Sander Meertins

It is time to review our investment case on HeidelbergCement (HLBZF, OTCPK:HDELY). In our initiation of coverage, we emphasized how “the unprecedented situation created by the COVID-19 health crisis has triggered a worldwide Keynesian government spending to renovate the infrastructure in the major markets both at the public level and also at a private level“. This was our thinking behind HeidelbergCement’s initial investment. Our buy case recap was also supported by 1) the Italcementi acquisition (Italian Real Estate bonuses were set at 110%), 2) the continuous portfolio optimization as well as 3) the compelling valuation (at that time, we saw a 40% upside using a multiple of 5.5x on our EV/EBITDA).

Time has not played us any favor and since then, HeidelbergCement declined by almost 40%. We all know the reason behind this: raw material inflationary pressure, energy price increase, and a slowdown in economic activities with a very likely recession in the EU. Currently, the company’s market cap is at approximately €8 billion. During the year, we cover the main HeidelbergCement events:

- Q1 Results: Again a Buy

- HeidelbergCement’s Russian Exposure, confirming an immaterial exposure

- Comments On Q2 2022 Results, providing a comps analysis and favoring Holcim half-year performances

Here at the Lab, we have a good grip on the sector, we have a buy rating on Holcim and recently we initiate to cover CRH. So, what’s going on? and more importantly what the market is pricing in?

- Despite the lower financial results compared to Holcim and CRH, HeidelbergCement delivered solid numbers in Q2. In the first half, the company achieved an EBITDA of €1.5 billion and due to the higher working capital requirements, HeidelbergCement recorded a negative FCF;

- With a lower cash flow generation and the company’s strategy on portfolio optimization, HeidelbergCement was still able to decrease its debt obligation by €662 million. Currently, it is in line with its net debt/EBITDA target;

- Related to points 1) and 2), during the Q2 results, Holcim raised the 2022 outlook and left its net profit forecast unchanged, whereas, HeidelbergCement announced a lower projection at the EBITDA;

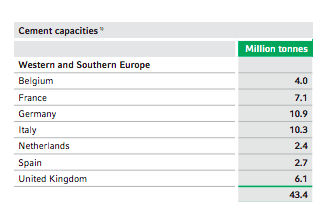

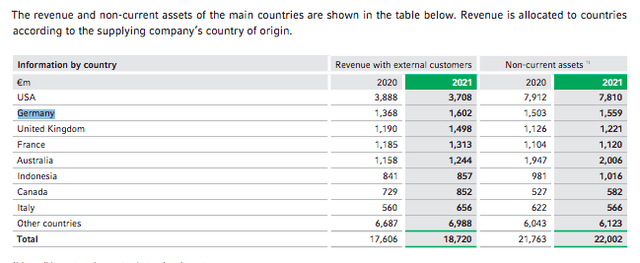

- As we already mentioned in our Uniper (OTCPK:UNPRF) follow-up note, starting from the first of October, “gas prices will be transferred to Uniper’s customers but we should note that gas bills already increased by more than 100% compared to last year’s price”. However; if we are looking deeper into the company’s 2021 annual report, HeidelbergCement Germany’s cement capacities production represents just six percent of the company’s total output (Fig 1) and 8% of its top-line sales (Fig 2). Energy shortage and constraints are not isolated only in Germany, we should mention that HeidelbergCement’s exposure toward the whole EU represents 46% of its entire production capacity;

- In conjunction with point 4), many EU State members are implementing national policies to limit and contrast the higher energy prices. This should support the company’s numbers;

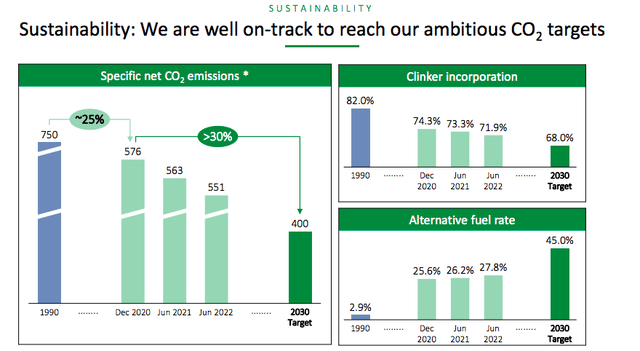

- Still related to the EU, HeidelbergCement is still subject to the carbon tax which is one of the main problems for the industry. This is one of the reasons why the company’s margins are lower than its peers. For this reason, the company is planning to cut by two its CO2 emission by 2030, using higher recycled materials to decarbonize cement production (Fig 3). This might support the company’s profitability over the long term versus the higher investment at CAPEX.

Source: HeidelbergCement 2021 Annual Report (Fig 1)

HeidelbergCement cement industrial capacity

Conclusion and Valuation

Going to the numbers, HeidelbergCement is currently trading at a lower multiple on EV/EBITDA (and also at P/E level) compared to Holcim and CRH (EBITDA multiple is at 4x against comps at a 5x average). We believe this is justified for two main reasons 1) HeidelbergCement’s CAPEX on sales are higher in the next two years (our German player is at >7%, whereas on average we are forecasting a 5% for CRH and Holcim) and 2) FCF yield is lower than its competitors (8% versus 10%). The company is proactively managing its pricing to offset costs and our internal team sees the delta spread to be balanced in Q3. In our internal number, we estimate another minus 8% in EBITDA level for 2022. Rolling forward our valuation for HeidelbergCement, we are still confident that the company is fundamentally undervalued. Uncertain times are ahead, and we are lowering our valuation for the next 12 months, and we derive a price target of €50 per share.

Be the first to comment