Circle Creative Studio/E+ via Getty Images

Investment Thesis

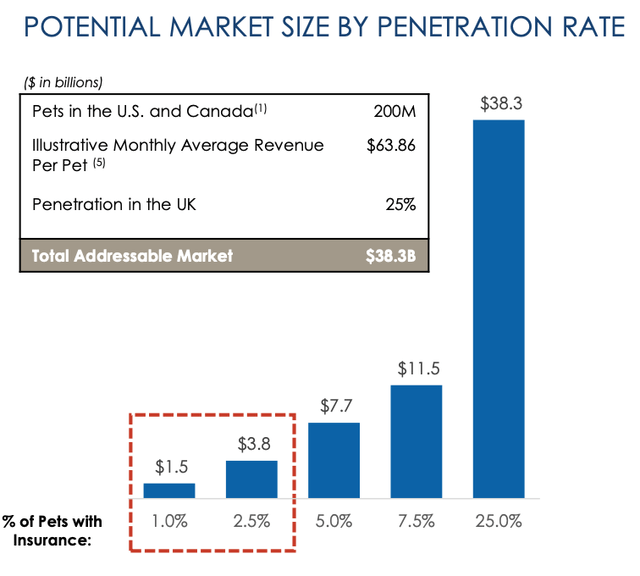

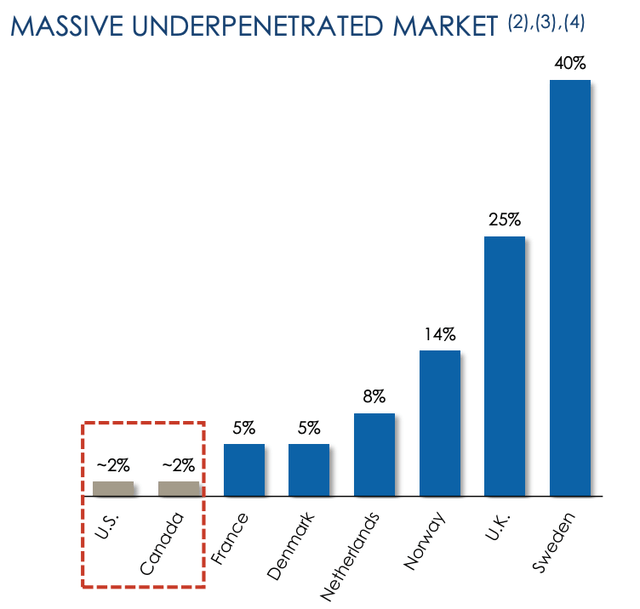

The massive TAM (total addressable market) and underpenetrated market has kept Trupanion (NASDAQ:TRUP) on my watchlist. Despite improvements in some of the financial metrics, I am hesitant in starting a fresh investment in Trupanion at the current valuation. Below I compare the current financial performance against what I had written about two years ago. If you need an introduction to the company and the opportunity that the company is addressing, please read my previous article about the company Trupanion: Love The Company But Not The Valuation.

Revenue, Pets Enrolled, Lifetime of a Pet

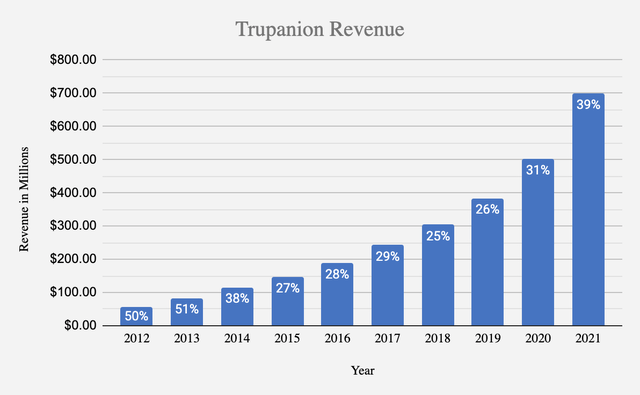

The revenue has grown from $384M in 2019 to $502M in 2020 to $699M in 2021. The revenue growth rate has actually accelerated from 26% in 2019 to 31% in 2020 to 39% in 2021.

Author’s own work based on Trupanion’s 2019 & 2021 Annual Reports

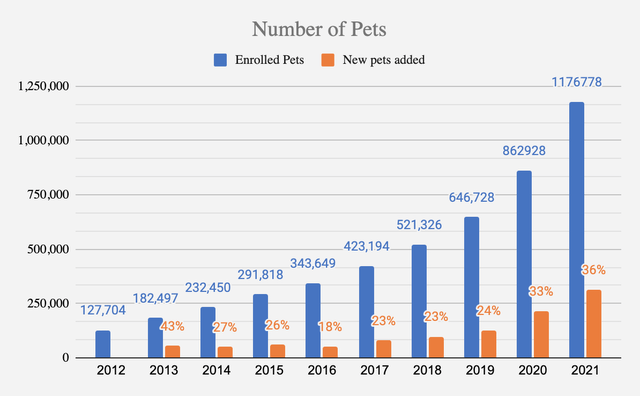

Author’s own work based on Trupanion’s 2019 & 2021 Annual Reports

Lifetime of a pet has also increase from 71 months in 2019 to 80 months in 2021.

These three metrics have moved in the right direction. And this is what has prompted me to take a closer look at the business again.

Pet Acquisition cost (PAC), Revenue Per Pet

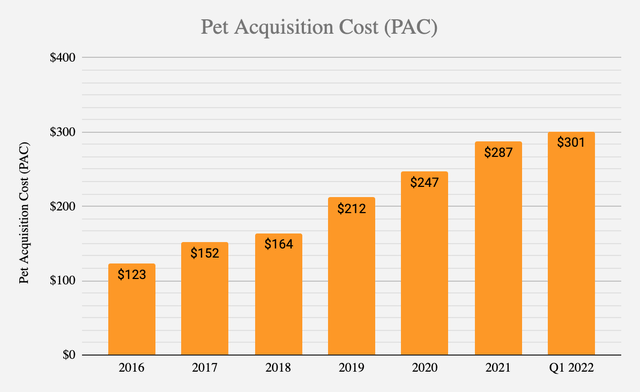

The amount that Trupanion spends on acquiring new pets is referred to as the Pet Acquisition Cost (PAC). PAC has also gone up over the years and it does not look like it will stabilize or settle anytime soon. When I wrote my previous article, average PAC was $212 for the year 2019 and $222 for Q1 2020. The average PAC for 2021 has increased to $287 and this has again increased to $301 for Q1 2022.

Author’s own work based on Trupanion’s 2019 & 2021 Annual Reports

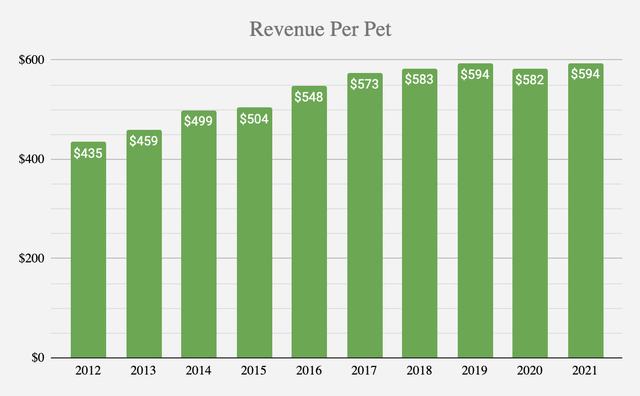

Another metric that I track is the average revenue that Trupanion generates for the total number of pets that are enrolled. Average revenue per pet has almost stabilized to just below $600 for the last 3-4 years.

Author’s own work based on Trupanion’s 2019 & 2021 Annual Reports

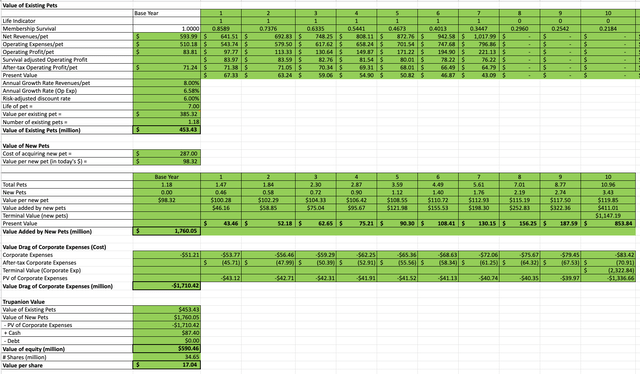

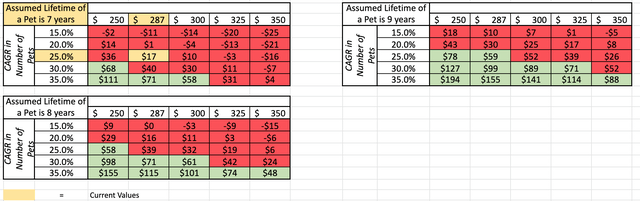

Valuation using Per Pet Economics

Here I began by valuing the existing pets over its lifetime of around 7 years that the company mentions in its April 2022 Investor Presentation. And then I calculated the value added by new pets based on the PAC mentioned by the company in its 2021 Annual Report. Finally, I subtract the non-pet related corporate expenses like G&A and R&D to arrive at a fair value for Trupanion of $17.04.

Author’s own work

Author’s own work

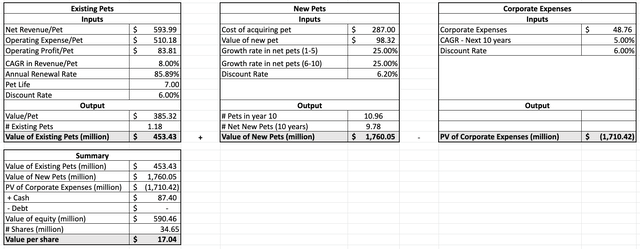

The assumptions I make clearly influences the value. So I decided to vary the key assumptions that have a big impact on my fair value of Trupanion. The three key assumptions that I played with are the PAC, CAGR in number of pets, and average life of the pet for Trupanion (If you have read my previous article, you will notice that I have not varied the CAGR in net revenue/pet, instead I have kept it at a constant growth rate and tried to vary the CAGR in number of pets. If you see the revenue/pet graph above, it is clear that revenue/pet is almost stabilizing, hence I do not see it as a big variable factor going forward). Below is what I arrived at using different values for these three key inputs.

Author’s own work

In the first table, I assumed the lifetime of a pet to be 7 years or 84 months, which is slightly higher than what Trupanion has mentioned in their April 2022 Investor Presentation. With that fixed, I have varied the PAC between $250 and $350, and CAGR in number of pets between 15% and 35%. This gives me Trupanion’s fair value range of -$25 to $111.

For the other two tables, I have copied the first table and just increased the lifetime of a pet to 8 & 9 years. Assuming a pet lifetime of 8 years, the fair value for Trupanion fluctuates in the range of -$15 to $155. And assuming a pet lifetime of 9 years, the fair value for Trupanion fluctuates between -$5 to $194.

It is abundantly clear that improving the PAC, average lifetime of a pet and CAGR in number of pets can add significant value to Trupanion. Since the average life of a pet in the USA is 10-12 years, I believe that Trupanion will eventually reach 8 years of average lifetime value of a pet and be able to stabilize the PAC at $300. However, I do not think that CAGR in number of pets can stay at 30%-35% for a long time, so I am assuming it to be 25%. This gives me a fair value of $32 for Trupanion. At the current trading price of ~$60, I believe Trupanion is priced for a perfect future.

The question is, what value you believe is achievable, and that will determine your fair value for Trupanion. If you believe that the management can achieve 30% or more CAGR in number of pets just like they have been able to achieve for the last couple of years and keep the PAC under control, the value of Trupanion would be much closer to the current ~$60.

Metrics To Monitor

- Number of new pets added

- Pet acquisition cost

- Average lifetime of a pet

- Average monthly pet retention rate

- Average revenue/pet

Conclusion

The massive TAM, underpenetrated market, industry growing at a decent pace and the recurring subscription revenue has kept Trupanion on my watchlist.

Trupanion’s April 2022 Investor Presentation

Trupanion’s April 2022 Investor Presentation

The number of pets being enrolled has accelerated, the average monthly pet retention has improved, and the average lifetime of a pet has increased over the last two years. Clearly, some of the metrics that I track are heading in the right direction. However, I would like to see the PAC reduce or stabilize in order for me to get excited about an investment in Trupanion. Unarguably, I love the business and the future prospects of Trupanion, so Trupanion stays on my watchlist.

Be the first to comment