eyegelb

While the general market has suffered a significant correction, with its drawdown exceeding 27%, the Gold Miners Index (GDX) has suffered the real bear market. This is evidenced by a 53% correction from its 2020 highs. Given that bear markets take time and damage to eradicate bullish sentiment entirely, I believe the more fertile ground for looking for new ideas is in the gold sector, where the 22-month cyclical bear market has ground any remaining optimism to fine dust. So, with one of Africa’s largest producers trading at a deep discount to fair value with a ~5.1% dividend yield, I expect any dips below US$3.00 to provide buying opportunities for B2Gold (NYSE:BTG).

Q3 Production & Sales

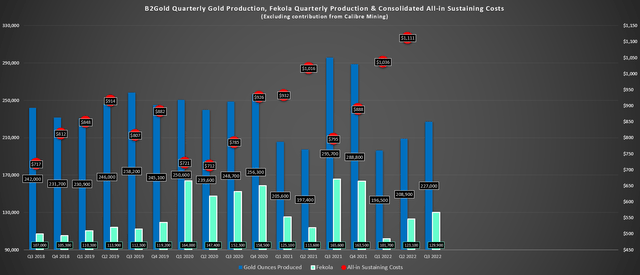

B2Gold released its preliminary Q3 results earlier this month, reporting consolidated production of ~227,000 ounces, a 19% decline from the year-ago period. The much lower production in Q3 can be attributed to a softer quarter at Otjikoto with a delay in bringing Wolfshag Underground [WSUG] into production and a higher ratio of sulfide and transitional to oxide ore that negatively impacted throughput and recovery at Masbate, where Q3 output came in just shy of the 50,000-ounce mark. However, the biggest shortfall was at Fekola, where the rainy season delayed access to extremely high-grade Fekola Phase 6 ore.

B2Gold – Consolidated Gold Production & Fekola (Company Filings, Author’s Chart)

Given the reliance on low-grade stockpiles to replace delayed access to high-grade Fekola Phase 6 ore, the mine only saw a minor improvement in sequential production (Q3 vs. Q3) and a massive drop in production year-over-year (~129,900 ounces vs. ~165,600 ounces). The result is that B2Gold is heading into Q4 with just ~660,000 ounces of gold produced, a figure that is miles shy of the 1.0+ million-ounce guidance at the mid-point. On the surface, this might suggest a significant miss relative to the company’s guidance of 990,000 ounces to 1,050,000 ounces in FY2022. However, there are some important points worth making:

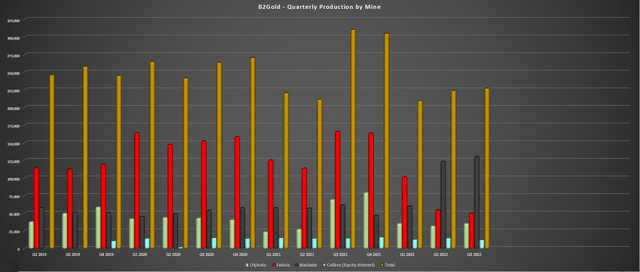

B2Gold – Quarterly Production By Mine (Company Filings, Author’s Chart)

For starters, the Fekola Phase 6 ore is extremely high-grade at 3.40+ grams per tonne of gold and is currently being mined, and the company has been consistently processing over 2.20 million tonnes per quarter due to outperformance at the mill. Based on what I believe to be reasonable assumptions of 2.35+ million tonnes processed in Q4 at an average grade of 2.80+ grams per tonne of gold and a 94.5% recovery rate, Fekola should produce at least 200,000 ounces in Q4, making up a considerable portion of the 330,000 gap that lies between year-to-date production and the low end of full-year guidance.

Meanwhile, at Otjikoto, the company should enjoy a very strong Q4 with ~65,000 ounces of gold production. I would expect this to be helped by a lift in head grades from the higher-grade portion of the Phase 3 Otjikoto Pit and high-grade stope ore from WSUG, which was delayed in coming online. Finally, while Masbate is expected to deliver into the lower end of its annual guidance, this asset should also contribute at least 50,000 ounces of gold in Q4. Combining this with 16,000+ ounces from the equity interest in Calibre would place Q4 production at just over 330,000 ounces, with B2Gold able to deliver into the bottom end of guidance.

Fekola Operations (Company Website)

It’s worth noting that this won’t be an easy accomplishment, with record production for the company coming in at just shy of 300,000 ounces in Q3 2021. However, the company has a track record of being conservative and delivering on its promises, and it’s certainly got significant tailwinds as it heads into Q4 as it benefits from much higher-grade ore at Fekola Phase 6, higher-grade zones at Otjikoto Phase 3 and Wolfshag Underground stope ore. In summary, I am cautiously optimistic that B2Gold can deliver within its guidance range, but it will need a massive quarter from Fekola (195,000+ ounces) vs. a previous record of 165,600 ounces in Q3 2021.

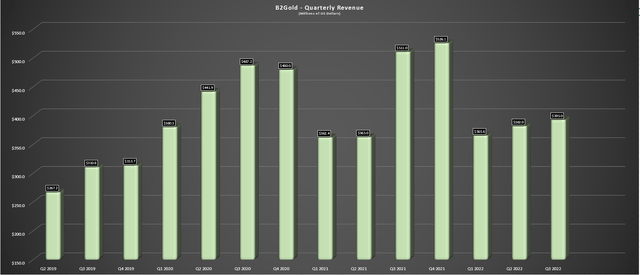

B2Gold – Quarterly Revenue (Company Filings, Author’s Chart)

Moving over to sales, B2Gold reported preliminary revenue of $393 million in Q3 2022, a significant decline from the $511 million reported in Q3 2021. While this is a massive drop (23%), this is largely due to being up against very difficult year-over-year comps having to lap a record quarter in the year-ago period. This was exacerbated by working with a lower average realized gold price, which was an $83/oz headwind in the period ($1,794/oz in Q3 2021 vs. $1,711/oz in Q3 2022). While this may look disappointing, I don’t see much value in judging a company with an outstanding track record by a single quarter, especially when it’s lapping extremely difficult year-over-year comparisons and has a record production quarter on deck.

Recent Developments

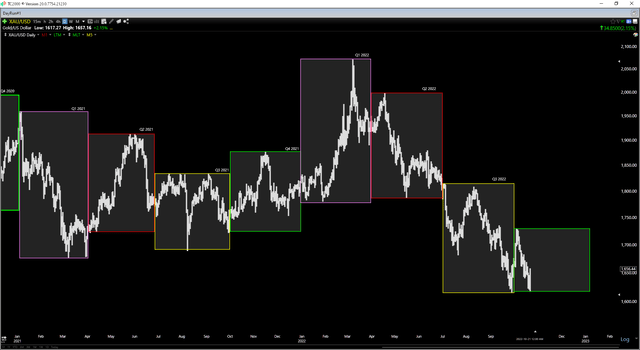

Looking at recent developments, the gold price weakness is certainly a negative development, and the decline below the $1,750/oz and $1,700/oz levels have led to a violent third leg down for the Gold Miners Index. This can be attributed to the margin compression we’re seeing for gold producers, who have to deal with inflationary pressures on the cost side and a lower gold selling price due to the commodity price weakness. Some investors unfamiliar with the sector or B2Gold might prefer to shy away given this margin compression, but it’s worth noting that some commodities look to have peaked earlier this year, and while B2Gold will see further margin compression, it still has exceptional all-in-sustaining cost margins (FY2022 estimates: $690/oz).

Besides, B2Gold is down over 50% from its all-time highs and is now trading at just ~5.2x FY2023 cash flow estimates at a share price of $3.05. This suggests that a lot of the negativity is priced into the stock, especially when these cash flow per share estimates ($0.59) are based on the gold price remaining under pressure for most of 2023. So, while the gold price weakness is certainly catastrophic for some miners that are not consistent and have $1,500/oz+ costs that have put extreme pressure on their profitability, this is not remotely the case for a producer with industry-leading costs like B2Gold (sub-$1,100/oz).

Gold Futures Price (TC2000.com)

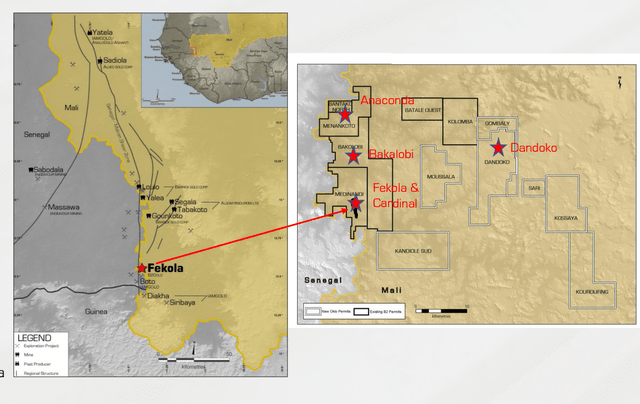

From a positive development standpoint, B2Gold noted in its Q3 preliminary results that it is working on a Fekola Complex Feasibility Study with the potential to increase its Malian production profile significantly. B2Gold discussed that it is looking at the possibility of a stand-alone plant capable of processing at least 4.0 million tonnes per annum of saprolite and oxide resources, with an option to add sulphide processing capability down the road. Investors should get more detail by this time next year, but early indications suggest that this could increase production to over 800,000 ounces per annum by 2026.

Assuming B2Gold chooses to go ahead with this expansion and that Otjikoto and Masbate can continue to combine for at least 380,000 ounces per annum, B2Gold has a path to becoming a ~1.25 million-ounce producer (including Calibre equity interest) in 2027. This is based on 380,0000+ ounces from its two smaller mines, 85,000 attributable ounces from Calibre (340,000 ounces at 0.25%), and 800,000+ ounces at the Fekola Complex (Fekola + Anaconda stand-alone facility). The result would represent 25% plus production growth from the lower end of 2022 guidance (1.0 million ounces), giving B2Gold one of the better growth rates in the sector among its peer group of million-ounce producers.

Mali Land Position (Company Presentation)

Just as importantly, a stand-alone facility in Mali should have quite reasonable capex compared to the massive Gramalote operation ($1.10+ billion with inflationary pressures) and certainly very reasonable capex compared to some of the massive greenfield projects being built in areas with higher-cost labor and tight labor markets (Ontario and Western Australia). So, with B2Gold having over $500 million in cash (~$0.50 per share) and over $1.0 billion in liquidity, I would expect the company to be able to easily fund its next phase of growth while maintaining an aggressive exploration budget to add additional ounces on its growing land position surrounding Fekola.

Valuation & Technical Picture

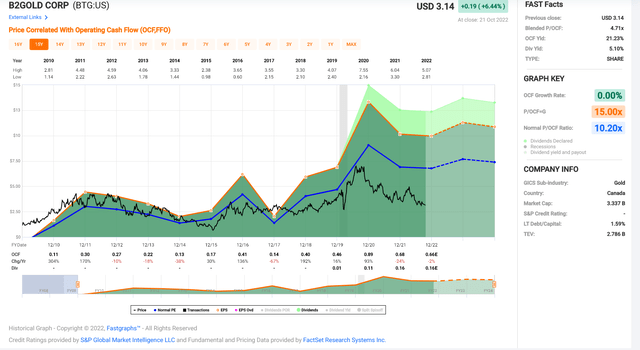

Based on ~1.07 billion shares outstanding and a share price of $3.10, B2Gold trades at a market cap of ~$3.32 billion. This leaves B2Gold trading at a forward cash flow multiple of 5.2 based on FY2023 cash flow estimates of $0.59. This compares very favorably to its historical cash flow multiple of ~7.7 (10-year average) and ~10.2 since 2008. I believe that a conservative multiple for the company is 8.25x cash flow based on its strong track record of delivering on promises and its peer-leading operating margins. Assuming the company meets FY2023 cash flow estimates, this translates to a 57% upside in the stock from current levels to its conservative fair value ($4.88).

B2Gold – Historical Cash Flow Multiple (FASTGraphs.com)

From a technical standpoint, there’s also a lot to like, with B2Gold trading within the lower portion of its expected trading range ($2.90 support vs. $4.85 resistance). From a current share price of $3.10, this translates to an attractive reward/risk ratio of 8.75 to 1.0, assuming this support level holds. So, with BTG long-term oversold after a 55% plus correction and also being undervalued at less than 0.85x P/NAV, I see the stock as a steal at current levels. To summarize, if I were looking for a way to get exposure to gold with a meaningful margin of safety, this looks like a low-risk area to start an initial position in the stock.

Summary

There’s no arguing that B2Gold’s year-to-date operational performance might be a little disappointing given that the company is tracking below guidance, which is rare for a company with this strong a track record. However, many of the issues were out of the company’s control, and the first half was expected to be much weaker regardless, with production back-end weighted due to much higher grades. That said, I’m cautiously optimistic that B2Gold can meet the low end of FY2022 guidance, and with the stock 55% off its highs, this is largely priced in already. Hence, I see BTG as a Buy below US$3.00.

Be the first to comment