HJBC

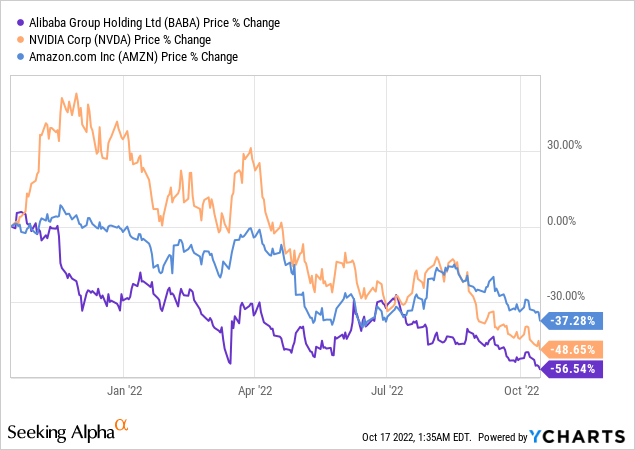

As shown in the chart below, NVIDIA (NVDA) has suffered following the U.S. Department of Commerce’s decision on October 10 to restrict the export of its advanced A-100 AI chips to China with Alibaba’s (BABA) shares also dropping for related reasons.

I will provide a detailed explanation for the above price actions in this thesis whose main objective is to explain how U.S. peer Amazon (NASDAQ:AMZN) could profit from Alibaba’s sufferings. For this purpose, I start by providing some insights into China’s thriving cloud and AI sectors.

Cloud sector and Alibaba’s eCommerce

We often hear of the Chinese government cracking down on its tech sector with sweeping regulations, but we often overlook that today’s China is the main competitor of the United States in the field of AI (artificial intelligence). For this matter, the country’s research including AI start-ups spent about one-fifth of the world’s total private investment funding in 2021 with a lot of opportunities being created, with 64% of payments being made through smartphones.

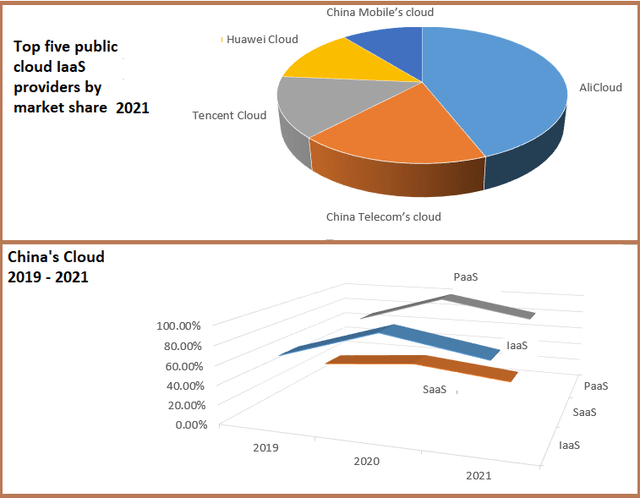

The country’s top five public cloud providers offer AI-based applications ranging from image recognition, advanced computing, eCommerce, and gaming.

Charts built using data from (interconnected. blog)

As shown in the chart above, their growth since 2019, especially in PaaS or Platform as a Service compared to IaaS and SaaS remains impressive despite having slowed in 2021.

With 34.3% of China 2021’s cloud market share, AliCloud’s position is somewhat analogous to Amazon’s AWS which has about 33% of the market share in front of the other two cloud infrastructure providers Microsoft (NASDAQ:MSFT) with Azure and Alphabet (NASDAQ:GOOG) with GCP.

Besides their cloud businesses, Amazon and Alibaba are two eCommerce giants, which compete aggressively against each other to win over more online customers. For this purpose, they both have their own payment systems, but, in the new online marketplace, more is required in terms of sentiment analysis in order to always be a step ahead in anticipating what the customer wants and what items need to be present in the inventory. This is where AI comes into play.

Amazon v/s Alibaba for AI

While Amazon Connect uses AI-driven speech analytics to provide real-time customer insights to help contact center agents track customer sentiment, Alibaba’s Taobao uses AI-powered chatbots to discern the intent behind customers’ queries. The aim in both cases is to recommend additional products to customers based on their profiles and resolve issues more efficiently. In addition, both companies now have matured AI applications deployed in the areas of online retail, inventory management, and logistics.

Their underlying massive IT infrastructures support various computing scenarios, including graphics as well as large-scale machine learning tools in heterogeneous cloud data centers including big data applications. These not only support both companies’ internal operations but also offer robust services to corporate customers. Now, these data centers need processors like some of Intel’s (NASDAQ:INTC) CPUs processors which can be used for AI. However, after a breakthrough innovation called Tensor Core, NVIDIA, has instead developed GPUs that are more efficient while needing less power.

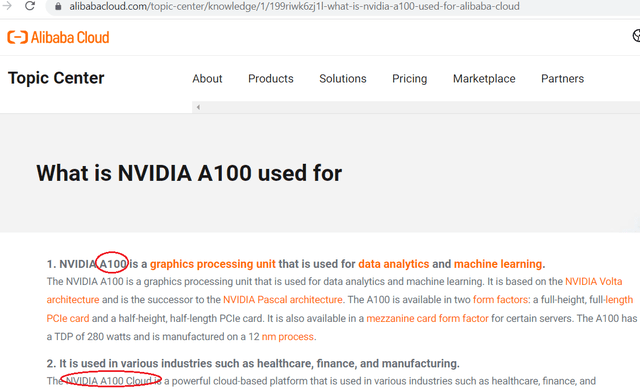

Interestingly, as pictured below, the Chinese eCommerce and cloud computing giant uses NVIDIA’s A100 to provide GPU services for industries spanning healthcare, finance, manufacturing, and classification of images.

Alibaba using NVDIA’s A-100 (www.alibabacloud.com)

In this connection, Alibaba took first place in front of Amazon during the DAWNBench competition for speed of image classification some years back. Hence, depriving the Chinese company of NVIDIA’s AI processors for its cloud infrastructure (as a result of U.S. sanctions) could impact its very competitiveness, which depends on continuously improving the performance and versatility of its machine learning algorithms.

Boosting Amazon’s competitiveness by 6 times

However, benefiting from a reprieve, NVIDIA can export GPUs to China till March 2023 which means that Chinese hyperscalers should not be impacted too much in the short term, but, the real pain will be felt by the fact that it cannot use the latest H100 GPU version which offers unprecedented performance.

NVDIA’s H100 (www.nvidia.com)

When the GPU was unveiled last year, all the hyperscalers including Amazon, Alibaba, Google, Microsoft, Baidu (BIDU), and Tencent (OTCPK:TCEHY) were planning to offer it as part of their AI clouds. Now, the Chinese tech giants will be deprived of the H100 and, given that it may take 3-5 years for a Made-in-China equivalent to emerge, they will surely lose in terms of competitiveness with respect to their American counterparts for applications that rely on AI.

Specifically for Amazon and Alibaba, some of the areas where machine language is useful are logistics, automation of storage operations in the warehouse, management of transport fleets, and interpreting and integrating updated traffic information in real time. In this respect, in contrast to conventional methods which take time, AI has the capacity to combine sales history with data extracted from social networks or other internet sources to predict the behavior of demand while ensuring optimum supply routes.

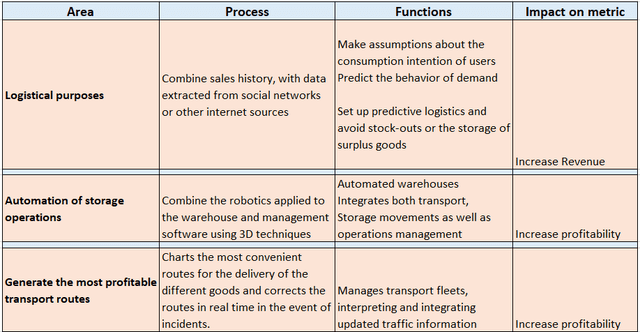

Pursuing further, the table below shows the areas where technology can be a game changer, and is aligned with Amazon’s strategy to deliver goods faster through the use of automation while opting for the most profitable transport routes. Thus, faster algorithms can optimize the company’s supply chains resulting in more productivity as it reduces its headcount by 100K.

Table built using data from (www.transmetrics.ai)

Now, considering that NVIDIA’s H100 is six times faster than the previous generation A100, it will offer Amazon an edge over its Chinese peer, enabling it to garner more revenues and profitability as shown in the above table.

Translating superior performance into sales

This performance differentiator together with the improvement of the supply management it brings in its wake should enable the American eCommerce giant, to reclaim back the market share it lost, especially in Eastern Europe to AliExpress in 2020. Here, the fact that Amazon sells goods directly to customers, compared to AliExpress which relies mostly on the B2B model should help it gain market share rapidly as it has more control over the entire supply chain.

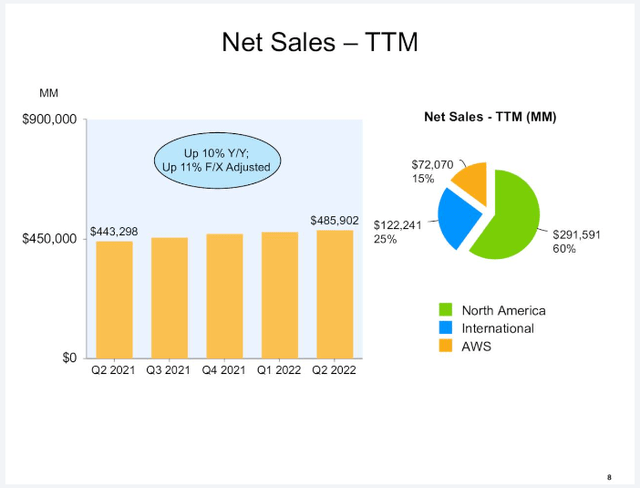

Looking at revenues for the second quarter of 2022, the company’s international sales which include Europe were at $122 billion from July 2021 to June 2022 and constituted 25% of total sales.

Net Sales by Geography (www.seekingalpha.com)

Now, the H100 is already in production, and assuming that AWS is able to upgrade its infrastructure by 2024 and optimize its supply chain algorithms, the U.S. company should harvest the full benefits only during fiscal 2025. For that year, analysts have predicted an 11.95% YoY growth to $768.3 billion in revenue. Now, assuming Amazon doubles its rate of growth at 23% after equipping its IT infrastructure with AI processors which are six times faster than the previous generation, the forward price to sales should fall to 0.71x (1.42/2) or lower than the sector median of 0.78x. Adjusting the share price based on Amazon’s forward P/S of 2.0x, I obtain a target of $301 ((106.9 x 2)/0.71)) based on the current stock price of $106.9 for the end of 2025.

To be realistic, AWS also faces competition from Microsoft and Google in the cloud space, and several competitors in the ecommerce space, both local ones in the different geographies it operates as well as some big ones in the U.S like Walmart (WMT), but, none of these have its massive scale especially when it comes to synergizing AI for both its AWS cloud and online marketplace.

Also, this above $300 price target is for the long term, and in the meantime, the stock market is highly volatile as the Federal Reserve has clearly voiced out its mandate to fight high inflation. This may entail much higher interest rates at the point of inflicting a slowdown in the economy or inducing a liquidity crunch.

Conclusion

This thesis makes the case for investment in Amazon, based NOT on selling a few more of its Alexa AI-driven voice kits, but more on its underlying machine learning algorithms being accelerated sixfold while its main Asian competitor is sidelined. This is analogous to hardware manufacturers Dell (DELL) and HPE (HPE) benefiting from additional market share after Huawei had to liquidate its XFusion server business after being denied Intel’s x86 processors as of 2019.

Moreover, for those who are still in doubt about Chinese progress and ambitions, they will note that Alibaba boasts the largest enterprise intelligent computing center in the world, offering up to 12 ExaFLOPS of AI computing power, dwarfing Google’s 9 ExaFLOPS and Tesla’s (NASDAQ:TSLA) 1.8 ExaFLOPS.

Therefore, in addition to denying China of the computing power it needs to develop the most sophisticated weapons, these export restrictions should boost U.S. competitiveness in areas lie the cloud and eCommerce. Ultimately, it will also depend on how Amazon is able to take advantage of the temporary window of opportunity offered to it as China is sure to ramp up domestic capability.

Be the first to comment