Abstract Aerial Art

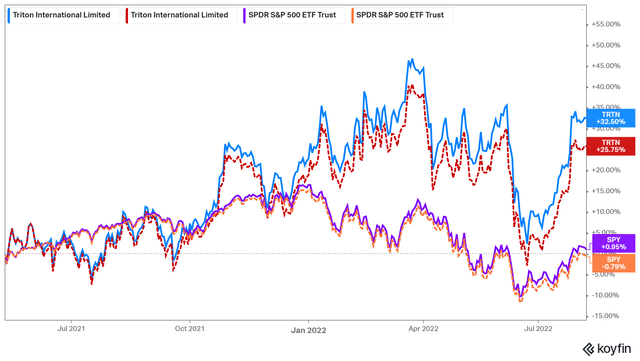

Triton International Limited (NYSE:TRTN) has been one of our favorite and most fruitful investments since we initiated a position back in May of last year, buying the stock at just under $50.

Since then, Triton’s performance has been very satisfactory. Shares have gained over 26%, while Triton’s notable dividend, which has averaged close to 4% during this period, has pushed the stock’s total returns to 32.5%. In comparison, the S&P500 has produced virtually no returns during this period, even including its dividends.

With the company’s performance continuing to exceed our expectations and positive developments further honing its investment case over time, we have remained quite bullish on the stock.

Triton recently posted its Q2 results, exhibiting another excellent quarter of record net income, growing book value, and accelerating capital returns, that should keep driving the stock’s bullish momentum. This is especially the case as, even though the stock rallied notably lately, Triton shares remain quite undervalued, in our view.

Latest Developments, Q2 Results, The Market

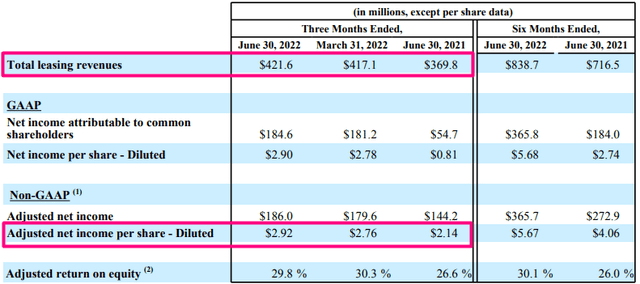

Triton’s Q2 results came in fairly strong, beating consensus adjusted EPS estimates once again. Revenues climbed 14% to $421.6 million, while adjusted net income was $186.0 million or $2.92 per diluted share. This implies an increase of 36.4% year-over-year and a 5.8% increase quarter-over-quarter.

Triton International Q2 Performance (Q2 Results)

As a reminder, Triton purchased $3.6 billion worth of containers last year, resulting in the company expanding its asset base by 30%. After such a busy year, new container transactions have been limited this year. Still, container drop-offs are low, and with Triton employing virtually all of its containers under long-term contracts, utilization remained at sky-high levels, coming in at 99.4% at the end of the quarter. Besides the company’s long-term contracts ensuring container employment, container supply conditions also remain fairly tight.

This primarily means that:

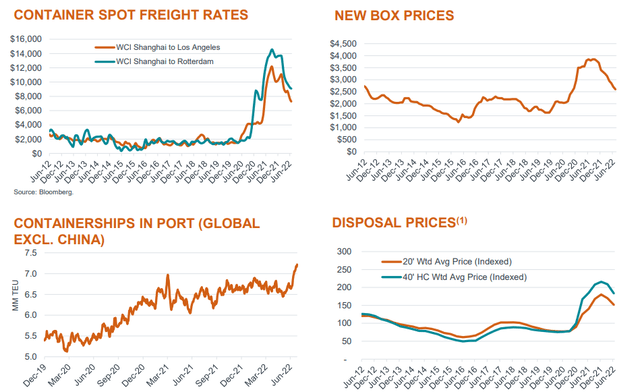

- Firstly, container prices remain high versus their historical levels, allowing Triton to dispose of some of its assets at higher prices than the company paid for, resulting in Triton posting additional gains (bottom left chart).

- Secondly, Triton can further stretch its existing contracts at even longer-term leases at record rates while gaining exceptional cash flow visibility.

As you can see in the upper left chart, while freight rates are down from last year’s peak as the severe shortages of vessel and container capacity have softened, they still remain well above pre-pandemic levels. This reflects continued strong trade volumes and persisting logistical challenges that continue to harm shipping line operations and absorb effective capacity.

Freight Rates and Container Prices (Investor Presentation)

Further, as the upper right chart depicts, new container prices may have declined from last year’s peak levels but have remained historically high at roughly $2,600. Thus, market leasing rates remain notably higher than the average rates in Triton’s lease portfolio, which means that it may be able to score even more attractive rates upon any upcoming lease renewal discussions.

Finally, and most importantly, the chart on the bottom left displays that port congestion remains as high as it has ever been, mirroring the ongoing operational hurdles across a broad range of international ports. This congestion continues to delay container turn times and give birth to extra demand for containers.

Regardless, Triton’s current fleet employment profile is guaranteed to keep producing very attractive profits for the company for years to come. With container lessees battling to reserve an adequate amount of containers during the ongoing shortage, Triton has capitalized on their agony by locking in fantastic multi-year leases.

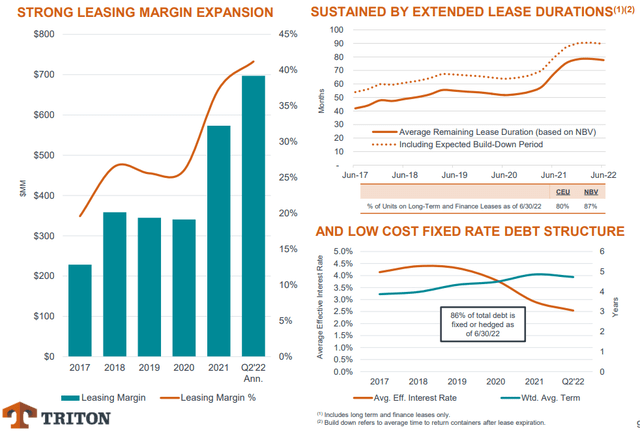

Particularly, Triton’s average remaining lease duration currently hovers at 80 months (6.66 years). In the previous quarter, this figure stood at 79 months. This demonstrates the ongoing renewals that stretch even further into the future, while taking place at record rates, as mentioned later. Hence, we see how the underlying market’s favorable conditions of today will keep having a positive effect on the company’s financials even after many years.

Sustainable Profitability (Triton International Q2 Investor Presentation)

Therefore, Triton’s record profitability levels are not a temporary theme but are set to last for quite some time. To add to that, the company’s average effective interest rate has been on the decline amid the refinancing activities that occurred over the last two years. The combination of attractive long-term leases and cheap long-term financing guarantees that high levels of leasing margins (currently over 40%) will be sustained, and hence record profitability will indeed endure for years to come. Thus, the idea that Triton will continue to post record net income levels over the medium term is pretty much cemented at this point.

Double-Digit Combined Yield, Upside Potential

Triton’s dividend on its own makes for a solid capital turn. The yield hovers near 4%, while with four $0.65 quarterly dividends declared, it’s quite likely that another double-digit dividend hike is on its way (last October’s quarterly dividend hike was by 14%).

After all, the payout ratio stands below 25% based on our FY2022 adjusted EPS estimate of $11.50. Basically, Triton has reported an adjusted EPS of $5.67 for H1-2022. Management mentioned that Triton’s adjusted EPS in Q3 will remain in line with its record results in the second quarter ($2.92). Even if we assume a similar adjusted EPS in Q4 (which is highly unlikely as aggressive buybacks lower the share count very rapidly), H2-2022 adjusted EPS should equal at least $5.84.

Thus, FY2022 adjusted EPS should exceed $11.50. It is certainly going to be considerably higher than the consensus adjusted EPS estimate of $11.29. This also implies that the stock is trading at a P/E of 5.6, which we find incredibly low and extensively humble considering Triton’s cash flow visibly and aggressive capital returns.

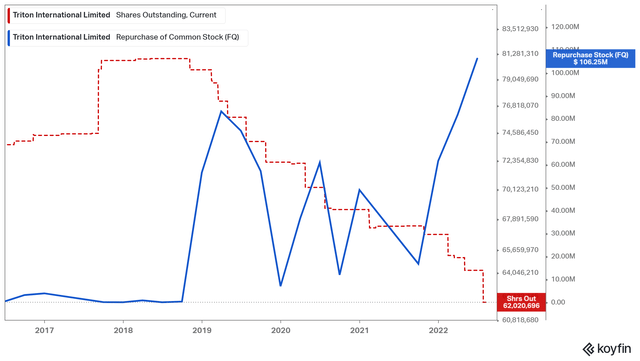

Speaking of aggressive capital returns and share buybacks, Triton has taken the opportunity to exploit its stock’s undervaluation by ramping up its share repurchases. Specifically, year to date, Triton has repurchased 3.9 million or 6.0% of its shares outstanding, following a bump in buybacks in Q2.

Triton International’s Buybacks & Share Count (Koyfin)

With the core business running on autopilot, management reiterated its focus on buybacks as this is where the company can squeeze out additional shareholder value, especially at the current stock price levels. Thus, the share repurchase program was boosted again, back to $200 million.

Even if buybacks were to slow down from their Q2 levels, we could easily see the company buying back north of $350 million per annum based on its current profitability prospects, implying a buyback yield of 8.7%. This, combined with the current dividend yield of 4%, suggests a double-digit investor yield. This would be the case even if you take a more conservative view on the dollars to be spent on buybacks per annum.

Regarding the stock’s upside, even if we were to employ a prudent, fair multiple of 8.0X adjusted EPS, we come out with a fair price north of $90. It would imply an upside greater than 40%.

Frankly, we are low-key happy the stock remains undervalued, as Triton is able to repurchase and retire a bunch of shares at a discount. Eventually, this will have a much larger effect on Triton’s total return prospects over the long run. We reiterate our Strong Buy rating.

Be the first to comment