nimis69

(Note: This was in the newsletter on October 30, 2022.)

Chart Industries (NYSE:GTLS) is growing every bit as fast as any high-tech company out there. But unlike the high-tech crowd, this company is generating earnings and cash flow from the business that makes the current story very believable. Investors do not have to wait for some distant future to “cash-in” on the profitable business. Instead, there is a very profitable business now with a very bright future promising a lot more profits. This company is a true disrupter because it has the cash to show for its efforts.

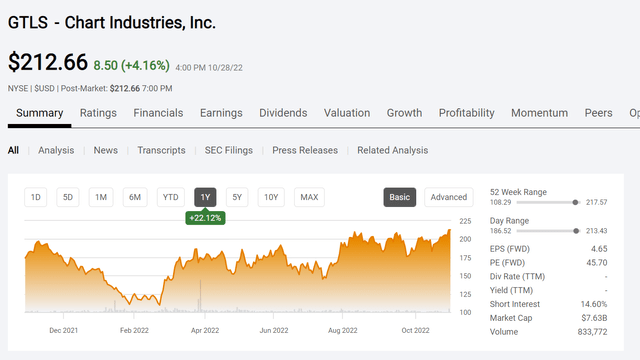

Chart Industries Stock Price History And Key Valuation Measures (Seeking Alpha Website October 30, 2022)

This company makes any kind of natural gas supported liquification and storage products. It has been diversifying away from the cyclical natural gas business for years. The entrance of the company into the renewables and hot marijuana processing market has ignited the imagination of the market about lots of future profits. The big difference between this and a lot of story stocks is the “lots of current profits”.

The stock price has been “treading water” at a fairly high level compared to earnings for some time. But this is a very volatile stock due to the small number of shares outstanding. Therefore, the stock can make large moves in either direction without a business reason for the move.

The Cash Difference

Any time one hears about a “disrupter” and a lot of cash “in the future” one needs to get out the cash flow statement to determine if the business really is a profit generator that demonstrates a true current disrupter.

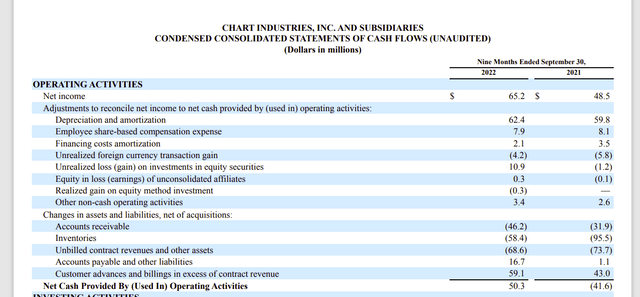

Chart Industries Third Quarter 2022, Cash Flow Statement (Chart Industries Third Quarter 2022, 10-Q)

Growing businesses often need cash to “feed” a growing working capital that grows as fast as the business. This management guided to record backlog levels and a profit increase of 50% in fiscal year 2023. So, this business is growing very fast. Therefore, it is not surprising that the changes in assets and liabilities reflect a negative $97.4 million due to the likely working capital and related accounts growth needed to support a rapidly growing business.

But that means that the business actually generated about $148 million in cash before the current asset and liability growth. With the traditionally largest fourth quarter likely to report a very large amount of earnings, the cash generated is comfortable for this rapidly growing company. Debt levels will be satisfactory. Traditionally, the fourth quarter reports as much or more than the other three quarters combined. This is similar to the retail business pattern.

Green Products

The market imagination is attracted to the “green revolution” type businesses. This company was long linked to oil and gas major projects. That is changing because the products can be used for really any kind of gas (with modifications of course). So, the company logically began to participate in new markets as they became profitable.

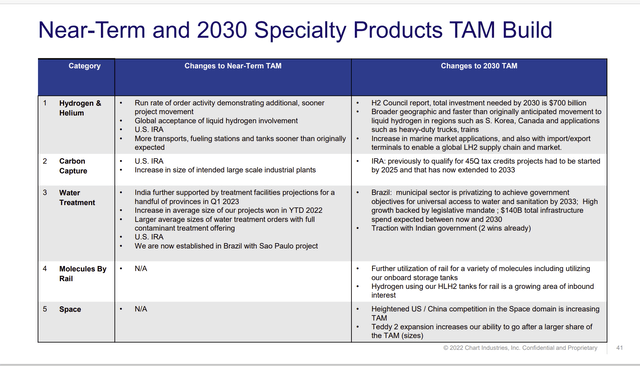

Chart Industries Breakdown Of Future New Market Prospects (Chart Industries Third Quarter 2022, Conference Call Slides)

The above slide shows some of the future potential that has attracted the market. Generally, this company has a full complement of liquification and storage products (along with dispensing abilities) for any market, including the rapidly growing hydrogen market.

Since Chart is a relatively small company compared to the orders received and the projects in which it participates, the orders can come in lumpy fashion, with various subsidiaries reporting good or slow months. Because of this factor, it usually takes quite a few months to figure out a trend that requires correction.

Quarterly financial reports can vary considerably based upon the mix of products shipped without a down quarter indicating a problem. The fourth quarter is usually large enough that earnings should be sequentially higher. But it is the only quarter like that. Sales are rarely lost (if ever). But sales are frequently pushed into other quarters caused by delays.

Repair Business

Management has been looking for countercyclical businesses to smooth out the earnings of this cyclical growth story. The repair business fits that requirement nicely.

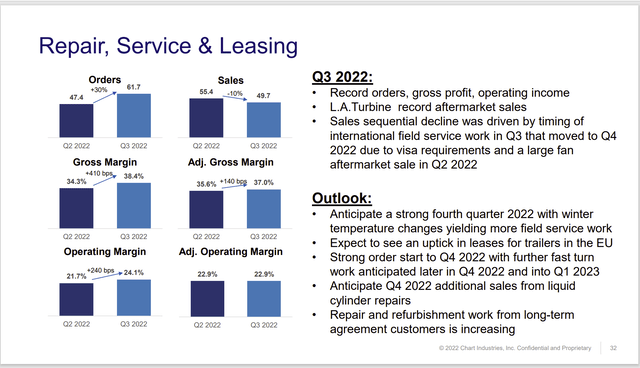

Chart Industries Summary Of Repair Business Results (Chart Industries Third Quarter 2022, Conference Call Slides)

The company has been growing a repair business because this business typically expands during economic downturns. That helps offset the largely cyclical nature of much of the company.

This company began as a supplier of parts to large natural gas businesses very roughly 50 years or so ago. As recently as the 2015 oil price crash, it was still mostly a natural gas industry supplier with a small food business that showed a little diversification.

Now the company has entered new growth markets and repair business so that the company no longer depends upon the large natural gas projects to maintain and grow the business. The strategy has been expanded to literally anything that needs gas in bulk. That meant this company supplied a lot of oxygen bulk equipment to hospitals during the pandemic.

The next economic cyclical downturn is likely to see a very different financial performance from this company.

Debt

The company has roughly one-third of its debt represented by convertible bonds. Those bonds can currently be converted and so are part of current liabilities. The latest 10-Q previously referenced, has the information on these bonds.

Traditionally, management has issued convertible bonds to “pay” for the acquisitions of small companies that expand the business. These bonds then convert as the company grows and the stock price climbs.

The only time this strategy was delayed, or did not work was back around 2017 when some bonds came due, and the stock price was below the bond conversion price. That was related to the big oil price crash that literally drove big project orders to zero for a quarter. Back then, management refinanced that debt but, in the process, gave up the right to force conversion of the bonds.

These bonds will likely convert before the maturity date in 2024. But they are also likely to remain outstanding until then because they pay interest. The common stock does not pay a dividend. So, it is to the advantage of the bond holders to hang onto them as long as possible.

That waiting entails a small risk of a stock price decline below the conversion price. That is unlikely to happen given the current outlook. But then again, no one saw the challenges of fiscal year 2020 ahead of time. Those challenges pushed the price of the stock into the teens (as shown on the Seeking Alpha Website). Such an occurrence would likely force a refinancing of the bonds into something less attractive to shareholders.

Once these bonds mature, the company will likely convert more debt to convertible bonds. This company generally buys companies with products that complement the product line rather than organically developing a lot of new products themselves. The company has a very long and successful acquisitions history.

Key Takeaways

This company continues to grow at a blistering pace that shows no signs of letting up.

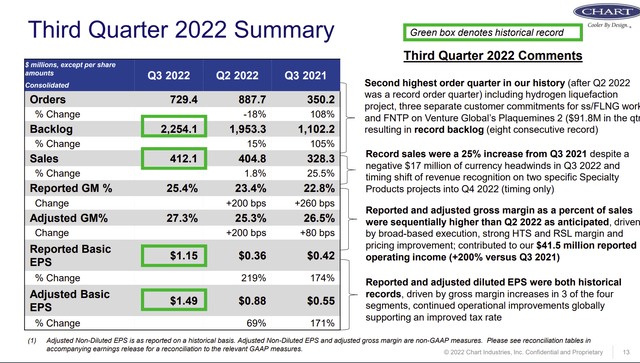

Chart Industries Third Quarter 2022, Operating And Financial Summary (Chart Industries Third Quarter 2022, Conference Call Presentation)

The backlog is at record levels. That implies at least another good year because many of the products made have very long lead times.

The company does operate worldwide. So, currency translation issues will appear from time to time.

Management does trumpet the gross sales margin because that is an accomplishment. However, sales margins vary widely with the mix of products sold. So, the margin each quarter has the potential to be different without indicating a problem.

The natural gas large project boom has already gone on for several years. Somewhere in the future, there should be a cyclical downturn in that business. Even though management has diversified from that business, it still is a significant part of orders received. A downturn would have a material impact on the company growth rate.

This is a cyclical growth stock that has entered some highly attractive growth markets. I like everything here but the stock price. Potential investors pay full price for the enticing growth prospects. Most likely, sometime in the future, there will be a bargain opportunity to invest. But right now, it looks like the stock is rather expensive for the prospects.

Fast growth has its own risks as the ability to raise production levels quickly can be daunting as a company grows. This company has mitigated that risk by retaining the managements of the various acquisitions and keeping a lot of small plants that run a few products rather than a few large plants. So far, this strategy has worked. But a loss of cost control or quality control is a risk to fast growth.

In summary, Chart has business interests in a lot of new markets that investors are attracted to. That is currently reflected in the stock price. Management is top notch. But the small number of shares outstanding suggests that the stock will continue to be extremely volatile. That suggests that investors should wait for a stock price “downdraft” to establish an investment in the company. This stock can move 50% or more “because it is Tuesday” and not related to the business. Any investor needs to review the stock price history before investing.

Be the first to comment