lamyai

Global weather extremes

The combination of a warming planet, brought on by climate change and the long extended La Niña has caused global weather disasters from floods in Pakistan, drought in the Yangtze River region of China, historic fires out west, droughts in Europe, and of course, reduced corn and soybean yields in the western corn belt.

There has been much discussion and confusion by some scientists and commodity analysts that La Niña will soon transition to El Niño. However, I have stuck to my guns for months that La Niña will not weaken until late winter (or spring 2023). Any chance for El Niño conditions will not have an effect on commodities for at least 8-12 months.

This video talks about La Niña and implications of a weak Atlantic and Gulf hurricane season that I predicted months ago.

Commodities and La Nina (Weather Wealth Newsletter)

Implications of another La Niña winter

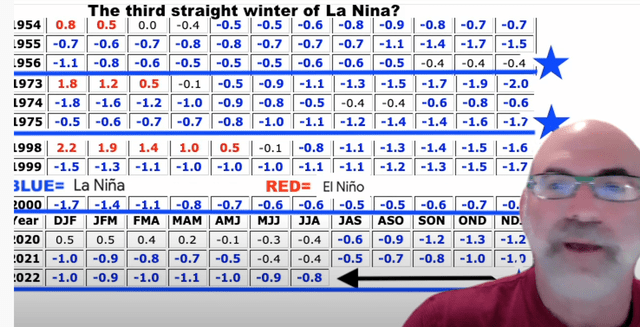

There have been three other cases in which La Niña extended for three consecutive winters (1956, 1975, 2000). So… what were the global impacts on commodities during those three winters (South American summer)?

1) Production problems to either Argentina and/or Brazil soybeans (ETF:SOYB) and corn (ETF:CORN) in two of three cases;

2) A cold U.S. and/or European winter in two of three cases;

3) Generally improved weather for Brazil coffee (JO) (in contrast to other scientists who keep preaching more drought and a longer-term bullish attitude in this market);

4) Potential for flooding rains to hurt more of the Pakistan cotton (BAL) crop this fall;

5) More wet weather for Australian grains: maintaining mostly above normal yields for wheat and other crops, but some flood issues may be possible in a few locations;

6) Generally good weather for west African cocoa (ETN:NIB).

Due to the record warm global summer across much of the globe, one study I will be preparing for clients is to research which of these winter La Niña years (1956-57; 1975-76; 2000-2001) had similar spring and summer weather events. In other words, not all La Niña events are the same, and a warming planet might offset the chance of having a cold winter and a bullish move in natural gas.

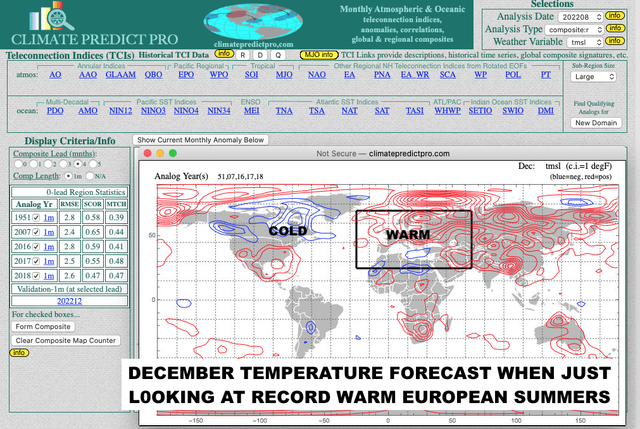

For example, my in-house Climate Predict program illustrates how the record warm European summer portends a potential warm early winter in many parts of the globe. Obviously, if this is correct, natural gas prices (NYSEARCA:UNG) and certain heating oil vs. gasoline and crude oil spreads (SCO) will offer great trading opportunities.

Best Weather Inc. Weather Analogs (www.climatepredict.com)

The bottom line is that not only La Niña has an exclusive effect on global weather. It is also important to look at historical trends and climatic similarities to predict weather months in advance.

Conclusion

We have had some recent profitable trades in the UNG natural gas and JO coffee ETF markets, and you are more than welcome to receive a free past issue of Climatelligence. You will also see how we caught the summer bull move up in the CORN ETF on droughts in Europe, China, and the western Midwest

Right now, some of my highest-confidence trades based on La Niña are likely buying grains after the U.S. harvest and playing option strangles again in natural gas or looking to sell way out of the money call options. Any major bull move in coffee is unlikely as the drought eases in parts of northern Brazil.

Be the first to comment