Maja Hitij/Getty Images News

I understand that everybody is bearish right now: Everybody is bearish right now about the stock market (which is the reason we might move higher in the coming weeks). And everybody is particularly bearish about Europe and especially Germany. And without doubt, Germany is facing a challenging winter – probably from an economic standpoint and therefore also from a political standpoint. Keeping that in mind, the headline might sound outrageous. You might also point out me being wrong about Bayer AG (OTCPK:BAYZF) in my last article when I saw the stock as a buy about six months ago and it declined 34% in the meantime (about 25% when looking at the stock price in Euro).

Nevertheless, I remain convinced that Bayer is trading well below its intrinsic value and will argue in the following article why fears about a blackout are overblown and why Bayer will perform quite well in the coming years (despite the highly probable scenario of a global recession/depression).

Europe Energy Crisis

Let’s start with the European Energy Crisis, which is causing a lot of uncertainty right now. And many European countries will face a tough winter – and especially Germany might be affected more than other countries as my native country made the fatal mistake to depend on Russia for energy. This led to cheap energy for Germany for many years but created a problem today for reasons I don’t have to explain anymore. And investors are obviously punishing European (and especially German) stocks right now as they are expecting the worst for the winter.

However, I like to offer some counterarguments to the narrative of a catastrophic winter. In my last article about Henkel (OTCPK:HENKY), I also talked a bit about a potential energy crisis. The situation in Germany is critical and we should not sugar-coat the situation. It is also possible that energy demand can’t be met by the energy supply which could create turbulences. But a real blackout for 24 hours and more (the narrative which is pushed frequently) seems unlikely. It seems possible for huge factories – including Bayer – being detached from electricity supply for several hours to stabilize the situation. However, we are talking about brief periods and about critical, but manageable, situations.

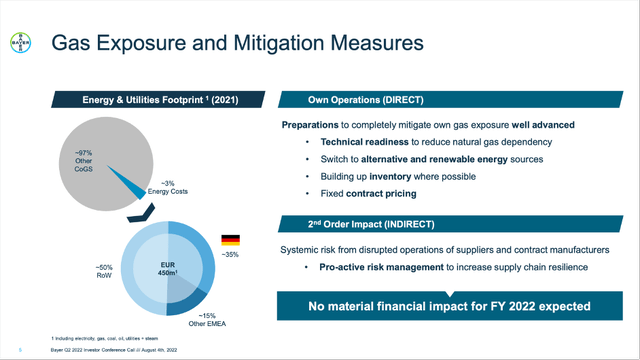

Additionally, Bayer is not extremely energy intensive. Energy costs are making up only about 3% of costs of goods sold for Bayer and so far, management is seeing no material financial impact for full year 2022 results (the company even raised its guidance – we will get to this).

Rising energy costs are certainly a drag for Bayer and the risk of a forced production stop for a few hours is not really a good outlook. But there seems to be no reason to expect doom and gloom and Werner Baumann also seemed rather optimistic (as far as one can be optimistic in the current situation) as he commented during the earnings call:

From a cost perspective, our total energy and utilities costs represent around 3% or €450 million of our total cost of goods sold, with approximately 35% in Germany and 15% in the rest of Europe, all related to 2021 data. We have fixed contract prices for significant parts of our natural gas demand at low price levels. In Germany, unless government provisions supersede these agreements, 70% of the demand is contractually fixed for this year, and actually about half of the volumes are also fixed for next year.

The situation in Germany is not critical because of a potential long-lasting blackout. It is critical as the country will most likely end in a recession – a fate Germany will be sharing with many other countries around the world. But Bayer will be able to manage a recession.

Looking Optimistic Into The Future

In 2023, most countries around the world could be in a severe recession – and the European Energy Crisis might only be one of the catalysts. But Bayer can be seen as a rather recession-resilient business. All three business segments are producing essential items, which are either purchased by end-consumers (consumer health), are necessary for food production (crop science) or are essential to treat severe illnesses (pharmaceuticals). And while we could see a declining demand for certain products of Bayer’s consumer health segment and lower demand for crop science products, I don’t see a steep decline. It is extremely difficult to postpone purchases or to abstain from using these products and Bayer’s sales will probably remain more or less stable.

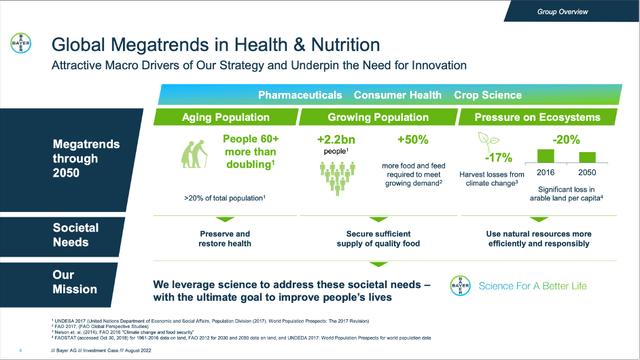

Bayer August 2022 Investment Case Presentation

And as I have already mentioned in past articles, Bayer is profiting from several tailwinds and is operating in three markets, that are not only rather recession-resilient but might also see increased demand in the coming years and decades. In a previous article, I already wrote about Bayer’s Capital Markets Day 2021 and the mid-to-long term targets for the three different segments. For the pharmaceutical segment I wrote:

When summing up, Bayer is expecting pharma sales to increase between 3% and 5% in the next years until 2023. For fiscal 2024, the company is expecting pharma sales to decline in the low-to-mid single digits compared to fiscal 2023 and it is also expecting the trough in sales. After 2024, Bayer is much more optimistic than the market and expecting sales to increase and the segment to return to sustainable growth.

But Bayer is not only expecting growth rates of 3% to 5% for its pharmaceutical segment. It is expecting similar growth rates for its two remaining segments – crop sciences and consumer health – and in the second quarter, Bayer showed impressively it can meet these targets.

Improving Business

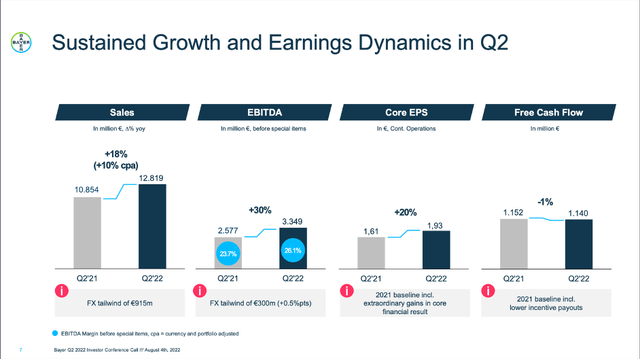

A third reason we should be rather optimistic about Bayer is the continuously improving fundamental business. When looking at the results for the second quarter of fiscal 2022, Bayer reported solid numbers. Sales increased from €10,854 million in Q2/21 to €12,819 million in Q2/22 resulting in 18.1% year-over-year growth. And although the 8.4% growth stemmed from currency effects, about 9.5% increase in sales is due to higher prices for the products.

EBIT before special items also improved from €1,620 million in the same quarter last year to €2,280 million this quarter – an increase of 40.7% year-over-year. And core earnings per share from continuing operations increased from €1.61 in Q2/21 to €1.93 in Q2/22 – an increase of 19.9% YoY. Only free cash flow declined slightly from €1,152 million to €1,140 million – a decline of 1.0% YoY.

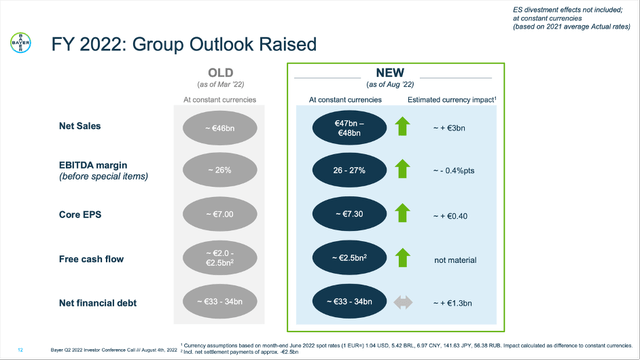

Aside from reporting strong quarterly results, Bayer also increased its guidance for fiscal 2022. Net sales are now expected to be between €47 billion and €48 billion (instead of €46 billion before). Core EPS is now expected to be around €7.30 instead of €7.00 before and free cash flow should be around €2.5 billion (compared to a range between €2.0 billion and €2.5 billion before). We should point out again, that free cash flow assumptions are already including about €2.5 billion net settlement payments and free cash flow would actually be higher (about €5 billion).

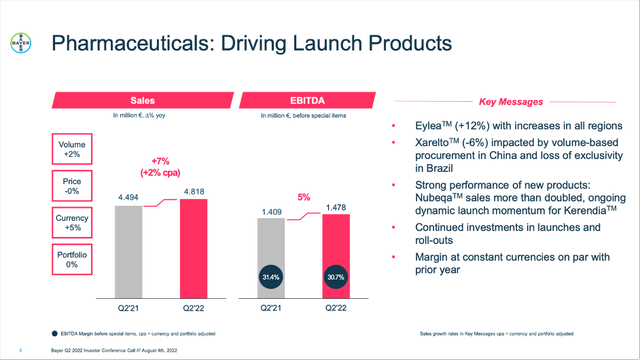

And when looking at the three different segments, all three contributed to growth. Pharmaceuticals, which is number two according to sales and EBITDA, could report 7% net sales growth (2% growth at constant currencies) and 5% EBITDA growth.

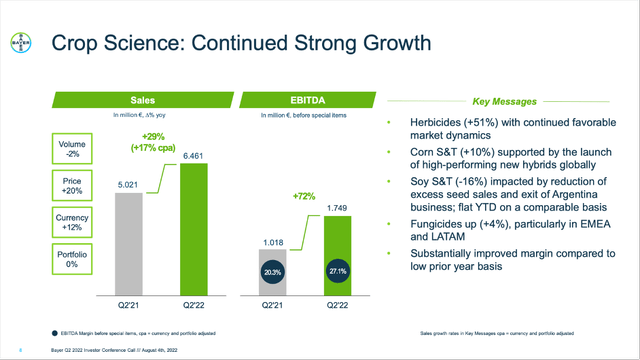

The most important segment – Crop Sciences – could report impressive sales growth of 29% year-over-year. And although fluctuating FX rates were a tailwind, growth in constant currencies was still 17%. And EBITDA increased even 72% year-over-year. Of course, we should not ignore Consumer Health (although it is contributing a much smaller part to revenue and EBITDA than the other two segments), which could report 16% year-over-year net sales growth (with sales growing 7% in constant currencies) and EBITDA increasing 19% year-over-year.

Stock Deeply Undervalued

And finally, Bayer still seems to be deeply undervalued. We can start by looking at the price-earnings ratio the stock is currently trading for. When using the expected core EPS for fiscal 2022 (which will be around €7.30), Bayer is trading for a forward P/E ratio of only 6.5 right now. We should not forget that the core EPS is an adjusted number Bayer is reporting and I am always a bit careful with adjusted numbers. But Bayer’s stock seems to be extremely cheap – even if the core EPS is a bit “tweaked”.

We can also back up this statement by calculating an intrinsic value using a discount cash flow calculation. And as always, we must make some assumptions. For fiscal 2022, we assume €2.5 billion in free cash flow – according to management’s updated guidance. In the past, management stated it is expecting at least €5 billion in free cash flow in fiscal 2024 (and without the litigations, Bayer would also report about €5 billion FCF in fiscal 2022). For fiscal 2023, we assume about €4 billion in free cash flow.

And for the years following 2025 until perpetuity, we assume 5% growth. Additionally, we calculate with 982 million outstanding shares and a discount rate of 10%. Using these assumptions, we get an intrinsic value of €89.84 for Bayer, and there seems to be more than 80% upside potential right now.

Don’t Forget The Litigations

But despite all the optimism, we should not forget about the dark clouds still hanging over Leverkusen, Germany. Bayer is still facing litigations due to the acquisition of Monsanto and RoundUp and during the last earnings call, Werner Baumann gave updated numbers. There are about 141,000 claims in total and about 108,000 have been settled. And although there was little dynamic in the recent past (not much new claims), about 33,000 claims are still not settled. The battle is still ongoing with Bayer having a winning streak in the recent past, but also reported setbacks and court rulings against Bayer. Overall, uncertainty remains, and we won’t know if €9,039 million set aside for litigations (on December 31, 2021) will be enough.

And the balance sheet remains an issue and is far from perfect. On June 30, 2022, Bayer still had €6,573 million in short-term liabilities as well as €38,061 million in long-term liabilities. And when comparing the total debt of €44,634 million to the total equity of €38,019 million, we get a D/E ratio of 1.17 which is not perfect but acceptable. Aside from high amounts of debt, Bayer also had €41,583 million in goodwill on its balance sheet, which is also not great.

The company also has €3,412 million in cash and cash equivalents but compared to €44 billion in debt this is a rather small amount. Aside from calculating a debt-equity ratio, we can also compare the total debt to the operating income (or EBIT) the company is generating annually. In four of the last five years, EBIT before special items was between €7.0 billion and €7.3 billion. When taking that amount – after subtracting the available cash – it would take six times the current EBIT to repay the outstanding debt. And that is certainly not a perfect ratio and a higher ratio than I am usually willing to accept. But Bayer is a business with an economic moat, recession-resilient and so deeply undervalued that the risk-reward assessment is in favor of Bayer.

Conclusion

I know that almost 100% upside for the stock is a bold claim and can be called a rather sensational headline. But I honestly believe that Bayer is deeply undervalued. And even when Bayer is doubling in value again, we only get a share price of €90 to €100, which is still way below the all-time high of almost €150. Of course, we are facing tumultuous times for the economy (for the German economy in particular) and the still looming litigation risks should also not be ignored.

Nevertheless, Bayer is trading for an extremely depressed stock price, and as the stock lost about 25% in value again compared to my last article, the stock is a tempting buy once again. And with global stock markets facing a high risk of steep declines in the coming quarters, it will be difficult for Bayer to go against that trend. Hence, there is a chance for the stock staying at that depressed level for quite some time.

And I certainly don’t want to bash Baumann; although, in his time of being CEO of Bayer (since 2016), the stock performance was horrible. Baumann said already in 2020, he will step down in 2024. In September it was reported by Bloomberg that Bayer has started its search for the person to replace Baumann as CEO and there are also speculations Baumann might leave before 2024. And as Baumann seems to be controversial as CEO of Bayer (as he is responsible for the Monsanto acquisition, which is seen as a disaster by most investors), announcing a new CEO could be a catalyst for the stock to finally move higher towards its intrinsic value.

Be the first to comment