Getty Images/Hulton Archive via Getty Images

Note: This article was published to the Daily Drilling Report on Oct. 8th.

Introduction

HighPeak Energy (NASDAQ:HPK) has a contrarian philosophy to many of its start-up peers. Where many junior and senior operators have rolled out a capital restraint mentality that allows only for single-digit growth, HPK has turned that model on its head. They are punching holes in the West Texas prairie like the “Spindletoppian Wildcatters” of old. You don’t often get a growth story as clear cut as the one for HighPeak. Here are the details.

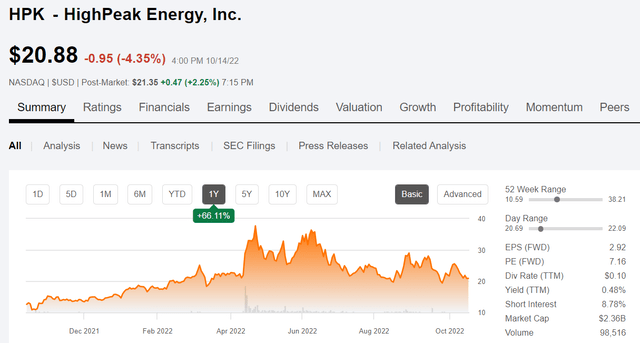

HPK price chart (Seeking Alpha)

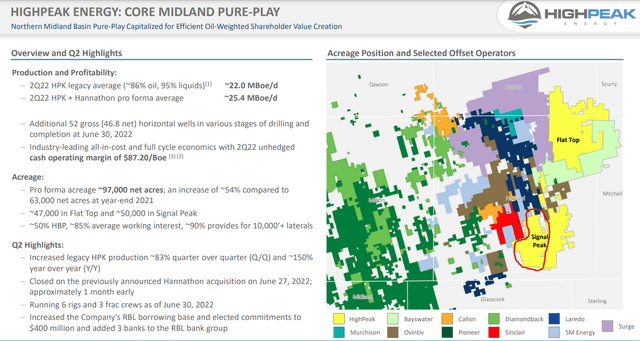

The company focuses its operations in the northern lobe of the Midland sub-basin of the Permian, primarily in Howard County. HPK has been growing rapidly organically and through strategic acquisitions since its formation a couple of years ago.

The company isn’t widely followed by the analyst community, but the two listed in this WSJ link have a buy rating on it. Price targets range from a low of $40 to $50, meaning a potential doubling from its current level, if these valuations can be justified. Conceptually, more oil coming into the market we see developing in 2023, should validate these estimates, and boost the shares.

The thesis for HighPeak

The company was formed in 2020 by the Jack Hightower, a serial oil and gas company starter with decades of experience developing properties and then selling them to larger companies. The most prominent example of which being the sale of Pure Resources to Unocal for ~$400 mm in 2002. HighPeak received the assets owned by Hightower’s Pure Acquisition Corp., and then in 2022 closed the acquisition of 18K acres from Hannathon Petroleum, that bolted on to their acreage in the Signal Peak area. This included $283 mm in cash and $97 mm in stock. I’ve circled the Hannathon buy in red on the slide below to illustrate what a strategic pick up this was.

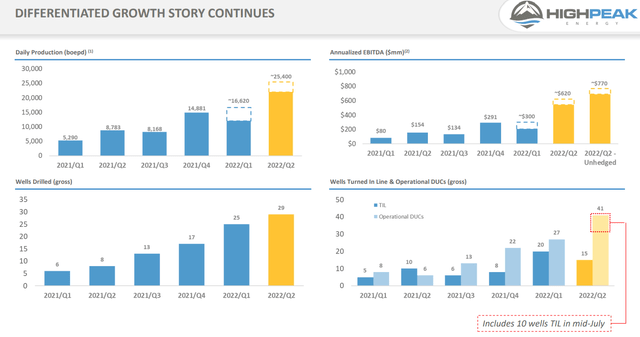

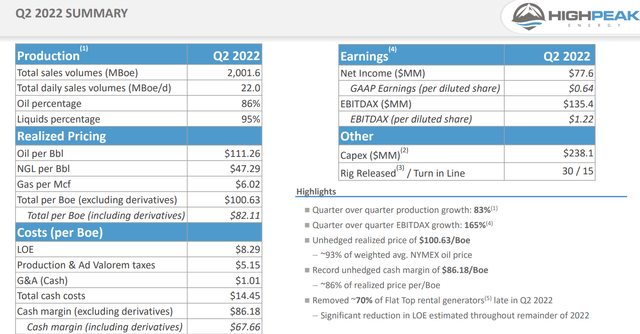

This is a liquids rich section of the play, and you will see as of Q-2, HPK was producing 95% liquids, oil and condensate. Growth has been meteoric, rising from 12K BOEPD in Q-2 to 22K BOEPD in Q-2. Jack Hightower, CEO, comments on the HPK growth profile:

We’re going to continue that as we go forward and looking forward to the rest of this year and into next year and throughout next year, we’re going to continue this growth profile, which is unprecedented in the industry.

The company also lists an amazing cash margin for production in Q-2, driven by low costs. This is impressive in the face of cost inflation being experienced by many operators. The six rigs the company is running is an impressive stat given their size and the demand for rigs, and must have been the product of some far-thinking negotiations in the dark days of 2020. HPK is programming 35 new wells per quarter for 2022, and an equivalent number of DUCs.

Growth plans and high margins form the core thesis for owning HPK.

Q2 2022

The company generated revenues of $201 mm for the quarter, which included $98 mm of OCF, an increase of $49 mm from Q-1. Capex included the Hannathon closing costs of $400 mm, and was $483 mm. LT debt is $488 mm consisting of $225 mm of notes due February 2024, and $285 mm on its $400 mm Reserves Backed Loan-RBL, due 2023. Total liquidity consists of $22 mm in cash and a remaining $138 mm on the RBL.

Several potential catalysts for HighPeak

The first catalyst is that HPK is very quickly approaching cash flow neutrality. With the rate at which they are adding production over the next 12 months, the company forecasts reaching somewhere between 65,000 and 80K-plus thousand barrels a day. Or nearly triple today’s output. Meaning by 2024, they can literally go down almost 50% of budget to maintenance capex, and with 50% less rigs running and still maintain in excess of $1 billion a year, possibly as high as $1.5 billion a year of operational free cash flow.

Essentially, costs will decline and be distributed over a much larger production base. Jack Hightower discusses the impact of “front footing” capex in an era of high prices:

We are an operational differentiated growth story in that if oil prices go down, we can eliminate some of our drilling rigs and reduce our capital expenditures. But as long as oil prices remain where they are today, it would be crazy with payouts happening as quickly as they are for us not to keep six rigs operating. One thing that people are thinking about is inventory. We had literally differentiated now over 50-year rig life years, and that’s almost 8.3 — at 6 rigs running at 8.3 years of drilling activity. So it doesn’t matter what price you want to use.

A wildly differentiated model from the one where more senior producers are just holding capex steady to maintain rather than grow production.

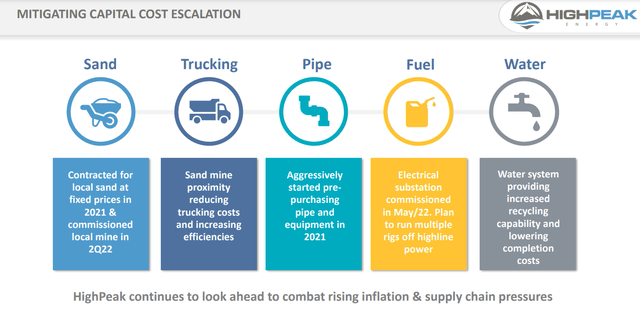

The second catalyst is their determination to reduce capex per well. Key here is the electrical substation for Flat Top that puts that area on the grid and eliminates diesel generators. Ryan Hightower, EVP, HPK, comments on this event and the use of wet sand from a local mine:

The HighPeak substation has enabled us to begin removing rental generators which is estimated to reduce lease operating expenses throughout the year, further expanding our industry leading margins while greatly reducing our carbon footprint. We started powering one of our drilling rigs with highline power, saving roughly $90,000 per well at today’s diesel costs. The use of local wet sand is decreasing capital costs per well while also reducing emissions associated with trucking and drying the sand. When fully utilized, wet sand will save approximately $300,000 per well.

You can see from the slide below that HPK is running the full gamut of cost saving and ESG measures to reduce costs and conserve resources in their operations.

The third catalyst for HPK is the company’s commitment to building out its acreage footprint. From the time of their IPO last year, the company had 51,000 acres under lease. As of the end of Q-2, they had closed on over 97,000 acres which is a ~50% increase in the last year alone. It was also mentioned in the call line that additional acreage buys were underway that would take them well over 100,000 acres.

As we all know, size matters in this business. Among other things, it enables the drilling of long laterals to optimize capital efficient draining of the reservoir, as well as large commodity buys – sand, pipe, and water treatment services.

A Risk

Takeaway is always an issue for growth. If you can’t move it to market then drilling has to be suspended. Flat Top gathering infrastructure is about 40% built out, and the company expects to have it complete by Q-4, 2022. In regard to Signal Peak, the company reports the following:

We are also in the process of negotiating long-term gas and oil takeaway opportunities on the legacy Signal Peak area. With our recent positive well results, we do expect to receive very favorable pricing terms.

It certainly makes sense that these agreements are not as mature for Signal Peak as they are for Flat Top. With Howard County’s location and a number of pipelines passing through on their way to sales points on the Gulf Coast, I doubt takeaway will be a big issue here. If it is, though, it’s a problem for HPK’s growth plans, as the default would be tanker truck and rail. Expensive.

Hedging

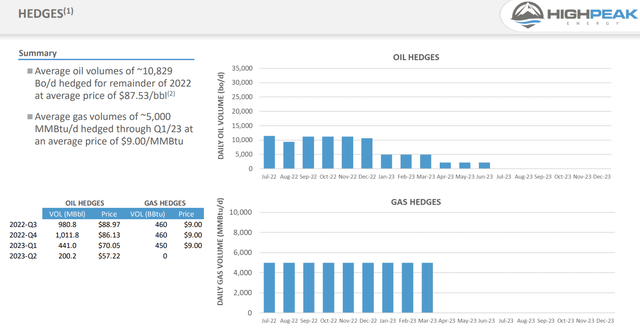

The company is minimally hedged as shown below, and at pretty good pricing. Upside exposure is positive with growth production, and at today’s prices should have finished the quarter with realizations at or near the settlement price of their hedges.

Your takeaway

HPK looks like a winner to me. The counter-cycle strategy of growing rapidly when everyone else is just maintaining, makes sense to me. I buy into their strategy of frontloading capex while oil prices are in an already high and still ascending trajectory.

Currently, the company is trading at 5X EV/EBITDA, kind of high. But let’s acknowledge their rapid growth. Their P/FB is also high at $128K per barrel, so no great bargain there either. Clearly the analysts are factoring growth into their price estimates for the company, so we will too.

With six rigs and three frac spreads churning constantly, they are going to add 35-40 new wells per quarter, and should easily hit their target of between 65 and 80K BOEPD by YE 2023. With their cash margin in the $65-$70 range – including derivative costs, that’s another ~$1.5-$2.0 bn in OCF on an annual basis, at a time when capex will be cut in half.

Folks, HPK is set up to be a money machine, and shareholder returns should explode next year as this comes to fruition.

Using the EV/EBITDA metric, to maintain the same 5X multiple, the shares should rerate to $90-100. Obviously no one is forecasting this, but it makes the analyst projections of up to $50 per share seem fairly achievable, and would put the multiple at a very competitive ~3X. That would also put their P/FB down in the $75K per barrel range and be more consistent with other companies or at a slight advantage to many.

I think investors with a moderate risk profile should take a hard look at HPK, to see if this company fits into their portfolio.

Be the first to comment