Khanchit Khirisutchalual/iStock via Getty Images

Investment Summary

We continue to re-rate large cap healthcare and med-tech stocks with a view that the basket has tremendous upside potential within this latest market cycle. We’ve been pleased to see many of our healthcare longs performing to expectations as the sector catches a bid and recoups its losses of the YTD.

With that in mind we revised our position on a previous long, Zimmer Biomet Holdings, Inc. (NYSE:ZBH), after indications the company has potential to unlock long term shareholder value. We’re here today to discuss our findings and demonstrate the key numbers driving our buy thesis. Net-net, we rate ZBH a buy on valuation and EPS growth, seeking 2 long term targets of $147 and then $261.

Q3 financial results: return to long-term growth trends

Turning to ZBH’s financials, we noted operational and divisional strengths across its portfolio. However, forex (“FX”) headwinds were also rampant due to the strengths of the USD.

For instance, net sales of $1.67Bn tightened by ~90bps YoY, but reported in constant currency (“cc.”) terms, was up 500bps from last year. It pulled this down to reported EPS of $0.92, up from $0.72. The bottom line result was helped by a reduction in litigation expenses and an additional tax benefit.

Continuing in cc. terms, we saw that ZBH’s U.S. revenue lifted 320bps YoY, underscored by normalization of elective surgery trends in its orthopedics segment. International sales were up 7.3% in cc. and was again lifted by strong procedural volumes and favorable patient turnover in its EMEA (European, Middle Eastern, African) and APAC (Asian) markets. Perhaps a little surprising, China revenues were flat despite lockdown policies throughout this year.

Turning to the divisional takeout, we observed the following:

- ZBH recognized strong uplift in its orthopaedic knee procedure (“knees”) segment as patient volumes return towards pre-pandemic levels throughout the globe, up 700bps. US knees grew 730bps YoY, with ~720bps upside in its international knees as well.

- We also should note the company’s orthopedic hip procedures (“hips”) were a standout with 10.5% upside on the previous year. The breakdown of this saw 530bps growth in US hips and 15.5% expansion in the international hips division. We saw particular strengths in ZBH’s focus on anterior surgical entry through its Avenir complete primary hip arthroplasty. Note, the anterior hip approach is gaining traction in surgical practice as a preferred method due its minimally invasive nature vs. posterior approach to hip replacement, that involves incision through the gluteal muscle complex. For contrast, anterior hip approach mobilizes the anterior hip musculature instead, with no muscle incision.

- It’s also worth noting the decline in the sports extremities and trauma division, sales tightened by ~210bps YoY, primarily from a difficult comparable period in FY21. Still, management noted it was happy with the cadence of placements of its ROSA systems.

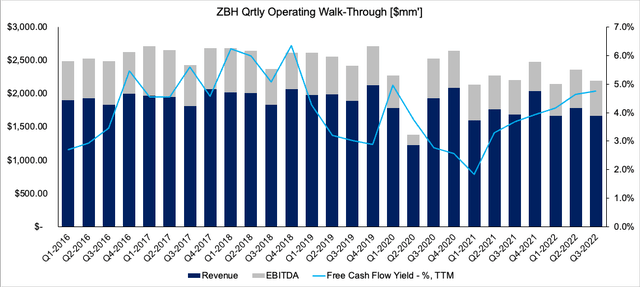

Meanwhile, there are several other data points worth mentioning. First, we’ve observed ZBH’s free cash flow (“FCF”) yield revert back towards longer-term range [Exhibit 1]. It recognized $332mm in quarterly FCF from operating cash flow of $451mm, paying down $160mm of debt liability in the process. We’re intrigued by this growth route in FCF and note investors can now buy ZBH at a c.500bps TTM FCF yield, its highest mark since FY19 [excluding adjustments made to working capital from COVID-19 in Q1 FY20]. You can see ZBH’s quarterly operating performance from FY16–date in Exhibit 1.

Exhibit 1.

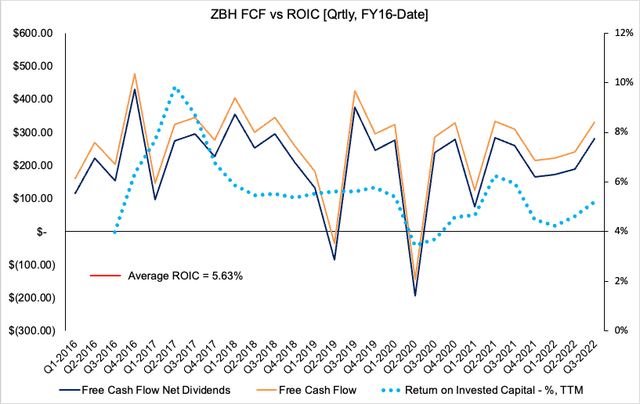

Analyzing FCF further, we also noted the company is again generating return on its investments at longer-term ranges as well.

It realized ~5.8% in TTM return on invested capital (“ROIC”) last quarter, above the average of 5.63% since FY16 [Exhibit 2]. This is incredibly valuable data in our estimation. The cost of capital has increased markedly this year and ZBH’s WACC hurdle now rests at 8.16%. Hence, the company needs to continue driving its ROIC number higher into the coming periods. We’d suggest this to be a key factor investors look out for down the line.

Exhibit 2. Trailing ROIC curling up back rot LT range

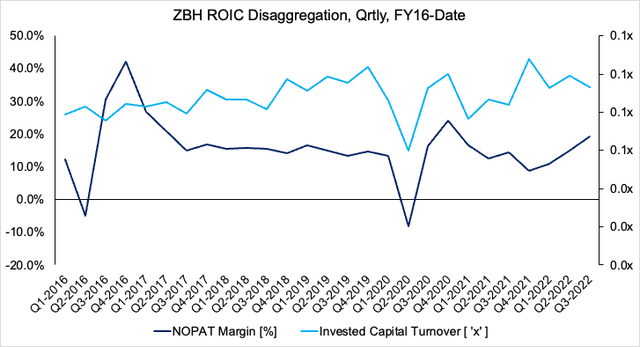

We decided to check what’s beeping the recent gains in ROIC to understand management’s capital budgeting strategy.

You can see below that from Q4 FY21’ the level of NOPAT margin has lifted to 19.4% last quarter from ~14% the year prior. Meanwhile, invested capital turnover remained flat. To us this says ZBH is generating additional profit for the same level of capital intensity as a year ago, and would explain the uplift in trailing ROIC as well.

Exhibit 3. NOPAT margin the key upside driver to ROIC numbers

Guidance revision: does it improve the risk/reward calculus?

Management revised guidance in cc. terms, projecting 550-650bps upside at the top versus FY21. We’d note, however that in absolute terms it forecasts a flat result to 100bps of growth. Hence, there’s around 600bps of FX headwind baked into management’s assumptions. On this note, it projects around 300bps compression on revenue growth from FX in FY23’.

What this says margin growth vertically down the P&L we’ll see at each respective reporting period. Nevertheless, ZBH still narrowed its adjusted EPS guidance range to $6.80–$6.90, from the above-mentioned FX drag.

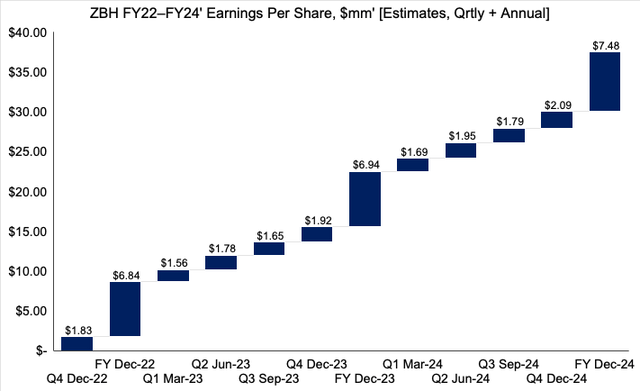

We project ZBH to print $6.84 in non-GAAP EPS this year and see it stretching this number to $6.94 the year after. For reference, we estimate GAAP EPS of $2.95 in FY22’. We like ZBH’s long term growth prospects and estimate $7.84 per share at the bottom line in FY24. This adds to our buy thesis. You can see our full stream of EPS assumptions below.

Exhibit 4. ZBH FY22-24’ EPS growth assumptions [internal estimates]

Valuation and conclusion

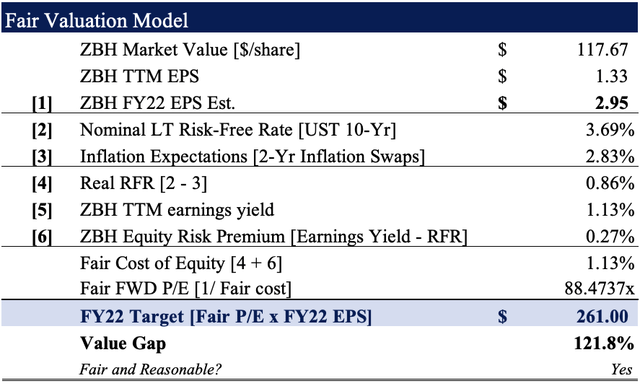

We should note that consensus values ZBH at 19.5—26x forward earnings [non-GAAP—GAAP respectively]. However, we believe this underestimates the earnings leverage the company showed us last period and the EPS upside looking ahead. For the sake of simplicity, when using GAAP estimates and comparing to the last 12 months, we see tremendous growth at the bottom line.

Rolling our FY22 GAAP EPS assumptions forward, we see ZBH trading fairly at a mid-term price objective of $261 [Exhibit 5]. This helps confirm our buy thesis.

Exhibit 5.

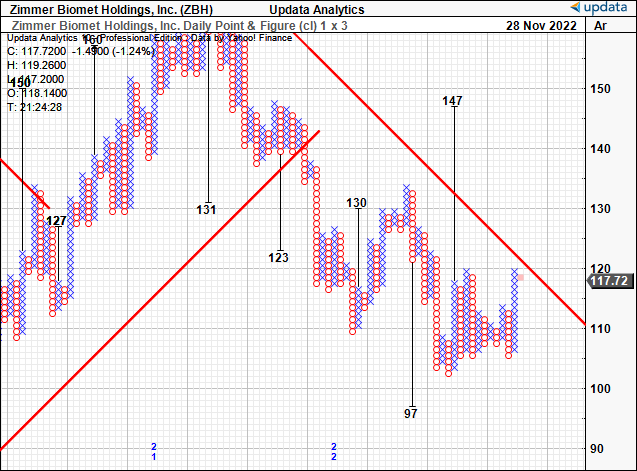

Looking at available technical data, we see good support to an upside target $147, as seen below. Alas our two price objectives in this name are $147, then $261.

Exhibit 6. Upside targets to $147

Data: Updata

Net-net, we rate Zimmer Biomet Holdings, Inc. a buy on valuation and its forward-looking revenue, EPS growth. We note there are FX headwinds to the to consider as key risks, along with another surge in COVID-19 cases. We are seeking price objectives for ZBH of $147 and the $261 over the next 12-24 months.

Be the first to comment