Aleksandr_Kravtsov/iStock via Getty Images

As signs start pointing to some version of the SAFE Banking Act getting approval later this year, investors need to start positioning in U.S. cannabis companies set to benefit from access to the banking system and uplisting to major stock exchanges. Trulieve Cannabis (OTCQX:TCNNF) is one of the safer options to play federal legalization while protected in a scenario where legalization again fails to obtain approval. My investment thesis remains Bullish on the multi-state operators (MSOs) set to benefit the most from changes to the cannabis rules at the federal level.

Legislative Cover

The biggest issue preventing the SAFE Banking Act from obtaining approval were Democrats concerned the legislation didn’t cover social justice aspects and criminal expungement of past crimes. The combination of President Biden pardoning criminals in federal prison for minor possession and now the NAACP Board of Directors passing a resolution supporting the act suggests a path forward now exists.

States like New York and Illinois are moving forward with social equity and diverse ownership plans for dispensary licenses and now the access to the banking system is needed even more. The large MSOs have access to capital without needing the banking system creating a situation where a company like Trulieve Cannabis is likely to survive and thrive against small social and diverse owners without a large capital backing and limited access to the banking system.

New York plans to approve 150 retail licenses with a focus on applicants with a cannabis-related convictions. These investors will no doubt need access to banking on top of investments from the social equity funds established in the state.

Even Sen. Cory Booker (D-N.J.) continues to push away from the Cannabis Opportunity and Administration Act bill wrote with Senate Majority Leader Chuck Schumer (D-N.Y.). The signs continue to lineup for a path forward on SAFE Banking Plus with the need for only limited reforms included in the bill due to solutions via pardons and other routes.

Relative Safety

Trulieve Cannabis is already a profit machine with adjusted EBITDA targets for 2022 at $415 to $450 million. The MSO has strong EBITDA margins above 30%.

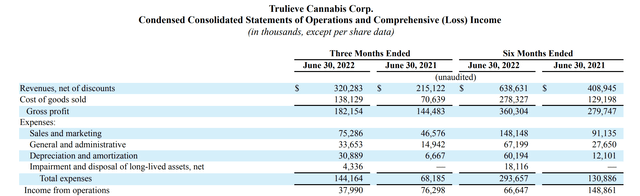

For an MSO, Trulieve Cannabis is very profitable already once excluding one-time charges and extra income tax expenses. During Q2’22, the company reported income from operations of $38 million.

Source: Trulieve Cannabis Q2’22 10-Q

Now, the MSO does have $20 million in interest expenses to offset the income from operations, but also, Trulieve Cannabis has plenty of one-time charges to bolster income going froward. The company took $17 million in acquisition costs in Q2 and another $5 million in divestment and impairment charges along with ~$6 million in stock-based compensation.

In essence, Trulieve Cannabis had somewhere around $28 million in non-cash charges along with $45 million in income tax expenses. Even at a 35% tax rate, the company would only pay ~$16 million in income taxes based on $46 million in income after accounting for the non-cash chargers and interest expenses.

Of course, until cannabis is de-scheduled or legalized, the IRS will continue enforcing 280E and force Trulieve Cannabis to pay these extra income taxes. This is where the operating cash flows matter with Trulieve only burning $10 million from operations in the 1H of the year. The company spent $56 million on building up inventories or the cash flows would’ve very positive.

Trulieve Cannabis has over 175 retail dispensaries and 4.0 million square feet of cultivation and processing capacity in the U.S. The MSO still has a dominant position in Florida with 121 stores and volumes still holding above 35% of the state cannabis sales levels providing a cushion for now. Long term, the MSO still faces the threat of losing market share with only 25% of the open retail locations hurting growth in the Sunshine state.

The MSO does now have $539 million in total debt with just $181 million in cash. Trulieve Cannabis has net debt of $358 million, though the leverage ratio is easily below 1x the adjusted EBITDA targets.

In addition, the large MSO has $830 million in property and equipment and another $270 million in inventory providing a large asset pool to fund the business. Trulieve spent another $93 million on capex in the 1H of the year, but like most MSOs the plan is to drastically cut spending going forward with most cultivation and production assets built out and the pending recession reducing the need to aggressively compete with other MSOs reigning in spending.

The stock only has a market cap of $2.1 billion with EBITDA topping $400 million this year and set to grow next year. Trulieve Cannabis only trades at 4x forward EBITDA targets.

Takeaway

The key investor takeaway is that the stock doesn’t offer the best upside on federal cannabis approval highlighted in some previous research, but Trulieve Cannabis provides one of the best risk/return scenarios with downside protection on another failed legalization attempt. The stock is a buy trading at multi-year lows near $10.

Be the first to comment