adamdodd

Thesis

In 2020, American Express Company’s (NYSE:AXP) business has been hit hard by the pandemic as consumer activity plummeted, and travel, an important part of AmEx’s strategy, was no longer such a usual part of people’s lives. While consumer activity has long returned to pre-pandemic levels and even surpassed it, the recovery of the tourism industry, which is considered one of the main catalysts for further business growth, remains in question.

Tourism and AmEx

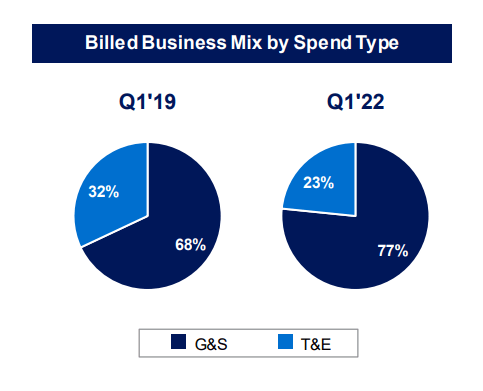

Since a big part of AmEx’s revenue is related to tourism and travel, further growth will also be supported by the recovery of this area. Travel & Entertainment accounts for 23% of total revenue, down from 32% in 2019.

American Express

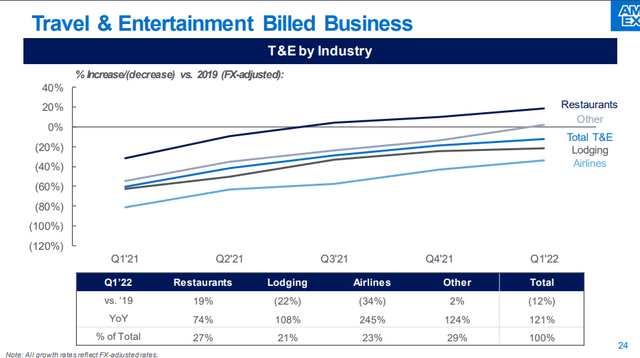

Only the restaurant business has recovered to 2019 levels, with air travel and hospitality still showing lower occupancy rates, according to the company.

First of all, the recovery of the aviation industry will benefit from the strategic partnership with Delta Airlines (NYSE:DAL) that AmEx entered into in 2019 for 10 years, thus extending the 5-year agreement of 2014. Delta provides travel-related benefits and services, including airport lounge access to select cardholders. The management expects the airlines’ capacity to get to 2019 levels in 2023. In addition to Delta, American Express has partnerships with British Airways, Emirates, Etihad, and Finnair.

American Express also creates unique offers for its partners in the hospitality industry. For example, the company partnered with Hilton (HLT) in Q4 2021 to develop an attractive welcome bonus program with the ability to earn membership rewards. Partnerships with Hilton, Marriott (MAR), and Radisson, where owners can redeem points earned on the AmEx network, will also boost revenue.

At the same time, the company owns the amextravel.com website, which features more than 1,800 hotels. The portal allows users to book trips and use membership rewards points directly to book trips and activities instead of transferring the rewards to partner airlines or hotels.

amextravel.com (American Express)

Summing up, American Express has one of the strongest travel business models that creates a massive opportunity to benefit from the recovering industry.

Macroeconomic environment

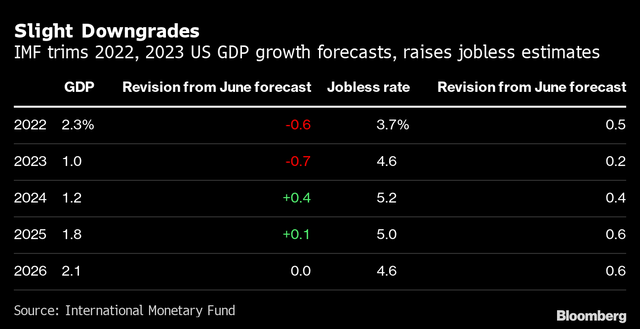

Despite the significant uncertainty associated with ongoing macroeconomic and geopolitical risks, I still don’t think a recession is inevitable. This is also indicated by the estimates of leading international organizations such as the IMF, OECD, and the World Bank. In recent months, these organizations have significantly lowered their economic forecasts, but they all continue to base their base case on global GDP growth in 2022 and 2023, with positive dynamics expected in all major countries and regions of the world. In particular, the IMF in its latest report expects the U.S. economy to grow by 2.3% in 2022 and by 1% next year.

Against this background, we can say that the U.S. economy is not weak enough to stop people from traveling. Given the unusual macroeconomic environment we find ourselves in, consumers are reluctant to spend less despite raging inflation as the labor market remains very strong. Thus, we can also count on further growth in consumer and business spending on American Express cards.

2022 travel season

The 2022 travel season is facing lots of problems that it pretty much inherited from 2021.

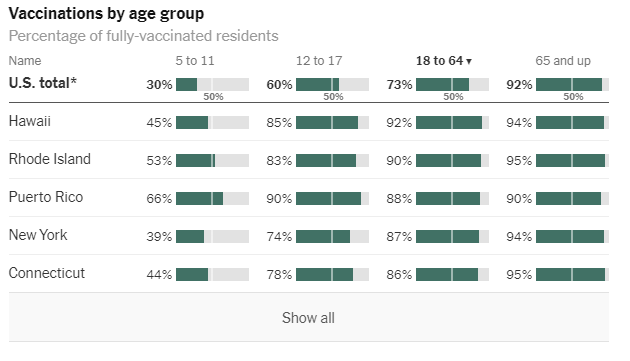

The first problem to overcome was COVID. According to the New York Times, as of July 14, 73% of the U.S. population aged 18 to 64 is fully vaccinated. A huge number of countries are canceling the mask regime and restrictions on international travel. Thus, travelers will have more opportunities for traveling abroad.

nytimes.com

Then, inflation. Despite skyrocketing prices, travelers are not yet ready to give up their planned summer trips. Airline bookings in May were 4.4% above pre-pandemic levels. As of the end of May, the number of tickets sold for the summer season was only 2% lower than in 2019.

American Express conducted a survey, which showed that 74% of respondents agree they are willing to book a trip for 2022 and 86% expect to spend more or the same on travel in 2022 compared to a typical pre-pandemic year. At the same time, according to marketing agency Zeta Global, 74% of Americans are trying to save money while traveling. We can conclude that brand strength and a reward system that attracts high spenders help the company overcome macroeconomic challenges.

I do think that while the 2022 travel season still faces some headwinds, they will be offset by huge pent-up demand. As said earlier, the current economic environment won’t stop consumers from spending less.

Q2 Earnings: What to look for?

American Express is set to report its quarterly earnings results on the 22nd of July.

We will get valuable information about consumer activity in an economic environment like this. Investors’ attention will be riveted on the Global Consumer Services Group, within which it issues a wide range of different consumer cards. This sector’s revenue amounted to $6.9 billion in the first quarter. I think the strong consumer services results will lead to strong AmEx results overall as it shows the brand’s customers’ willingness to keep spending.

This earnings report is likely to reaffirm the brand’s strength, helping the company significantly increase transaction volume during the travel season.

Conclusion

2022 is the first COVID-off travel season as many countries lift restrictions in an attempt to attract tourists.

American Express has a solid bet on tourism. Its strategic partnerships with airlines and hotel chains with strong brand names create a solid revenue stream even if the macroeconomic environment is not perfect.

Given the big name and the industry recovery as a tailwind, I believe that the travel rebound is still a massive growth catalyst. Thus, I believe American Express stock is a Buy.

Be the first to comment