BraunS/E+ via Getty Images

Co-produced with Beyond Saving

Too many retirees feel a need to be hovering over their portfolios. Fingers on the trigger, ready to sell at a moment’s notice. Often, the only justification they have to sell is that the price dropped. Is there a sillier reason to sell? No. Yet in the stock market, it has perversely become normal.

Suppose that you just bought a rental house for $150,000 in what you believed was an “up and coming” neighborhood that would provide you the potential for some gain in property value in addition to the rent collected. A couple of months later, I come around and buy an identical house next door for only $125,000. Now nothing has really changed in the neighborhood, your tenant is paying rent on time and isn’t creating any problems.

Would you suddenly decide to sell your house for $125,000 and realize a 17% loss, just because a house next door sold at a cheaper price?

Of course not! Maybe you give yourself a mental kick for not waiting for a better price. Maybe you did overpay, but you’re still collecting rent, and if the neighborhood is as up and coming as you believe, you will still make a nice profit when you sell the house in 5-10 years. Selling your rental property solely because a house next door sold for less than you paid wouldn’t even cross your mind.

Step into the stock market, and a lot of investors will set “stop losses”, which by definition trigger the sale of their assets for absolutely no reason other than someone else in the market sold their shares below a certain price! Countless others will panic when they see the stocks they own trading hands at lower prices. “The price is going down, should I sell?”

This tells me that a lot of people don’t have confidence in the quality of their investments. When you’re invested in a high-quality company, you aren’t going to worry about what price it’s trading at. You know that in the long term, the company will do well. If you feel the need to put a stop-loss on an investment, it probably isn’t something you should buy in the first place.

Buy high-quality dividend stocks, and you don’t have to fear the market gyrations. While your neighbors are dumping their stocks at discount prices, you can sit back, collect dividends and maybe even buy a few of their shares – knowing that these are companies that are high enough quality to invest in forever!

ARCC Firing On All Cylinders! – Yield 8.4%

Ares Capital (ARCC) is a BDC (Business Development Company) that uses its size and scale to invest in the larger-end of “middle-market” companies. The companies that ARCC invests in have an average EBITDA of over $127 million/year. These are privately-owned companies, in which ARCC provides a combination of debt and equity investments. ARCC collects recurring income through the interest on loans, and from time to time, realizes gains on their equity investments.

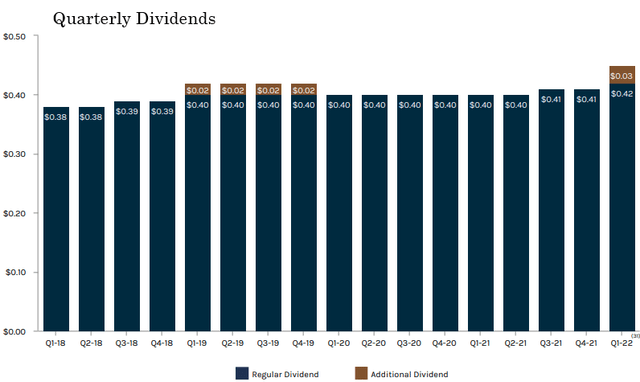

For Q4 2021, ARCC produced core earnings of $0.58/share, a 7.4% increase over Q4 2020. Core earnings is an important metric because it represents gains/losses from operations excluding the impact of realized/unrealized capital gains or losses. It’s primarily made up of recurring interest and dividend income and therefore is the go-to metric for judging dividend safety. ARCC covered its $0.41 dividend by 140%.

In addition to core earnings, ARCC also realizes capital gains. These are lumpier and the timing of them is less predictable. So with these more temporary gains, BDCs will pay out non-recurring dividends. BDCs are designed to pay out materially all of their gains as dividends, but since gains will not be realized consistently, it’s important to recognize which dividends can be expected to be recurring, and which will be more temporary. This is an important concept to understand to interpret ARCC’s recent dividend raise.

ARCC raised its dividend in two parts. Due to its high dividend coverage, ARCC increased its “regular” dividend to $0.42/quarter. We can interpret this as management’s confidence that it will be able to continue paying out $0.42/quarter indefinitely out of recurring interest payments. As old loans are paid off, they will redeploy in new debt investments, and be able to consistently out-earn the $0.42/quarter.

Second, ARCC announced a $0.12 dividend for the year that will be paid out in installments of $0.03/quarter. This dividend is being paid from excess gains that have accumulated. It will last for four quarters and then it might or might not continue depending on the timing of future gains.

ARCC last did one of these in 2019, they didn’t continue it into 2020 for obvious reasons. Here’s a recap from their Q4 Earnings Presentation:

ARCC Q4 Earnings Presentation

For 2022, ARCC is off to a great start with an increase in its regular dividend that will fuel our income for years, and an extra $0.12/year thanks to the significant gains that ARCC has been realizing in this environment. Historically, ARCC has announced raises to its regular dividend in Q3. So there’s a very good chance we could be looking at a second raise of the regular dividend later this year if ARCC’s core earnings continue to be above $0.50/quarter.

ARCC has a backlog of $1.2 billion, which points to more growth throughout the year. Net Asset Value is up to $18.96/share and continues to grow each quarter.

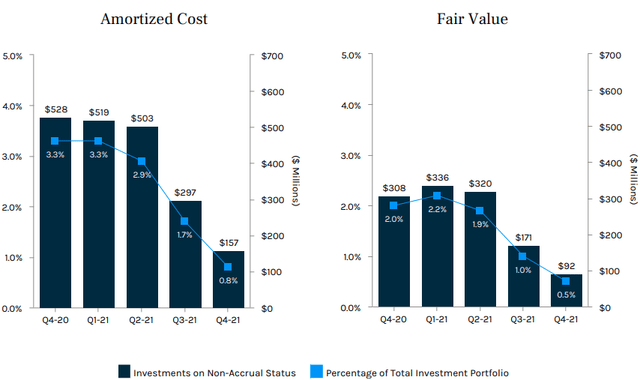

Additionally, ARCC’s “non-accrual” assets dropped off substantially in the second half of last year. These are investments that are not paying interest whether through forbearance or default.

ARCC Q4 Earnings Presentation

The macro-environment remains extremely favorable for BDCs as investment opportunities abound. Meanwhile, the majority of investments are floating rate, while ARCC has been taking out fixed-rate debt at historically low rates. ARCC is very profitable today, and will become even more profitable if interest rates rise!

ARCC has a great history, a very bright future and is continuing to grow. This blue-chip BDC will keep your portfolio overflowing with dividends!

WPC: Raising Your Income Every Quarter – Yield 5.6%

W. P. Carey Inc. (WPC) is a “triple-net” REIT, meaning that it invests in diverse properties using triple-net leases.

Triple-net leases have become a favorite for investors because they make the tenant responsible for property-level expenses and maintenance, allowing the landlord to take a “hands-off” approach. A light bulb goes out? Need the parking lot plowed? Want new flooring? Property taxes go up? In a triple-net lease, all of that is the responsibility of the tenant. The landlord doesn’t have to pay someone to manage the little things at a property. Tenants like the triple-net structure because it usually grants them more control over the property and the rent is lower.

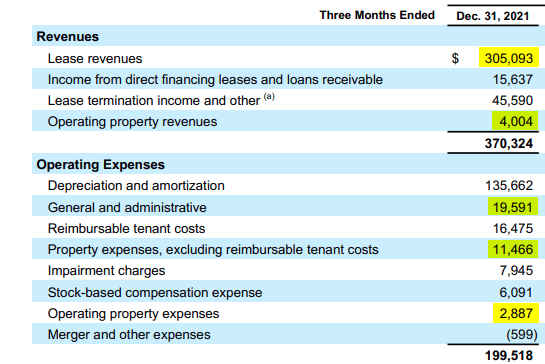

When it comes to inflationary times, this lease structure is pure gold for the landlord. Let’s show you what I mean. Here are WPC’s revenues and operating expenses for Q4 2021. I highlighted the revenues/expenses that will be impacted by inflation.

W. P. Carey Q4 2021

On the revenue side, lease revenues and operating property revenues can both be impacted by inflation. Loan revenue is usually fixed and lease termination income comes when a tenant wants to end a lease early, it’s lumpy and unpredictable. WPC has disclosed that 59% of its leases are linked to CPI or a similar inflation index. So call it $180 million of revenue will directly benefit from higher CPI.

On the expense side, general and administrative, non-reimbursable property expenses and operating property expenses are all areas which could be impacted by inflation. We’ll round up and call it $34 million.

You can see how higher inflation is a fantastic driver for WPC’s profits! Inflation is impacting approximately $180 million in revenue, but only about $34 million in expenses each quarter.

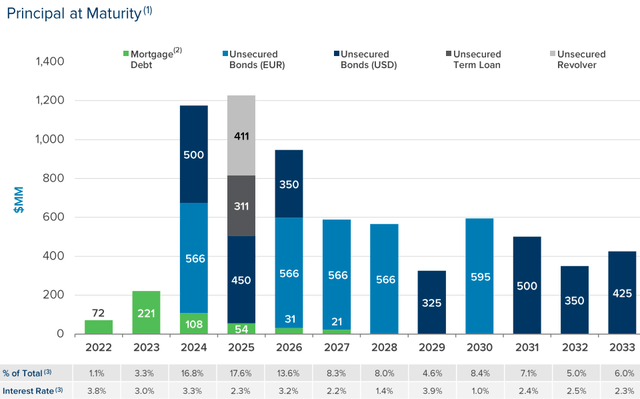

WPC’s largest single cash expense is interest at $47.2 million last quarter. The bulk of WPC’s debt is fixed-rate and WPC has no major maturities until 2024.

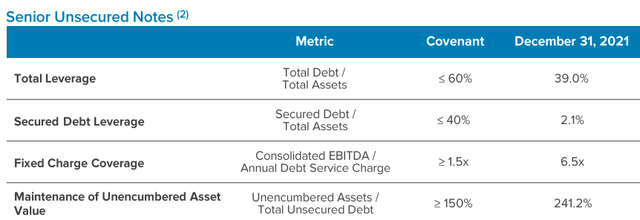

W. P. Carey Q4 2021 Capitalization

– Source: WPC Q4 2021 Capitalization & Leverage

Also note, the maturities in 2024 are at a higher average interest rate than most of WPC’s debt. Even with rising interest rates, the impact of refinancing that debt will have only a small impact on WPC’s interest expense.

Over the past year, we have been highlighting the opportunity of WPC because it has been expanding at a record pace, exceeding $1.7 billion in acquisitions in 2021 – a pace that WPC intends to maintain in 2022. It’s equally important to note that WPC has been growing in a very responsible way, without adding risk to its balance sheet.

W. P. Carey Q4 2021

Thanks to its strong balance sheet, WPC has been able to reduce its average interest rate from 3.2% in 2019, to only 2.5% today!

WPC has raised its dividend every year for 24 years and every quarter since 2001. Dividend raises in recent years have been small, however, we expect the size of dividend raises to increase. WPC’s acquisitions, rising rents due to higher inflation, combined with WPC saving on interest expense and you have a recipe for higher FFO (Funds From Operations) and faster dividend growth.

Conclusion

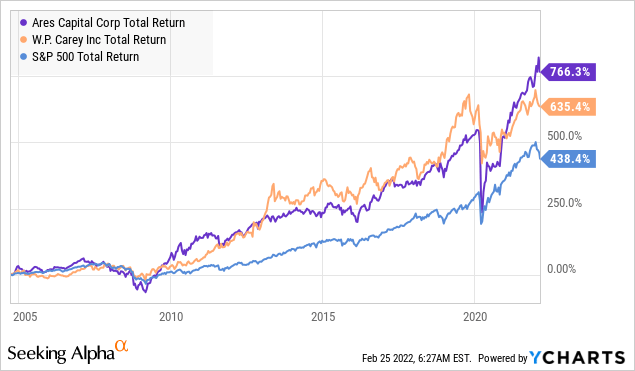

Both ARCC and WPC have impressive track records. Pushing through the Great Financial Crisis and COVID, emerging from the other side with market-beating returns.

The best part is that while outperforming the market, ARCC and WPC have rewarded shareholders with large and growing dividends. Share prices will vary, it’s what the market does. You should never base your investment decisions solely on price. If you own high-quality companies, prices will recover. In the meantime, sit back and collect dividends.

If you find yourself interrupting your life to check what the stock market is doing, then it’s time to invest in some companies that you have more confidence in. These are two companies that you can buy and then go live your life without worrying about what the share prices are doing day-to-day. Collect your dividends and go about the much more important business of living your life!

Be the first to comment