wdstock

July 21st proved to be something of a bloodbath for shareholders in telecommunications giant AT&T (NYSE:T). After the company reported financial results covering the second quarter of its 2022 fiscal year prior to the market opening, shares of the enterprise plummeted, falling by as much as 11% before closing down a more modest but still painful 7.6% for the day. All of this was spurred on by headline news that revealed that the company would see its free cash flow come in lower this year than previously anticipated. But at the end of the day, this development is actually a positive for shareholders, especially when factoring in some major changes that management made public. At the end of the day, value-oriented investors should view this decline as a gift. After all, all it did was make an incredibly attractive company that was already training at a substantial discount to its intrinsic value trade even cheaper than it was before.

The panic that shouldn’t have been

The main news item that seemed to push shares of AT&T down considerably on July 21st is the company’s announcement that free cash flow this year will be lower than previously anticipated. Leading into the earnings release, management had been guiding for $16 billion in excess cash flow. But that number has now been reduced to $14 billion. Usually, such a move would be considered painful. But at the end of the day, we need to put this all in context. According to management, this revision is not because of weak financial performance. In fact, the fundamental picture for the business so far has been quite positive. Operating cash flow in the latest quarter came in at $7.7 billion. The company still seems to be on track for operating cash flow of around $40 billion this year. The decline in expectations, then, seems to have more to do with growth-oriented investments initiated by the company and by working capital changes associated with the timing of certain operating activities.

It’s easy for a company to say what a change is caused by without backing it up. Backing it up is another thing entirely. And what management revealed in this most recent financial filing is that they are, indeed, making some excellent progress on some key initiatives. For starters, the company had previously expected to target between 70 million and 75 million people for its 5G spectrum by the end of this year. In the latest quarter, the company hit the 70 million limit and is now increasing that target to 100 million by the end of this year. And by the end of 2023, they still are aiming for 200 million. The firm is also making great progress elsewhere. Under the fiber category, the company has now reached 18 million customer locations, with 316,000 net additions over the past quarter. This brings their total net additions over the past two years to 2.3 million, with 10 straight quarters of over 200,000 net additions per quarter. This is not to say that everything was great on this front. Total broadband connections, excluding those that are under the DSL category, drop by 25,000 quarter over quarter. But the 28% growth in fiber revenue helped push total revenue for broadband up by 5.6% year over year.

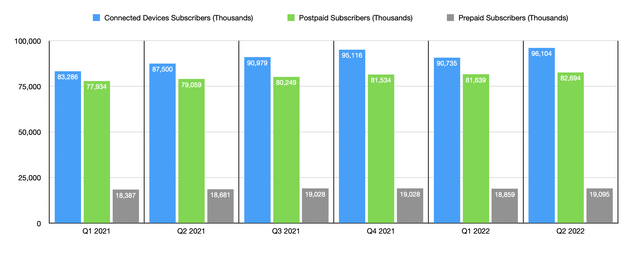

In another showing of strength, AT&T also announced a major increase in the number of connected devices on its platform. That number rose in the course of one quarter by 6.60 million from 90.74 million to 96.10 million. That’s an all-time high for the company, and the net additions came in higher than the 5.54 million experienced the same quarter one year earlier. Such strong growth over a short timeframe is a testament to the strength of AT&T’s offerings and its potential from an IoT perspective. The firm also boasted 813,000 net additions to its post-paid phone plans. This is up from the 789,000 seen one year earlier, and it’s the second-largest quarterly increase in the business’ history. Another major plus for investors is that the company continues to believe that it will reduce annualized costs by the end of this year by more than $4 billion from their $6 billion plan.

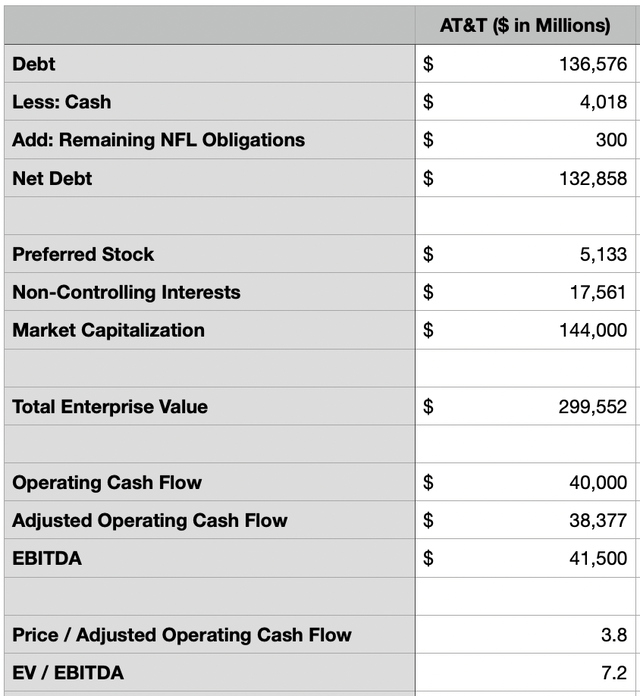

Perhaps the biggest letdown for me during the quarter was that debt didn’t fall quite as much as I had forecasted. Net debt for the quarter plunged by $37.48 billion, thanks in large part to the cash proceeds the business got from the spinning out of its WarnerMedia business and its subsequent merger with Discovery to create Warner Bros. Discovery (WBD). That brought total net debt down to $132.56 billion. That compares to the $129.24 billion (for a difference of $3.32 billion) that I forecasted in a prior article. In the grand scheme of things, this is not a horrible outcome.

As part of this analysis, I also used updated figures from the firm’s recent quarterly release to re-value the business compared to rival Verizon Communications (VZ). At present, AT&T is trading at a forward price to operating cash flow multiple of 3.8. And its forward EV to EBITDA multiple is 7.2. If AT&T were to trade at the same multiples as Verizon, then this would imply upside, using the EV to EBITDA approach, of up to 39.8% from current prices, while the price to operating cash flow approach would provide upside of 49.8%. That doesn’t factor in the strong payout AT&T right now is paying, which works out to a yield at this moment of 5.9%.

Takeaway

Based on the data provided, it seems to me that AT&T has actually done really well over the past few months. Although debt reduction fell short of what I wanted, I have no other real complaints. Shares are incredibly cheap, and its fundamentals are remarkably robust. Yes, free cash flow will be lower this year than anticipated, but that is because of vital investments that already seem to be bearing fruit. If anything, this makes the company even more appealing. For all of these reasons, I have decided to keep my ‘strong buy’ rating on the enterprise, reflecting my belief that it should significantly outperform the market moving forward.

Be the first to comment