for its commercial use.

Biogen and its Japanese Pharma partner Eisai have been working on a new Alzheimer’s therapy, Lecanemab, and results published in the New England Journal of Medicine yesterday have been heralded as the first conclusive evidence that the drugs’ mechanism of action (“MoA”) – targeting the build up of a sticky substance known as amyloid beta that builds up in the brains of Alzheimer’s patients – actually works. In a pivotal study, Lecanemab reduced cognitive decline in patients by 27% compared to placebo over an 18 month period.

Biogen’s stock price has been significantly buoyed by the progress of Lecanemab and is up >50% across the past 3 months, with more upside likely in the coming days as the market fully digests the NEJM data.

Anavex has its own potentially major share price catalyst arriving tomorrow when management will present top line data of its randomized, double-blind, placebo-controlled Phase 2b/3 study of ANAVEX 2-73-AD-004 for the treatment of early Alzheimer disease in a late breaking oral presentation at the upcoming clinical trials on Alzheimer disease (“CTAD”) Congress 2022 at 4:30 PM Pacific Time in San Francisco, California.

ANAVEX 2-73 uses a different mechanism of action to Lecanemab, targeting a small transmembrane protein known as a sigma-1 receptor present on the surface of CNS and nerve cells, and carrying out various physiological and pathological processes which the drug is supposedly able to influence. According to Alzheimer’s News Today:

Specifically, Anavex 2-73 is thought to help restore cellular balance by targeting protein misfolding (when proteins fail to fold correctly, into a normal configuration, they do not work as intended), oxidative stress (which damages cells due oxygen molecules with free radicals, or unpaired electrons), mitochondrial dysfunction, inflammation, and cellular stress.

Over the past couple of years hype around potential new Alzheimer’s therapies has seen some biotech company’s share prices double, triple, or even more than quadruple, such as Cassava Sciences (SAVA), Prothena (PRTA), Annovis Bio (ANVS), Cortexyme (CRTX) and even the Big Pharma Eli Lilly (LLY). In most cases doubts around efficacy, safety, and even accusations of fraudulent behavior has brought many of these companies’ share prices crashing back down again.

Tomorrow, it will be Anavex’ turn to present some potentially make or break data that may determine whether the underwhelming share price performance of 2022 is confirmed by underwhelming data and a major sell-off, or whether Anavex finishes 2022 on a major high, with a genuine shot at an Alzheimer’s therapy approval in 2023.

Let’s look at the opportunity – and the implications of success or failure – in some more detail, beginning with a quick review of FY22 earnings data and the earnings call with analysts.

Anavex Life Sciences Fiscal 2022-End Results

Anavex reported a cash position of $149.2m as of fiscal Q422, and a net loss for the full fiscal year of $48m versus $37.9m in the prior year. Broadly speaking then, Anavex seemingly has the necessary funds to complete its various clinical studies, which includes 2 Phase 2/3 studies of ANAVEX 2-73 in Parkinson’s Disease, 2 Phase 3 and 1 Phase 2/3 study in Rett Syndrome, Phase 1-3 studies in Fragile X and an undisclosed rare disease target, and 3 Phase 1/2 studies of a second candidate, ANAVEX-3-71 in frontotemporal dementia, Schizophrenia, and Alzheimer’s.

If the Alzheimer’s data presented tomorrow is positive enough (i.e. meeting the primary endpoint) Anavex would doubtless be able to complete a substantial at-the-market fundraising – likely anything up to $500m – whilst still driving triple-digit percentage share price gains.

After Anavex reported its Q422 results, its stock price – which had climbed from <$9 at the end of September, to an 11-month high of $14.5, fell back <$9 once again. In my opinion this was likely more due to management remaining tight lipped about the upcoming Alzheimer’s data readout on its earnings call than the financial position, cash burn, or progress in other studies.

Management would not be drawn on what the data may look like, repeatedly responding to analysts’ questions on the subject by advising that all will be revealed on December 1st – nor would they discuss plans to submit for an FDA approval, or a launch or commercialization strategy.

ANAVEX 2-73 In Alzheimer’s – Data To Date

Data from the trials that enabled Anavex to initiate its pivotal, 48-week study Alzheimer’s study of ANAVEX-273 is hard to locate and also difficult to interpret.

In a Phase 2a study Anavex-273, otherwise known as blarcamesine, was apparently administered to 32 patients who were to be followed over a 5-year period. 2-year data seems to have been released in December 2019, which showed that:

Change in MMSE score from baseline at week 104 of matched cohorts was assessed. It showed that ANAVEX®2-73 (blarcamesine) high dose cohort had a significantly lower MMSE decline (-1.1) compared to the ADNI control cohort (-4.4) at week 104 (p < 0.01).

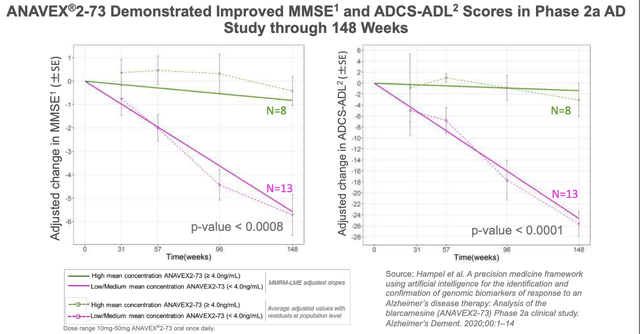

Anavex also shares 148-week data from a 21 patient study in its investor presentation as follows:

ANAVEX-273 Phase 2a study results (Anavex presentation)

These results additionally show improved Alzheimer’s Disease in basic and instrumental activities of daily living (“ADCS-ADL”) scores, although the small patient population should be noted, as should the fact that placebo data appears to have been taken from studies of rival Alzheimer’s drugs.

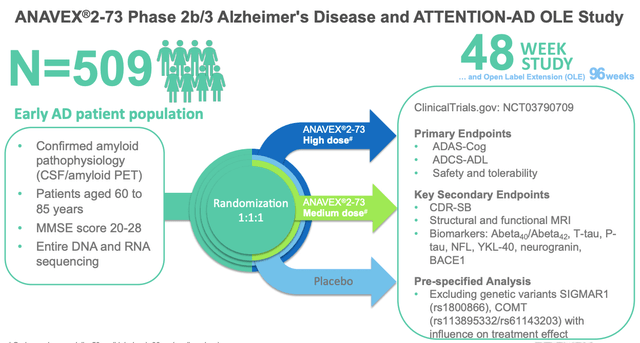

It seems to be the kind of data that has triggered excitement in the markets for other Alzheimer’s drug developers in the past, without being entirely convincing. The Phase 2/3 study, however, has enrolled 509 patients randomized 1:1:1 to receive either Anavex-273 high dose, medium dose, or placebo.

The Pivotal Study Design

Anavex Phase 2/3 AD study design for ANAVEX-273 (presentation)

The key endpoints of ADAS-COG and ADCS-ADL are “gold standard” measures of cognitive decline and ought to make Anavex’ results comparable with e.g. studies of Eisai’s Lecanemab, Eli Lilly’s Donanemab, Roche’s (OTCQX:RHHBY) Gantenerumab, and even Cassava’s Phase 3 studies of its controversial drug Simufilam.

In other words, data from this study, should it prove positive, ought to be sufficient for Anavex to submit the drug for a full approval. If primary and secondary endpoints aren’t met, however, it may mean that all efforts to win approval for ANAVEX-273 are shelved.

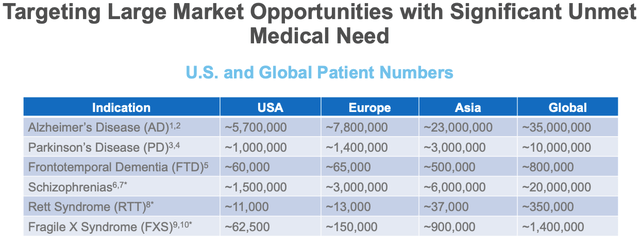

Anavex target markets (Anavex presentation)

As we can see above, Alzheimer’s is by far and away Anavex’ biggest target market, with 5.7m potential patients in the US alone. The next largest market, Parkinson’s, is >5x smaller.

Based on Anavex’ current market of ~$700m, it is pretty clear that the market does not rate the prospect of positive Alzheimer’s data highly. The current market cap of Cassava Sciences, for example, is nearly double that of Anavex, and Cassava has a single drug that is yet to report data from anything other than an open label Phase 2 study with no placebo arm.

Are There Reasons To Be Cheerful About Tomorrow’s Data Presentation?

There are some positives for an optimistic investor to focus on based on my research into the company. Some of the preclinical research around Anavex-273 and the mechanism of action appears to be quite thorough and the thesis that targeting SIGMA-1 helps restore cellular balance in some way has arguably been proven – although not sufficiently for there to be no doubts.

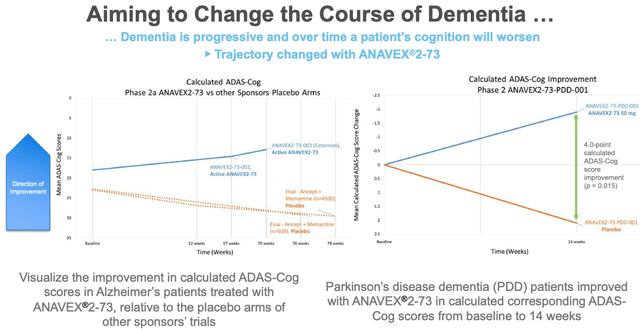

The most compelling reason to believe is probably the data – albeit somewhat convoluted – that the drug is capable of changing the course of dementia, as is shown in the below slide which compares the effect of ANAVEX 2-73 against placebo arms from rival companies’ trials.

Anavex Evidence that ANAVEX-273 can alter course of dementia (Anavex presentation)

It is precisely these types of studies – which cobble together diverse data from different studies – that the Alzheimer’s community has been trying to distance itself from however, and therefore it would be risky and perhaps wrong to make a bull case for the success of ANAVEX-273 based on this evidence.

Still, management has asked investors and analysts to be patient and wait for the data, and although it may not have sounded bullish, it did not attempt to manage expectations downward either – some may take that as a positive.

There is also the fact that ANAVEX-273 has shown signs of efficacy in other CNS conditions also, although some of these studies have been critiqued also – in the case of Rett syndrome, Phase 3 endpoints were apparently changed shortly before the final data read out.

Are There Reasons To Be Fearful?

If you are looking for them, there certainly seem to be signs that tomorrow’s data readout may not be positive. Primarily, Alzheimer’s is a notoriously tricky target and there probably isn’t enough prior evidence that ANAVEX-273 works to make us believe that the larger trial is anything other than speculative.

Although Anavex’ share price has been rising, the recent downturn suggest there is not much enthusiasm in the market for the upcoming results, which could be taken as evidence those with the most information on the subject do not believe there will be a positive outcome.

Short interest in Anavex also appears to be relatively high – according to shortsqueeze.com there are more than 10m shares short, out of a float of 78m, representing ~13% short interest.

Finally, more broadly speaking the implications of a negative readout are quite serious for Anavex, since the thesis that its lead drug candidate can positively affect SIGMA-1 may be disproven once again. Coupled with the questionable Rett syndrome data, management may be forced to consider whether it is worth persevering with the drug in other indications.

Conclusion – In 24 Hours’ Time, We’ll (probably) Know If AVXL Can Move Forward In Alzheimer’s With Blarcamesine

Personally, based on the available evidence and my research my gut feeling is that it would be a major surprise if Anavex meets primary and secondary endpoints in its Phase 2/3 EXCELLENCE Study. As discussed, I am not sure the prior data is compelling enough to give full confidence of such a positive result.

Such is the subjective nature of Alzheimer’s study data – even the “gold standard” tests of cognition like ADAS-COG are not necessarily free of subjectivity – I wouldn’t be surprised however if Anavex finds a way to frame the data in such a way that supports persevering with the drug.

Lecanemab is the first ever Alzheimer’s drug to conclusively show in a placebo-controlled trial that it can have a positive effect on cognitive decline, which speaks to how hard it is to develop drugs for the disease, given the decades of research and billions spent on R&D.

There have been plenty of cases where a company has found enough within its data set – patients at a particular stage of decline showing more positive results than others, anomalies in the placebo arm, or patients with a particular genetic profile for example – to argue that its data is positive or that a differently designed trial may yield more positive results.

I think that something similar may happen tomorrow when Anavex presents its data. Management will obviously want to highlight the positives, whilst the market will try to uncover any flaws. It may be that the results could be considered inconclusive, and management will ask the FDA for more time to study the data.

It would be great news for patients if ANAVEX-273 meets a primary or a secondary endpoint, since it appears to be a safer therapy potentially than Lecanemab, which has been associated with at least 2 patient deaths in its clinical studies. On balance, however, I suspect the data will be inconclusive at best, and fail to show any improvement at worst.

If there is a suggestion that a tweaked study would turn a promising trend into a statistically significant one, I would expect Anavex to go ahead and design such a study.

Be the first to comment