Jetlinerimages/E+ via Getty Images

Based in Berwyn, PA, Triumph Group (NYSE:TGI) supplies aerospace systems, structures, and support. Their business interests include the manufacturing of both military and commercial aircraft components as well as components for much larger aircraft carriers. Triumph has three main operating organizations: Integrated Systems, Aerospace Structures, and Product Support. Additionally, they are contracted to regional and commercial airlines to manufacture aircraft parts. Formally a company under the umbrella of the Alco Standard Corporation, a conglomerate of companies across diverse and unrelated markets, Triumph eventually took over their newly restructured parent company in the 1990s. By 2003, the Triumph Group had acquired a failing Boeing (NYSE:BA) facility located in Spokane, Washington, and restructured their five aviation organizations into the aforementioned three. Since that time, Triumph Group has become a leading force in the aerospace and defense market due to its position in the supply chain, the general yearly increase in demand, and the diversification across the many facets of its business holdings.

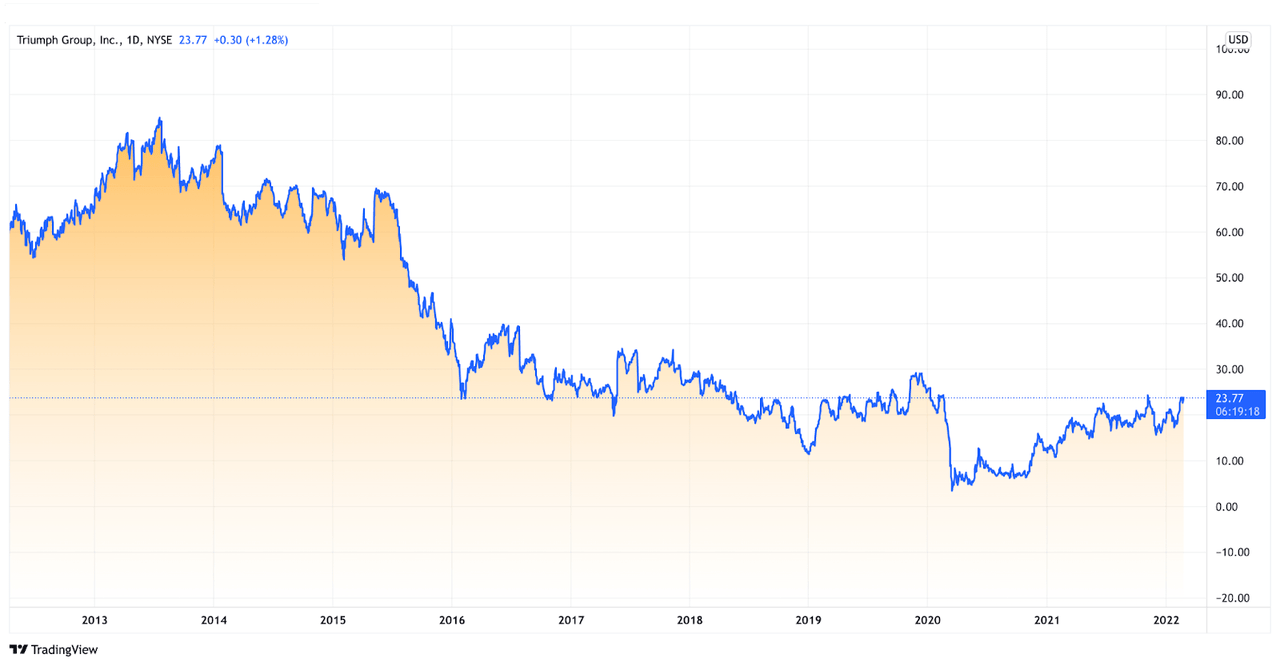

tradingview.com

In this article, I will show that despite a recent downward trend in profits and middling stock performance, Triumph Group’s market potential metrics warrant a serious look. The fact that Triumph has been able to stay afloat during a pandemic riddled last two years leads me to speculate that as travel returns to normal, a sharp spike in demand will once again propel Triumph into market relevance, becoming a very profitable investment. For those reasons, investors should be optimistic and bullish regarding Triumph.

Triumph Group’s Debt Concerns Overblown

In 2020, Triumph Group was saddled with debt. At that time, the company’s long-term debt exceeded $2 billion. With airline demand at an all-time low, there was serious concern about the viability of the Triumph Group’s future. Their debt was sitting at over three times the debt level of competitor Lockheed Martin (NYSE:LMT) and double that of Boeing. In 2020, due to the declining performance, the company was forced to take on $700 million in excess debt, ballooning their overall number. This raised their inflation payments from $122 million to $155 million. This was concerning due to industry decline, the uncertainty of the lingering effects of the pandemic, and the state of the market overall. In 2021, the outlook shifted. The debt level has not significantly altered; it has largely stayed the same, but several other factors have helped mitigate this. Current liquidity raises have seen a sharp rise from 158% to 216%. Gross margins have seen a minor bump of 1% from 20% in 2020 to 21% in 2021. Accounts receivables have also ballooned on the balance sheet, going from $5 million in 2020 to $126 million in 2021, helping shape the company’s financial future.

The pandemic has eased up, and things have begun to return to normal. While many analysts recommended a panic sell in 2020 as prices plummeted, those who held fast or bought the dip will be well rewarded. In a pre-pandemic world, Triumph was a profit machine chewing through $3.3 billion in revenue in 2019. There is nothing to suggest that it will not return to that number in the near future. While the pandemic punished the company (and the industry in general), there are brighter days ahead. Triumph is slowly increasing its margins and can pay off its massive debts in a relatively quick fashion and remain financially flexible while doing so. While debt was once a major concern for long-term viability, I do not view that as the case now.

The Pandemic and the Aerospace Industry

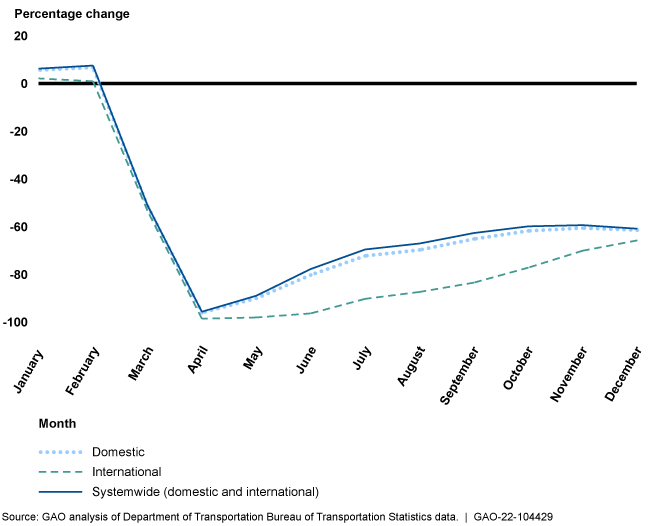

gao.gov

Of all of the markets that were affected by the Covid-19 pandemic, the aerospace industry was among those who took the hardest hit. The U.S. Aviation industry saw a decrease in air traffic of a crushing 96% from April 2019 to April 2020. The spread of the deadly virus, and the travel bans that ensued, coupled with complete country-wide shutdowns, devastated the market as a whole.

The market has begun to recover, but the recovery has been much slower than anticipated. Nearly 25% of the global aviation fleet was still in storage in February of 2021, which improved over the 60% rate recorded in 2020. The emergence of the delta variant was the likely culprit in the delay of market recovery. International air travel for business, one of the most lucrative segments in air travel, is projected to be uneven, which could shape how the market plays out as a whole. There is cause for optimism, though, as domestic travel markets have drastically and steadily improved, and the nearly $100 billion in federally funded payroll support proved pivotal in keeping the airline industry alive, allowing for its comeback. So far in 2022, the market looks to be steadily climbing as the world returns to normal in the post-pandemic financial climate.

Triumph Group Financial Overview

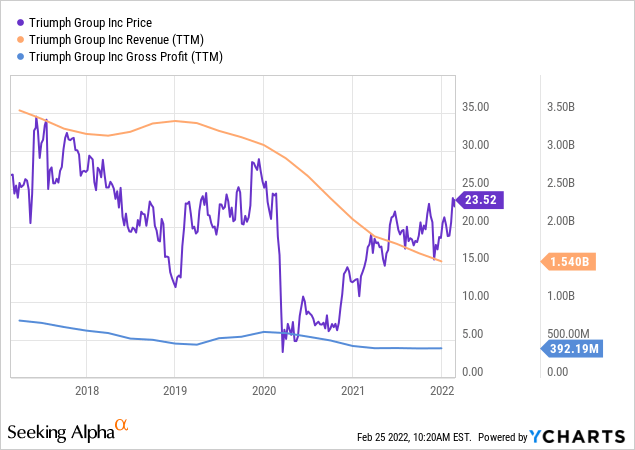

ycharts.com

Company revenue has been steadily declining since the 2019 posting of $3.36 billion. In 2021 it posted nearly $1.87 billion in revenue, a 2-year decline of over $1 billion, which is suboptimal for any company. As a result, gross profits have also seen a steady decline. In 2018, Triumph recorded $591 million in gross profits. 2021 yielded only $392 million, representing a nearly $200 million decline, also not a positive metric for the company. Unlike 2018, which despite a listing of favorable financial metrics, posted a negative cash rate of -$33.8 million, 2021 saw a positive metric in terms of cash flow. Net cash flow in this last year closed at just over $104.4 million, displaying a healthy amount of cash at hand, which leaves the company well suited to navigate whatever residual effects from the pandemic remain.

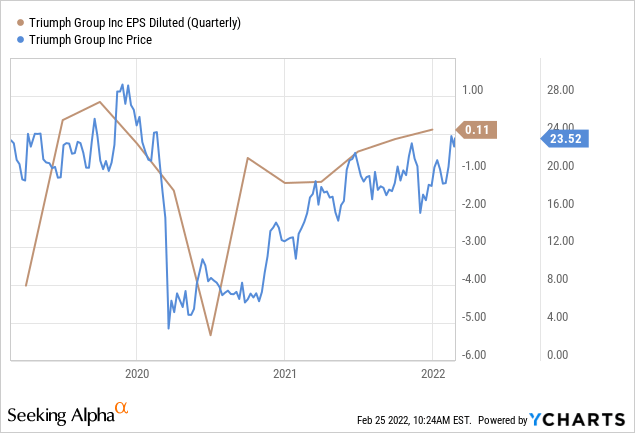

ycharts.com

Currently, Triumph is expected to announce an EPS of $0.38 for shareholders in the fiscal quarter. Last year, the EPS was only $0.10. By year-end, experts estimate Triumph will post earnings of $1.04 per share. This is yet another indication that the stock is healthy, climbing, and showing no signs of slowing down.

Conclusion

Despite the decline in revenue since 2018, coupled with the sharp decline in net profits, Triumph is actually in much better shape than an initial purview of their financial analysis indicates. Capitalizing on government funding to help the company navigate through the industry killing pandemic, Triumph was able to set themselves up for a major rebound by maintaining their profitability ratios (20% in 2020 to 21% in 2021), holding on to a healthy amount of cash flow, and doing so without taking on any excess debt. Triumph’s ability to keep its financials afloat during one of the steepest declines in the aerospace and aviation industries ever demonstrates resilience to market conditions that should get the attention of potential investors.

The market factors indicate that a future increase in demand over the next several quarters will not only restore the market relevance of Triumph but bring about the appreciation investors have been looking for during the past few years. Considering all of these factors, investors in the aerospace and aviation industry should look no farther than Triumph Global for a company with significant growth potential.

Be the first to comment