sommart

This article was originally published to members of the CEF/ETF Income Laboratory on July 1st, 2022.

We closed out another volatile quarter and month. The bad times always feel as though they drag on forever. While the good times feel like they never last long enough. That’s just the psychology of investing. We are still way better off than we were three years ago but not so much twelve months ago.

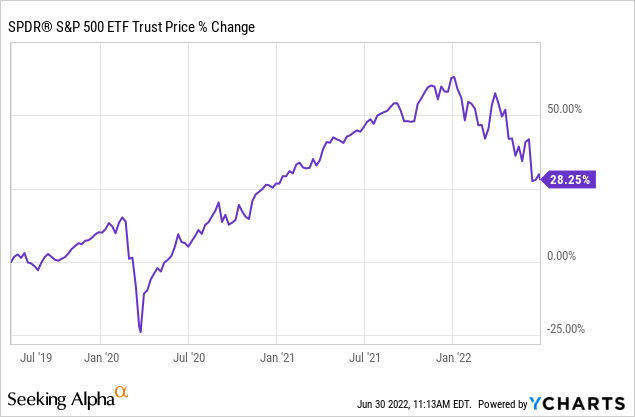

Here is the SPDR S&P 500 ETF (SPY) price return in the last three years.

Ychart

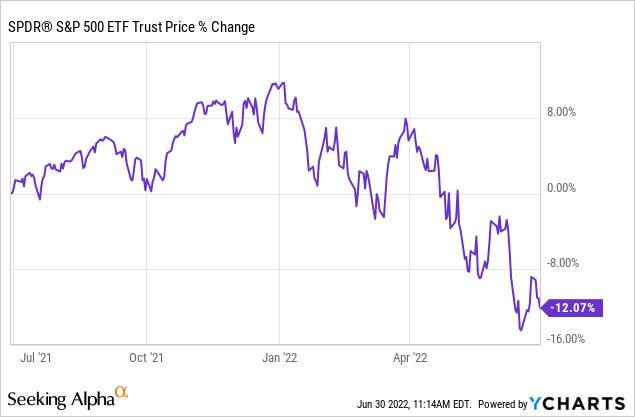

Now, here is the price return for the last year.

Ychart

YTD, if you were more heavily invested in energy, utilities, consumer staples or healthcare at all, there is also a good chance you’re down less than the broader market. On the other hand, if you were heaviest in consumer discretionary, communications, technology and real estate, you’re likely feeling it worse.

However, I’m still confident we can and will make new highs in the long run. The timing on when that will happen is really anyone’s guess.

A good sign will be when the Fed slows or even stops hiking interest rates. That could be one of the first signs markets could start turning and stop their downward momentum. Of course, other good news, such as a resolution to the Russian invasion, could also be a positive catalyst. China opening back up completely could also help some stocks too.

For now, I’ve been taking the opportunity – as I really always do anyway – to continue adding to new or existing positions. In this way, my income continues to grow over time. It helps offset the negative impacts of inflation too. While prices are depressed, this compounding effect is even more pronounced. Distributions thus far have been holding up rather resiliently.

Eaton Vance Tax-Advantaged Dividend Income Fund (EVT)

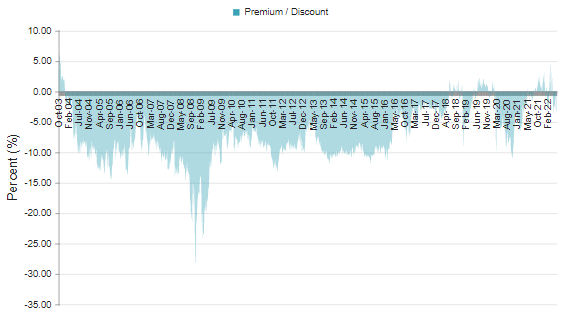

This is a fund that has been rare to get on sale. The combination of a lower overall market and a discount starting to appear again is what made this fund attractive. That being said, historically, the fund had traded at some fairly deep discounts. Around 2017/18, the fund began flirting with a premium.

EVT Discount/Premium (CEFConnect)

Should we see those deeper discounts, I’d take the opportunity to continue to add to my position in the fund. I believe this is a solid long-term play from an overall solid fund. They are mostly invested in the U.S. through equity positions.

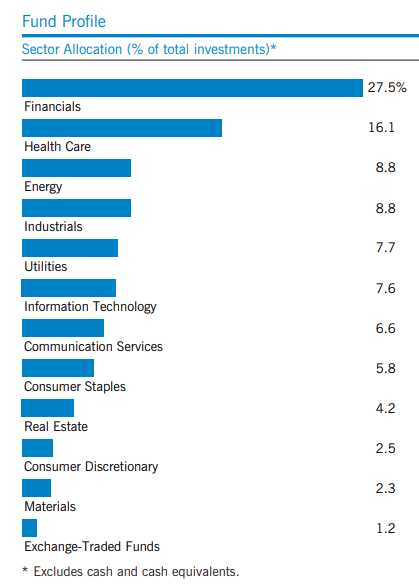

One of the fund’s main draws is that it isn’t overweight tech. Instead, they take a value approach; the largest sector exposure is to financials by a significant degree. This is followed up by higher allocations to healthcare, energy and industrials.

EVT Sector Exposure (Eaton Vance)

It really helps offset the other diversified funds that are generally quite weighty in tech allocations.

XAI Octagon Floating Rate & Alternative Income Term Trust (XFLT)

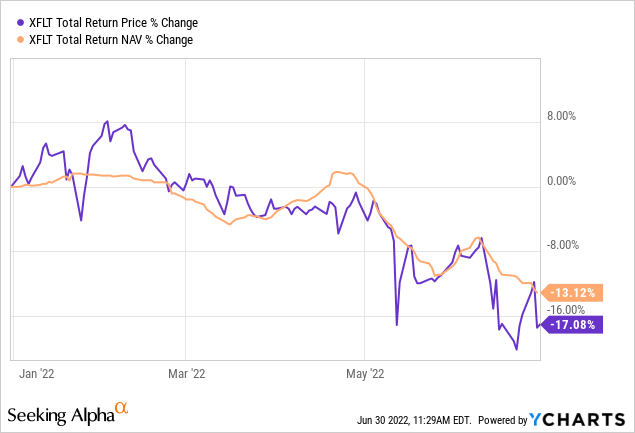

XFLT is in a unique situation for the current market environment. While they are invested in mostly below-investment-grade and riskier senior loan and CO investments, it also means that higher interest rates can benefit the fund. This is because these will be floating rate debts that will see their yields climb when rates rise.

Ycharts

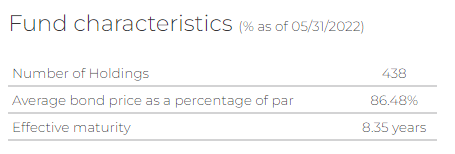

We haven’t really been seeing this play out, though. Instead, we see a sell-off that seems to be linked to greater credit risks. The potential for a recession means the weaker borrowers they are invested in have a higher chance of defaulting or going bankrupt. The high amount of leverage the fund employs exacerbates this impact of heading lower. This is measured by the fact that the average bond price in the portfolio is down to around 86.5% of PAR for the fund.

XFLT Fund Characteristics (XA Investments)

In more recent news, they announced they issued some private 6% Convertible Preferred Shares due June 2029. Along with this, they issued more common shares. The preferred is particularly interesting because while 6% is higher, it is fixed, and the types of investments they invest in are likely to yield higher than 6%. They already have a 6.5% publicly traded Series 2026 Term Preferred Share (XFLT.PA). With higher rates, having a portion of their leverage fixed isn’t a bad situation to be in.

I believe the fund is on the riskier side due to the lower-rated positions they are holding and the leverage. That being said, they are in a good situation in terms of being able to increase income going forward. That means its distribution should remain stable, and the lower prices allow investors to get a better deal and buy more shares at this time.

At the end of the day, if I didn’t find the fund attractive, I wouldn’t continue to add to my position. So putting my money where my mouth is, I added to my position despite the potentially higher risks.

BlackRock Enhanced Capital & Income Fund (CII)

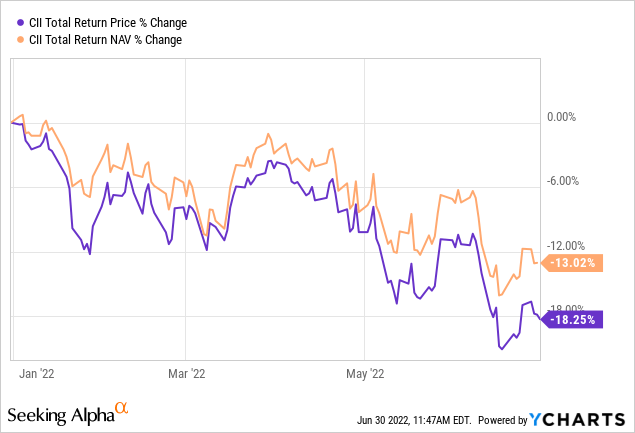

CII is a position I’ve recently covered. This is a similar situation to EVT. It is a fund I’ve owned and wanted to add to. The fund’s discount recently began to widen out on top of equity declines, making it a fairly attractive deal. On a YTD basis, we can see that the fund’s total share price return has fallen materially more than the total NAV return. Thus, a discount has been opened up on the fund.

Ycharts

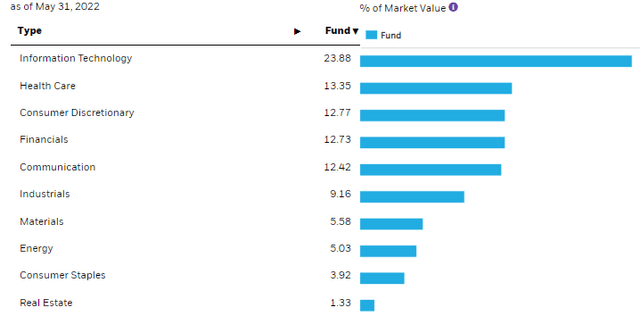

However, this fund isn’t leveraged, and that’s a difference from EVT. That can mean the downside risks here are limited, relatively speaking. However, it is one of those diversified funds that are overweight a tech allocation, meaning this is exactly one of the funds that I was talking about above. On top of this, the fund utilizes a covered call strategy on individual positions in the portfolio. That means that it can be a weaker performer in a raging bull market – but better performing in a flat market with little volatility.

CII Sector Breakdown (BlackRock)

Tekla Healthcare Opportunities Fund (THQ)

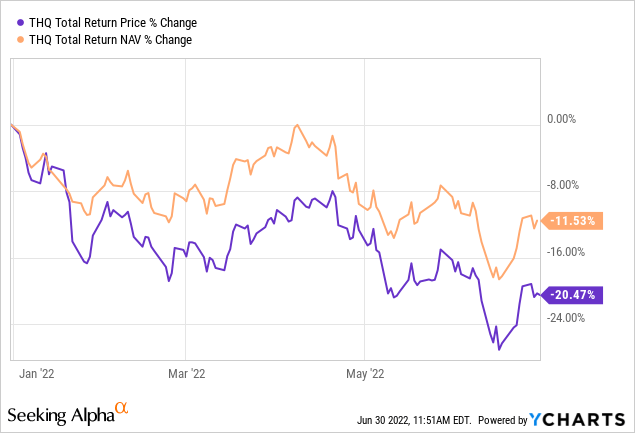

THQ is another fund I recently updated my thoughts on. I don’t want to sound like a broken record, but we have the same setup here. It is a primarily equity fund. The losses combined with the fund’s discount opening up this year make it an attractive offer at this time. This is a fund that was a smaller position in my portfolio, so I was quite happy to get the opportunity to add to my position. In this case, the total share price return has significantly lagged the total NAV return.

Ycharts

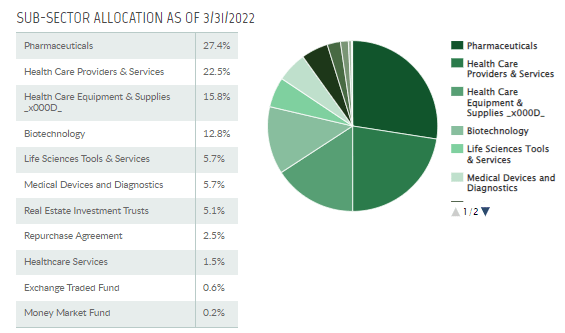

The fund is focused specifically on investing in the healthcare space. That can make it another appropriate place to put capital to work in this current environment. Healthcare is going to be required for people if we are in a recession or not. They are most heavily invested in pharma and healthcare providers & services. These are generally more predictable than something such as the biotech subsector of healthcare.

THQ Sector Allocation (Tekla)

That sets the fund up for a relatively more stable position. The added bit of leverage on the portfolio is rather moderate at around 20%. Keep in mind, though, that it is all based on SOFR plus 0.75%. As rates head higher, this will be a bit of a headwind for the fund. The hope is that the resiliency of the healthcare space will offset what should be a minimal impact.

Conclusion

June presented another solid month of picking up closed-end funds at cheaper prices. Much of 2022 has been basically the same pattern, too, making generally lower lows throughout the year. That has resulted in a significant opportunity to reinvest at much better prices. Therefore, growing one’s income is exponentially greater than we saw in 2021. While my cash position was building up in 2021, in 2022, I have been draining the cash position.

Be the first to comment