SasinParaksa/iStock via Getty Images

The market didn’t have big expectations for SmileDirectClub (NASDAQ:SDC) heading into its Q2 results as consensus estimates anticipated steep declines in revenues and slightly narrower losses on the back of cost-cutting measures. The market had slowly adjusted to these lower expectations over the last few months as SDC experienced five downward revenue revisions compared to two upwards revisions. Despite these low expectations, SDC still managed to miss estimates.

I knew this quarter, as for many other stocks, would be a telling sign for the market as to how it would deal with the current crisis and it supported the bearish view in more ways than one.

Q2

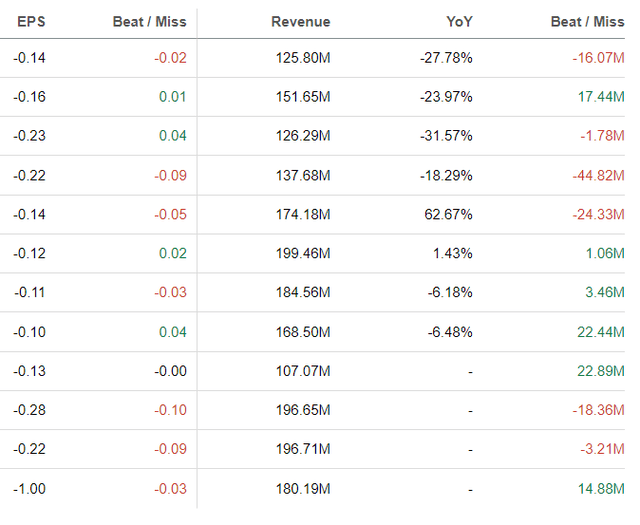

Revenue came in at $126M, down 27.6%, nearly 10% worse than the market had anticipated. Management were quick to point to some success in the cost-cutting measures, yet the GAAP loss ($65M or $0.17) was $0.02 worse than the market had anticipated. The market had overestimated SDC’s ability to successfully cut costs. SDC has now missed seven estimates out of twelve since its 2019 IPO.

SDC earnings performance since IPO (Seeking Alpha)

The results reaffirmed the bears’ views that SDC will not be able to meaningfully and successfully cost cut without seeing a steep decline in demand. It is never a positive to see a former perceived high-growth stock having to turn to cost cutting just a few years after IPO, but these are the times for SDC.

Even worse, they are trying to execute this turnaround through an incredibly precarious economic environment that is severely affecting consumer spending. Particularly products like Aligners which fall in the consumer discretionary category. Competitor Align Technology (ALGN) is also feeling the pressure but Align actually has a long history of operating success and profitability giving it a wider margin of safety to mitigate future troubles. SDC simply does not have this.

Guidance

SDC’s guidance was also really bad, Full-Year revenues are expected to be $450-500M. The pessimistic market was going for $600-650M. The only real positive is that SDC is forecasting an end-of-year cash balance of between $120M and $160M. With negative OCF of $18 million, SDC does have time to turn things around, however at current prices the market is not exactly pricing SDC to go bust.

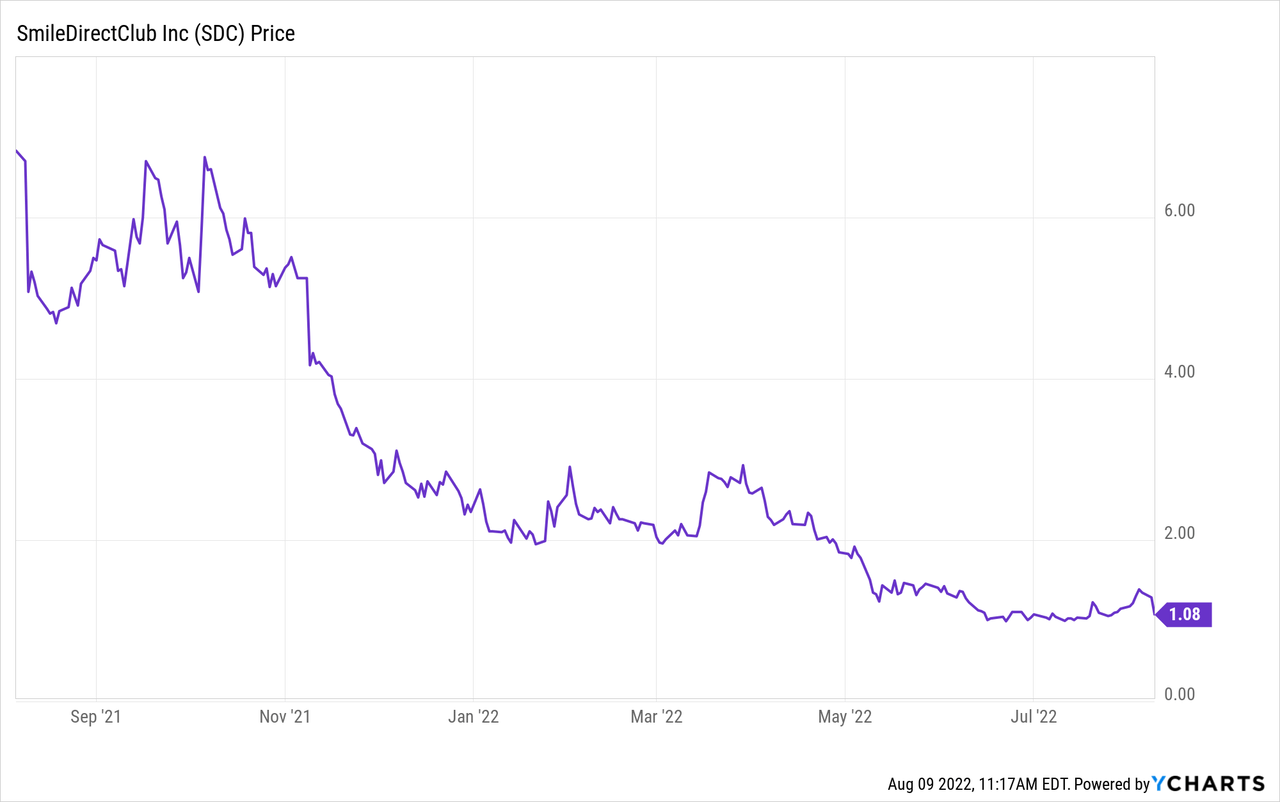

Even after today’s 16% decline, SDC’s market capitalization is still $420M. Considering that SDC is anticipating an adjusted EBITDA loss of at least $140M there could be a lot further to fall. As SDC is facing deteriorating growth and widening losses, its model is appearing more broken each quarter. Not only this but unlike a lot of other tech stocks, SDC has a substantial debt pile of $785 million, this has increased by $55 million since the end of 2021. This is mainly comprised of a 2026 convertible senior notes. SDC’s finance expense alone in Q2 was $4.4M.

Considering this, as to why SDC still trades above cash at all is bizarre to me, let alone triple it. If SDC falls below $1 (which I believe it will) the stock enters into a whole new ball game. The focus then turns to maintaining its NASDAQ listing requirements and getting the stock back above $1, which may involve a reverse split – increasing the chance of further free fall (or even small free float squeezes).

The Bottom Line

The only thing stopping me from taking a very bearish stance on SDC is the short interest. Short squeezes are now back in style, further downward pressure from shorts (I feel they would want to double down after these results) may allow SDC to bounce back like a coiled spring. Stock price ignored, the underlying fundamentals for SDC are shocking and with guidance that will generate little optimism, it is hard to see how SDC’s deterioration is likely to end.

Be the first to comment