J. Michael Jones

Shares of Truist Financial Corporation (NYSE:TFC) have lost about a third of their value from their early 2022 highs. However, this morning the company reported solid earnings that showed material upside from higher rates and only a modest deterioration in credit quality. At the same time, we are seeing expense benefits from the integration of BB&T and SunTrust systems. With well over $5 in earnings power, TFC is an attractive stock

In the company’s third quarter, Truist earned $1.24 in adjusted EPS on revenue of $5.88 billion. Earnings were a penny ahead of estimates even as revenue was a bit lighter than consensus. EPS was down 13% from last year, though this was more than entirely explained by the fact last year the company released credit loss reserves as the economy rebounded from COVID lockdowns, something that would not continue to recur. Overall, Truist generated a return on equity of 11.5% with an adjusted ROA of 1.28%.

Ultimately, the reason to own regional bank stocks during a Fed tightening cycle is to get exposure to rising interest income, and TFC delivered on this front. Net Interest income rose $620 million from last year to $3.78 billion, more than offsetting a $150 million decline in noninterest income as investment banking activity weakened by 30% given the substantial slowdown in M&A. Decreased mortgage origination activity was also a meaningful headwind from last year. This increased interest income helps to offset increased credit costs and boost profits.

Importantly, not only did interest income increase, but the company’s net interest margin also rose at 3.12%, up from 2.89% last quarter and 2.81% last year. This was due to solid performance on both the asset and the funding side of the balance sheet. Loan growth was 4.3%, and about 58% of its loans are corporate vs 42% consumer. The average rate on its loans rose from 4.49% to 3.91%, showing nice upward mobility alongside interest rates. The fact Truist’s loan book tilts toward commercial and industrial loans is a nice tailwind. Unlike mortgages which tend to be fixed rate for 30-year terms, most C&I loans are floating rate, meaning the interest Truist earns rises alongside the Fed funds rate. This gives its loan book significant upward exposure to higher rates as not only do new loans start with a higher rate but rates on existing loans also rise. This explains why yields on its loans could rise by 58bp in just one quarter. With the Fed continuing to raise rates aggressively, we should see another nice increase in Q4.

On the funding side, deposits were only down 0.9% sequentially and were up 4.5% from last year. Its cost of deposits rose 22bp to 0.31%. It is finding it has a deposit “beta” of 21%, meaning it has to raise deposit rates about 1/5 as much as the Fed raises rates to retain them. These betas can rise as the Fed raises rates more as consumers have more incentive to look for the most attractive yield, but with so much room before having to match the Fed, increased rate hikes should continue to expand Truist’s net interest margin.

TFC’s floating-rate dominated-loan book and its ability to retain deposits while only raising rates modestly has been a recipe for material net interest expansion, worth about $0.46 per share on a pre-tax basis. It should continue to be a tailwind for results in Q4 and likely Q1 2023 with the path from there dependent on whether the Fed continue to raise interest rates or not.

Noninterest expenses fell by $182 million (5%) from last year as its merger expenses fell $211 million; investors are starting to see what the cost structure looks like now that BB&T and SunTrust operates are largely integrated, and this substantial decline in costs during a period of elevated inflation is encouraging. The bank has closed 399 branches to eliminate overlap between the two legacy bank networks. Last year, one-time merger expenses were $0.21 per share; this quarter, such expenses were $0.09.

On the negative side, investment banking revenue fell by $33 million sequentially and by 30% from last year, but as just about 5% of Truist’s business, the company is less exposed to markets and M&A activity than the large investment banks like Goldman Sachs (GS). Wealth management assets under management did fall 3.5% to $173.9 billion as market declines offset fund inflows. Just about every wealth or asset manager is reporting assets under management (“AUM”) declines, so this was not a particular surprise, and actually a smaller decline than many others indicative of the solid inflows.

Bank investors are now laser-focused on credit losses as fears of a recession dominate. Truist did take $234 million in provisions for credit losses, up from $171 million last quarter (there was a $324 million reserve release last year). These provisions were entirely in the consumer division; there was actually a small net decline on the corporate side. Charge-offs totaled $213 million, so the net build was actually quite small at $23 million.

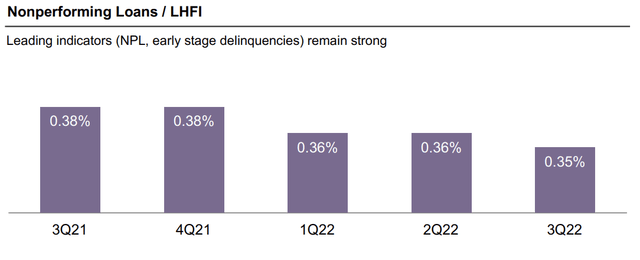

I would note while losses are normalizing from extremely low levels in 2021 that credit quality is strong. While there were 0.27% in charge-offs, nonperforming loans actually ticked down during the quarter. Today’s nonperforming loans are tomorrow’s potential loss, so the fact NPLs are still so low leads me to expect that we should not face material further degradation in credit provisions, absent a much sharper economic downturn.

Truist also remains well capitalized with a CET1 capital ratio of 9.1%, which enables the bank to support ongoing loan growth and shareholder returns. During the quarter, it raised its dividend 8% to $0.52. That gives shares an attractive 4.7% yield. Book value per share is $40.79.

Over the next two quarters combined, Truist should conservatively be able to increase its net interest income as much as last quarter, or another $600 million tailwind. Even if we assume a doubling in credit provisions and a further 15% decline investment banking activity, that is an additional $350 million in pre-tax income or another $0.20 per share in quarterly EPS. While investors are focused on credit losses, the higher interest margins are so powerful that this can comfortably be funded and still result in higher earnings. I do not expect credit costs to rise this much, but it illustrates the bank’s earnings power, which I see as $5.50-$6.00 next year. That gives the stock just an 8x multiple.

As investors appreciate how Truist’s expense load is falling now that merger costs are largely behind it and that its loan book is well positioned to benefit from higher rates, this stock should trade at least 10x earnings or above $55 per share. In the meantime, investors collect an attractive dividend, providing total return potential of 25%. I would be a buyer of shares.

Be the first to comment