thekopmylife

A few weeks ago, we wrote:

AT&T Inc. (NYSE:T) has underwhelmed over the past decade, with heavily leveraged ill-fated acquisitions leading to massive underperformance and ultimately culminating in a steep dividend cut. While the company has spun off its media business (WBD) along with a hefty pile of debt in an effort to better focus on its core telecom business and take a step forward towards deleveraging, the forward outlook for T is bleak. With little to no dividend growth expected for the foreseeable future, T is effectively a dying dividend growth stock.

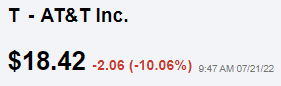

Well, T just reported a dud of a second quarter, and the stock is crashing this morning:

AT&T (Seeking Alpha)

In this article, we will look at the Q2 results and provide an update to our thesis on T.

Q2 Takeaway #1: T Is Not As Inflation & Recession Resistant As Some Might Think

T’s CEO reported that it is facing “very real inflationary pressures” which are forcing it to make “selective pricing adjustments” though even these efforts have not proven to be capable of offsetting all inflationary headwinds:

We estimate those to be more than $1B above the elevated cost expectations embedded into our outlooks…The macroeconomic backdrop is evolving in a dynamic manner.

This ultimately means that T is not nearly as inflation and recession resistant as some might think. While telecommunications services are generally essential services that see a lower amount of demand volatility during economic downturns, the hefty capital expenditure requirements on T at the moment mean that it is getting pinched by inflation while shrinking consumer purchasing power. Furthermore, the deceleration of the economy is also leading to increased defaults on payments, resulting in slower bill paying and even increased bad debt for T. This means that T has only limited pricing power and will likely have to keep swallowing more of the inflationary headwinds in order to avoid forcing their customers to default on payments at an even greater frequency.

Q2 Takeaway #2: Debt Paydown Progress In Doubt

The biggest headwind to the T thesis in recent years is how it will go about tackling its massive debt burden. It first incurred this debt via reckless spending of tens of billions of dollars on ill-fated acquisitions like DirectTV.

As a result, profits failed to keep up with debt growth, combining with rising interest rates and CapEx requirements to ultimately for T to freeze and then slash its highly regarded dividend while also spinning off its growthiest businesses along with a pile of debt.

However, despite these efforts, the debt pile remains substantial, meaning that management has had to remain focused on paying down debt with free cash flow left over after the current dividend payout.

Now, however, with inflationary and recessionary pressures forcing management to slash free cash flow forecasts for 2022 from $16 billion to $14 billion, the progress towards paying down debt is all but certain to slow meaningfully. Even more remarkable is that T only collected $4 billion in free cash flow in the first half, placing an enormous burden on the second half to generate $10 billion in free cash flow. If economic conditions continue to deteriorate, this too could prove to be far too optimistic.

Management thinks they will get there via wireless customer growth in conjunction with price increases, but again, if economic conditions continue to deteriorate, growth will likely fail to meet expectations and price increases could cause them to lose customers. To make matters worse, management refused to double down on its 2023 $20 billion cash flow forecast, citing increased macroeconomic uncertainty.

Q2 Takeaway #3: Meaningful Dividend Growth Firmly On The Backburner

Prior to this very discouraging quarterly update, analysts already had a very weak outlook on T’s future dividend growth. Consensus estimates put dividend per share growth at a 0.4% CAGR through 2026, as the company already had a mountain of debt and CapEx requirements to tackle.

However, thanks to inflationary pressures, free cash flow forecasts are meaningfully declining for 2022 and quite possibly the same will be in store for 2023. On top of that, interest rates are soaring, and bad debt and late payments are rising, making deleveraging even more urgent than it was previously.

As a result, it is safe to assume that T’s already very weak dividend growth outlook is not only firmly entrenched for the foreseeable future, but management may very well forego dividend growth entirely for the next several years, confirming that it is truly dead as a dividend growth stock.

Investor Takeaway

T’s management continues to overpromise and underdeliver, giving income investors gut punch after gut punch. At what point does the remaining income investor base lose confidence in this company’s direction?

With dividend growth all but certain to be nonexistent for the next several years and the current yield at 6% with the EV/EBITDA multiple still trading at a 1.4 turn premium to its five-year average, total return performance looks very weak at best.

Yes, the dividend yield looks appetizing here, and for now, the dividend should be safe, but with no dividend growth on the horizon, deleveraging likely to slow meaningfully, the valuation multiple implying that multiple expansion is likely off the table, and management repeatedly underperforming, where is the buy thesis?

Be the first to comment