Morsa Images

trivago N.V. (NASDAQ:NASDAQ:TRVG) is a Germany-based meta-search platform for hotels and other accommodation services. As a subsidiary of Expedia Group, it focuses on the US, Germany, and the UK. It goes hand in hand with travel agencies and hotels through its 53 localized websites and apps in 31 languages. As of 2021, it caters to over five million hotels and other accommodation services globally.

Today, it reaps the spillovers of the strong travel rebound with an influx of customers. Revenues and margins are expanding with a more solid financial positioning. Yet, it must not be complacent due to macroeconomic pressures. Competition with other meta-search platforms is also tighter. That may be the reason why the stock price remains hammered. Nevertheless, it does not appear too cheap yet, but investors may still consider its potential.

Company Performance

The past two years have been challenging for the travel and accommodation industry. The pandemic fear and restrictions have hammered the potential growth of most companies. Demand had a drastic drop, leading to a gloomy performance. As such, it is not a surprise that trivago N.V. did not avert the disruptions in its operations.

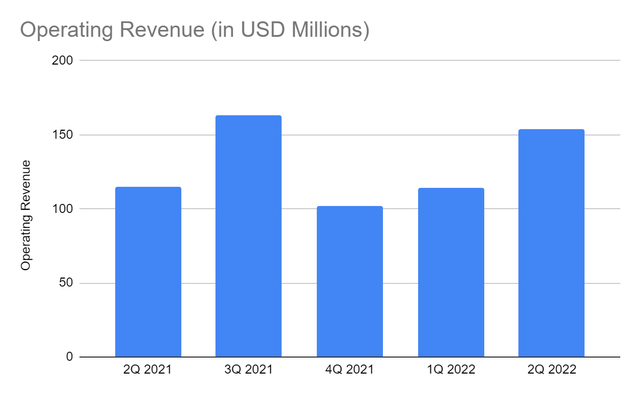

Today, trivago N.V. is showing a more promising outlook as the pandemic fears ebb. The easing of restrictions and the economic rebound allow revenge travel across the world. So, its operations are bouncing back with the most recent quarter’s operating revenue at $152 million, a 34% year-over-year growth. Thanks to the increased mobility across the world, leading to a sharp travel activity rebound. Indeed, the pent-up demand for travel also benefits advertising and meta-search platforms like TRVG. It is timely as it coincides with the trends this quarter due to seasonal factors. As travel spending increases in 2Q and 3Q, qualified referrals show a 15% year-over-year growth. Better bidding dynamics arise from its solid auction with a 31% increase in revenue per qualified referral.

Operating Revenue (MarketWatch)

With regards to its competitors, it is a bit challenging to compare it to peers. Its business model appears as a website that compares hotels and accommodation prices. It earns from its primary partners using its cost-per-click (CPC) advertising business model. Over 80% of its referral revenue comes from Expedia (EXPE) and Booking Holdings (BKNG). It also offers fee-based business models for hotel manager products.

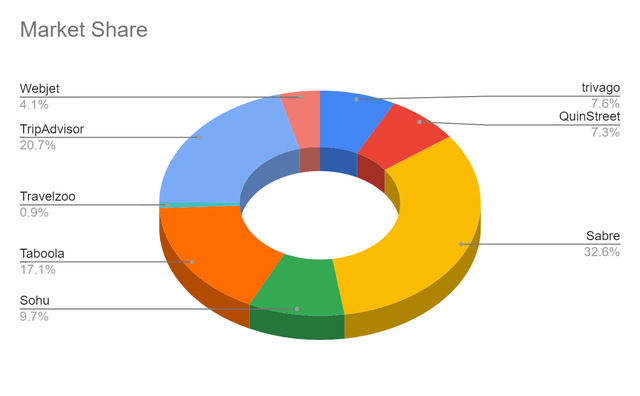

Its peers are also meta-search platforms, but some are booking websites with meta-search platforms. So, it makes the competition tighter and a bit overlapping. Fortunately, revenues appear to be more stable than many of its peers. Its revenue growth is also higher than the market average of 13%. Likewise, its market share of 7.6% is higher than 6.9% of the same quarter in the previous year.

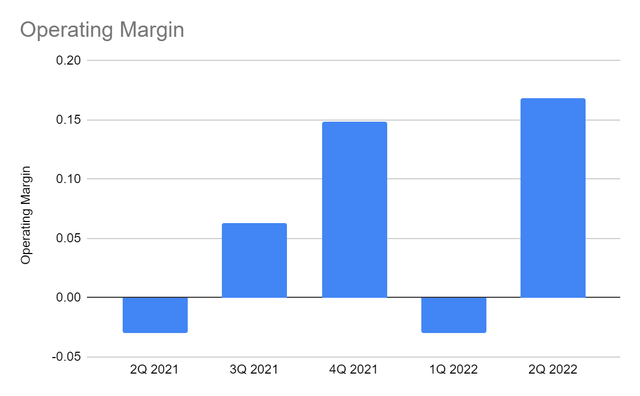

Aside from the impressive industry comeback, TRVG also benefits from its better asset management. Despite the larger operations due to larger demand, it keeps its costs and expenses manageable. It is a nice move amidst the sustained increase in prices. It is also good preparation for another potential economic slowdown as inflation intensifies. The operating margin of 0.17 is much higher than the previous quarter since the start of the pandemic.

Operating Margin (MarketWatch)

Potential Risks and Opportunities

Although leisure and business travel continues to fire up, the company must watch out for inflation. The rising prices combined with the geopolitical unrest in Europe may affect the travel industry. It must also not downplay the potential impact of the potential Monkeypox outbreak. The pandemic scare, matched with high market volatility may affect its performance. Travel and leisure is a popular trend, but it may not be as high as expected should the price increase again. Now, inflation seems to calm down at 8.5%, but it may still bounce back to 9-10%.

The tighter and closer competition is another potential risk to consider. Although its revenue growth and market shares are better this year, the market landscape is dynamic. Also, Google is another larger competitor that it has to watch out for. I did not include it in the pie chart in the previous section, but its platform also competes with trivago N.V.

Even so, TRVG appears to be wiser than it was in the last two years. It dedicates the second half to improving the reasonability and flexibility of its pricing to improve user retention. It also enhances other aspects of its marketing strategy, such as its display ads and Weekend product. Doing so may improve the consistency of its marketing approach and user engagement to generate more leads. However, macroeconomic pressures also affect the value of its intangible assets, which are vital to its core operations. It gives impairment expenses of $90 million, leading to a net loss of -$64 million, the lowest value in the last year. Nevertheless, it also conveys the conservative approach of the company to value its core operations better. EBITDA amounts to $28 million since it focuses on the actual transactions. It is the highest amount in the last year. If we exclude impairment, net income will be $25.9 million.

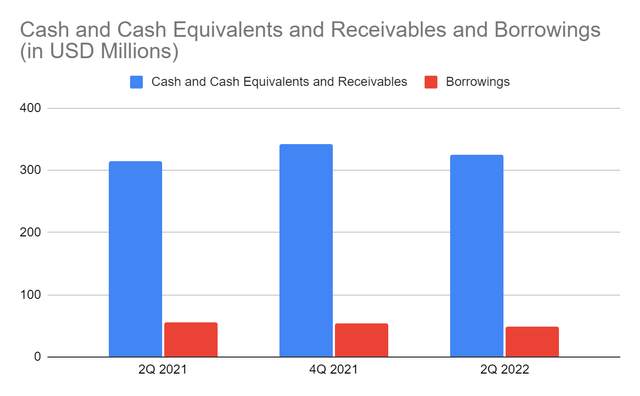

Liquidity is another attribute it continues to improve. It has stable cash levels with a substantial increase in receivables. Intangibles are way lower due to impairment, affecting their value. Meanwhile, borrowings are also stable, allowing the company to cover them using only its cash. Net Debt/EBITDA will be a negative value since it has more cash. The ratio will still be low at 1.5x even if we disregard cash. It earns more than enough to cover borrowings. But again, it has to be careful since macroeconomic pressures affect the value of its primary assets, which affects its viability.

Cash and Cash Equivalents and Receivables and Borrowings (MarketWatch)

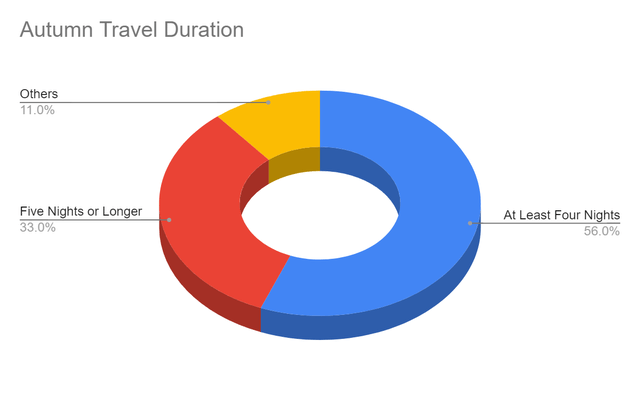

The hype in travel stays evident amidst inflation. Hotel bookings bounced back this summer. It has reached pre-pandemic bookings, showing recovery. Now, autumn does not show a travel lull as many Americans are still on the go, domestic or international. In a survey last month, demographics do not affect their willingness to travel. The same survey conveys that many fall travelers this year plan to travel almost twice as much as they did last summer and almost thrice as much last fall. Another recent survey shows that over 50% of Americans plan autumn trips for at least four nights. Meanwhile, 33% plan to make autumn trips for at least five nights.

Autumn Travel Duration (TravelPulse)

Stock Price

The stock price of trivago N.V. is still in a downtrend despite the travel hype and better fundamentals. It may still be logical since the risks and macroeconomic pressures remain evident. At $1.51, the stock price is 33% lower than the starting price. But, the price is still reasonable with a slight undervaluation, not too cheap. The PB Ratio of 0.83, the Price/Cash Flow Ratio of 8.82, and the EV/EBITDA of 7.69 adheres to it. Investors may still consider the stock as travel continues to hype up. Yet, they must assess how long it can sustain its rebound amidst inflation. To assess the price better, we may use the DCF Model and the EV/EBITDA.

DCF Model:

FCFF $24,820,000

Cash $241,000,000

Borrowings $49,000,000

Perpetual Growth Rate 4.8%

WACC 9%

Common Shares Outstanding 360,176,000

Stock Price $1.51

Derived Value $1.57

EV/EBITDA:

EV $352,000,000

Net Debt -$192,000,000

Common Shares Outstanding 360,176,000

Stock Price $1.51

Derived Value $1.52

Both models show that the stock price is reasonable with potential undervaluation. There may be a 1-4% upside in the next 12-18 months. Even so, interested investors may still have to wait for a better entry point.

Bottom line

trivago N.V. proves its resilience and durability with a solid rebound from its rock bottom. It has better fundamentals and marketing strategies to cope with the tighter competition. Yet, inflationary pressures are still a challenge despite the travel hype. The stock price adheres to its fundamentals after weighing the risks and growth prospects and remains reasonable. The recommendation, for now, is that trivago N.V. is a hold.

Be the first to comment