metamorworks/iStock via Getty Images

Texas Instruments (NASDAQ:TXN) has struck a fine balance between investment in growth and rewarding shareholders. This is a name which has compounded earnings per share while at the same time paying a growing dividend and buying back stock. The company maintains a strong balance sheet which may be a source for positive alpha in the future. The stock trades at 17x forward earnings, a reasonable multiple for a company that may grow cash flows for years to come. I rate the stock a buy for those looking for a potential dividend growth winner.

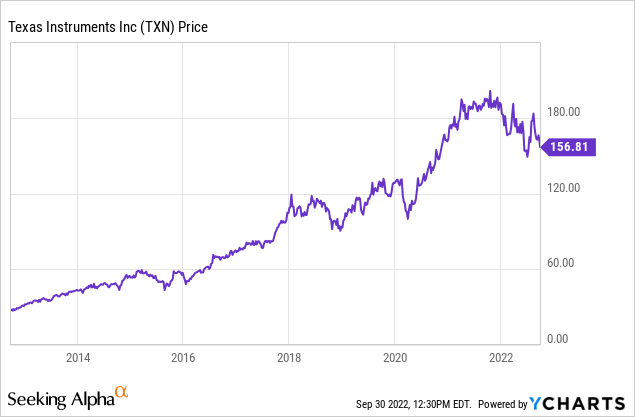

TXN Stock Price

TXN has more or less been immune to the broader weakness in equities, with the stock down only 22% from recent highs.

Compare that with the 64% drawdown at Nvidia (NVDA) and 60% drawdown at AMD (AMD). What’s the secret? It all comes down to track record.

Texas Instruments Key Metrics

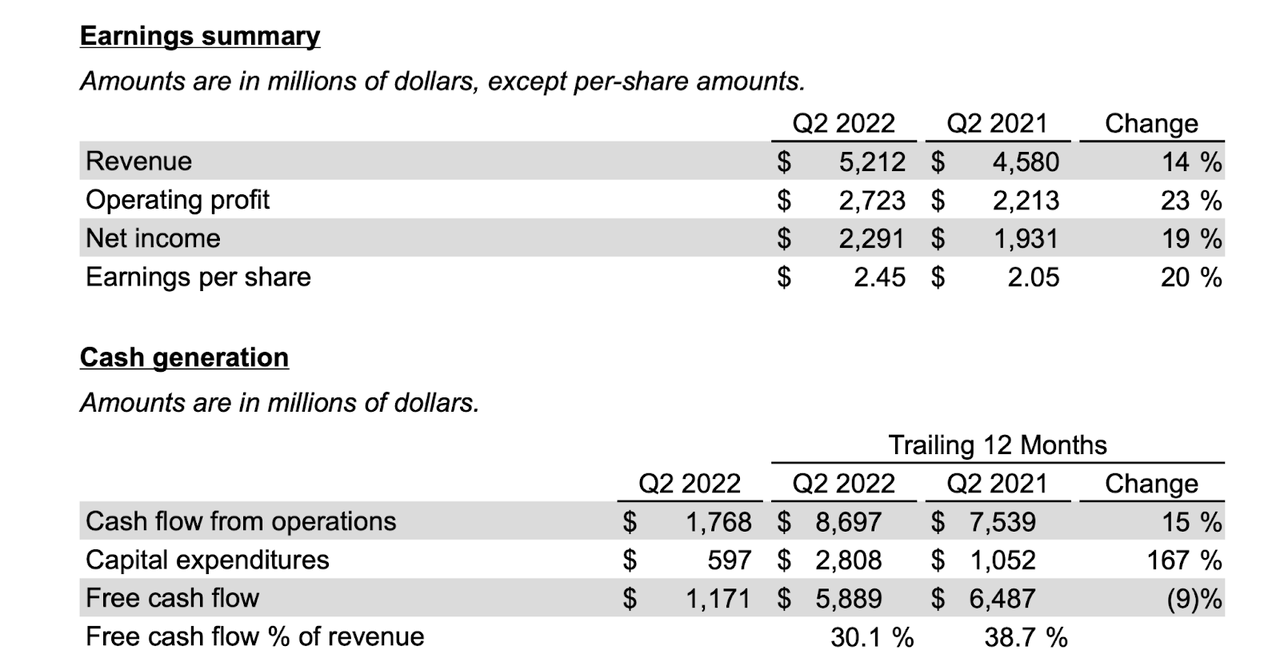

When TXN last reported in July, the company generated 14% revenue growth and grew earnings per share by 20% to $2.45. The company has typically done a good job of converting net income into free cash flow though, as noted in the conference call, free cash flow came up short in this quarter due to both delayed revenue collection as well as increased capital expenditure plans.

2022 Q2 Press Release

The company nonetheless still returned $2.2 billion to shareholders through dividends and share repurchases.

2022 Q2 Press Release

TXN ended the quarter with $8.4 billion of cash and investments versus $7.3 billion of debt. This is the kind of company that can likely support net debt, suggesting that debt-fueled share repurchases can always be a catalyst for the future.

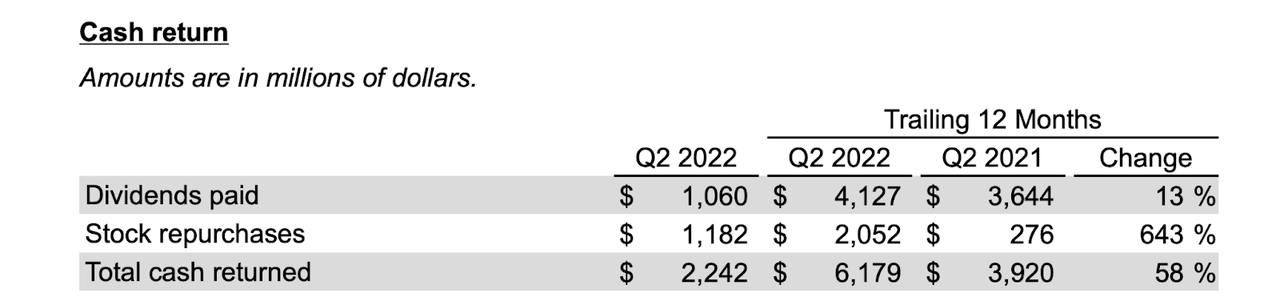

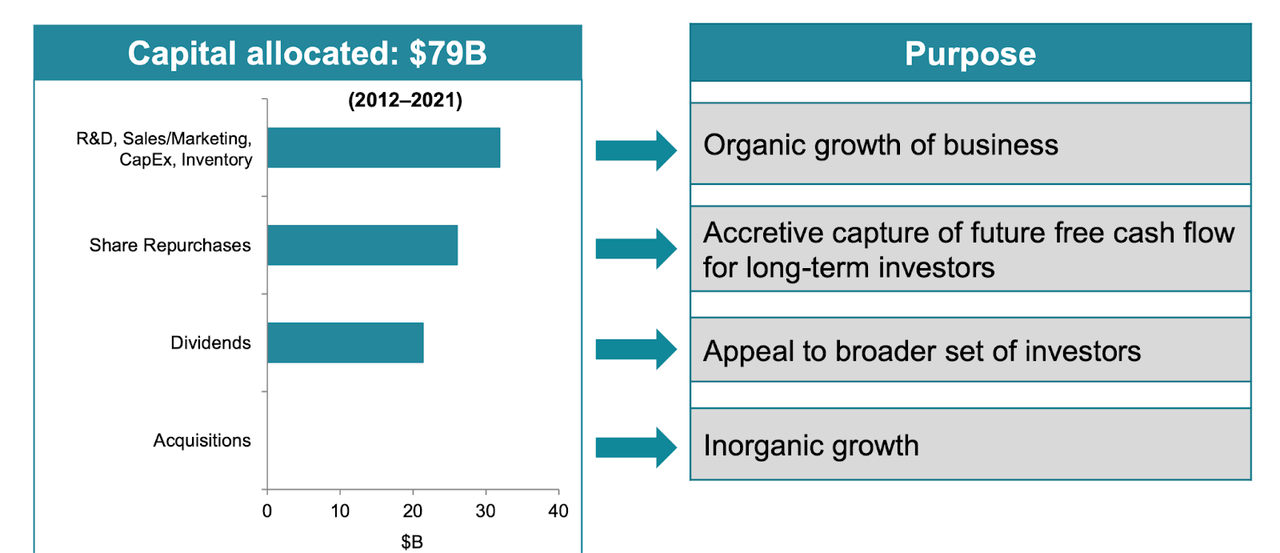

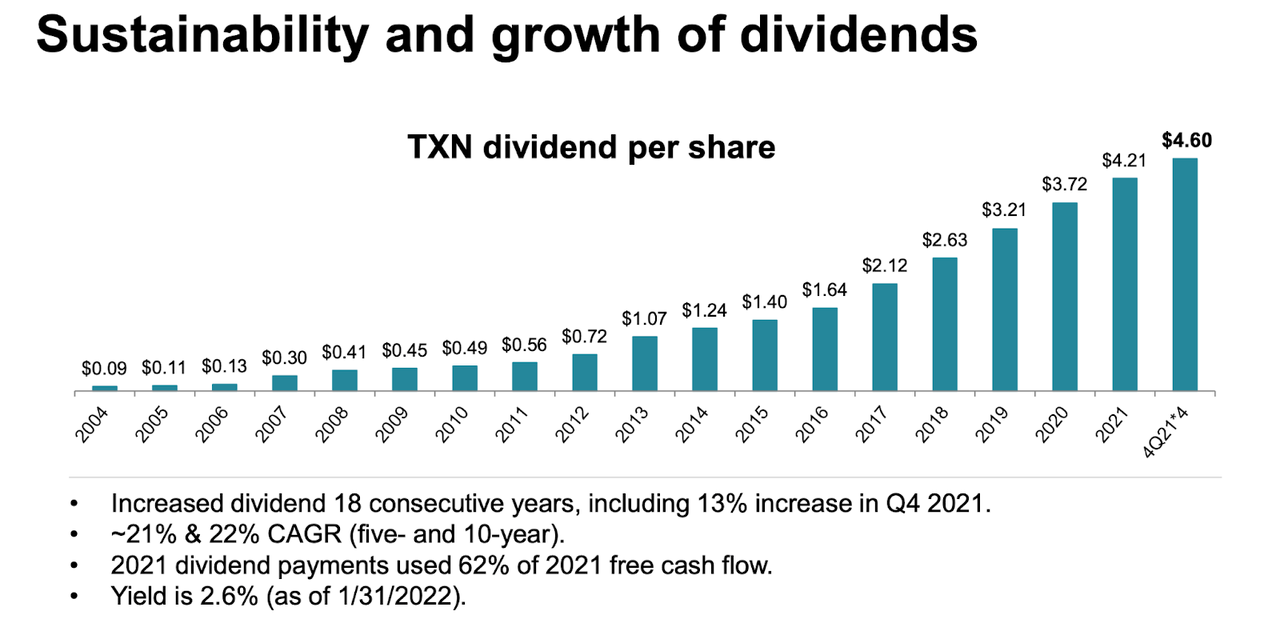

Over the past decade, TXN has been razor-focused on balancing organic growth with returning cash to shareholders.

2022 Capital Allocation Presentation

This is evidenced by the 18 consecutive years of dividend increases.

2022 Capital Allocation Presentation

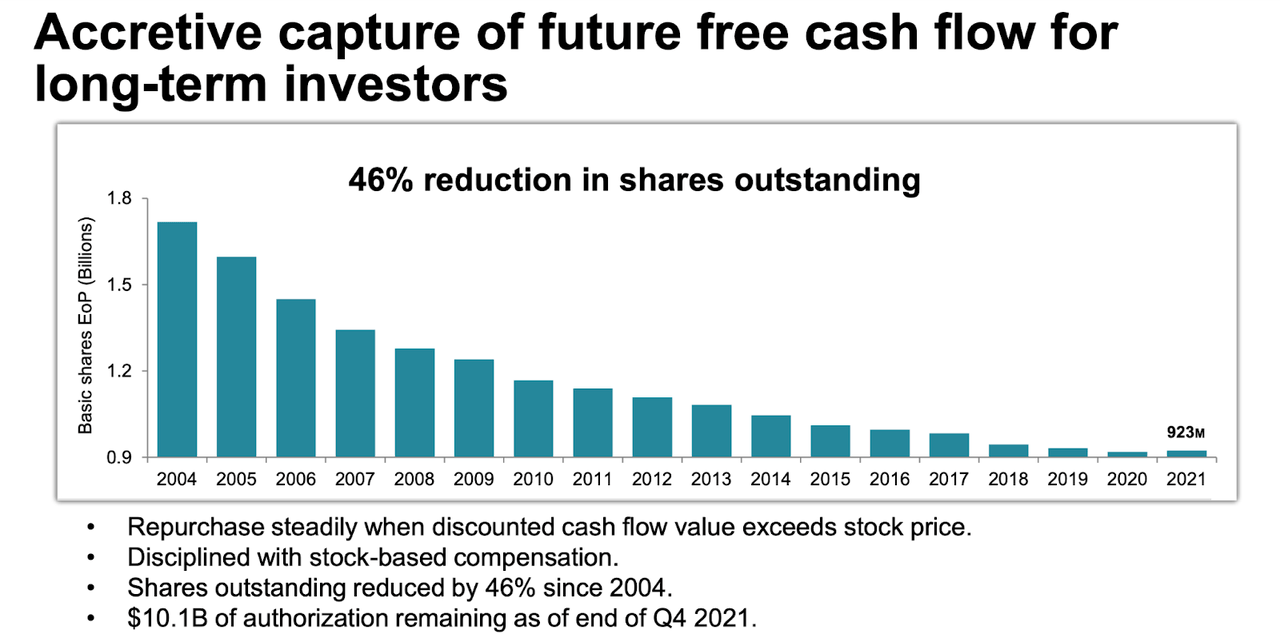

TXN has reduced shares outstanding by 46% since 2004, an impressive feat considering the sizable dividend payments.

2022 Capital Allocation Presentation

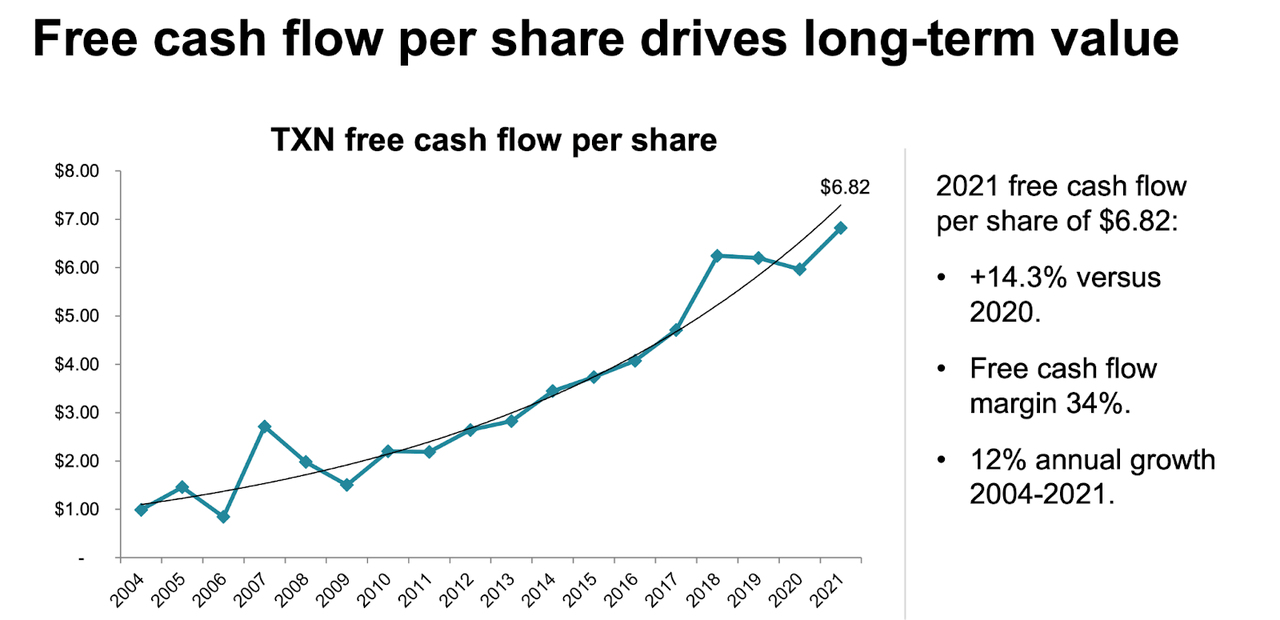

The share repurchases and organic growth have helped TXN rapidly grow free cash flow per share – the most important metric for shareholders.

2022 Capital Allocation Presentation

Is TXN Stock A Buy, Sell, or Hold?

It is in times of market volatility that long term investors may appreciate the attractive buying opportunities in high quality stocks such as TXN. The stock trades at just 17x forward earnings – a more than reasonable multiple for this kind of risk profile.

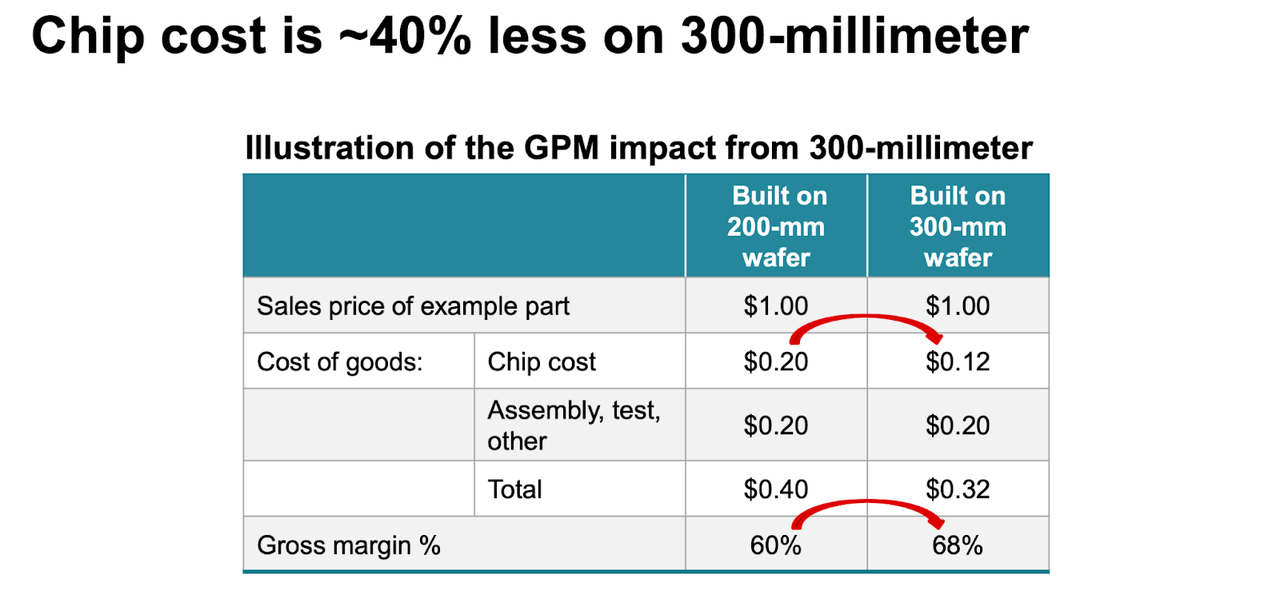

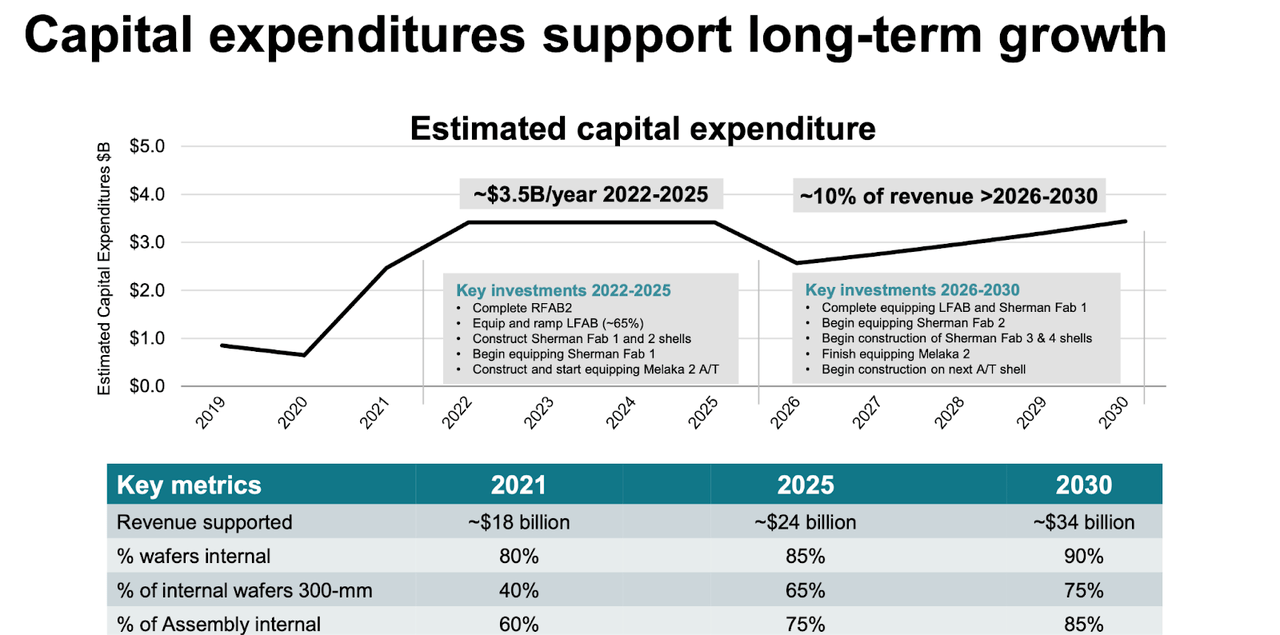

Looking ahead, TXN has identified its growth prospects as coming from reducing costs and increasing margins from moving to the 300-mm wafer.

2022 Capital Allocation Presentation

The company plans to spend $3.5 billion on capital expenditures to make that transition through 2025, with plans to spend 10% of revenue on capital expenditures thereafter. TXN expects to reach around $24 billion in revenue by 2025 and $34 billion of revenue by 2030.

2022 Capital Allocation Presentation

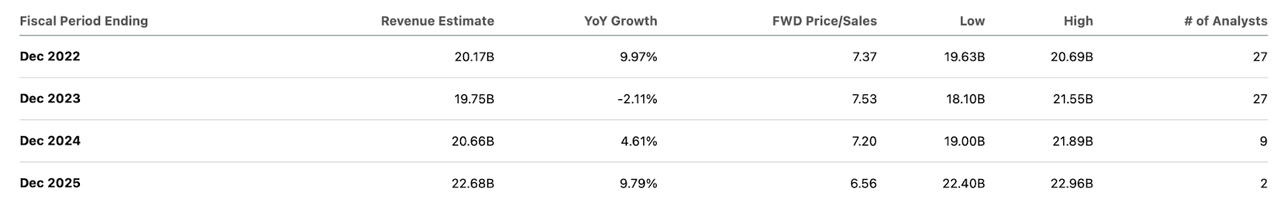

Consensus estimates are more cautious, expecting only $22.7 billion of revenue by 2025.

Seeking Alpha

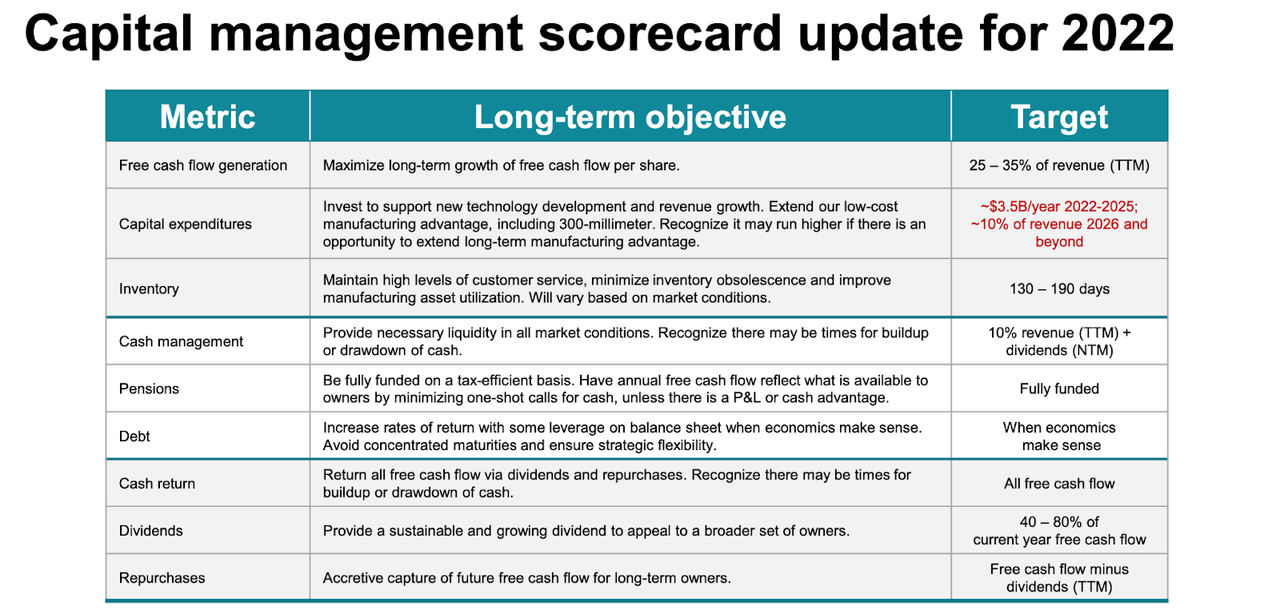

TXN has guided for free cash flow margins between 25% to 35% of revenue though it might be lower than that in the near term due to elevated CapEx spend. It is worth noting that TXN has fully funded its pension plans – an often overlooked risk at older companies.

2022 Capital Allocation Presentation

The stock yields 3.1%, which might not look impressive as compared to the roughly 3.5% yields of US Treasury bonds. But one must factor in the roughly double-digit growth rate as well. Given the strong balance sheet, high return of cash to shareholders, and secular growth, I can see TXN re-rating to at least 20x earnings, representing a 2x price to earnings growth ratio (‘PEG ratio’) and implying 18% potential upside from multiple expansion alone.

What are the key risks here? For starters, TXN faces more competition and does not have clear differentiation like NVDA or AMD. That may lead to gross margin compression over the long term if commoditization occurs. Investors will need to count on the secular growth of the internet of things to offset supply growth. Another risk is that while 17x earnings is a reasonable valuation for a high quality name, it is arguably a rich valuation if commoditization occurs and the company becomes more cyclical like, for example, Micron (MU). In such a scenario, I can see TXN trading down as low as 10x earnings, implying over 40% potential downside. In the near term, it is possible that TXN reports a disappointing quarter, as semiconductor peers have in general given mild guidance in recent months since the company last reported. That may imply that investors can get a better buying opportunity if they wait until after earnings. I have discussed with subscribers of Best of Breed Growth Stocks that the best way to invest amidst the tech crash is to own a diversified basket of undervalued tech names. TXN can fall under the high quality allocation though as noted one should keep a close eye on commoditization risk. I rate the stock a buy for long term investors.

Be the first to comment