JimVallee

The question everybody is asking

I bet everybody has been pondering about how to limit one’s losses in a rising interest rate environment. Or even better, how to benefit from it. Should you buy equities, fixed income or, God forbid, even crypto? Thankfully, you don’t have to venture that far out on the risk spectrum to accomplish these things. Our well-known American company Berkshire Hathaway (NYSE:BRK.A, NYSE:BRK.B) will benefit directly from rising interest rates and I’ll show you how.

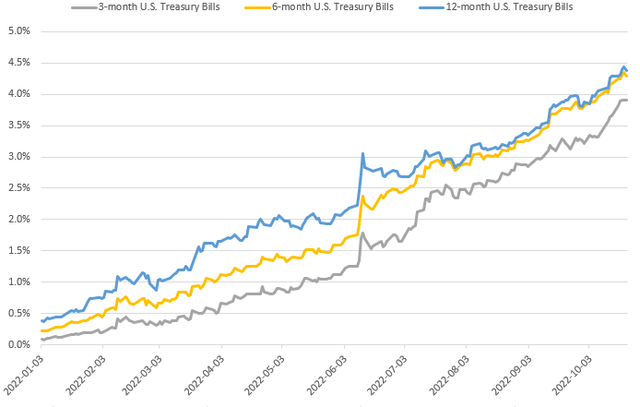

U.S. treasury bill rates (U.S. DEPARTMENT OF THE TREASURY)

Treasury Bills of all maturities have been rising significantly during 2022 and there’s no stop in sight as long as inflation rages on. So, which company has a lot of treasury bills on their balance sheet? You guessed it – Berkshire Hathaway.

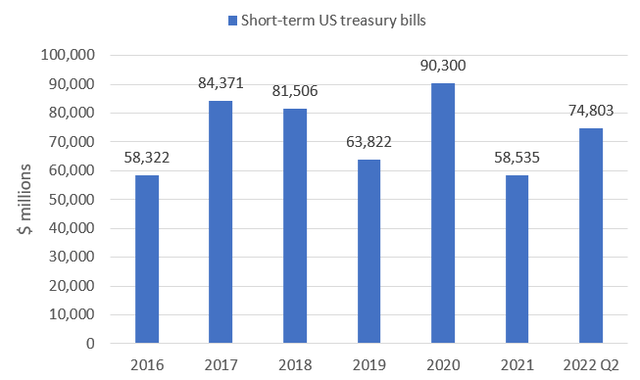

Berkshire Hathaway’s treasury bills (BRK financial statements)

Now, whether BRK has bought 3-month or 12-month T-Bills I don’t know. If they all actually were 3-month, they would already have refinanced them during the third quarter so that the new batch would be earning close to 4% annually or a little less than 1% quarterly – that’s about $740 million interest income per quarter pre-tax (T-Bills are zero-coupon bonds which means they do not pay coupons but instead you buy them at a discount to par value and when they mature you get that full par/face value and the difference between purchase price and face value is your gain or “interest”). The truth is that some of BRK’s T-Bills are likely to be of various maturities between 1-month to 12-month and will most likely mature in a rolling manner during the year. We can see some of this at work already during the first and second quarter of 2022.

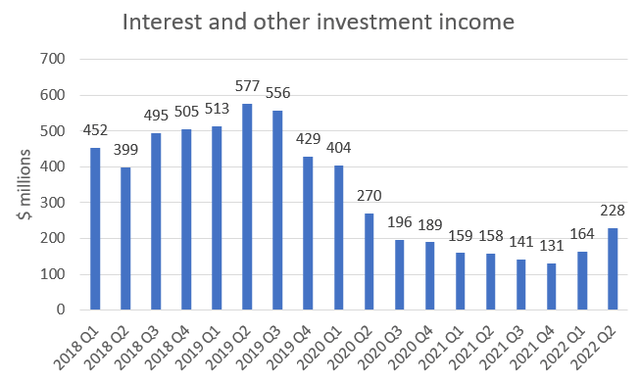

Berkshire Hathaway quarterly interest income (BRK financial statements)

When the Federal Reserve decreased the fed funds rate during the COVID-19 pandemic, BRK’s interest income obviously decreased as well. However, now when rates are rising, there’s been quite a sizeable increase in a short amount of time. We’re now almost at 2020 Q2 levels. “So what” you say. If BRK’s interest income reaches the high levels seen for most of 2019 it’s still only a bit higher than $2 billion on a rolling yearly basis. It won’t make much of a dent you say. Well, true, you’re right. What if I said BRK could make +$4 billion yearly from short-term T-Bills plus the additional interest it earns on fixed maturity securities? Would that make you interested? Let’s put it into perspective. In 2021 BRK had $33.1 billion in pre-tax earnings and interest income was $589 million which is about 1.8% of the total pie. $4 billion (let’s assume the additional interest from fixed income securities is included here), however, is a bit over 12% of pre-tax earnings. With these stats at your disposal, do you still think it’s peanuts? “I’m interested” you say, “show me how”. Let’s see.

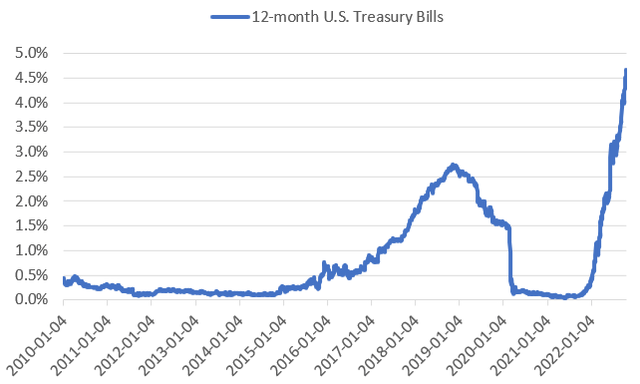

12-month U.S. treasury bill rates (Macrotrends)

You will recall that for the better part of the last decade the 12-month T-Bill rate was actually close to 0%. The rate hikes during 2015 to 2019 got the T-Bill rate as high as ~2.75% but fairly quickly decreased which means BRK couldn’t fully capitalize on the higher rate environment. Currently, the 12-month T-Bill rate is well above 4%. Lookit, I’m the first one to admit that I have no idea how the T-Bill rate will behave next year or tomorrow for that matter. What I do know, however, is that inflation is still raging and as long as that’s the case, rates will rise or at least not decrease. So, I don’t think it’s a stretch to say that rates can remain above 4% for the next twelve months on average. So let’s use 4% as our base figure here. Another assumption I’d like to make is that BRK will increase their T-Bill holdings to ~$100 billion by the end of 2022. You should of course be wary of such claims and I do not have any facts to back it up other than business intuition. Assuming that BRK won’t find any attractive businesses at the right price during the rest of 2022, they would assuredly put almost all of their excess cash into T-Bills at current rates (currently BRK has about $30 billion in excess cash and will most likely make something close to $10 billion in free cash flow during H2/2022 which means they could afford it). According to this rather simplistic analysis, BRK will earn about $4 billion in interest income during 2023. “Okay, I get it”, you say, “but is this a satisfactory return on capital in the long-term?”, you ask. Fair question. And the short answer is no, no it’s not.

Business ownership

Warren Buffett and Charlie Munger have always preferred business ownership over all other forms of investments. However, from time-to-time, there may not be any profitable opportunities to act upon which leaves them sitting on cash instead.

The above analysis is actually a testament to the downside protection of BRK. It’s an analysis on what could happen if BRK didn’t find any attractively valued businesses during the remainder of 2022 and whole of 2023. The current interest rate environment provides a tailwind to BRK while many other companies are suffering. It should enhance BRK’s competitive position on the acquisition front as they are making money while others who have been all in are losing it. Should this scenario materialize, BRK will have even more cash to deploy in profitable enterprises. I’ve been pounding the table for a while that cash provides an option for its owner to deploy it when the time is right. In times like these it has tremendous value.

I, for one, think that the odds of an “elephant” acquisition over the next 12 months have increased significantly during 2022. I also hope that this happens. A 4% return on $100 billion in T-Bills sounds great, but a 10-15% return on $100 billion capital employed sounds even better.

Be the first to comment