dgdimension/iStock via Getty Images

TOLWF Is On A Stable Path

The conducive drilling environment in Canada has prompted Trican Well Service (OTCPK:TOLWF) to reactivate another frac spread in Q1. To improve efficiency and maintain higher emission standards, it will reactivate two Tier IV fleets by the end of the year, which should amp up the topline and operating margin.

Higher volume and pricing will increase its revenue and margin in the short-to-medium term. However, Trican can counter a steep cost curve led by supply chain disruption and commodity price inflation. Low debt and high shareholders’ equity will provide robust protection from near-term financial risks, despite a dwindling free cash flow. The stock is reasonably valued, with a positive bias, at the current level versus its peers. Investors would want to buy the stock for reasonably solid returns in the medium term.

Industry Activity And Pricing

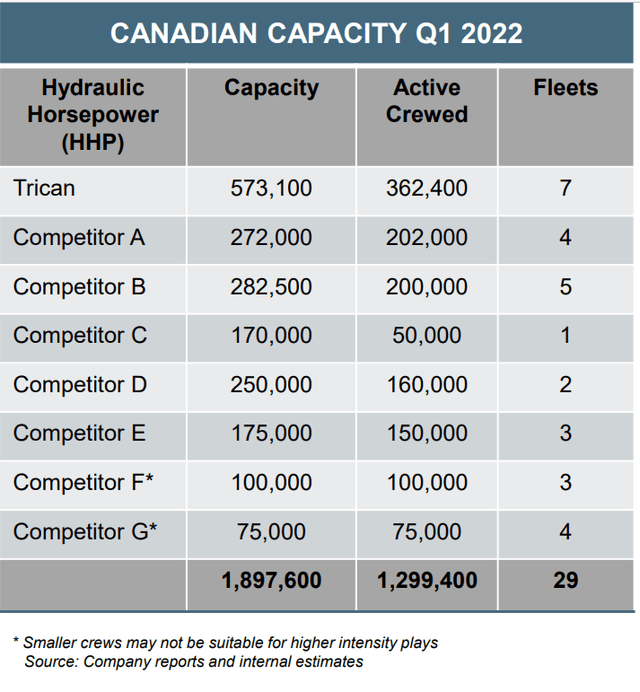

Trican Well’s Corporate Presentation, April 2022

Industry activity ramped up quickly in 2022 after a moderately slow start. According to Primary Vision’s forecast, the US frac spread count (or FSC) reached 288 by mid-May and increased by 23% since 2022. The Western Canadian rig count was over 200 in March and has gone up meaningfully since Q4 2021. I expect rig additions to remain strong while frac spreads gain momentum in June.

As the commodity pricing strengthened and the industry environment remained robust, it made way for a stronger pricing environment compared to the previous year. Some of Trican’s service lines raised pricing by 15% to 25% in recent times. However, it failed to benefit adequately from the pricing recovery because the supply chain-led cost inflation ate away some gains.

Frac Spread Efficiency

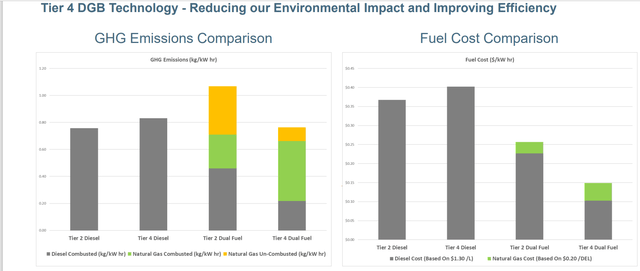

TOLWF’s Corporate Presentation, April 2022

The fracking industry has kept Trican’s management interested because a much sharper demand for the advanced Tier IV DGB (dynamic gas blending) frac spreads far outweighed the Tier II fracs. Higher demand brought the company’s fracturing crew count to seven in Q1, with 85% utilization. The company focuses on pad-based programs, promoting efficiency, and minimizing downtime and travel time between jobs. Also, the company’s cementing service line benefited from increased rig count. The utilization of assets in this business was steady in the first two months of the year before slowing in mid-March.

The logistics and supply chain issues can bite it in ways more than one. In the company’s chemical business, we can expect delays and increased costs associated with transportation in the short-to-medium term. This is because most of its chemical input comes from China and the US, so that the volatility can persist.

Technology Benefits And Challenges

Trican rolled off its first Tier IV DGB in Q1. So, the use of natural gas and diesel displacement has progressed fast. It plans to reactivate a second Tier 4 fleet in Q2 and a third Tier 4 in late Q4. As diesel prices increase, natural gas will have a relative advantage, and therefore, it can charge premium pricing on these fleets. The management believes this technology will become the standard in the next few years.

One of the challenges for TOLWF will be to manage the supply chain cost hikes, which, it believes, will intensify by Q4. Diesel price, which is highly correlated with crude oil, increased steeply from January through March. Such high prices reflected in high transportation costs, which resulted in high sand prices. By the company’s estimates, about 60% of its frac fleets are internally supplied with diesel. The trucking volume also increased in Q1 because of higher proppant volumes, larger pads, and more work up in the Montney and Deep Basin. The company reduced its workforce to lower costs, which can create bottlenecks when the activity level increases.

Analyzing The Q1 Financial Results

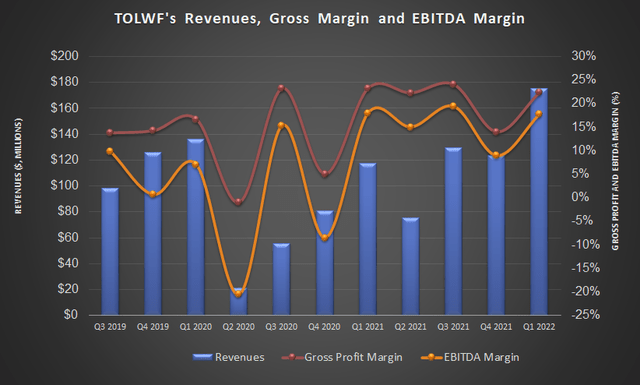

In Q1 2022, higher demand for fracturing operations in Canada and the deployment of the first Tier 4 dynamic gas blending frac spread resulted in revenues increasing by 42% compared to Q4 2021. Although higher costs related to the supply chain challenges mitigated the margin growth, it managed to post 830 basis points quarter-over-quarter gross margin expansion in Q1.

The adjusted EBITDA margin also improved similarly in this period. Coiled tubing operating days increased 17% from Q4 2021 to Q1 2022. The company has been trying to grow this portion of its business.

The Current Financial State

On March 31, 2022, TOLWF’s cash flow from operations was relatively low ($1.3 million). Despite higher revenues in the past year, its cash flows failed to increase. On top of that, capex increased significantly due to the ongoing capital refurbishment program, including upgrading a portion of its conventionally powered diesel pumper fleet with Tier 4 DGB engines. This led to negative free cash flows in Q1.

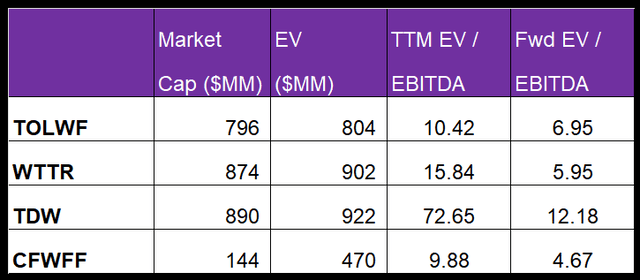

As of March 31, 2022, Trican had a working capital balance of $115.1 million. The company’s debt-to-equity (or leverage) ratio is close to zero because of low debt and high shareholders’ equity. It is also lower than some peers (WTTR, TDW, CFWFF).

Linear Regression Based Forecast

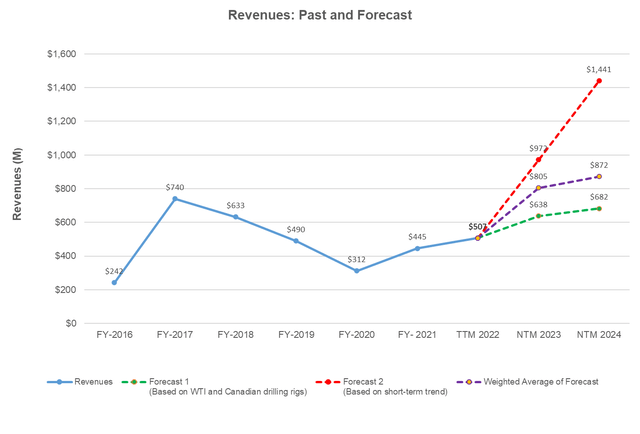

Author created, Baker Hughes rig count, EIA, and Seeking Alpha

Based on the historical relationship between WTI crude oil price, Canadian rig count, and TOLWF’s revenues for the past seven years and the previous four-quarters, I expect revenues to increase sharply in the next 12-months (or NTM 2023). However, the growth rate can moderate the following year.

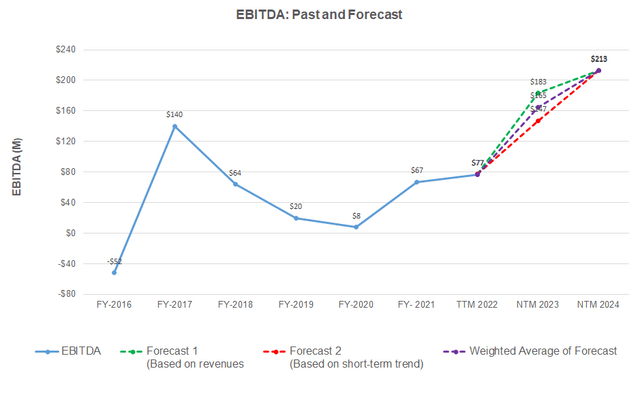

Author Created and Seeking Alpha

Based on the regression model using the average forecast revenues, I expect the company’s EBITDA to more than double in NTM 2023 and increase at a more stable rate in NTM 2024.

Target Price

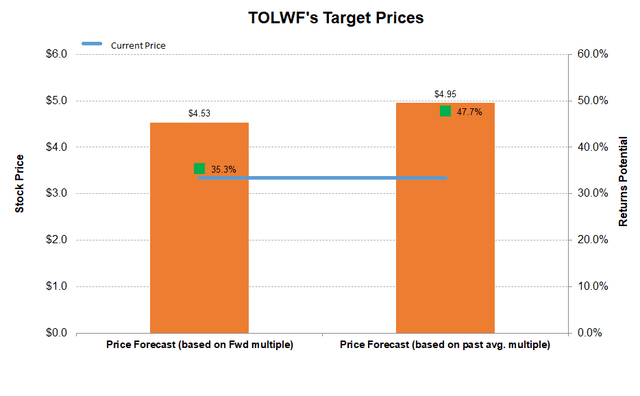

Author created and Seeking Alpha

Returns potential using TOLWF’s forward multiple (7x) is lower (35% upside) than the returns potential using the past five-year average (16.3x).

What Does The Relative Valuation Imply?

Trican Well Service is trading at an EV-to-adjusted EBITDA multiple of 10.4x. Its forward EV-to-EBITDA multiple contraction is less steep than its peers, which typically results in a lower EV/EBITDA multiple. The stock’s EV/EBITDA multiple is significantly lower than its peers’ (WTTR, TDW, and CFWFF) average of 32.8x. So, the stock is reasonably valued, with a positive bias, at the current level.

What’s The Take On TOLWF?

Over the past few months, the energy industry’s rapid recovery and the rig additions in Western Canada have energized Trican Well to expand and improve its services. Not only has it reactivated another frac spread in Q1, but its focus on adding Tier IV DGB pumps has also led to improved efficiency and higher emission standard. Because Tier IV pumps are in short supply in the market, they command premium pricing.

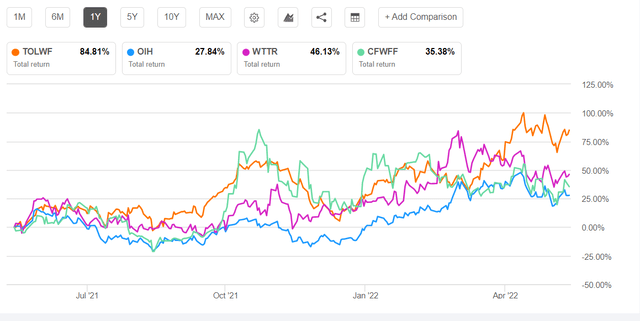

Despite increasing pricing for many service lines by 15% to 20% over the past few months, Trican has had to counter steep cost inflation led by supply chain disruption and commodity price inflation. Because most of its chemical input comes from China and the US, I think it will continue to face the cost challenges in 2022. So, the stock outperformed the VanEck Vectors Oil Services ETF (OIH) in the past year. You might buy the stock for a steady return given the relative valuation. Although increased capex burnt a hole in free cash flow, low leverage will ensure the balance sheet has very limited near-term financial risks.

Be the first to comment